chapter 2 - CSUN.edu

... likely to overstate assets and income. Many times items in inventory become obsolete or damaged. In this instance inventory items should be listed at market value if it is lower than cost. ...

... likely to overstate assets and income. Many times items in inventory become obsolete or damaged. In this instance inventory items should be listed at market value if it is lower than cost. ...

Chapter 11

... • These investments are issued by the United States Treasury Department. Municipal Bonds • Municipal bonds are issued by state or local governments to finance such improvements as highways, state buildings, libraries, and schools. Corporate Bonds • A corporate bond is a bond that a corporation issue ...

... • These investments are issued by the United States Treasury Department. Municipal Bonds • Municipal bonds are issued by state or local governments to finance such improvements as highways, state buildings, libraries, and schools. Corporate Bonds • A corporate bond is a bond that a corporation issue ...

Allianz Global Investors Fund Société d`Investissement à Capital

... Subject in particular to the provisions of letter h), up to 25% of Sub-Fund assets may be invested in Equities of Global Small Caps whose registered offices are in a country outside the U.S., or which generate a predominant proportion of their sales and/or profits in a country outside the U.S., othe ...

... Subject in particular to the provisions of letter h), up to 25% of Sub-Fund assets may be invested in Equities of Global Small Caps whose registered offices are in a country outside the U.S., or which generate a predominant proportion of their sales and/or profits in a country outside the U.S., othe ...

Financial Statements

... The information and any analyses contained in this presentation are taken from, or based upon, information obtained from the WCM Executive Team or from publicly available sources. Any information taken from external literature is appropriately referenced. The completeness and accuracy of this presen ...

... The information and any analyses contained in this presentation are taken from, or based upon, information obtained from the WCM Executive Team or from publicly available sources. Any information taken from external literature is appropriately referenced. The completeness and accuracy of this presen ...

Informe de Mercado Oficinas Q1 2016

... the cost for banks of issuing medium-term loans to mid-sized corporates. Strengthened capital requirements may shrink the bank’s ROE, as debt is replaced with more expensive equity. ...

... the cost for banks of issuing medium-term loans to mid-sized corporates. Strengthened capital requirements may shrink the bank’s ROE, as debt is replaced with more expensive equity. ...

National Settlement Depository

... ● To build a unique structure for the Russian market providing the whole range of services of a settlement depository and a non-banking credit organization ...

... ● To build a unique structure for the Russian market providing the whole range of services of a settlement depository and a non-banking credit organization ...

Nippon Sheet Glass Decides to Issue Preferred Shares— Outcome

... Banking Corporation, the Company’s main financing bank, along with other entities. The proceeds from the issuance will be appropriated for debt repayment and capital investments related to the manufacturing of high value-added products. (2) Drastic measures to enhance equity capital were required of ...

... Banking Corporation, the Company’s main financing bank, along with other entities. The proceeds from the issuance will be appropriated for debt repayment and capital investments related to the manufacturing of high value-added products. (2) Drastic measures to enhance equity capital were required of ...

Budget to Save—The Balance Sheet

... 8. When an item is consumed, it does not increase the total value of assets owned. When money is borrowed to purchase consumable items, liabilities increase. If total assets remain the same while total liabilities increase, net worth decreases. 9. A house is a wealth-creating asset when it appreci ...

... 8. When an item is consumed, it does not increase the total value of assets owned. When money is borrowed to purchase consumable items, liabilities increase. If total assets remain the same while total liabilities increase, net worth decreases. 9. A house is a wealth-creating asset when it appreci ...

here - HLNDV

... • To improve quality or because it is required by regulation. New – examples • Expanded service. • Improve safety conditions. • Reduce operating expenses. • Improve patient care. ...

... • To improve quality or because it is required by regulation. New – examples • Expanded service. • Improve safety conditions. • Reduce operating expenses. • Improve patient care. ...

