Volatility - U.S. Options

... Corporation. A prospectus, which discusses the role of The Options Clearing Corporation, is also available, without charge, upon request at 1-888-OPTIONS or www.888options.com. Any strategies discussed, including examples using actual securities price data, are strictly for illustrative and educatio ...

... Corporation. A prospectus, which discusses the role of The Options Clearing Corporation, is also available, without charge, upon request at 1-888-OPTIONS or www.888options.com. Any strategies discussed, including examples using actual securities price data, are strictly for illustrative and educatio ...

Derivatives - MyCourses

... OPTION: A privilege sold by one party to another that offers the buyer the right, but not the obligation, to buy (call) or sell (put) a security at an agreed-upon price during a certain period of time or on a specific date. FUTURE: A contractual agreement, generally made on the trading floor of a fu ...

... OPTION: A privilege sold by one party to another that offers the buyer the right, but not the obligation, to buy (call) or sell (put) a security at an agreed-upon price during a certain period of time or on a specific date. FUTURE: A contractual agreement, generally made on the trading floor of a fu ...

Information to clients concerning the properties and special

... limited experience of trading in financial instruments, since such trading often requires specialised knowledge. It is important that those intending to trade in derivative instruments are aware of the following characteristic properties of these instruments. The structure of derivative instruments ...

... limited experience of trading in financial instruments, since such trading often requires specialised knowledge. It is important that those intending to trade in derivative instruments are aware of the following characteristic properties of these instruments. The structure of derivative instruments ...

PART 5: RISK MANAGEMENT CHAPTER 15: Hedging Instruments

... Financial Futures and Forwards Future contracts are agreements to accept (buy) or make delivery of (sell) an asset on a particular future date at a price struck today. In a spot market (cash market), the asset is delivered at the same time as the determination of price. Future contracts are made bot ...

... Financial Futures and Forwards Future contracts are agreements to accept (buy) or make delivery of (sell) an asset on a particular future date at a price struck today. In a spot market (cash market), the asset is delivered at the same time as the determination of price. Future contracts are made bot ...

Title A Note on Look-Back Options Based on Order - HERMES-IR

... value of the cr-Percentile. This may be obtained by some more effort. Now we outline the present paper. In Section II, the notations and the definitions are given. In Section 111, the unconditional and the conditional distribution of the i-th order statistic of the prices of the underlying asset are ...

... value of the cr-Percentile. This may be obtained by some more effort. Now we outline the present paper. In Section II, the notations and the definitions are given. In Section 111, the unconditional and the conditional distribution of the i-th order statistic of the prices of the underlying asset are ...

24. Portfolio Insurance and Synthetic Options

... Stop Loss Order - a conditional market order which indicates that the investor wishes to sell his holdings when the market price (asset price) drops to a predefined level. ...

... Stop Loss Order - a conditional market order which indicates that the investor wishes to sell his holdings when the market price (asset price) drops to a predefined level. ...

dO t - University of Pennsylvania

... The logic of arbitrage pricing is not yet established beyond a question of doubt, even if it is closed to “as good as economics gets.” Popularity of a model should be meaningless as far as science goes, but on a social level it always maters more than one could imagine. As theoreticians, we need to ...

... The logic of arbitrage pricing is not yet established beyond a question of doubt, even if it is closed to “as good as economics gets.” Popularity of a model should be meaningless as far as science goes, but on a social level it always maters more than one could imagine. As theoreticians, we need to ...

Risk-Neutral Valuation in Practice:

... • If replacement contract is fairly priced (ft = 0) then can model as anti-selective lapse ...

... • If replacement contract is fairly priced (ft = 0) then can model as anti-selective lapse ...

Price Comparison Results and Super-replication: An

... In the Black Scholes model, it is clear that the price of a call option is increasing in the volatility parameter. However, once we step away from this simple model, this property is no longer immediate. Indeed, if we consider option payoffs other than calls, it is not obvious that this monotonicity ...

... In the Black Scholes model, it is clear that the price of a call option is increasing in the volatility parameter. However, once we step away from this simple model, this property is no longer immediate. Indeed, if we consider option payoffs other than calls, it is not obvious that this monotonicity ...

