RMS Policy ESTEE ADVISORS PRIVATE LTD. RMS PROCESS

... We have margin based automated RMS system. Total deposits of the clients are uploaded in the system and client may take exposure on the basis of margin applicable for respective security as per VAR based margining system of the stock exchange. Client may take benefit of “credit for sale” i.e. benefi ...

... We have margin based automated RMS system. Total deposits of the clients are uploaded in the system and client may take exposure on the basis of margin applicable for respective security as per VAR based margining system of the stock exchange. Client may take benefit of “credit for sale” i.e. benefi ...

Presentation - Federal Reserve Bank of Atlanta

... • It is not devising policies to minimize private trading costs over time. (Counterparties have strong incentives to do this by Bonding, Transparency, and Deterrency) • In forward markets, systemic risk develops from incentives for managers of difficult-to-fail financial institutions to devise new a ...

... • It is not devising policies to minimize private trading costs over time. (Counterparties have strong incentives to do this by Bonding, Transparency, and Deterrency) • In forward markets, systemic risk develops from incentives for managers of difficult-to-fail financial institutions to devise new a ...

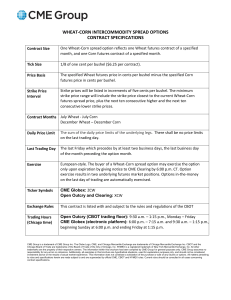

Wheat-Corn Intercommodity Spread Options Contract

... The last Friday which precedes by at least two business days, the last business day of the month preceding the option month. ...

... The last Friday which precedes by at least two business days, the last business day of the month preceding the option month. ...

2010-12 DC Bar 1256

... they are marked-to-market, they would meet the definition of regulated futures contract under Section 1256. But to date, IRS has held to the 1981 legislative history of the section which refers only to regulated futures contracts and does not include types of instruments added by Congress. Dodd-Fran ...

... they are marked-to-market, they would meet the definition of regulated futures contract under Section 1256. But to date, IRS has held to the 1981 legislative history of the section which refers only to regulated futures contracts and does not include types of instruments added by Congress. Dodd-Fran ...

Changes to Result in Better Framework and Incentive Structure for

... The new MM model is designed to simplify and improve the quality of market making services. It focuses on registration and responsibility of Exchange Participants (EPs) for MM activities and will discontinue registration of third parties known as Registered Traders (see chart on next page). The main ...

... The new MM model is designed to simplify and improve the quality of market making services. It focuses on registration and responsibility of Exchange Participants (EPs) for MM activities and will discontinue registration of third parties known as Registered Traders (see chart on next page). The main ...

Table of Contents

... You are able to place certain order types (e.g. “stop-loss”, “stop and limit”) which are intended to limit the losses to a certain amount. These order types may not be effective when market conditions make it difficult or impossible to execute such orders. At times, it is also difficult or impossibl ...

... You are able to place certain order types (e.g. “stop-loss”, “stop and limit”) which are intended to limit the losses to a certain amount. These order types may not be effective when market conditions make it difficult or impossible to execute such orders. At times, it is also difficult or impossibl ...

financial engineer / front office quantitative researcher

... – Research, idea generation and prototyping of quantitative equity and derivatives trading strategies – Modelling pricing inputs (e.g. dividends, volatility) and improve pricing platform in close collaberation with traders and programmers – Develop and maintain quantitative pricing models ...

... – Research, idea generation and prototyping of quantitative equity and derivatives trading strategies – Modelling pricing inputs (e.g. dividends, volatility) and improve pricing platform in close collaberation with traders and programmers – Develop and maintain quantitative pricing models ...

Chapter 10

... another between the parties Usually associated with borrowing money The exchanges can be at a fixed or a variable rate of interest as negotiated in the contract, but the exchanges occur at a known currency exchange rate Used to hedge exchange rate risk from mismatched currencies of assets and ...

... another between the parties Usually associated with borrowing money The exchanges can be at a fixed or a variable rate of interest as negotiated in the contract, but the exchanges occur at a known currency exchange rate Used to hedge exchange rate risk from mismatched currencies of assets and ...

RMS Policy - Dyna Securities Ltd.

... We have margin based automated RMS system. Total deposits of the clients are uploaded in the system and client may take exposure on the basis of margin applicable for respective security as per VAR based margining system of the stock exchange. Client may take benefit of “credit for sale” i.e. benefi ...

... We have margin based automated RMS system. Total deposits of the clients are uploaded in the system and client may take exposure on the basis of margin applicable for respective security as per VAR based margining system of the stock exchange. Client may take benefit of “credit for sale” i.e. benefi ...

rainbow trading corporation spyglass trading. lp

... • Opening position in a stock or index of a short put or call • Later add a short of the opposite option • Little to no additional margin required • Risk needs to be low to be effective ...

... • Opening position in a stock or index of a short put or call • Later add a short of the opposite option • Little to no additional margin required • Risk needs to be low to be effective ...

Who we are

... PMEX has developed a Murabaha product to facilitate the Islamic Finance Industry (IFI) International commodity exchanges such as London Metal Exchange, Bursa Malaysia & Jakarta Futures Exchange are also enabling Murabaha transactions and are acting as hubs for Islamic Banking liquidity management PM ...

... PMEX has developed a Murabaha product to facilitate the Islamic Finance Industry (IFI) International commodity exchanges such as London Metal Exchange, Bursa Malaysia & Jakarta Futures Exchange are also enabling Murabaha transactions and are acting as hubs for Islamic Banking liquidity management PM ...

