Federal Reserve Rule Regarding Capital

... The Fed has decided, as proposed, to retain in the final rule the standard that voting common stock should be the dominant form of a BHC’s Tier 1 capital. The final rule continues to caution that excessive non-voting elements generally will be reallocated to Tier 2 capital. Pooled issuances generall ...

... The Fed has decided, as proposed, to retain in the final rule the standard that voting common stock should be the dominant form of a BHC’s Tier 1 capital. The final rule continues to caution that excessive non-voting elements generally will be reallocated to Tier 2 capital. Pooled issuances generall ...

Chapter 14

... are smaller than those of unlevered equity, levered equity will sell for a lower price ($500 versus $1000). However, you are not worse off.You will still raise a total of ...

... are smaller than those of unlevered equity, levered equity will sell for a lower price ($500 versus $1000). However, you are not worse off.You will still raise a total of ...

Chapter 1 - Universidade do Minho

... who in turn hire the management team. Contracts can be carefully constructed to be incentive compatible. There is a market for managerial talent—this may provide market discipline to the managers—they can be replaced. If the managers fail to maximize share price, they may be replaced in a hostile ta ...

... who in turn hire the management team. Contracts can be carefully constructed to be incentive compatible. There is a market for managerial talent—this may provide market discipline to the managers—they can be replaced. If the managers fail to maximize share price, they may be replaced in a hostile ta ...

ING Group Inaugural AT1 Roadshow (PDF 0,4 Mb)

... All capital ratios are non-GAAP metrics, except for unadjusted phased-in CET1 capital and CET1 ratio * For a presentation of fully-loaded CET1 capital and risk-weighted assets compared to phased-in CET1 capital and risk-weighted assets, see p. F-223 of the 2014 20-F ** Reversal of deduction from CET ...

... All capital ratios are non-GAAP metrics, except for unadjusted phased-in CET1 capital and CET1 ratio * For a presentation of fully-loaded CET1 capital and risk-weighted assets compared to phased-in CET1 capital and risk-weighted assets, see p. F-223 of the 2014 20-F ** Reversal of deduction from CET ...

(PPT, 269KB)

... where Kt represents the firm's Invested Capital|invested capital at the end of period t. Increases in non-cash current assets may, or may not be deducted, depending on whether they are considered to be maintaining the status quo, or to be investments for growth. ...

... where Kt represents the firm's Invested Capital|invested capital at the end of period t. Increases in non-cash current assets may, or may not be deducted, depending on whether they are considered to be maintaining the status quo, or to be investments for growth. ...

VENTURE CAPITAL, 2002, VOL. 4, No.4, 275-287

... net free cash flow. Formal corporate alliances are another popular method. The entrepreneurial venture forms an alliance with a larger corporation to develop complementary products and services, in exchange for funding and/or other support. The evidence, at least as far as software entrepreneurs are ...

... net free cash flow. Formal corporate alliances are another popular method. The entrepreneurial venture forms an alliance with a larger corporation to develop complementary products and services, in exchange for funding and/or other support. The evidence, at least as far as software entrepreneurs are ...

Supervision of Credit Rating Agencies: The Role of Credit Rating

... the securities) of an enterprise and/or legal entity. In some jurisdictions, like the United States, CRAs are expressly excluded from prospectus liability (s.11 liability). It is possible that CRAs will be held liable in the Netherlands for prospectus liability (through s.6:194 of the Dutch Civil Co ...

... the securities) of an enterprise and/or legal entity. In some jurisdictions, like the United States, CRAs are expressly excluded from prospectus liability (s.11 liability). It is possible that CRAs will be held liable in the Netherlands for prospectus liability (through s.6:194 of the Dutch Civil Co ...

The Capital Structure Debate

... are smaller than those of unlevered equity, levered equity will sell for a lower price ($500 versus $1000). – However, you are not worse off. You will still raise a total of $1000 by issuing both debt and levered equity. Consequently, you would be indifferent between these two choices for the firm’s ...

... are smaller than those of unlevered equity, levered equity will sell for a lower price ($500 versus $1000). – However, you are not worse off. You will still raise a total of $1000 by issuing both debt and levered equity. Consequently, you would be indifferent between these two choices for the firm’s ...