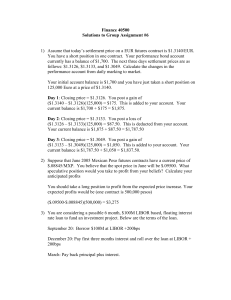

Institute of Actuaries of India INDICATIVE SOLUTION

... borrowed and repaid later incurring a loss of interest on this amount which would push down the cash flow in six months time. It is likely that the broker may allow the brokerage on stocks to be adjusted with the margin but not on the futures in which case it will only be the interest on Rs 10. All ...

... borrowed and repaid later incurring a loss of interest on this amount which would push down the cash flow in six months time. It is likely that the broker may allow the brokerage on stocks to be adjusted with the margin but not on the futures in which case it will only be the interest on Rs 10. All ...

Lecture 6 - IEI: Linköping University

... You observe the spot exchange rate is 2,45$/£, the 3 Month forward rate is 2,60$/£. 3 Month Call option premium for strike price 2,6 is 2 cents. • A US company will pay £10 million for imports from Britain in 3 months and decides to hedge using a long position in a forward contract, he fixed his cos ...

... You observe the spot exchange rate is 2,45$/£, the 3 Month forward rate is 2,60$/£. 3 Month Call option premium for strike price 2,6 is 2 cents. • A US company will pay £10 million for imports from Britain in 3 months and decides to hedge using a long position in a forward contract, he fixed his cos ...

Pricing Your Home-What To Consider

... • Regression - The phenomenon of an expensive house being decreased in value because of less desirable homes around it or it being situated in an undesirable neighbourhood. • Progression - Alternately, a home may increase in market value if it is situated in a particularly desirable neighbourhood, o ...

... • Regression - The phenomenon of an expensive house being decreased in value because of less desirable homes around it or it being situated in an undesirable neighbourhood. • Progression - Alternately, a home may increase in market value if it is situated in a particularly desirable neighbourhood, o ...

Modeling Asset Prices in Continuous Time

... on 100,000 shares of a non-dividend paying stock: S = 49 X = 50 r = 5% σ = 20% T –t = 20 weeks µ = 13% ...

... on 100,000 shares of a non-dividend paying stock: S = 49 X = 50 r = 5% σ = 20% T –t = 20 weeks µ = 13% ...

Static Hedging and Pricing American Exotic Options

... strike lookback put options under the BS model to demonstrate that the proposed method is applicable for other types of exotic options beyond barrier options. ...

... strike lookback put options under the BS model to demonstrate that the proposed method is applicable for other types of exotic options beyond barrier options. ...

RISK DISCLOSURE STATEMENT FOR INVESTMENTS

... option is uncovered, then the possible loss may be unlimited. 27. If the writer of a call option has a corresponding quantity of the underlying asset at his disposal, the call option is described as covered. In such case, if the value of the underlying asset exceeds the strike price, the writer miss ...

... option is uncovered, then the possible loss may be unlimited. 27. If the writer of a call option has a corresponding quantity of the underlying asset at his disposal, the call option is described as covered. In such case, if the value of the underlying asset exceeds the strike price, the writer miss ...

VARIABLE STRIKE OPTIONS and GUARANTEES in LIFE

... and hedging strategies, overcoming the traditional risk profile. The innovation process leads to new kinds of exotic options and it modifies the typical elements such as the underlying, the strike price, the maturity. In this note, we are especially interested with the development of the strike pric ...

... and hedging strategies, overcoming the traditional risk profile. The innovation process leads to new kinds of exotic options and it modifies the typical elements such as the underlying, the strike price, the maturity. In this note, we are especially interested with the development of the strike pric ...

Greeks- Theory and Illustrations

... What is the delta of a short position in 1,000 European call options on silver futures? The options mature in 8 months, and the futures contract underlying the option matures in 9 months. The current 9-month futures price is $8 per ounce, the exercise price of the option is $8, the risk-free inter ...

... What is the delta of a short position in 1,000 European call options on silver futures? The options mature in 8 months, and the futures contract underlying the option matures in 9 months. The current 9-month futures price is $8 per ounce, the exercise price of the option is $8, the risk-free inter ...