hanmi financial corp

... LOS ANGELES, November 14, 2011 (GLOBE NEWSWIRE) — Hanmi Financial Corporation (Nasdaq: HAFC) (the “Company”), the holding company for Hanmi Bank, today announced that it has commenced an underwritten public offering of approximately $70 million of its common stock. FBR Capital Markets & Co. will ser ...

... LOS ANGELES, November 14, 2011 (GLOBE NEWSWIRE) — Hanmi Financial Corporation (Nasdaq: HAFC) (the “Company”), the holding company for Hanmi Bank, today announced that it has commenced an underwritten public offering of approximately $70 million of its common stock. FBR Capital Markets & Co. will ser ...

DuPont System of Analysis

... ROE = Net Profit Margin x Total Asset Turnover x Financial Leverage Multiplier i. Financial Leverage Multiplier, or “Equity Multiplier” as some call it, is really a debt ratio ii. More assets financed with debt mean less assets financed with equity, so higher this number is, the greater the use ...

... ROE = Net Profit Margin x Total Asset Turnover x Financial Leverage Multiplier i. Financial Leverage Multiplier, or “Equity Multiplier” as some call it, is really a debt ratio ii. More assets financed with debt mean less assets financed with equity, so higher this number is, the greater the use ...

8 - Maryland Public Service Commission

... for the New Bonds and Notes with a maturity of more than ten years, not in excess of 200 basis points above the yield to maturity on United States Treasury Bonds of comparable maturity at the time of pricing; ...

... for the New Bonds and Notes with a maturity of more than ten years, not in excess of 200 basis points above the yield to maturity on United States Treasury Bonds of comparable maturity at the time of pricing; ...

Global Financial Capital Fund June 2017

... The securities that the fund invests in may not always make interest and other payments nor is the solvency of the issuers guaranteed. Market conditions, such as a decrease in market liquidity for the securities in which the fund invests, may mean that the fund may not be able to sell those securiti ...

... The securities that the fund invests in may not always make interest and other payments nor is the solvency of the issuers guaranteed. Market conditions, such as a decrease in market liquidity for the securities in which the fund invests, may mean that the fund may not be able to sell those securiti ...

Risk, Cost of Capital, and Capital Budgeting

... Important: The debt-to-value ratio B/(S+B) is market-value based. In practice, the market value of debt is generally very close to its book value. But we should never use the equity on the balance sheet as its market value. We must rely on stock price to calculate this amount. We should also use the ...

... Important: The debt-to-value ratio B/(S+B) is market-value based. In practice, the market value of debt is generally very close to its book value. But we should never use the equity on the balance sheet as its market value. We must rely on stock price to calculate this amount. We should also use the ...

Lecture 8a Ch 19 Investment Banks Security Brokers and

... determine why type of security (equity, debt, etc.) to offer – Assisting in determining when to issue, how many, at what price (more important with IPOs than SEOs) ...

... determine why type of security (equity, debt, etc.) to offer – Assisting in determining when to issue, how many, at what price (more important with IPOs than SEOs) ...

high yield bonds under stress?

... phenomenon of “artificial stability” is likely to have been a factor in the sudden redemption problems surrounding the Third Avenue fund. It’s unlikely that a typical diversified high yield fund will have trouble meeting redemptions and we believe most high yield investors view this incident as an o ...

... phenomenon of “artificial stability” is likely to have been a factor in the sudden redemption problems surrounding the Third Avenue fund. It’s unlikely that a typical diversified high yield fund will have trouble meeting redemptions and we believe most high yield investors view this incident as an o ...

XXV Asamblea Annual de ASSAL XV Conferencia sobre

... indirect, special, consequential, compensatory or incidental damages whatsoever (including without limitation, lost profits), even if AMB is advised in advance of the possibility of such damages, resulting from the use of or inability to use, any such information. The credit ratings, financial repor ...

... indirect, special, consequential, compensatory or incidental damages whatsoever (including without limitation, lost profits), even if AMB is advised in advance of the possibility of such damages, resulting from the use of or inability to use, any such information. The credit ratings, financial repor ...

