WIS ACCOUNTING BASICS

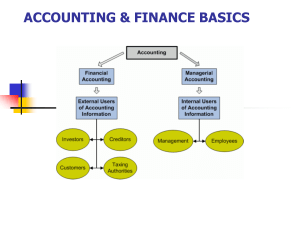

... External users are parties outside the reporting entity (company) who are interested in the accounting information. Investors (owners) use accounting information to make buy, sell or keep decisions related to shares, bonds, etc. Creditors (suppliers, banks) utilize accounting information to make len ...

... External users are parties outside the reporting entity (company) who are interested in the accounting information. Investors (owners) use accounting information to make buy, sell or keep decisions related to shares, bonds, etc. Creditors (suppliers, banks) utilize accounting information to make len ...

Shares

... Method of acquiring finance to purchase assets Cost of assets fully deductible (immediately) from profits for tax purposes Operating Lease - manufacturer or stockist of equipment provides a short-term contract to use the equipment subject to payment of lease charges (or subject to ongoing purchase o ...

... Method of acquiring finance to purchase assets Cost of assets fully deductible (immediately) from profits for tax purposes Operating Lease - manufacturer or stockist of equipment provides a short-term contract to use the equipment subject to payment of lease charges (or subject to ongoing purchase o ...

private equity market outlook

... plunge in the fundraising activity finally materialized. According to EVCA, total funds raised in 2009 amounted to EUR 13bn, down 84% from 2008’s figure of EUR 82bn (Figure 6). In fact, 2009’s fundraising figure is equivalent to only approximately 75% of the two largest funds raised in 2008. Buyout ...

... plunge in the fundraising activity finally materialized. According to EVCA, total funds raised in 2009 amounted to EUR 13bn, down 84% from 2008’s figure of EUR 82bn (Figure 6). In fact, 2009’s fundraising figure is equivalent to only approximately 75% of the two largest funds raised in 2008. Buyout ...

Margin Handbook

... Line of Credit are many: lightning fast process, low interest rates, and repayment on your schedule. There are also some risks and financial terms that may be new to you and are covered in the following standard disclosure statement. Some of the language in the Wealthfront Margin Disclosure Statemen ...

... Line of Credit are many: lightning fast process, low interest rates, and repayment on your schedule. There are also some risks and financial terms that may be new to you and are covered in the following standard disclosure statement. Some of the language in the Wealthfront Margin Disclosure Statemen ...

Bonds

... 2. the length of time until the amounts are received, 3. the market rate of interest. The features of a bond (callable, convertible, etc) affect the market rate of the bond. A corporation only makes journal entries when it issues or buys back bonds, and when bondholders convert bonds into common sto ...

... 2. the length of time until the amounts are received, 3. the market rate of interest. The features of a bond (callable, convertible, etc) affect the market rate of the bond. A corporation only makes journal entries when it issues or buys back bonds, and when bondholders convert bonds into common sto ...

Small Business Management

... • What is the nature of current assets? They are cash or moving toward cash. ...

... • What is the nature of current assets? They are cash or moving toward cash. ...

Use of Derivatives for Debt Management and Domestic Debt Market

... derivative asset class and, last but not least, the maintenance of market liquidity. In turn, these factors can contribute directly to lower funding costs for the government, with more competitive participation in auctions (by investors and intermediaries) and better market-making in the secondary m ...

... derivative asset class and, last but not least, the maintenance of market liquidity. In turn, these factors can contribute directly to lower funding costs for the government, with more competitive participation in auctions (by investors and intermediaries) and better market-making in the secondary m ...

FM302-MANAGEMENT OF FINANCIAL SERVICES

... endorsement and delivery, issued in bearer form and issued at such discount on the face value as may be determined by the issuing co. • Short-term borrowings by corporate, financial institutions, primary dealers from the money market • Can be issued in the physical form (Usance Promissory Note) or d ...

... endorsement and delivery, issued in bearer form and issued at such discount on the face value as may be determined by the issuing co. • Short-term borrowings by corporate, financial institutions, primary dealers from the money market • Can be issued in the physical form (Usance Promissory Note) or d ...

