Atlas - Atlas - Paying for College

... 9.1.12.B.2 Compare strategies for saving and investing and the factors that influence how much should be saved or invested to meet financial goals. Strand C: Credit And Debt Management 9.1.12.C.3 Compute and assess the accumulating effect of interest paid over time when using a variety of sources of ...

... 9.1.12.B.2 Compare strategies for saving and investing and the factors that influence how much should be saved or invested to meet financial goals. Strand C: Credit And Debt Management 9.1.12.C.3 Compute and assess the accumulating effect of interest paid over time when using a variety of sources of ...

Floating rate Term Deposits

... If banks were to offer floating rate deposits, individuals can partially immunize their assetliability portfolio. An individual may have taken a housing loan for Rs 25 lakh at, say, the 10-year government bond yield plus one per cent with a six-month reset. The same individual may choose to invest R ...

... If banks were to offer floating rate deposits, individuals can partially immunize their assetliability portfolio. An individual may have taken a housing loan for Rs 25 lakh at, say, the 10-year government bond yield plus one per cent with a six-month reset. The same individual may choose to invest R ...

payment holiday - BondPlus Online

... consecutive repayments The additional funds will enable them to use the funds for an emergency, furnish their new home or use it for a holiday over the festive period. Example : Registration of a bond usually takes between 2 -3 months. If a client applies for a home loan and takes up the payment hol ...

... consecutive repayments The additional funds will enable them to use the funds for an emergency, furnish their new home or use it for a holiday over the festive period. Example : Registration of a bond usually takes between 2 -3 months. If a client applies for a home loan and takes up the payment hol ...

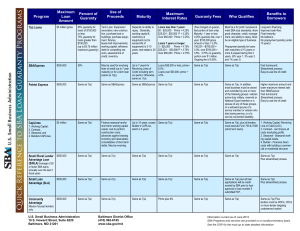

Program Maximum Loan Amount Percent of Guaranty Use of

... servicing fee of 0.625%1.5% on unpaid balance Ongoing guaranty fee (FY 2012) is 0.9375% of ...

... servicing fee of 0.625%1.5% on unpaid balance Ongoing guaranty fee (FY 2012) is 0.9375% of ...

Notes

... using goods and services. Ways in which people make, distribute, and use their goods and services. The amount of goods and services available for sale. ...

... using goods and services. Ways in which people make, distribute, and use their goods and services. The amount of goods and services available for sale. ...

Name Date Test Review Exponentials Standard: MCC9

... current herd size of 1500, is the concern valid? Why or why not? ...

... current herd size of 1500, is the concern valid? Why or why not? ...

Federal Funds Rate

... Committee (FOMC) to ease, tighten or leave the target FF rate as it is. At the last FOMC meeting on August 13, rates were left unchanged at 1.75% ...

... Committee (FOMC) to ease, tighten or leave the target FF rate as it is. At the last FOMC meeting on August 13, rates were left unchanged at 1.75% ...

Impact on Rising Interest Rates

... Financial assets will see lowering down its market value at the time of Rising Interest rates. Lowering Market value will reduce the wealth of Individual and will Save more Rupee and which in turn expenditure will fall. Expenditure fall will generate lowering demand of goods and As mentioned above F ...

... Financial assets will see lowering down its market value at the time of Rising Interest rates. Lowering Market value will reduce the wealth of Individual and will Save more Rupee and which in turn expenditure will fall. Expenditure fall will generate lowering demand of goods and As mentioned above F ...

The Money Demand Curve

... • Long-term interest rates don’t necessarily move with short-term interest rates. • If investors expect short-term interest rates to rise, investors may buy short-term bonds even if long-term bonds offer a higher interest rate. • In practice, long-term interest rates reflect the average expectation ...

... • Long-term interest rates don’t necessarily move with short-term interest rates. • If investors expect short-term interest rates to rise, investors may buy short-term bonds even if long-term bonds offer a higher interest rate. • In practice, long-term interest rates reflect the average expectation ...

14-June-Property-buyers-face-new-threat-from

... This is regularly resulting in maximum loans offered being reduced by 10 per cent. Other lenders are not taking into account certain types of income. For example, overtime, bonuses, commission payments are either being excluded, or only a percentage considered in calculating eligibility. Some lender ...

... This is regularly resulting in maximum loans offered being reduced by 10 per cent. Other lenders are not taking into account certain types of income. For example, overtime, bonuses, commission payments are either being excluded, or only a percentage considered in calculating eligibility. Some lender ...

20009_Macro_FRQ

... (a) Assume that Kim deposits $100 of cash from her pocket into her checking account. Calculate each of the following. (i) The maximum dollar amount the commercial bank can initially lend (ii) The maximum total change in demand deposits in the banking system (iii) The maximum change in the money supp ...

... (a) Assume that Kim deposits $100 of cash from her pocket into her checking account. Calculate each of the following. (i) The maximum dollar amount the commercial bank can initially lend (ii) The maximum total change in demand deposits in the banking system (iii) The maximum change in the money supp ...

solve(A*m^NR*(m^N-1)/(m

... This is the same result we obtained earlier. To conclude, let's determine the amount of money A one can afford to borrow as a function of what one can afford to pay as the monthly payment R. We simply solve for A in the equation that P = 0 after N payments. solve(A*m^N-R*(m^N-1)/(m-1),A) ans = R*(m^ ...

... This is the same result we obtained earlier. To conclude, let's determine the amount of money A one can afford to borrow as a function of what one can afford to pay as the monthly payment R. We simply solve for A in the equation that P = 0 after N payments. solve(A*m^N-R*(m^N-1)/(m-1),A) ans = R*(m^ ...

Real Estate Finance: An Overview

... B. Post-Civil War – Westward expansion. Money was needed, but nationally chartered banks could not make real estate loans. Mortgage banking firms were created to originate loans in the West, sell notes to investors in the East. (State-chartered banks made loans, also.) C. Early 1900s – Passage of F ...

... B. Post-Civil War – Westward expansion. Money was needed, but nationally chartered banks could not make real estate loans. Mortgage banking firms were created to originate loans in the West, sell notes to investors in the East. (State-chartered banks made loans, also.) C. Early 1900s – Passage of F ...

what would you do with a million dollars?

... policy gridlock that were a drag in 2013. UK and Eurozone pulled out of their recessions and China’s growth stabilized. Long-term unemployment and stagnant pay rates in the U.S. are cause for concern. Manufacturing, construction and home sales remain below optimal. The Dow lost 5.6% during January 2 ...

... policy gridlock that were a drag in 2013. UK and Eurozone pulled out of their recessions and China’s growth stabilized. Long-term unemployment and stagnant pay rates in the U.S. are cause for concern. Manufacturing, construction and home sales remain below optimal. The Dow lost 5.6% during January 2 ...

History of pawnbroking

This history is partially outdated for developments in the 20th centuryThe history of pawnbroking began in the earliest ages of the world. Lending money on portable security is one of the oldest professions.