Key Mechanics of Tri-Party Repo Markets

... length of time necessary to allocate collateral in the tri-party repo market has been a significant obstacle to market reform. Another impediment to reform is the unwind process, the settlement of expiring repos that occurs before new repos can be settled. The unwind creates a need for intraday fun ...

... length of time necessary to allocate collateral in the tri-party repo market has been a significant obstacle to market reform. Another impediment to reform is the unwind process, the settlement of expiring repos that occurs before new repos can be settled. The unwind creates a need for intraday fun ...

Borrowed securities - Bank for International Settlements

... In some cases, it may be easy to avoid reporting securities that have been borrowed and re-lent. For example, if all borrowed securities are in a segregated account, it is likely that none of them will be reported, unless the reporter makes a special effort to report lent securities. Certainly, brok ...

... In some cases, it may be easy to avoid reporting securities that have been borrowed and re-lent. For example, if all borrowed securities are in a segregated account, it is likely that none of them will be reported, unless the reporter makes a special effort to report lent securities. Certainly, brok ...

Download attachment

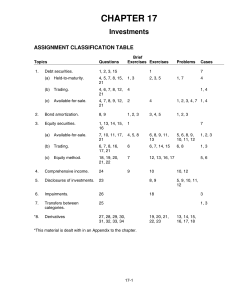

... loans receivable are not debt securities because they do not meet the definition of a security. An equity security is described as a security representing an ownership interest such as common, preferred, or other capital stock. It also includes rights to acquire or dispose of an ownership interest a ...

... loans receivable are not debt securities because they do not meet the definition of a security. An equity security is described as a security representing an ownership interest such as common, preferred, or other capital stock. It also includes rights to acquire or dispose of an ownership interest a ...

The Canadian Fixed Income Market Report

... In the past, regulators have tended to place a greater focus on issues that impact the equity market than they have on those that impact the fixed income market. The 2008 financial crisis, however, marked a new epoch with regard to how regulators assess the regulatory environment. In its Statement o ...

... In the past, regulators have tended to place a greater focus on issues that impact the equity market than they have on those that impact the fixed income market. The 2008 financial crisis, however, marked a new epoch with regard to how regulators assess the regulatory environment. In its Statement o ...

Centene Corporation - corporate

... contracts and other important documents we have summarized in this prospectus. Since these summaries may not contain all the information that you may find important in deciding whether to purchase the securities we and/or any selling securityholders offer, you should review the full text of these do ...

... contracts and other important documents we have summarized in this prospectus. Since these summaries may not contain all the information that you may find important in deciding whether to purchase the securities we and/or any selling securityholders offer, you should review the full text of these do ...

FSB Securities Lending and Repos: Market Overview and Financial

... Short-sale proceeds may be used by hedge funds as cash collateral against borrowed securities. That cash is in turn used by prime brokers to collateralise securities borrowing from securities lenders that reinvest the cash in the separate accounts or commingled funds (e.g., registered MMFs or unregi ...

... Short-sale proceeds may be used by hedge funds as cash collateral against borrowed securities. That cash is in turn used by prime brokers to collateralise securities borrowing from securities lenders that reinvest the cash in the separate accounts or commingled funds (e.g., registered MMFs or unregi ...

securities regulations

... SUMMARY of PURPOSE of security regulation “good regulation” instills public confidence and promotes an efficient capital market by ensuring that investors are informed (disclosure) and regulating the conduct of securities market participants (including brokers, dealer, advisors, underwriters, port ...

... SUMMARY of PURPOSE of security regulation “good regulation” instills public confidence and promotes an efficient capital market by ensuring that investors are informed (disclosure) and regulating the conduct of securities market participants (including brokers, dealer, advisors, underwriters, port ...

international stock exchanges

... City of London). It was officially opened by Queen Elizabeth II once again, accompanied by The Duke of Edinburgh, on 27 July 2004. The new building contains a specially commissioned dynamic sculpture called "The Source", by artists Greyworld. In December of 2005, the London Stock Exchange rejected a ...