Nordrhein-Westfalen`s green policy delivers credit positive economic

... comes at a cost. The Land's total expenditure has been growing at a higher pace than the sector average, contributing to a belowaverage financial performance (Exhibit 2). While capital expenditure levels are close to the sector average, NRW's efforts to consolidate its budget through expenditure cut ...

... comes at a cost. The Land's total expenditure has been growing at a higher pace than the sector average, contributing to a belowaverage financial performance (Exhibit 2). While capital expenditure levels are close to the sector average, NRW's efforts to consolidate its budget through expenditure cut ...

Koppers Holdings Inc. (Form: 8-K, Received: 08/21

... Page 2 –Koppers Completes Acquisition of Osmose Businesses annually over the next 15 years. Koppers is financing the purchase through new and existing bank debt, including a new term loan and an increase to the company’s existing revolving credit facility. Revenues for the Acquired Businesses in 20 ...

... Page 2 –Koppers Completes Acquisition of Osmose Businesses annually over the next 15 years. Koppers is financing the purchase through new and existing bank debt, including a new term loan and an increase to the company’s existing revolving credit facility. Revenues for the Acquired Businesses in 20 ...

Consider the risks - Guinness Asset Management

... Some offerings in the Guinness EIS Service can invest in companies which are not expected to have a listing or quotation. Therefore, there may not be a recognised or active market for the shares of investee companies and it may be difficult to sell or realise the investment or obtain reliable inform ...

... Some offerings in the Guinness EIS Service can invest in companies which are not expected to have a listing or quotation. Therefore, there may not be a recognised or active market for the shares of investee companies and it may be difficult to sell or realise the investment or obtain reliable inform ...

What Happens to Bondholders When a Company Files for Bankruptcy

... are held in your name, then you should receive information directly from the company. Investors should also contact their brokers or investment advisor if they do not receive any information from the company. Investors may be asked to vote on a company's reorganization plan. Before you do, you shou ...

... are held in your name, then you should receive information directly from the company. Investors should also contact their brokers or investment advisor if they do not receive any information from the company. Investors may be asked to vote on a company's reorganization plan. Before you do, you shou ...

Quiznos Completes Restructuring of Debt and Strengthens Financial

... and pioneer of the toasted sandwich, today announced that the Company has successfully completed its previously announced financial restructuring on an out‐of‐court basis. The agreement eliminates one‐ third – or approximately $300 million – of the company’s outstanding debt, and provides a signifi ...

... and pioneer of the toasted sandwich, today announced that the Company has successfully completed its previously announced financial restructuring on an out‐of‐court basis. The agreement eliminates one‐ third – or approximately $300 million – of the company’s outstanding debt, and provides a signifi ...

GRAY ROCK RESOURCES LTD.

... Held-to-maturity investments - These assets are non-derivative financial assets with fixed or determinable payments and fixed maturities that the Company's management has the positive intention and ability to hold to maturity. These assets are measured at amortized cost using the effective interest ...

... Held-to-maturity investments - These assets are non-derivative financial assets with fixed or determinable payments and fixed maturities that the Company's management has the positive intention and ability to hold to maturity. These assets are measured at amortized cost using the effective interest ...

Taylor Economics Chapter 29 Test Bank

... net worth, and the various methods that banks may employ to protect themselves from this type of outcome. Banks run a risk of negative net worth if the value of their assets declines. The value of assets can decline because of an unexpectedly high number of defaults on loans, or if interest rates ri ...

... net worth, and the various methods that banks may employ to protect themselves from this type of outcome. Banks run a risk of negative net worth if the value of their assets declines. The value of assets can decline because of an unexpectedly high number of defaults on loans, or if interest rates ri ...

Decree-Law No. 69/2004 of 25 March

... The legal requirements for short-term debt securities, commonly known as «commercial paper», were established in Decree-Law no. 181/92, of 22 August, having previously been amended by Decree-Law no. 231/94, of 14 September, and by Decree-Law no. 343/98, of 6 November and no. 26/2000, of 3 March. Giv ...

... The legal requirements for short-term debt securities, commonly known as «commercial paper», were established in Decree-Law no. 181/92, of 22 August, having previously been amended by Decree-Law no. 231/94, of 14 September, and by Decree-Law no. 343/98, of 6 November and no. 26/2000, of 3 March. Giv ...

