C09 Personal Financial Management

... • Gary is planning to invest his money in stock market in Hong Kong. He does not know whether he should invest his money in the Main Board or Growth Enterprise Market. He does not have any prior experience investing in the stock market. He also does not have much money and prefers less risk. As an i ...

... • Gary is planning to invest his money in stock market in Hong Kong. He does not know whether he should invest his money in the Main Board or Growth Enterprise Market. He does not have any prior experience investing in the stock market. He also does not have much money and prefers less risk. As an i ...

Trading Nokia: The Roles of the Helsinki vs. the New York Stock

... between its price formation processes in the different markets becomes an important and interesting issue. Is perhaps one market leading the other in incorporating new information into the price of the stock? Discovering such patterns ...

... between its price formation processes in the different markets becomes an important and interesting issue. Is perhaps one market leading the other in incorporating new information into the price of the stock? Discovering such patterns ...

Basic Principles Of Corporate Management Of State

... In the ranking list of the Top 100 most profitable companies for 2010 – among others 14 are state companies. The group consists of mainly energy and transport companies. ...

... In the ranking list of the Top 100 most profitable companies for 2010 – among others 14 are state companies. The group consists of mainly energy and transport companies. ...

The Stock Market: What Does it Do and How Has It Performed

... will increase the firm’s future income, they buy more of the stock, driving its price up. When investors believe that bad decisions are being made, the the stock’s price falls. ...

... will increase the firm’s future income, they buy more of the stock, driving its price up. When investors believe that bad decisions are being made, the the stock’s price falls. ...

Mergers, LBOs, Divestitures, and Holding Companies

... benefits, that is, the final price is close to full value. ...

... benefits, that is, the final price is close to full value. ...

International Portfolio Investment

... if it were a single stock. Being open-end funds, WEBS trade at prices that are very close to their net asset values. In addition to single country index funds, investors can achieve global diversification instantaneously just by holding shares of the S&P Global 100 Index Fund that is also trading on ...

... if it were a single stock. Being open-end funds, WEBS trade at prices that are very close to their net asset values. In addition to single country index funds, investors can achieve global diversification instantaneously just by holding shares of the S&P Global 100 Index Fund that is also trading on ...

FF018G

... other than in relation to the pricing of the issue or takeover offer, number of securities, figures depending on such information and correction of errors; and 12. that all (if any) conditions contained in the formal letter granting listing of and permission to deal in the securities have been fulfi ...

... other than in relation to the pricing of the issue or takeover offer, number of securities, figures depending on such information and correction of errors; and 12. that all (if any) conditions contained in the formal letter granting listing of and permission to deal in the securities have been fulfi ...

saving and investing slide show

... Buy low, sell high … Must sell ownership to see profit (profit = income= taxes) Sometimes Dividends are paid based on profit of company (Earnings to shareholder – pay tax) Paid on a per share basis (example $1.00 per share) An Annual Report is published each year The SEC (Securities and Exchange Com ...

... Buy low, sell high … Must sell ownership to see profit (profit = income= taxes) Sometimes Dividends are paid based on profit of company (Earnings to shareholder – pay tax) Paid on a per share basis (example $1.00 per share) An Annual Report is published each year The SEC (Securities and Exchange Com ...

Chapter 13

... Switch into stocks, out of cash As economy recovers, stock prices may level off or even decline Based on past, the market P/E usually 17 rises just before the end of the slump ...

... Switch into stocks, out of cash As economy recovers, stock prices may level off or even decline Based on past, the market P/E usually 17 rises just before the end of the slump ...

FREE Sample Here

... b. That primary markets allow corporations, government units, and others to raise needed funds for the expansion of their capital base C. Price competition in the secondary markets between different risk-return classes enables the primary market to price new issues at higher prices to reflect existi ...

... b. That primary markets allow corporations, government units, and others to raise needed funds for the expansion of their capital base C. Price competition in the secondary markets between different risk-return classes enables the primary market to price new issues at higher prices to reflect existi ...

Document

... Istanbul Stock exchange (ISE) is foreign. Foreign Investor’s capital gains are tax-exempt Free Repatriation of capital and proceeds Size is still smaller than banks, as banks have relatively significant interest rates ...

... Istanbul Stock exchange (ISE) is foreign. Foreign Investor’s capital gains are tax-exempt Free Repatriation of capital and proceeds Size is still smaller than banks, as banks have relatively significant interest rates ...

Chapter 20, Section I

... Many factors go into the performance of stocks. Profits and expectations of success are one area: another is the overall economic climate. Investors are generally positive, or bullish, during periods of abundant money, low interest rates, tax cuts, political stability, and high employment. Investors ...

... Many factors go into the performance of stocks. Profits and expectations of success are one area: another is the overall economic climate. Investors are generally positive, or bullish, during periods of abundant money, low interest rates, tax cuts, political stability, and high employment. Investors ...