... City of London). It was officially opened by Queen Elizabeth II once again, accompanied by The Duke of Edinburgh, on 27 July 2004. The new building contains a specially commissioned dynamic sculpture called "The Source", by artists Greyworld. In December of 2005, the London Stock Exchange rejected a ...

comisión nacional del mercado de valores - madrid

... which to the best knowledge of KPN is a telecommunication service provider or an Affiliate thereof. For the purposes of this Article 2.4.1 (a), to the best knowledge of KPN means the knowledge of KPN after due and careful due diligence. b) Not to Sell any Telefónica Swap Shares during seven (7) cale ...

... which to the best knowledge of KPN is a telecommunication service provider or an Affiliate thereof. For the purposes of this Article 2.4.1 (a), to the best knowledge of KPN means the knowledge of KPN after due and careful due diligence. b) Not to Sell any Telefónica Swap Shares during seven (7) cale ...

Australian REITs - Regulation and market trends

... required. If a stapled entity consists of a trust and a company, it must comply with both the PDS and the prospectus regime (which can be achieved in one document - a combined prospectus and PDS). Issuing interests in an LPT to retail investors under a secondary offer has also historically required ...

... required. If a stapled entity consists of a trust and a company, it must comply with both the PDS and the prospectus regime (which can be achieved in one document - a combined prospectus and PDS). Issuing interests in an LPT to retail investors under a secondary offer has also historically required ...

standards for the use of eu securities settlement systems in escb

... 3) the smooth functioning of the Single Market. This chapter elaborates on the three main objectives mentioned above. However, the standards address the first objective more specifically. Given the time constraints and the long lead times required to make possible changes to the existing infrastruct ...

... 3) the smooth functioning of the Single Market. This chapter elaborates on the three main objectives mentioned above. However, the standards address the first objective more specifically. Given the time constraints and the long lead times required to make possible changes to the existing infrastruct ...

Benchmarking a Transition Economy Capital Market

... A liquid and efficient stock market is generally accepted to be a key feature a developed economy. As the centrally planned communist nations of Central Europe lacked such infrastructure, financial systems architecture was instrumental to their transition into market economies. Now, after almost 17 ...

... A liquid and efficient stock market is generally accepted to be a key feature a developed economy. As the centrally planned communist nations of Central Europe lacked such infrastructure, financial systems architecture was instrumental to their transition into market economies. Now, after almost 17 ...

Primary Market Design: Direct Mechanisms And Markets

... investors polled under the mechanism. This indeed seems to be what happens in European when-issued markets for IPO shares. According to information from one of the largest brokers in these markets, when-issued trading never starts before the underwriters announce price ranges, giving an indication o ...

... investors polled under the mechanism. This indeed seems to be what happens in European when-issued markets for IPO shares. According to information from one of the largest brokers in these markets, when-issued trading never starts before the underwriters announce price ranges, giving an indication o ...

For Whom the Bell Tolls: The Demise of Exchange

... NYSE and the Chicago futures exchanges to demutualize, consolidate, and reduce the ...

... NYSE and the Chicago futures exchanges to demutualize, consolidate, and reduce the ...

1 UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... statements contain all adjustments (consisting only of normal recurring adjustments) necessary for a fair presentation of the Company's financial condition as of June 30, 1998 and December 31, 1997 and its results of operations for the three and six months ended June 30, 1998 and 1997, cash flows fo ...

... statements contain all adjustments (consisting only of normal recurring adjustments) necessary for a fair presentation of the Company's financial condition as of June 30, 1998 and December 31, 1997 and its results of operations for the three and six months ended June 30, 1998 and 1997, cash flows fo ...

Prudential Requirements Consultation Paper

... The Government of Jamaica has announced its intention to continue strengthening the regulatory and supervisory framework of the securities dealers (SD) sector in order to assist in strengthening the sectors ability to withstand future shocks. The Government recognises the major contribution made by ...

... The Government of Jamaica has announced its intention to continue strengthening the regulatory and supervisory framework of the securities dealers (SD) sector in order to assist in strengthening the sectors ability to withstand future shocks. The Government recognises the major contribution made by ...

Dreyfus Variable Investment Fund: Quality Bond Portfolio

... held by the fund directly and the bonds underlying derivative instruments entered into by the fund, if any, adjusted to reflect provisions or market conditions that may cause a bond's principal to be repaid earlier than at its stated maturity. Duration is an indication of an investment's "interest r ...

