Option Pricing - Department of Mathematics, Indian Institute of Science

... Call Option: gives the holder the right to buy something. Put Option: gives the holder the right to sell something. Asset: can be anything, but we consider only stocks which will be referred to as a primary security. An option is a derivative security. Strike (or Exercise) Price: A prescribed amount ...

... Call Option: gives the holder the right to buy something. Put Option: gives the holder the right to sell something. Asset: can be anything, but we consider only stocks which will be referred to as a primary security. An option is a derivative security. Strike (or Exercise) Price: A prescribed amount ...

K 1 K 2

... 0 from the option + 1000 from the bond The $ 1,000 principal can be received for certain What is the cost? ...

... 0 from the option + 1000 from the bond The $ 1,000 principal can be received for certain What is the cost? ...

9 Complete and Incomplete Market Models

... But the second integral can not be written as an integral w.r.t. dS̃s . ...

... But the second integral can not be written as an integral w.r.t. dS̃s . ...

Puts and calls

... option is the right but not the obligation to sell 100 shares of the stock at a stated exercise price on or before a stated expiration date. The price of the option is not the exercise price. ...

... option is the right but not the obligation to sell 100 shares of the stock at a stated exercise price on or before a stated expiration date. The price of the option is not the exercise price. ...

Lecture Notes_Chapter 3

... Naked writing is writing an option when the writer does not have a position in the asset Covered writing is writing an option when there is a corresponding position in the underlying asset • Write a call and long the asset • Write a put and short the asset ...

... Naked writing is writing an option when the writer does not have a position in the asset Covered writing is writing an option when there is a corresponding position in the underlying asset • Write a call and long the asset • Write a put and short the asset ...

Digital Options

... 1.1 American Digital Options Like most options, American Digitals (Binary) com in both European and the American style (early exercise types). Like all American options, its market price may not be lower than the intrinsic value, so the American option price rises more steeply than the European equi ...

... 1.1 American Digital Options Like most options, American Digitals (Binary) com in both European and the American style (early exercise types). Like all American options, its market price may not be lower than the intrinsic value, so the American option price rises more steeply than the European equi ...

When t=T

... Assume the risky asset to be a stock. Since the stock option price is a random variable, the seller of the option is faced with a risk in selling it. However, the seller can manage the risk by buying certain shares (denoted asΔ) of the stocks to hedge the risk in the option. This is the idea! ...

... Assume the risky asset to be a stock. Since the stock option price is a random variable, the seller of the option is faced with a risk in selling it. However, the seller can manage the risk by buying certain shares (denoted asΔ) of the stocks to hedge the risk in the option. This is the idea! ...

Options and Risk Measurement

... option is the right but not the obligation to sell 100 shares of the stock at a stated exercise price on or before a stated expiration date. The price of the option is not the exercise price. ...

... option is the right but not the obligation to sell 100 shares of the stock at a stated exercise price on or before a stated expiration date. The price of the option is not the exercise price. ...

butterfly spread

... call and short put with strike price K1) and a synthetic short forward at a different price (short call and long put with strike price K2 ≠ K1). At time 0, cash flow: • – C(K1, T) + P(K1, T) + C(K2, T) – P(K2, T) ...

... call and short put with strike price K1) and a synthetic short forward at a different price (short call and long put with strike price K2 ≠ K1). At time 0, cash flow: • – C(K1, T) + P(K1, T) + C(K2, T) – P(K2, T) ...

Monopoly 1

... Tip 1: MR curve is a straight line with the same vertical intercept as demand and half the horizontal intercept. Tip 2: Equilibrium price is the mid-point/average of the vertical intercept of demand and marginal cost at equilibrium quantity. ...

... Tip 1: MR curve is a straight line with the same vertical intercept as demand and half the horizontal intercept. Tip 2: Equilibrium price is the mid-point/average of the vertical intercept of demand and marginal cost at equilibrium quantity. ...

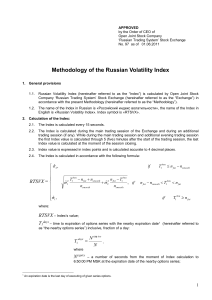

Methodology of the Volatility Index Calculation

... price of a futures contract, which is an underlying asset for nearby/next options series (hereinafter referred to as the “underlying futures contract”). ...

... price of a futures contract, which is an underlying asset for nearby/next options series (hereinafter referred to as the “underlying futures contract”). ...

Derivatives - WordPress.com

... In another scenario, if at the time of expiry stock price falls below Rs. 3500 say suppose it touches Rs. 3000, the buyer of the call option will choose not to exercise his option. In this case the investor loses the premium (Rs 100), paid which shall be the profit earned by the seller of the call o ...

... In another scenario, if at the time of expiry stock price falls below Rs. 3500 say suppose it touches Rs. 3000, the buyer of the call option will choose not to exercise his option. In this case the investor loses the premium (Rs 100), paid which shall be the profit earned by the seller of the call o ...

DEXIA « Impact Seminar

... Need to model the stock price evolution Binomial model: – discrete time, discrete variable – volatility captured by u and d Markov process • Future movements in stock price depend only on where we are, not the history of how we got where we are • Consistent with weak-form market efficiency Risk neut ...

... Need to model the stock price evolution Binomial model: – discrete time, discrete variable – volatility captured by u and d Markov process • Future movements in stock price depend only on where we are, not the history of how we got where we are • Consistent with weak-form market efficiency Risk neut ...

Professor Banko`s Presentation

... offsetting (no risk to system). Remaining short is covered by short position (net no risk). ...

... offsetting (no risk to system). Remaining short is covered by short position (net no risk). ...

New EDHEC-Risk Institute research examines dynamic hedging of

... The underlying asset may be unavailable because of liquidity constraints, legal constraints, high market friction, or for other reasons. If the substitute asset were perfectly correlated with the actual underlying asset, no further risk would be introduced, since one could offset any gain or loss in ...

... The underlying asset may be unavailable because of liquidity constraints, legal constraints, high market friction, or for other reasons. If the substitute asset were perfectly correlated with the actual underlying asset, no further risk would be introduced, since one could offset any gain or loss in ...

FROM NAVIER-STOKES TO BLACK-SCHOLES

... a call option that gives you the right but not the obligation to buy the share three months into the future for a certain strike price. Of course, having the right but not the obligation to buy a share at some time in the future comes at a price and this must be paid by the investor up-front. For ex ...

... a call option that gives you the right but not the obligation to buy the share three months into the future for a certain strike price. Of course, having the right but not the obligation to buy a share at some time in the future comes at a price and this must be paid by the investor up-front. For ex ...

jointly hedging jump-to-default risk and mark-to

... investment, they only indicate that the probability for receiving future cash flows decreases (increases). Consequently, they matter if we want to get out of the position and require a buyer for it in the marketplace. In order to hedge markto-market risk, one needs a mathematical model which relates ...

... investment, they only indicate that the probability for receiving future cash flows decreases (increases). Consequently, they matter if we want to get out of the position and require a buyer for it in the marketplace. In order to hedge markto-market risk, one needs a mathematical model which relates ...

Chapter 17

... not available on exchanges. Many dimensions of risk (greeks) must be managed so that all risks are acceptable. Synthetic options and portfolio insurance ...

... not available on exchanges. Many dimensions of risk (greeks) must be managed so that all risks are acceptable. Synthetic options and portfolio insurance ...