Standards for Bond Communication

... Corporate bonds rank among the best-performing asset classes, and it appears this trend will continue over the coming years. Viewed internationally, institutional portfolios carry relatively low proportions of equities (3-5%), with corporate bonds weighted more heavily. In times of reduced access to ...

... Corporate bonds rank among the best-performing asset classes, and it appears this trend will continue over the coming years. Viewed internationally, institutional portfolios carry relatively low proportions of equities (3-5%), with corporate bonds weighted more heavily. In times of reduced access to ...

Volta Finance Limited : Net Asset Value(s)

... Volta's investment objectives are to preserve capital across the credit cycle and to provide a stable stream of income to its shareholders through dividends. Volta seeks to attain its investment objectives predominantly through diversified investments in structured finance assets. The assets that th ...

... Volta's investment objectives are to preserve capital across the credit cycle and to provide a stable stream of income to its shareholders through dividends. Volta seeks to attain its investment objectives predominantly through diversified investments in structured finance assets. The assets that th ...

Rating Funding Agreement-Backed Securities Programs

... could be disrupted, for example, when interest rates decline and the durations of certain assets shorten, which often occurs with collateralized mortgage obligations (CMOs). To compensate, an insurer may fund a floating-rate FA with fixed-rate assets and then “swap” the resulting fixed payments for ...

... could be disrupted, for example, when interest rates decline and the durations of certain assets shorten, which often occurs with collateralized mortgage obligations (CMOs). To compensate, an insurer may fund a floating-rate FA with fixed-rate assets and then “swap” the resulting fixed payments for ...

the mosaic company

... Senior Notes. Each rating should be evaluated separately from any other rating. Stockholders, holders of the Senior Notes and others who are interested in additional detail about the restrictive covenants or other terms of the Indenture (including those covenants that have fallen away and those that ...

... Senior Notes. Each rating should be evaluated separately from any other rating. Stockholders, holders of the Senior Notes and others who are interested in additional detail about the restrictive covenants or other terms of the Indenture (including those covenants that have fallen away and those that ...

Certain statements in the below referenced discussion

... Certain statements in the below referenced discussion may constitute “forward-looking” statements as defined in Section 27A of the Securities Act of 1933 (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), and/or the Private Securities Litigation Reform A ...

... Certain statements in the below referenced discussion may constitute “forward-looking” statements as defined in Section 27A of the Securities Act of 1933 (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), and/or the Private Securities Litigation Reform A ...

What happens in the twilight zone

... Shifting interest rates to negative territory reduces borrowing costs for firms and households, boosting demand for loans and incentivising investment and consumer spending. This affects the economic outlook and bolsters confidence. These changes in turn influence investment and saving decisions of ...

... Shifting interest rates to negative territory reduces borrowing costs for firms and households, boosting demand for loans and incentivising investment and consumer spending. This affects the economic outlook and bolsters confidence. These changes in turn influence investment and saving decisions of ...

ABAC Comments to IASB on Conceptual

... The IASB disagree with the view that information needs may differ from those of short-term investors, and concluded that the Conceptual Framework contains sufficient and appropriate discussions of primary users and information needs, and appropriately address the needs of long-term investors. It a ...

... The IASB disagree with the view that information needs may differ from those of short-term investors, and concluded that the Conceptual Framework contains sufficient and appropriate discussions of primary users and information needs, and appropriately address the needs of long-term investors. It a ...

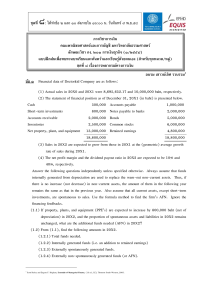

อบรม เชาวน์เลิศ รวบรวม1 ข้อ ๑ Financial data of Doctorkid Company

... ข้อ ๓ Suppose a firm makes the following policy changes. If the change means that external, nonspontaneous financial requirements (AFN) will increase, indicate this by a (+); indicate a decrease by a (-); and indicate indeterminate or no effect by a (0). Think in terms of the immediate, short-run ef ...

