Monetary Policy Monetary Policy Money Supply How Banks Make

... o The central bank buys financial assets (bonds (government or private), other securities) from financial institutions. o By purchasing these instruments (increasing demand), this increases the price and lowers the yield (the percentage return the investor receives) on the security o Bond yields are ...

... o The central bank buys financial assets (bonds (government or private), other securities) from financial institutions. o By purchasing these instruments (increasing demand), this increases the price and lowers the yield (the percentage return the investor receives) on the security o Bond yields are ...

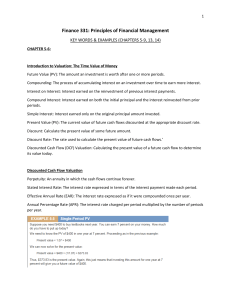

Finance Glossary

... Dividends: Payments by a corporation to shareholders, made in either cash or stock. Dividend Growth Model (DGM): A model that determines the current price of a stock as its dividend next period divided by the discount rate less the dividend growth rate. Dividend Yield: A stock’s expected cash divide ...

... Dividends: Payments by a corporation to shareholders, made in either cash or stock. Dividend Growth Model (DGM): A model that determines the current price of a stock as its dividend next period divided by the discount rate less the dividend growth rate. Dividend Yield: A stock’s expected cash divide ...

Slide 1

... Question: It is fair to ask, how can something with no intrinsic value be an asset? Answer: Fiat money has value simply by virtue of the fact that people believe it has value! Fiat money maintains its value only so long as people believe that other people will accept it in exchange for commodities. ...

... Question: It is fair to ask, how can something with no intrinsic value be an asset? Answer: Fiat money has value simply by virtue of the fact that people believe it has value! Fiat money maintains its value only so long as people believe that other people will accept it in exchange for commodities. ...

Saving and Capital Formation

... remember that interest rates, like prices, are a result of supply and demand, not a cause. Higher investment is a “good thing” from the point of view of economic growth, but it is compatible with either higher or lower interest rates. ...

... remember that interest rates, like prices, are a result of supply and demand, not a cause. Higher investment is a “good thing” from the point of view of economic growth, but it is compatible with either higher or lower interest rates. ...

Slides session 7 - Prof. Dr. Dennis Alexis Valin Dittrich

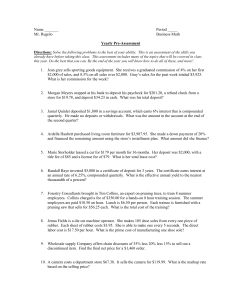

... 8. Consider the data in the previous question: If 10% of all machines become worthless every year (they depreciate, in other words), then how many machines will become worthless in these three countries this year? Are there any countries where the amount of depreciation is actually greater than GDP? ...

... 8. Consider the data in the previous question: If 10% of all machines become worthless every year (they depreciate, in other words), then how many machines will become worthless in these three countries this year? Are there any countries where the amount of depreciation is actually greater than GDP? ...

Chapter 1: Personal Finance - Westmoreland Central School

... economy "A system of managing the productive and employment resources of a country, community, or business." employee benefit "Compensation for employment that does not take the form of wages, salaries, commissions, or other cash payments." entitlements services that are offered such as Medicaid, Me ...

... economy "A system of managing the productive and employment resources of a country, community, or business." employee benefit "Compensation for employment that does not take the form of wages, salaries, commissions, or other cash payments." entitlements services that are offered such as Medicaid, Me ...

Section 5

... investments, lie 3-month CDs and 3-month Treasury bonds. • Typically long-term rates are higher due to risk. ...

... investments, lie 3-month CDs and 3-month Treasury bonds. • Typically long-term rates are higher due to risk. ...

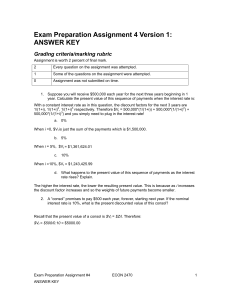

Homework 5

... a. Draw graphs of Hong Kong’s money market and Hong Kong’s foreign exchange market to show the impact of this event keeping in mind that it will be the policy of Hong Kong’s central bank to keep the exchange rate fixed. The lower US interest rates would make HK dollar deposits more attractive to bot ...

... a. Draw graphs of Hong Kong’s money market and Hong Kong’s foreign exchange market to show the impact of this event keeping in mind that it will be the policy of Hong Kong’s central bank to keep the exchange rate fixed. The lower US interest rates would make HK dollar deposits more attractive to bot ...

File

... Bridging the gap between net borrowers and net savers. Net borrowers or investors are the deficit sector. They demand loan. Net savers are surplus sector. They supply loan. The two groups do not know each other, financial market brings them together. (Slide 3) Providing the equilibrium interest rate ...

... Bridging the gap between net borrowers and net savers. Net borrowers or investors are the deficit sector. They demand loan. Net savers are surplus sector. They supply loan. The two groups do not know each other, financial market brings them together. (Slide 3) Providing the equilibrium interest rate ...

History of pawnbroking

This history is partially outdated for developments in the 20th centuryThe history of pawnbroking began in the earliest ages of the world. Lending money on portable security is one of the oldest professions.