BridgeForce template

... insurance companies and resolve any questions you may have throughout the time you hold a policy, and to ensure your ongoing satisfaction. [Insert if applicable] I am bound by the Code of Ethics of my professional association, [Independent Financial Brokers of Canada, The Financial Advisors Associat ...

... insurance companies and resolve any questions you may have throughout the time you hold a policy, and to ensure your ongoing satisfaction. [Insert if applicable] I am bound by the Code of Ethics of my professional association, [Independent Financial Brokers of Canada, The Financial Advisors Associat ...

practice final

... (a) If the bank is offering simple interest, what must be the annual interest rate for this investment? (b) If the bank is offering compound interest, compounded quarterly, what must be the annual interest rate for this investment? (c) If the bank is offering compound interest, compounded continuous ...

... (a) If the bank is offering simple interest, what must be the annual interest rate for this investment? (b) If the bank is offering compound interest, compounded quarterly, what must be the annual interest rate for this investment? (c) If the bank is offering compound interest, compounded continuous ...

Exponential and Logarithmic Functions

... In general, suppose that a sum of money P (called the principal) is invested at an interest rate of r% compounded annually. The interest earned the first year is Pr, and the new principal for the second year is P + Pr or P(1 + r). Note that the new principal for the second year can be found by multi ...

... In general, suppose that a sum of money P (called the principal) is invested at an interest rate of r% compounded annually. The interest earned the first year is Pr, and the new principal for the second year is P + Pr or P(1 + r). Note that the new principal for the second year can be found by multi ...

How Higher Interest Rates Affect the Economy

... influence over the economy, the Fed’s interest rate-setting authority isn’t as potent as it once was. In large measure that’s because nonbank financial firms control a growing portion of money and credit while the banking industry – the Fed’s main channel for implementing monetary policy – accounts ...

... influence over the economy, the Fed’s interest rate-setting authority isn’t as potent as it once was. In large measure that’s because nonbank financial firms control a growing portion of money and credit while the banking industry – the Fed’s main channel for implementing monetary policy – accounts ...

Characteristics of Money Market Instruments

... maturity date. For example, an interest rate of 6% per annum means either that the borrower must pay the lender interest of 6% on the value of the principal every year, or that the borrower must pay a proportion of 6% if interest payments are made more frequently, or that the borrower must pay the e ...

... maturity date. For example, an interest rate of 6% per annum means either that the borrower must pay the lender interest of 6% on the value of the principal every year, or that the borrower must pay a proportion of 6% if interest payments are made more frequently, or that the borrower must pay the e ...

Real Money Rob Rikoon Good news for retirees: low

... rates have moved up over the last month and this benefits savers, most notably retirees. For nearly 5 years now, the Federal Reserve Board has suppressed interest rates via its bond buying program and control of the federal funds rate. The bull market in bonds that began in 1981 all but ended this l ...

... rates have moved up over the last month and this benefits savers, most notably retirees. For nearly 5 years now, the Federal Reserve Board has suppressed interest rates via its bond buying program and control of the federal funds rate. The bull market in bonds that began in 1981 all but ended this l ...

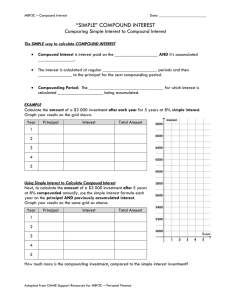

SIMPLE INTEREST VS COMPOUND INTEREST

... a) Carlene wants to borrow $7 000 for five years. Compare the growth of this loan at 7% per year, simple interest, to the same loan at 7% per year, compounded annually. ...

... a) Carlene wants to borrow $7 000 for five years. Compare the growth of this loan at 7% per year, simple interest, to the same loan at 7% per year, compounded annually. ...

General information about AA mortgages

... You may incur additional costs when taking out a mortgage which are not included in the Total Cost of Credit. This will include costs such as solicitor fees, a more detailed valuation report, insurance and stamp duty. If you have chosen a product that offers feesassisted legal work there may be disb ...

... You may incur additional costs when taking out a mortgage which are not included in the Total Cost of Credit. This will include costs such as solicitor fees, a more detailed valuation report, insurance and stamp duty. If you have chosen a product that offers feesassisted legal work there may be disb ...

History of pawnbroking

This history is partially outdated for developments in the 20th centuryThe history of pawnbroking began in the earliest ages of the world. Lending money on portable security is one of the oldest professions.

![[Type Book Title here] Name: Section: Chapter 4 Test Form F 1](http://s1.studyres.com/store/data/010766429_1-cbfeb3d24d58c60cae31ac47865c83f2-300x300.png)