Homework 3

... bank increases the reserve ratio while maintaining a fixed money level of reserves. If there is a given level of reserves and the reserve to deposit ratio rises, what effect will this have on the money supply. Draw a graph of the money market to show the impact of a rising reserve ratio. The increas ...

... bank increases the reserve ratio while maintaining a fixed money level of reserves. If there is a given level of reserves and the reserve to deposit ratio rises, what effect will this have on the money supply. Draw a graph of the money market to show the impact of a rising reserve ratio. The increas ...

Fractions and Decimals

... earns 5% per year. Match each number to a variable in the simple interest formula: p= r= t= Step 2 The rate must be converted from a percent to a decimal before it is put into the formula. What is 5% as a decimal? Step 3 Substitute the values for p, t and the decimal value of r into the equation I = ...

... earns 5% per year. Match each number to a variable in the simple interest formula: p= r= t= Step 2 The rate must be converted from a percent to a decimal before it is put into the formula. What is 5% as a decimal? Step 3 Substitute the values for p, t and the decimal value of r into the equation I = ...

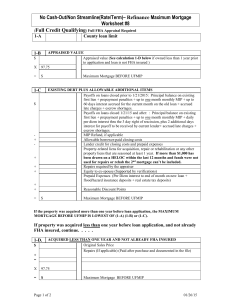

No Cash-Out/Non Streamline(Rate/Term)– Refinance Maximum

... of original borrowers and type of loan. Other credit verifications are also required (VOE, VOD, etc.) There is no holding period. Acquisition could be a limiting factor. Max CLTV is 97.75. Borrower may receive no more than $500.00 cash back at closing. Social Security Numbers must be verified for al ...

... of original borrowers and type of loan. Other credit verifications are also required (VOE, VOD, etc.) There is no holding period. Acquisition could be a limiting factor. Max CLTV is 97.75. Borrower may receive no more than $500.00 cash back at closing. Social Security Numbers must be verified for al ...

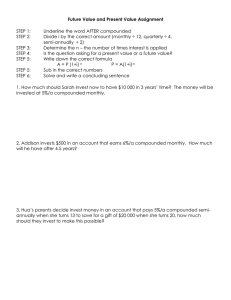

Future Value and Present Value Assignment

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

Why Can`t My Bank Help Me?

... rules and regulations are ever changing. Banks are required to reserve part of their profits to cover bad loans or bad debt. If collateral is attached to a loan – for example, a car is used to secure an auto loan – the car can always be sold off to pay off as much of the loan as possible. A plan is ...

... rules and regulations are ever changing. Banks are required to reserve part of their profits to cover bad loans or bad debt. If collateral is attached to a loan – for example, a car is used to secure an auto loan – the car can always be sold off to pay off as much of the loan as possible. A plan is ...

More... - Kevin Kavakeb

... A fixed-rate loan means you will always know how much your home payment will be each month, regardless of what is happening with the economy or current interest rates. What is the downside of Fixed Rate Loans? The disadvantage is that the interest is generally a little higher than an adjustable rate ...

... A fixed-rate loan means you will always know how much your home payment will be each month, regardless of what is happening with the economy or current interest rates. What is the downside of Fixed Rate Loans? The disadvantage is that the interest is generally a little higher than an adjustable rate ...

Doral Financial Corp

... Only 30% of loans past due 240 days actually go to foreclosure. Borrowers come up with money sporadically. Bank works with them based on their income and debt load auer they make up 3 payments ...

... Only 30% of loans past due 240 days actually go to foreclosure. Borrowers come up with money sporadically. Bank works with them based on their income and debt load auer they make up 3 payments ...

Review Guide 2

... The bank has $500 in reserves, and the reserve-deposit ratio is 5%. The Federal Reserve conducts open-market operations to stimulate the economy, and purchases bonds for $100. Assume the $100 from the Federal Reserve is deposited completely into the bank. What was the money supply before the Fed’s a ...

... The bank has $500 in reserves, and the reserve-deposit ratio is 5%. The Federal Reserve conducts open-market operations to stimulate the economy, and purchases bonds for $100. Assume the $100 from the Federal Reserve is deposited completely into the bank. What was the money supply before the Fed’s a ...

Personal Finance

... constant (usually), but the amount one pays or is paid changes according to the amount of the balance or debt. For example, if one pays off part of the principal on a loan each month, the amount one pays in interest decreases even though the rate remains the same. ...

... constant (usually), but the amount one pays or is paid changes according to the amount of the balance or debt. For example, if one pays off part of the principal on a loan each month, the amount one pays in interest decreases even though the rate remains the same. ...

GLOSSARY

... adjustable rate mortgage (ARM) mortgage loan with a rate that changes over the course of the loan (p. 178) aggregate measures measures of the money supply—M1, M2, M3, and MZM—which, taken together, are used to estimate its size (p. 64) annual percentage rate (APR) the nominal rate on which interest ...

... adjustable rate mortgage (ARM) mortgage loan with a rate that changes over the course of the loan (p. 178) aggregate measures measures of the money supply—M1, M2, M3, and MZM—which, taken together, are used to estimate its size (p. 64) annual percentage rate (APR) the nominal rate on which interest ...

PERSONAL FINANCE TEST B - Cardinal Spellman High School

... Higher Interest rates depress stock prices Investors move $ from Market to fixed rate , This reduces demand for stock Lowers stock prices A certificate of deposit or CD is a time deposit, a financial product commonly offered to consumers by banks, thrift institutions, and credit unions. CDs are ...

... Higher Interest rates depress stock prices Investors move $ from Market to fixed rate , This reduces demand for stock Lowers stock prices A certificate of deposit or CD is a time deposit, a financial product commonly offered to consumers by banks, thrift institutions, and credit unions. CDs are ...

History of pawnbroking

This history is partially outdated for developments in the 20th centuryThe history of pawnbroking began in the earliest ages of the world. Lending money on portable security is one of the oldest professions.