Orderly Liquidation Authority: FDIC Announces

... In a speech last Thursday, May 10, 2012, the Acting Chairman of the Federal Deposit Insurance Corporation (“FDIC”), Martin J. Gruenberg, outlined the agency’s strategy for the Orderly Liquidation Authority (“OLA”).1 On its face at least, the approach is simple: the FDIC will place only the top-tier ...

... In a speech last Thursday, May 10, 2012, the Acting Chairman of the Federal Deposit Insurance Corporation (“FDIC”), Martin J. Gruenberg, outlined the agency’s strategy for the Orderly Liquidation Authority (“OLA”).1 On its face at least, the approach is simple: the FDIC will place only the top-tier ...

Week 8 Slides

... – Hard: The firm cannot obtain outside capital to fund all its positive NPV projects » This typically applies to small, growing firms with high insider ownership where there may be significant agency costs ...

... – Hard: The firm cannot obtain outside capital to fund all its positive NPV projects » This typically applies to small, growing firms with high insider ownership where there may be significant agency costs ...

The Cost of Capital for Alternative Investments

... With a complete state-contingent description of an investable risk-matched alternative to the aggregate hedge fund universe, we can determine the rate of return that an investor would require as a function of his risk aversion and the underlying return distributions of other asset classes, all of w ...

... With a complete state-contingent description of an investable risk-matched alternative to the aggregate hedge fund universe, we can determine the rate of return that an investor would require as a function of his risk aversion and the underlying return distributions of other asset classes, all of w ...

DOC - Investor Relations

... guidance for 2015, which we announced in early September of this year. Mr. Wagner also discussed the company’s August follow-on offering, which raised $163 million and brought a good group of new institutional investors into the stock. He noted that the new equity issuance had resulted in an increas ...

... guidance for 2015, which we announced in early September of this year. Mr. Wagner also discussed the company’s August follow-on offering, which raised $163 million and brought a good group of new institutional investors into the stock. He noted that the new equity issuance had resulted in an increas ...

1 - Certified Financial Analyst

... such as funding structure (perhaps the company is too indebted, and should issue shares to raise more money; or does it have too much cash on its balance sheet, just sitting there not earning interest, so that it should consider paying a large dividend to its shareholders or buying back some of its ...

... such as funding structure (perhaps the company is too indebted, and should issue shares to raise more money; or does it have too much cash on its balance sheet, just sitting there not earning interest, so that it should consider paying a large dividend to its shareholders or buying back some of its ...

FMDQ OTC Plc - Association of Issuing Houses of Nigeria

... Outline Click totoedit Outline Click editMaster Mastertitle titlestyle style ...

... Outline Click totoedit Outline Click editMaster Mastertitle titlestyle style ...

Mezzanine Finance - NYU Stern School of Business

... fixed throughout the term of the loan or can fluctuate (i.e., float) along with LIBOR or other base rates. PIK interest — Payable in kind interest is a periodic form of payment in which the interest payment is not paid in cash but rather by increasing the principal amount of the security in the amou ...

... fixed throughout the term of the loan or can fluctuate (i.e., float) along with LIBOR or other base rates. PIK interest — Payable in kind interest is a periodic form of payment in which the interest payment is not paid in cash but rather by increasing the principal amount of the security in the amou ...

Ch_2

... • The more liquid a firm’s assets, the less likely the firm is to experience problems meeting short-term obligations. • Liquid assets frequently have lower rates of return than fixed assets. ...

... • The more liquid a firm’s assets, the less likely the firm is to experience problems meeting short-term obligations. • Liquid assets frequently have lower rates of return than fixed assets. ...

Hedge Funds

... That’s, for example, the reason hedge funds can’t advertise, and why they generally can take money from individuals only if they are ‘accredited investors’. The US Securities and Exchange Commission’s regulations define these as people with net assets of at least $1 million and an annual income of $ ...

... That’s, for example, the reason hedge funds can’t advertise, and why they generally can take money from individuals only if they are ‘accredited investors’. The US Securities and Exchange Commission’s regulations define these as people with net assets of at least $1 million and an annual income of $ ...