Mortgage Markets(9) - Rohan Chambers` Home Page

... Borrowers refinance if rates drop by paying off higher rate loan and financing at a new, lower rate Investor receives payoff but has to invest at the new, lower interest rate Manage the risk with ARMs or by selling loans soon after their origination ...

... Borrowers refinance if rates drop by paying off higher rate loan and financing at a new, lower rate Investor receives payoff but has to invest at the new, lower interest rate Manage the risk with ARMs or by selling loans soon after their origination ...

Chapter 7: Principles of Asset Valuation

... The transaction costs of buying gold in Los Angels and selling it in New York include the costs of shipping, handling, insuring, and broker fees, which account for $2 per ounce. ...

... The transaction costs of buying gold in Los Angels and selling it in New York include the costs of shipping, handling, insuring, and broker fees, which account for $2 per ounce. ...

lecture-notes-2-1

... These companies insure their policyholders against loss from theft, fire, and accidents etc They are very much like life insurance companies, receiving funds through premiums for their policies, but they have a greater possibility of loss of funds if major disasters occur. For this reason, they ...

... These companies insure their policyholders against loss from theft, fire, and accidents etc They are very much like life insurance companies, receiving funds through premiums for their policies, but they have a greater possibility of loss of funds if major disasters occur. For this reason, they ...

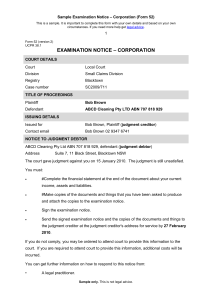

Examination notice - corporation

... Send the signed examination notice and the copies of the documents and things to the judgment creditor at the judgment creditor's address for service by 27 February ...

... Send the signed examination notice and the copies of the documents and things to the judgment creditor at the judgment creditor's address for service by 27 February ...

Reserves/Reserve Requirements Review

... the next 3 questions: • A bank has excess reserves of $10,000 and deposit liabilities of $40,000 when the required reserve ratio is 20 percent. • 6) Required Reserves: • 7) Total Reserves: • 8) If the reserve ratio is raised to 25, what will the new required reserves be? • 9) If the reserve ratio is ...

... the next 3 questions: • A bank has excess reserves of $10,000 and deposit liabilities of $40,000 when the required reserve ratio is 20 percent. • 6) Required Reserves: • 7) Total Reserves: • 8) If the reserve ratio is raised to 25, what will the new required reserves be? • 9) If the reserve ratio is ...

Chapter 2 Firms and the Financial Market

... B. A primary market is a market in which new securities are bought and sold for the first time. C. A secondary market is where all subsequent trading of previously issued securities takes place. D. Firms borrow money by issuing debt securities. These can be either short-term (i.e., notes) or long-te ...

... B. A primary market is a market in which new securities are bought and sold for the first time. C. A secondary market is where all subsequent trading of previously issued securities takes place. D. Firms borrow money by issuing debt securities. These can be either short-term (i.e., notes) or long-te ...

Balance Sheet Ratios and Analysis for Cooperatives

... Net Working Capital: The difference between total current assets and total current liabilities. It indicates the extent to which short-term debt is exceeded by short term assets. Formula: Current Assets - Current Liabilities Current Ratio: This relationship gauges how able the business is to pay cur ...

... Net Working Capital: The difference between total current assets and total current liabilities. It indicates the extent to which short-term debt is exceeded by short term assets. Formula: Current Assets - Current Liabilities Current Ratio: This relationship gauges how able the business is to pay cur ...

Working Capital Finance

... • Inter Corporate Deposits (ICDs) taken are to be treated as Current Liabilities. • Unsecured loans from promoters not to be included in both TNW as well as debt provided it is interest free and subordinated to Bank’s exposure. • In case of other statutory dues, dividends, etc., estimated amount pay ...

