Applying fuzzy parameters in pricing financial derivatives inspired by

... facilitating turnover, increasing flux liquidity and securing against the overestimation of possible emission reductions and the risk connected with such errors. Therefore, it is necessary to use adequate financial mathematics tools to solve problems arising from the issuing or pricing of such instr ...

... facilitating turnover, increasing flux liquidity and securing against the overestimation of possible emission reductions and the risk connected with such errors. Therefore, it is necessary to use adequate financial mathematics tools to solve problems arising from the issuing or pricing of such instr ...

Volatility Surfaces - 2.rotman.utoronto.ca

... different from the initial volatility surface. For example, in the case of a foreign currency the initial U-shaped relationship between implied volatility and strike price is liable to evolve to one where the volatility is a monotonic increasing or decreasing function of strike price. Dumas, Fleming ...

... different from the initial volatility surface. For example, in the case of a foreign currency the initial U-shaped relationship between implied volatility and strike price is liable to evolve to one where the volatility is a monotonic increasing or decreasing function of strike price. Dumas, Fleming ...

Brief Overview of Futures and Options in Risk Management

... contract, there can be no delivery since it would be impossible to deliver all to the basket of securities into the contract. Consequently, a financial index futures contract will trade based on the market value of the index and settlement is at, wherever the index is at the time of offset. A forwar ...

... contract, there can be no delivery since it would be impossible to deliver all to the basket of securities into the contract. Consequently, a financial index futures contract will trade based on the market value of the index and settlement is at, wherever the index is at the time of offset. A forwar ...

brownian motion and its applications

... for an arbitrary initial value S0 . This model is used in options pricing. Definition 4.1. [9] Options in the financial world are generally defined as a contract between two parties in which one party has the right but not the obligation to do something, usually to buy or sell some underlying asset. ...

... for an arbitrary initial value S0 . This model is used in options pricing. Definition 4.1. [9] Options in the financial world are generally defined as a contract between two parties in which one party has the right but not the obligation to do something, usually to buy or sell some underlying asset. ...

In segregating responsibilities, this office reconciles payments with

... 16. Which of the following is the exposure to a change in value of some market variables, such as interest rates, foreign exchange rates, equity or commodity prices? (A) credit risk (B) market risk (C) contract risk (D) value - at - risk ...

... 16. Which of the following is the exposure to a change in value of some market variables, such as interest rates, foreign exchange rates, equity or commodity prices? (A) credit risk (B) market risk (C) contract risk (D) value - at - risk ...

Common Option Strategies - NYU Stern School of Business

... offices in New York, Chicago, Boston, San Francisco and Philadelphia. Dr. Tucker was the founding editor of the Journal of Financial Engineering, published by the International Association of Financial Engineers (IAFE). He presently serves on the editorial board of Journal of Derivatives and the Glo ...

... offices in New York, Chicago, Boston, San Francisco and Philadelphia. Dr. Tucker was the founding editor of the Journal of Financial Engineering, published by the International Association of Financial Engineers (IAFE). He presently serves on the editorial board of Journal of Derivatives and the Glo ...

Option Pricing Implications of a Stochastic Jump Rate

... Since the Black-Scholes option pricing model was introduced in 1973, it has become the most widely used and most powerful tool for trading in option markets. Over the past two decades, however, researchers have found signiÞcant deviations of market prices from predictions by the model. Out-of-money ...

... Since the Black-Scholes option pricing model was introduced in 1973, it has become the most widely used and most powerful tool for trading in option markets. Over the past two decades, however, researchers have found signiÞcant deviations of market prices from predictions by the model. Out-of-money ...

Adjusting the Black-Scholes Framework in the Presence of a Volatility Skew

... • It is possible to borrow and lend cash at a known constant risk-free interest rate. • The price follows a Geometric Brownian motion with constant drift and volatility. • There are no transaction costs. • The stock does not pay a dividend. • All securities are perfectly divisible (i.e. it is possib ...

... • It is possible to borrow and lend cash at a known constant risk-free interest rate. • The price follows a Geometric Brownian motion with constant drift and volatility. • There are no transaction costs. • The stock does not pay a dividend. • All securities are perfectly divisible (i.e. it is possib ...

Towards a Theory of Volatility Trading

... Trading Realized Volatility via Static Positions in Options ...

... Trading Realized Volatility via Static Positions in Options ...

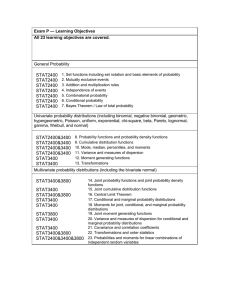

STAT2400 Exam P — Learning Objectives All 23 learning objectives are covered.

... ACT2120 a. Interest rate (rate of interest) ACT2120 b. Simple interest ACT2120 c. Compound interest ACT2120 d. Accumulation function ACT2120 e. Future value ACT2120 f. Present value/net present value ACT2120 g. Discount factor ACT2120 h. Discount rate (rate of discount) ACT2120 i. Convertible m-thly ...

... ACT2120 a. Interest rate (rate of interest) ACT2120 b. Simple interest ACT2120 c. Compound interest ACT2120 d. Accumulation function ACT2120 e. Future value ACT2120 f. Present value/net present value ACT2120 g. Discount factor ACT2120 h. Discount rate (rate of discount) ACT2120 i. Convertible m-thly ...

Pricing Volatility Derivatives with General Risk Functions Alejandro Balbás University Carlos III

... • Theorem 2: Let be a, b ∈ ℜ ∪ {−∞, ∞} and g : (a, b) → ℜ an arbitrary function such that g and its first derivative exist and are continuous out of a finite set D = {d1 < d 2 < ... < d m } ⊂ (a, b) . Suppose that g may be extended and become continuous on (a, d1 ] , and the same property holds if ( ...

... • Theorem 2: Let be a, b ∈ ℜ ∪ {−∞, ∞} and g : (a, b) → ℜ an arbitrary function such that g and its first derivative exist and are continuous out of a finite set D = {d1 < d 2 < ... < d m } ⊂ (a, b) . Suppose that g may be extended and become continuous on (a, d1 ] , and the same property holds if ( ...