Poof

... techniques, and the practice of persuading average moms and dads to put hard-earned money to work in big business with little fear as to its safety was born. Railroad and shipping barons of earlier times would be shocked to discover how little concern most people have exercised in the past few deca ...

... techniques, and the practice of persuading average moms and dads to put hard-earned money to work in big business with little fear as to its safety was born. Railroad and shipping barons of earlier times would be shocked to discover how little concern most people have exercised in the past few deca ...

stock exchange

... • How does the stock market work? – Stock, or shares in a company, are bought and sold on the stock market. – Stock brokers help individuals and businesses invest their money in the stock market. – Investors can keep track of the stock market by checking their local paper. When the market is doing w ...

... • How does the stock market work? – Stock, or shares in a company, are bought and sold on the stock market. – Stock brokers help individuals and businesses invest their money in the stock market. – Investors can keep track of the stock market by checking their local paper. When the market is doing w ...

Test Your IQ (Investment Quotient)

... c. corporate money market debt d. municipality money market debt 3. Fixed-Income Securities On what basis do we normally distinguish money market securities from fixed-income securities? a. issuer b. interest rate c. maturity d. tax status 4. Fixed-Income Securities Your friend told you she just rec ...

... c. corporate money market debt d. municipality money market debt 3. Fixed-Income Securities On what basis do we normally distinguish money market securities from fixed-income securities? a. issuer b. interest rate c. maturity d. tax status 4. Fixed-Income Securities Your friend told you she just rec ...

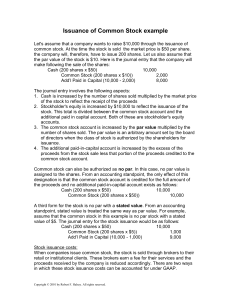

Issuance of Common Stock example

... are important: the declaration date (when the dividend is declared to be paid by the board of directors) and the date of distribution (then the chares are actually sent to the shareholders). Small stock dividends. When a company declares a small stock dividend, retained earnings is debited for the m ...

... are important: the declaration date (when the dividend is declared to be paid by the board of directors) and the date of distribution (then the chares are actually sent to the shareholders). Small stock dividends. When a company declares a small stock dividend, retained earnings is debited for the m ...

- Fairview High School

... Build a mock portfolio by choosing at least three companies that interest you. Write each company’s ticker symbol next to its name and the date. Document their performance. Read stories about them. ...

... Build a mock portfolio by choosing at least three companies that interest you. Write each company’s ticker symbol next to its name and the date. Document their performance. Read stories about them. ...

FINANCIAL MARKETS

... Stock brokerage – firm that buys/sells stock Stock exchange – stock is bought and sold ...

... Stock brokerage – firm that buys/sells stock Stock exchange – stock is bought and sold ...

Securities Markets Primary Versus Secondary Markets How

... Commission: fee paid to broker for making the transaction Spread: Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...

... Commission: fee paid to broker for making the transaction Spread: Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...

The Stock Exchange of Hong Kong Limited takes no responsibility

... approximately 36.31% of the total share capital of the Company. Immediately after this share purchase, Hualu Holdings held 172,271,838 shares of the Company by its subsidiaries, representing approximately 37.67% of the total share capital of the Company. ...

... approximately 36.31% of the total share capital of the Company. Immediately after this share purchase, Hualu Holdings held 172,271,838 shares of the Company by its subsidiaries, representing approximately 37.67% of the total share capital of the Company. ...

ESTR.ASpA successfully places EUR 100 million senior notes BNP

... Mr. Alessandro Piazzi, Chief Executive Officer of E.s.tr.a. declared “The placement and listing of the notes on the Irish Stock Exchange is a first important step to finance, not only the investment plan of the Group over the next three years – estimated at €100 million, but also the funding needs a ...

... Mr. Alessandro Piazzi, Chief Executive Officer of E.s.tr.a. declared “The placement and listing of the notes on the Irish Stock Exchange is a first important step to finance, not only the investment plan of the Group over the next three years – estimated at €100 million, but also the funding needs a ...

CHAPTER 13

... Closed-end Investment Companies: are completely unlike those just described. Issue only a limited number of shares and do not redeem their own shares on demand, like open end funds. ...

... Closed-end Investment Companies: are completely unlike those just described. Issue only a limited number of shares and do not redeem their own shares on demand, like open end funds. ...

Investing in Stocks Chapter Sixteen

... securities through an investment bank, or other representative, from the issuer of those securities. – An investment bank is a financial firm that assists corporations in raising funds, usually by helping to sell new security issues. – An IPO occurs when a corporation sells stock to the general publ ...

... securities through an investment bank, or other representative, from the issuer of those securities. – An investment bank is a financial firm that assists corporations in raising funds, usually by helping to sell new security issues. – An IPO occurs when a corporation sells stock to the general publ ...

Заголовок слайда отсутствует

... 1999 – began pension reform in Kazakhstan. It was started with accumulating pension funds. ...

... 1999 – began pension reform in Kazakhstan. It was started with accumulating pension funds. ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.