... • Inter Corporate Deposits (ICDs) taken are to be treated as Current Liabilities. • Unsecured loans from promoters not to be included in both TNW as well as debt provided it is interest free and subordinated to Bank’s exposure. • In case of other statutory dues, dividends, etc., estimated amount pay ...

Understanding financial statements

... • Must be used to report financial statements to the public • Requires assets to be valued at their purchase price, not at their market value • Requires use of accrual accounting method ...

... • Must be used to report financial statements to the public • Requires assets to be valued at their purchase price, not at their market value • Requires use of accrual accounting method ...

Instructions - Homework Market

... Explain how bond prices may be affected by money supply growth, oil prices, and economic growth. 13. Interaction Between Bond and Money Markets. (10 points) Assume that you maintain bonds and money market securities in your portfolio, and you suddenly believe that long-term interest rates will rise ...

... Explain how bond prices may be affected by money supply growth, oil prices, and economic growth. 13. Interaction Between Bond and Money Markets. (10 points) Assume that you maintain bonds and money market securities in your portfolio, and you suddenly believe that long-term interest rates will rise ...

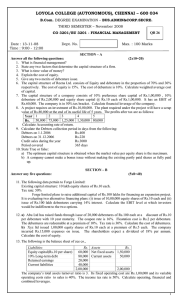

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... Existing capital structure: 10 lakh equity shares of Rs.10 each. Tax rate: 50% Forge limited plans to raise additional capital of Rs.100 lakhs for financing an expansion project. It is evaluating two alternative financing plans: (i) issue of 10,00,000 equity shares of Rs.10 each and (ii) issue of Rs ...

... Existing capital structure: 10 lakh equity shares of Rs.10 each. Tax rate: 50% Forge limited plans to raise additional capital of Rs.100 lakhs for financing an expansion project. It is evaluating two alternative financing plans: (i) issue of 10,00,000 equity shares of Rs.10 each and (ii) issue of Rs ...

Wealth and balance sheet effects of exchange rate In addition to its

... The balance sheet effect describes the impact of the exchange rate on the output gap caused by the effect of changes in wealth and net worth on the availability of bank loans. It is usually difficult and costly for banks to directly assess the clients’ future capacity to repay loans. As a result, ho ...

... The balance sheet effect describes the impact of the exchange rate on the output gap caused by the effect of changes in wealth and net worth on the availability of bank loans. It is usually difficult and costly for banks to directly assess the clients’ future capacity to repay loans. As a result, ho ...

IMPACT OF THE EURO DEBT CRISIS ON

... percentage of holders of the new payment terms binds all other holders so that no holdouts “a la Argentina” are permitted to disrupt future capital market fund raising when the country is back on its feet. Creditors will have to accept a “reasonable” interest rate, probably averaging 4%, not too bur ...

... percentage of holders of the new payment terms binds all other holders so that no holdouts “a la Argentina” are permitted to disrupt future capital market fund raising when the country is back on its feet. Creditors will have to accept a “reasonable” interest rate, probably averaging 4%, not too bur ...

Consumer Money Rates

... loans and credit card debt.7 Money Market - The money market interest rate is the rate at which short term debt securities are traded in an active market. A money market consists of financial instruments such as treasury bills, certificates of deposits (CD’s) and commercial paper that have short mat ...

... loans and credit card debt.7 Money Market - The money market interest rate is the rate at which short term debt securities are traded in an active market. A money market consists of financial instruments such as treasury bills, certificates of deposits (CD’s) and commercial paper that have short mat ...

Collateralized Mortgage Obligations (CMOs)

... mortgages led to higher possibility of default for mortgages underlying the CMO Collapse in housing prices End of 2-3 year fixed rate for Adjustable Rate Mortgages (ARMs) meant many could not make their new mortgage payment ...

... mortgages led to higher possibility of default for mortgages underlying the CMO Collapse in housing prices End of 2-3 year fixed rate for Adjustable Rate Mortgages (ARMs) meant many could not make their new mortgage payment ...