Commodity Marketing Activity

... illegal to “fix prices” • 1974 Commodity Futures Trading Act est. the Commodity Futures Trading Commission as the independent federal body that oversees all futures trading in U.S. • Exchanges today page 5 ...

... illegal to “fix prices” • 1974 Commodity Futures Trading Act est. the Commodity Futures Trading Commission as the independent federal body that oversees all futures trading in U.S. • Exchanges today page 5 ...

What Trading Teaches Us About Life

... uncertainty. In mastering trading, we necessarily face and master ourselves. Very few arenas of life so immediately reward self-development--and punish its absence. So many life lessons can be culled from trading and the markets: 1) Have a firm stop-loss point for all activities: jobs, relationships ...

... uncertainty. In mastering trading, we necessarily face and master ourselves. Very few arenas of life so immediately reward self-development--and punish its absence. So many life lessons can be culled from trading and the markets: 1) Have a firm stop-loss point for all activities: jobs, relationships ...

Document

... This material is considered as a marketing communication and does not contain and should not be construed as containing investment advice or an investment recommendation, or, an offer of or solicitation for any transactions in financial instruments. Past performance does not guarantee or predict fut ...

... This material is considered as a marketing communication and does not contain and should not be construed as containing investment advice or an investment recommendation, or, an offer of or solicitation for any transactions in financial instruments. Past performance does not guarantee or predict fut ...

Math Club Meeting #4 Friday, March 12th, 2010

... His talk was titled Math Finance and Quantitative Trading Strategies. The talk can be summarized in a few sentences said by Arindam Kundu himself: “In the last decade, mathematical and computational engineers have devised innovative strategies to generate consistent returns in the markets using a co ...

... His talk was titled Math Finance and Quantitative Trading Strategies. The talk can be summarized in a few sentences said by Arindam Kundu himself: “In the last decade, mathematical and computational engineers have devised innovative strategies to generate consistent returns in the markets using a co ...

Description of Financial Instruments and Principal

... An arrangement made in a futures contract whereby differences in settlement are made through cash payments, rather than the delivery of physical goods or securities. In effect CFDs are financial derivatives that allow traders to take advantage of prices moving up (long positions) or prices moving do ...

... An arrangement made in a futures contract whereby differences in settlement are made through cash payments, rather than the delivery of physical goods or securities. In effect CFDs are financial derivatives that allow traders to take advantage of prices moving up (long positions) or prices moving do ...

the golden ticket gold day-trading system

... generate returns or ensure against losses. We do not and cannot give individual investment advice. U.S. Government Required Disclaimer - Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be ...

... generate returns or ensure against losses. We do not and cannot give individual investment advice. U.S. Government Required Disclaimer - Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be ...

FREE Sample Here

... Which of the following statements is not true about the law of one price a. investors prefer more wealth to less b. investments that offer the same return in all states must pay the risk-free rate c. if two investment opportunities offer equivalent outcomes, they must have the same price d. investor ...

... Which of the following statements is not true about the law of one price a. investors prefer more wealth to less b. investments that offer the same return in all states must pay the risk-free rate c. if two investment opportunities offer equivalent outcomes, they must have the same price d. investor ...

CM-Equity AG General Information and Risk Disclosure for

... Note: Please be aware that certain Underlying Assets may not be available with all Brokers. A CFD is a contract between two parties, typically described as "buyer" and "seller", stipulating that the seller will pay the buyer the difference between the current value of an asset and its value at the e ...

... Note: Please be aware that certain Underlying Assets may not be available with all Brokers. A CFD is a contract between two parties, typically described as "buyer" and "seller", stipulating that the seller will pay the buyer the difference between the current value of an asset and its value at the e ...

Lalin Dias, VP Exchange Systems, MillenniumIT

... MillenniumIT is a leading provider of high performance, flexible and multi-asset class technology to exchanges, broker-dealers, clearing houses, depositories and regulators. Its trading engine, smart order routing, market data, clearing, CSD and surveillance products have been implemented at over 30 ...

... MillenniumIT is a leading provider of high performance, flexible and multi-asset class technology to exchanges, broker-dealers, clearing houses, depositories and regulators. Its trading engine, smart order routing, market data, clearing, CSD and surveillance products have been implemented at over 30 ...

Chapter 11 Securities Markets

... Security Market Indexes are used to track overall market and sector performance for stocks, bonds, and other investments Well-known stock market indexes: – Dow Jones Industrial Average • Based on price – Standard & Poor’s (S&P) 500 • Based on market value ...

... Security Market Indexes are used to track overall market and sector performance for stocks, bonds, and other investments Well-known stock market indexes: – Dow Jones Industrial Average • Based on price – Standard & Poor’s (S&P) 500 • Based on market value ...

Economics 330 Money and Banking Lecture 18

... 3. Mark to market and margin requirements: avoids default risk 4. Don’t have to deliver: netting ...

... 3. Mark to market and margin requirements: avoids default risk 4. Don’t have to deliver: netting ...

UK Contracts for Difference: Risks and

... current proposal is for intermittent generation technologies (e.g. wind, wave, solar) to be paid on the basis of an hourly day-ahead index. This reduces price risk for developers, given that the difference payments adjust dynamically with the reference price to ensure recovery of the strike price. P ...

... current proposal is for intermittent generation technologies (e.g. wind, wave, solar) to be paid on the basis of an hourly day-ahead index. This reduces price risk for developers, given that the difference payments adjust dynamically with the reference price to ensure recovery of the strike price. P ...