... ข้อ ๓ Suppose a firm makes the following policy changes. If the change means that external, nonspontaneous financial requirements (AFN) will increase, indicate this by a (+); indicate a decrease by a (-); and indicate indeterminate or no effect by a (0). Think in terms of the immediate, short-run ef ...

State of Connecticut Stable Value Fund

... to provide the basis for the crediting rate available to participants in the Fund. The underlying separate accounts are managed by ING investment Management, PIMCO Investment Advisors and Prudential Fixed Income Management. The underlying assets for all of the separate accounts are “insulated” from ...

... to provide the basis for the crediting rate available to participants in the Fund. The underlying separate accounts are managed by ING investment Management, PIMCO Investment Advisors and Prudential Fixed Income Management. The underlying assets for all of the separate accounts are “insulated” from ...

What Is An Investment

... which the firm finances its investments. Borrowing requires fixed payments which must be paid ahead of payments to stockholders. The use of debt increases uncertainty of stockholder income and causes an increase in the stock’s risk premium. ...

... which the firm finances its investments. Borrowing requires fixed payments which must be paid ahead of payments to stockholders. The use of debt increases uncertainty of stockholder income and causes an increase in the stock’s risk premium. ...

Islamic Finance Review 2009/10

... bonds and aims to respond to private investor demand by offering a cost-effective, transparent and efficient mechanism for concentrating on-screen liquidity and facilitating price discovery in a range of fixed income securities. The key benefit of this new retail market is that it offers an open and ...

... bonds and aims to respond to private investor demand by offering a cost-effective, transparent and efficient mechanism for concentrating on-screen liquidity and facilitating price discovery in a range of fixed income securities. The key benefit of this new retail market is that it offers an open and ...

Chapter 11

... • 5 main categories that determine your final FICO score: – 35% - Payment history – How you have paid your bills in the past – 30% - Amounts owed – Measures debt against credit – 15% - Length of credit History – Don’t open account after account. Keep a couple of credit cards for a long period of tim ...

... • 5 main categories that determine your final FICO score: – 35% - Payment history – How you have paid your bills in the past – 30% - Amounts owed – Measures debt against credit – 15% - Length of credit History – Don’t open account after account. Keep a couple of credit cards for a long period of tim ...

Chapter 11 Financial Reconstruction

... the company must meet certain contractual obligations, such as maintaining debt/equity ratio below a certain number. 2.4.6 Also a company may issue equity to avoid making coupon and face value payments because they feel they will be unable to do so in the future. 2.4.7 The contractual obligations me ...

... the company must meet certain contractual obligations, such as maintaining debt/equity ratio below a certain number. 2.4.6 Also a company may issue equity to avoid making coupon and face value payments because they feel they will be unable to do so in the future. 2.4.7 The contractual obligations me ...

Optimal Deal Flow for Illiquid Assets

... Investment process varies from investor to investor: • Single purpose investor focused by land use, geography, and/or strategy • Larger investor needs more flexible and may require possibly some formal “queuing” system for allocating deals across funds ...

... Investment process varies from investor to investor: • Single purpose investor focused by land use, geography, and/or strategy • Larger investor needs more flexible and may require possibly some formal “queuing” system for allocating deals across funds ...

Credit Guarantee - World Bank Treasury

... These products can be used to guarantee a portion of the public sector borrower’s debt service to lenders or bond holders. The objective is to help countries access capital markets or open up new sources of financing. The World Bank’s participation as guarantor not only makes commercial financing po ...

... These products can be used to guarantee a portion of the public sector borrower’s debt service to lenders or bond holders. The objective is to help countries access capital markets or open up new sources of financing. The World Bank’s participation as guarantor not only makes commercial financing po ...

ppt

... RECTIFICATION: DEBIT SALES WITH 4500/-, CREDIT SUSPENCE WITH 4500/-, CREDIT RENT WITH 4500/-, DEBIT SUSPENCE WITH 4500/-. ...

... RECTIFICATION: DEBIT SALES WITH 4500/-, CREDIT SUSPENCE WITH 4500/-, CREDIT RENT WITH 4500/-, DEBIT SUSPENCE WITH 4500/-. ...