... held by the fund directly and the bonds underlying derivative instruments entered into by the fund, if any, adjusted to reflect provisions or market conditions that may cause a bond's principal to be repaid earlier than at its stated maturity. Duration is an indication of an investment's "interest r ...

index of defined terms

... The distribution of this Prospectus and the offering, sale and delivery of the Securities in certain jurisdictions may be restricted by law. Persons into whose possession this Prospectus comes are required by the Issuer and the Guarantor to inform themselves about and to observe any such restriction ...

... The distribution of this Prospectus and the offering, sale and delivery of the Securities in certain jurisdictions may be restricted by law. Persons into whose possession this Prospectus comes are required by the Issuer and the Guarantor to inform themselves about and to observe any such restriction ...

Scaling Chinese Walls: Insights From Aftra v. JPMorgan Chase

... As purveyors of a variety of financial products, these companies are privy to material nonpublic information (MNPI) relating to their clients’ business operations and future economic outlook, such as when a corporate borrower provides the lending institution with financial statements and future expe ...

... As purveyors of a variety of financial products, these companies are privy to material nonpublic information (MNPI) relating to their clients’ business operations and future economic outlook, such as when a corporate borrower provides the lending institution with financial statements and future expe ...

ETF Trading and Execution in the European MarketsPDF

... Solutions, however, are beginning to appear. The first of these is Euroclear Bank’s new ‘international ETF structure’, which seeks to provide a centralised, simpler and more efficient settlement system. In this new structure, Euroclear Bank acts as an International Central Securities Depository (ICS ...

... Solutions, however, are beginning to appear. The first of these is Euroclear Bank’s new ‘international ETF structure’, which seeks to provide a centralised, simpler and more efficient settlement system. In this new structure, Euroclear Bank acts as an International Central Securities Depository (ICS ...

Do Debt Markets Price Ṣukūk and Conventional Bonds

... In case the yields are the same for identical securities from both types, one may conclude that the existing valuation model for conventional bonds may be applicable also for these new ṣukūk instruments and that the two instruments are the same as bonds. If empirical results are otherwise, it raises ...

... In case the yields are the same for identical securities from both types, one may conclude that the existing valuation model for conventional bonds may be applicable also for these new ṣukūk instruments and that the two instruments are the same as bonds. If empirical results are otherwise, it raises ...

Philippine Bond Market Guide

... International Experts for their contribution to provide information from their own market guides, as well as their valuable expertise. Because of their cooperation and contribution, the ADB Team started the research on solid ground. Last, but not least, the ADB Team would like to thank all the inter ...

... International Experts for their contribution to provide information from their own market guides, as well as their valuable expertise. Because of their cooperation and contribution, the ADB Team started the research on solid ground. Last, but not least, the ADB Team would like to thank all the inter ...

CLAREMONT McKENNA COLLEGE STOCK MARKET SENTIMENT

... discount on closed-end funds could be a proxy for investor sentiment, a systematic risk factor that is priced into securities held mainly by individual investors. Lee et al. acknowledge that their paper only measures the effect of differential sentiment between individual and institutional investor ...

... discount on closed-end funds could be a proxy for investor sentiment, a systematic risk factor that is priced into securities held mainly by individual investors. Lee et al. acknowledge that their paper only measures the effect of differential sentiment between individual and institutional investor ...

Working Paper Series Short Selling Regulation

... because it affects the way in which firms are subject to market discipline. As the financial crisis has attracted regulators’ notice to short selling once again, it is important to understand the fundamental legal and economic arguments regarding short selling. These arguments have at their core the ...

... because it affects the way in which firms are subject to market discipline. As the financial crisis has attracted regulators’ notice to short selling once again, it is important to understand the fundamental legal and economic arguments regarding short selling. These arguments have at their core the ...

funding for- profit social enterprises

... limits profit distributions) and, for tax-exempt not-for-profit firms, the prohibition on private inurement, for example, also are challenges in that they present barriers to the kind of profit-sharing ownership interest or revenue-sharing ownership rights that social enterprise typically seeks to e ...

... limits profit distributions) and, for tax-exempt not-for-profit firms, the prohibition on private inurement, for example, also are challenges in that they present barriers to the kind of profit-sharing ownership interest or revenue-sharing ownership rights that social enterprise typically seeks to e ...