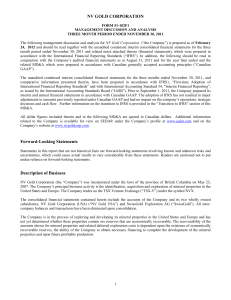

NV GOLD CORPORATION Forward-Looking Statements Description

... The Company has an agreement with Gold Standard Royalty (Nevada) Inc., (“Gold Standard”) to acquire a 100% interest in the Afgan-Kobeh project located in Eureka County, Nevada. The Afgan-Kobeh project covers approximately 2,180 acres and consists of 109 unpatented claims. In 2004, Castleworth Ventur ...

... The Company has an agreement with Gold Standard Royalty (Nevada) Inc., (“Gold Standard”) to acquire a 100% interest in the Afgan-Kobeh project located in Eureka County, Nevada. The Afgan-Kobeh project covers approximately 2,180 acres and consists of 109 unpatented claims. In 2004, Castleworth Ventur ...

EIF Presentation Template - EU Strategy for the Baltic Sea Region

... This presentation was prepared by EIF. The information included in this presentation is based on figures available for March 2011 Any estimates and projections contained herein involve significant elements of subjective judgment and analysis, which may or may not be correct. ...

... This presentation was prepared by EIF. The information included in this presentation is based on figures available for March 2011 Any estimates and projections contained herein involve significant elements of subjective judgment and analysis, which may or may not be correct. ...

Six Flags Entertainment Corp (Form: 8-K, Received: 12/21

... Loan Lender’s Tranche B Term Loan Commitment (as defined in the Credit Agreement). For purposes hereof, a Person shall become a party to the Credit Agreement as amended hereby and a Tranche B Term Loan Lender as of the Effective Date by executing and delivering to the Administrative Agent, on or pr ...

... Loan Lender’s Tranche B Term Loan Commitment (as defined in the Credit Agreement). For purposes hereof, a Person shall become a party to the Credit Agreement as amended hereby and a Tranche B Term Loan Lender as of the Effective Date by executing and delivering to the Administrative Agent, on or pr ...

Chapter 13 PowerPoint Presentation

... Partially Secured The value of the collateral covers only a portion of the obligation. The remainder is considered unsecured. ...

... Partially Secured The value of the collateral covers only a portion of the obligation. The remainder is considered unsecured. ...

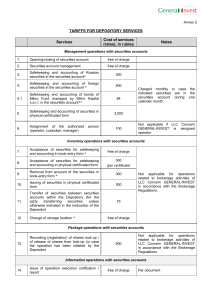

Tariffs depository

... 1. Settlement period shall be a calendar month; the calculation is carried out for each securities account of the Depositor. 2. All rates do not include any overhead costs and services of third parties (parent depositories, registrars). 3. Payment for Depository services shall be made by the Deposit ...

... 1. Settlement period shall be a calendar month; the calculation is carried out for each securities account of the Depositor. 2. All rates do not include any overhead costs and services of third parties (parent depositories, registrars). 3. Payment for Depository services shall be made by the Deposit ...

Kauss- Single Mortgage Loan

... such sale, and, if the holder of such claim purchases such property, such holder may offset such claim against the purchase price of such property. (Emphasis added) The Bankruptcy Court had found that there was no “cause” to deny credit bidding, and the debtor did not appeal this finding. The debtor ...

... such sale, and, if the holder of such claim purchases such property, such holder may offset such claim against the purchase price of such property. (Emphasis added) The Bankruptcy Court had found that there was no “cause” to deny credit bidding, and the debtor did not appeal this finding. The debtor ...

Richard Carter, Launch of the Allan Gray

... of participatory interest (units) may go down as well as up. Fluctuations or movements in exchange rates may also be the cause of the value of underlying international investments going up or down. Unit trusts are traded at ruling prices. Commissions and incentives may be paid and if so, would be in ...

... of participatory interest (units) may go down as well as up. Fluctuations or movements in exchange rates may also be the cause of the value of underlying international investments going up or down. Unit trusts are traded at ruling prices. Commissions and incentives may be paid and if so, would be in ...

T1.1 Chapter Outline - U of L Class Index

... Introduction to Corporate Finance Financial Statements, Taxes, and Cash Flow Working with Financial Statements Long-Term Financial Planning and Corporate Growth Introduction to Valuation: The Time Value of Money ...

... Introduction to Corporate Finance Financial Statements, Taxes, and Cash Flow Working with Financial Statements Long-Term Financial Planning and Corporate Growth Introduction to Valuation: The Time Value of Money ...