Financial Report - Charles Darwin University

... with the Corporations Act 2001, Accounting Standards and Interpretations and complies with other requirements of the law. Accounting Standards include Australian equivalents to International Reporting Standards ('A-IFRS') as applicable for not for profit entities. The financial statements were autho ...

... with the Corporations Act 2001, Accounting Standards and Interpretations and complies with other requirements of the law. Accounting Standards include Australian equivalents to International Reporting Standards ('A-IFRS') as applicable for not for profit entities. The financial statements were autho ...

SEC Shines a Spotlight on Short-Term Borrowings

... maximum amounts. Guide 3 also does not require the above quantitative information for any category of short-term borrowings for which the average balance outstanding during the period was less than 30 percent of stockholders’ equity at the end of the period. The proposed amendments do not include a ...

... maximum amounts. Guide 3 also does not require the above quantitative information for any category of short-term borrowings for which the average balance outstanding during the period was less than 30 percent of stockholders’ equity at the end of the period. The proposed amendments do not include a ...

The Role of Bond Covenants in Municipal Finance Credit

... of bondholder interests. Issuers with a rating in the Aaa and Aa categories often have sufficient margins of protection against adverse economic conditions that reduce the benefit of certain covenants that might be key to the rating of lower-rated entities. It is not expected, for example, that a Aa ...

... of bondholder interests. Issuers with a rating in the Aaa and Aa categories often have sufficient margins of protection against adverse economic conditions that reduce the benefit of certain covenants that might be key to the rating of lower-rated entities. It is not expected, for example, that a Aa ...

Finanšu un kapitāla tirgus komisijas padomes

... 2.1.5. about the protection or guarantee system of investors, a part of which is the cooperation partner; 2.1.6. about financial instrument and money recovery possibilities and the procedure in case of insolvency or liquidation of the cooperation partner; 2.1.7. about financial instrument accounting ...

... 2.1.5. about the protection or guarantee system of investors, a part of which is the cooperation partner; 2.1.6. about financial instrument and money recovery possibilities and the procedure in case of insolvency or liquidation of the cooperation partner; 2.1.7. about financial instrument accounting ...

download

... difference between cash on hand and the purchase price. A method of financing in which a company issues shares of its stock and receives money in return. Define Firms Cost of Capital The return expected by investors for the capital they supply to fund all the assets acquired and managed by the firm. ...

... difference between cash on hand and the purchase price. A method of financing in which a company issues shares of its stock and receives money in return. Define Firms Cost of Capital The return expected by investors for the capital they supply to fund all the assets acquired and managed by the firm. ...

FA2: Module 9 Tangible and intangible capital assets

... Machine 101 was purchased and put into operation on July 31. The following items and expenditures were noted: Invoice cost ...

... Machine 101 was purchased and put into operation on July 31. The following items and expenditures were noted: Invoice cost ...

Minister adopts the `Big Stick` approach

... with the rights, including property rights, of persons who may be affected by the performance of those functions SLO contains broad powers and removes default event According to the Act, the Minster may apply to the court for a Subordinated Liabilities Order to enable burden-sharing. This may result ...

... with the rights, including property rights, of persons who may be affected by the performance of those functions SLO contains broad powers and removes default event According to the Act, the Minster may apply to the court for a Subordinated Liabilities Order to enable burden-sharing. This may result ...

Credit Management

... • A Consumer Loan is when a buyer agrees to make monthly payments in specific amounts over a period of time. ...

... • A Consumer Loan is when a buyer agrees to make monthly payments in specific amounts over a period of time. ...

Addressing Issuer Concerns

... 8. Professor Robert Shiller stressed that GDP-indexed bonds would be difficult to price. Current pricing models are not very developed and, until this issue is resolved, the question which market player would be interested in these instruments would be academic. He pointed out that the simpler the s ...

... 8. Professor Robert Shiller stressed that GDP-indexed bonds would be difficult to price. Current pricing models are not very developed and, until this issue is resolved, the question which market player would be interested in these instruments would be academic. He pointed out that the simpler the s ...