CHAPTER 9 The Cost of Capital

... When a company issues new common stock they also have to pay flotation costs to the underwriter. Issuing new common stock may send a negative signal to the capital markets, which may depress the stock price. ...

... When a company issues new common stock they also have to pay flotation costs to the underwriter. Issuing new common stock may send a negative signal to the capital markets, which may depress the stock price. ...

1 - JustAnswer

... prepared on December 31, the company should make the following adjusting entry: a. Debit Depreciation Expense, $960; Credit Accumulated Depreciation, $960. b. Debit Depreciation Expense, $80; Credit Accumulated Depreciation, $80. c. Debit Depreciation Expense, $3,840; Credit Accumulated Depreciation ...

... prepared on December 31, the company should make the following adjusting entry: a. Debit Depreciation Expense, $960; Credit Accumulated Depreciation, $960. b. Debit Depreciation Expense, $80; Credit Accumulated Depreciation, $80. c. Debit Depreciation Expense, $3,840; Credit Accumulated Depreciation ...

main market-related risks

... The adoption of new rules applicable to the properties in the Company’s portfolio may necessitate additional investments and thereby entail increased costs to the Company and/or delays in ongoing projects (renovation, etc.). Non-compliance of a building with all the applicable regulations is liable ...

... The adoption of new rules applicable to the properties in the Company’s portfolio may necessitate additional investments and thereby entail increased costs to the Company and/or delays in ongoing projects (renovation, etc.). Non-compliance of a building with all the applicable regulations is liable ...

Improving Covenant Protections in the Investment

... The Credit Roundtable is an association of fixed income investors seeking to improve the protective covenants in investment grade bond indentures. These investors, assembled under the auspices of the Fixed Income Forum, have come together to prepare and publish this covenant white paper. The purpose ...

... The Credit Roundtable is an association of fixed income investors seeking to improve the protective covenants in investment grade bond indentures. These investors, assembled under the auspices of the Fixed Income Forum, have come together to prepare and publish this covenant white paper. The purpose ...

Financial instruments and related risks

... them partially or by concluding hedging contracts with durations and amounts which are not exactly covering maturity and amounts of the underlying risk. The risk related to active risk management lies between the risks associated with hedging and investment. ...

... them partially or by concluding hedging contracts with durations and amounts which are not exactly covering maturity and amounts of the underlying risk. The risk related to active risk management lies between the risks associated with hedging and investment. ...

sources of capital and economic growth - u.s.

... reform issues, but many of the specific regulations ...

... reform issues, but many of the specific regulations ...

Intangible Assets - McGraw Hill Higher Education

... A nonmonetary exchange is considered to have commercial substance if the company expects a change in future cash flows as a result of the exchange. ...

... A nonmonetary exchange is considered to have commercial substance if the company expects a change in future cash flows as a result of the exchange. ...

Liabilities

... a) A bond is a whole unit issued to a single person while a promissory note is subdivided into fractional parts sold to many different entities. b) Bonds will sell at a discount if their interest rate is higher than the prevailing market rate c) Effective interest on bonds is arrived at by multiplyi ...

... a) A bond is a whole unit issued to a single person while a promissory note is subdivided into fractional parts sold to many different entities. b) Bonds will sell at a discount if their interest rate is higher than the prevailing market rate c) Effective interest on bonds is arrived at by multiplyi ...

old dominion freight line, inc.

... credit commitment and a $15,000,000 letter of credit commitment. Interest on the line of credit was charged at rates that vary based upon a certain financial performance ratio and the stated period of time that the borrowings were outstanding. On January 14, 2000, the Company amended this credit fac ...

... credit commitment and a $15,000,000 letter of credit commitment. Interest on the line of credit was charged at rates that vary based upon a certain financial performance ratio and the stated period of time that the borrowings were outstanding. On January 14, 2000, the Company amended this credit fac ...

Unconstrained fixed income: generating consistent returns

... For those Defined Contribution (DC) pension plan members, and for those individual savers, that have shorter-term time horizons and lower tolerance for losses, UFI can be a valuable strategy. These investors need to be prepared to accept meaningful levels of risk over a 3-year timescale; however a w ...

... For those Defined Contribution (DC) pension plan members, and for those individual savers, that have shorter-term time horizons and lower tolerance for losses, UFI can be a valuable strategy. These investors need to be prepared to accept meaningful levels of risk over a 3-year timescale; however a w ...

Notice Concerning Debt Financing

... 1. Amounts are rounded down to the nearest million yen. Accordingly, adding or subtracting the above interest-bearing liabilities amounts, it is not always equal to the total amount or the amount of increase or decrease. 2. “Short-term borrowing” means a borrowing lasting within one year from the dr ...

... 1. Amounts are rounded down to the nearest million yen. Accordingly, adding or subtracting the above interest-bearing liabilities amounts, it is not always equal to the total amount or the amount of increase or decrease. 2. “Short-term borrowing” means a borrowing lasting within one year from the dr ...

Results of operations - Canadian Securities Exchange

... On June 4, 2013, following the acquisition of Portage Pharma Ltd, the Company’s wholly owned subsidiary, Portage Acquisition Inc. and Portage Pharma Ltd amalgamated. The amalgamated company was named PPL, which has been incorporated in the BVI. PPL’s focus is in discovering and developing innovative ...

... On June 4, 2013, following the acquisition of Portage Pharma Ltd, the Company’s wholly owned subsidiary, Portage Acquisition Inc. and Portage Pharma Ltd amalgamated. The amalgamated company was named PPL, which has been incorporated in the BVI. PPL’s focus is in discovering and developing innovative ...

Chapter 10 An Overview of Risk Management

... ü Is uncertainty the same as Risk ? Uncertainty exists whenever one does not know for sure what will occur in the future. Risk is uncertainty that "matters" because it affects people's welfare. Every risky situation is uncertain but there can be uncertainty without risk. Risk Aversion: This is a cha ...

... ü Is uncertainty the same as Risk ? Uncertainty exists whenever one does not know for sure what will occur in the future. Risk is uncertainty that "matters" because it affects people's welfare. Every risky situation is uncertain but there can be uncertainty without risk. Risk Aversion: This is a cha ...

Acceptance Of Deposits

... received by company, within 21 days from date of receipt of money/realization of cheque/date of renewal. A receipt - shall be signed by an officer of company duly authorized by Board in this behalf and shall state date, name and address, amount, ROI and date on which deposit is repayable. ...

... received by company, within 21 days from date of receipt of money/realization of cheque/date of renewal. A receipt - shall be signed by an officer of company duly authorized by Board in this behalf and shall state date, name and address, amount, ROI and date on which deposit is repayable. ...

preferred securities - Janney Montgomery Scott LLC

... baby bonds to reach investors with smaller size investments that are looking for additional yield over that which other securities are offering in the market. ...

... baby bonds to reach investors with smaller size investments that are looking for additional yield over that which other securities are offering in the market. ...

Business 3 Template

... information and credit reports and its confidentiality. E. The company’s database management plan, systems, devices, equipment and software to be Used, update mechanism, security measures, and the protection of its database. F. The organizational structure of the company. G. Budget estimates for the ...

... information and credit reports and its confidentiality. E. The company’s database management plan, systems, devices, equipment and software to be Used, update mechanism, security measures, and the protection of its database. F. The organizational structure of the company. G. Budget estimates for the ...

Chapter 5 The Time Value of Money

... This accountability is unlimited liability because an owner is liable not only to the extent of what is invested in the business but also for any other assets owned. ...

... This accountability is unlimited liability because an owner is liable not only to the extent of what is invested in the business but also for any other assets owned. ...

Understanding the Municipal Bond Marketplace

... investors seeking early return of principal for reinvestment and portfolio managers seeking total return strategies. • For investors seeking to keep their principal intact, adding premium structure bonds requires the discipline of distinguishing amortized principal from interest income. ...

... investors seeking early return of principal for reinvestment and portfolio managers seeking total return strategies. • For investors seeking to keep their principal intact, adding premium structure bonds requires the discipline of distinguishing amortized principal from interest income. ...

PRESS RELEASE - Tikehau Capital

... This press release and the information contained herein do not constitute an offer to sell or purchase, or the solicitation of an offer to sell or purchase, securities of Tikehau Capital. No communication or information relating to the contemplated Capital Increase may be distributed to the public i ...

... This press release and the information contained herein do not constitute an offer to sell or purchase, or the solicitation of an offer to sell or purchase, securities of Tikehau Capital. No communication or information relating to the contemplated Capital Increase may be distributed to the public i ...

NEW BOND ISSUE 5% €25000000 Tumas Investments plc Bonds

... The Bonds shall constitute the general, direct, unconditional and unsecured obligations of the Issuer and shall be guaranteed in respect of both the principal amount and the interest due under said Bonds by the Guarantor. This means that bondholders will rank pari passu (equally) with the other unse ...

... The Bonds shall constitute the general, direct, unconditional and unsecured obligations of the Issuer and shall be guaranteed in respect of both the principal amount and the interest due under said Bonds by the Guarantor. This means that bondholders will rank pari passu (equally) with the other unse ...

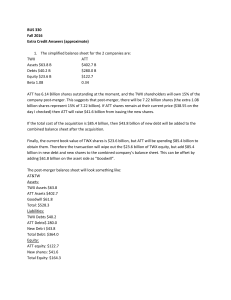

Bonus Assignment solution

... “if”) – then this would be a $2.4 billion cost savings per year, or an additional $2.4 billion of pretax income. Income tax is currently about 30% of its income, so that would leave $1.7 billion of additional net income. This amount would increase TWX earnings per share by 44%. Therefore cost saving ...

... “if”) – then this would be a $2.4 billion cost savings per year, or an additional $2.4 billion of pretax income. Income tax is currently about 30% of its income, so that would leave $1.7 billion of additional net income. This amount would increase TWX earnings per share by 44%. Therefore cost saving ...

RIS-2 DOC

... bonds and other sources of debt finance by ensuring that AIL or NRWT was always paid on foreign debt. However, there are a variety of ways that foreign debt can escape NRWT, some of which would be difficult to address with tax legislation. In other words, if we tried to implement this option it woul ...

... bonds and other sources of debt finance by ensuring that AIL or NRWT was always paid on foreign debt. However, there are a variety of ways that foreign debt can escape NRWT, some of which would be difficult to address with tax legislation. In other words, if we tried to implement this option it woul ...

Investment Principles

... borrow more funds. – In very simple terms: A lender prevents an entity from borrowing more money until they have paid back the lender. ...

... borrow more funds. – In very simple terms: A lender prevents an entity from borrowing more money until they have paid back the lender. ...

What to Know About Prime Funds

... Amortized Cost is the price a fund pays for a security, as adjusted over time for accounting changes in any discount or premium. Basis Point (bps) is one one-hundredths of a percentage point. This term is often used in describing changes in interest rates. For example, if a bond yield increases from ...

... Amortized Cost is the price a fund pays for a security, as adjusted over time for accounting changes in any discount or premium. Basis Point (bps) is one one-hundredths of a percentage point. This term is often used in describing changes in interest rates. For example, if a bond yield increases from ...