Chapter 15 PPP

... • Transaction will not be completed until some agreedupon date in the future • Delivery date and quantity are all set when the financial future is created • Seller has legally binding obligation to make delivery on specified date • Buyer/holder has legally binding obligation to take delivery on spec ...

... • Transaction will not be completed until some agreedupon date in the future • Delivery date and quantity are all set when the financial future is created • Seller has legally binding obligation to make delivery on specified date • Buyer/holder has legally binding obligation to take delivery on spec ...

The COT reports consist of three different reports

... OI (table 1), modestly higher than the five-year average (14%), but lower that the five-year high of 24% (reached in October of 2010). This suggests that investors anticipate prices may increase and are positioned to realize profits in such a move. It also indicates the potential for the speculator ...

... OI (table 1), modestly higher than the five-year average (14%), but lower that the five-year high of 24% (reached in October of 2010). This suggests that investors anticipate prices may increase and are positioned to realize profits in such a move. It also indicates the potential for the speculator ...

PART V - Georgia College & State University

... ownership of the underlying assets at the time the contract is initiated. A derivative represents an agreement to transfer ownership of underlying assets at a specific place, price, and time specified in the contract. Its value (or price) depends on the value of the underlying assets. The underlying ...

... ownership of the underlying assets at the time the contract is initiated. A derivative represents an agreement to transfer ownership of underlying assets at a specific place, price, and time specified in the contract. Its value (or price) depends on the value of the underlying assets. The underlying ...

Risk management through introduction of futures contracts in tea

... presently licensed by the auction organizer, who would have a dual role as the futures exchange. • The clearing house could be the present auction settlement bank. The issues of variability of quality if actual delivery is taken, or the price of the category of tea if cash closing out is taken will ...

... presently licensed by the auction organizer, who would have a dual role as the futures exchange. • The clearing house could be the present auction settlement bank. The issues of variability of quality if actual delivery is taken, or the price of the category of tea if cash closing out is taken will ...

derivatives_general_paper

... and fixed exchange rate) or to interest rates (I’ll receive fixed interest in the future, you’ll receive floating interest, let’s exchange them at a pre-agreed rate – different and higher than the fixed rate). Like options, swaps have developed over time into new and sometimes very sophisticated mar ...

... and fixed exchange rate) or to interest rates (I’ll receive fixed interest in the future, you’ll receive floating interest, let’s exchange them at a pre-agreed rate – different and higher than the fixed rate). Like options, swaps have developed over time into new and sometimes very sophisticated mar ...

INFINOX- Order Execution Policy

... Settled block trades, or positions larger than standard market size, may be crossed at a particular stage in the trading day or kept anonymous to the majority of market participants; unless otherwise directed. ...

... Settled block trades, or positions larger than standard market size, may be crossed at a particular stage in the trading day or kept anonymous to the majority of market participants; unless otherwise directed. ...

50 The LC Gupta Committee Report: Some Observations

... India has seen significant improvements during the nineties with the introduction of screen-based trading, creation of depositories, and dematerialisation of some of the shares; the participants in equity trading have had long exposures to this activity and hence have a fairly good understanding of ...

... India has seen significant improvements during the nineties with the introduction of screen-based trading, creation of depositories, and dematerialisation of some of the shares; the participants in equity trading have had long exposures to this activity and hence have a fairly good understanding of ...

10 Reasons to Consider Adding Managed Futures to

... CME Group is a trademark of CME Group Inc. The Globe logo, CME and Chicago Mercantile Exchange are trademarks of Chicago Mercantile Exchange Inc. Chicago Board of Trade and CBOT are trademarks of the Board of Trade of the City of Chicago, Inc. New York Mercantile Exchange and NYMEX are trademarks of ...

... CME Group is a trademark of CME Group Inc. The Globe logo, CME and Chicago Mercantile Exchange are trademarks of Chicago Mercantile Exchange Inc. Chicago Board of Trade and CBOT are trademarks of the Board of Trade of the City of Chicago, Inc. New York Mercantile Exchange and NYMEX are trademarks of ...

Mechanics of Futures Markets

... The clearing house acts as an intermediary. It guarantees the performance of the two parties. It has a number of members who must post funds with the exchange. The main task of it is to keep track of all the transactions and calculate the net positions of ...

... The clearing house acts as an intermediary. It guarantees the performance of the two parties. It has a number of members who must post funds with the exchange. The main task of it is to keep track of all the transactions and calculate the net positions of ...

CEE Trader - Wiener Börse

... Media owner and publisher: Wiener Börse AG Place of production: Vienna Responsible for the contents: Wiener Börse AG; February 2017 The information given in this publication does not constitute any investment advice or investment recommendation by Wiener Börse AG. This publication is protected by co ...

... Media owner and publisher: Wiener Börse AG Place of production: Vienna Responsible for the contents: Wiener Börse AG; February 2017 The information given in this publication does not constitute any investment advice or investment recommendation by Wiener Börse AG. This publication is protected by co ...

International Derivatives Brochure

... Upon expiry of an International Derivatives SSF contract or the closing of a position, the economic effect of all cash flows representing margin payments or receipts must reflect the total profit or loss to the holder of a contract. Each investor’s initial margin (with interest) is repaid together w ...

... Upon expiry of an International Derivatives SSF contract or the closing of a position, the economic effect of all cash flows representing margin payments or receipts must reflect the total profit or loss to the holder of a contract. Each investor’s initial margin (with interest) is repaid together w ...

Lecture 3

... to change hands before the delivery date. The (forward) price would go up and down depending on market conditions. people who had no intention buying or selling grain began to trade: speculators ...

... to change hands before the delivery date. The (forward) price would go up and down depending on market conditions. people who had no intention buying or selling grain began to trade: speculators ...

characteristics of financial instruments and a description of risk

... Contract for difference (CFD) is a derivative that allows investors to trade based on changing market prices of shares and indices without having ownership of the share. This instrument is non-standard, so the parameters of a CFD, as the transaction value, the minimum change in price or time to matu ...

... Contract for difference (CFD) is a derivative that allows investors to trade based on changing market prices of shares and indices without having ownership of the share. This instrument is non-standard, so the parameters of a CFD, as the transaction value, the minimum change in price or time to matu ...

WNE UW - Derivatives Markets

... But we do not live in a simple world of only stocks and bonds, and in fact investors can adjust the level of risk in a variety of ways. For example, one way to reduce risk is to use insurance, which can be described as the act of paying someone to assume a risk for you. The financial markets have cr ...

... But we do not live in a simple world of only stocks and bonds, and in fact investors can adjust the level of risk in a variety of ways. For example, one way to reduce risk is to use insurance, which can be described as the act of paying someone to assume a risk for you. The financial markets have cr ...

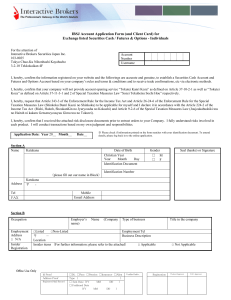

IBSJ Account Application Form (and Client Card) for Exchange listed

... Interactive Brokers (“IB”) can maintain its low commission structure because we have built automated trade processes to minimize human intervention and discretion. In this respect, we have established some simple terms which govern trading in all IB accounts. These rules recognize that from time to ...

... Interactive Brokers (“IB”) can maintain its low commission structure because we have built automated trade processes to minimize human intervention and discretion. In this respect, we have established some simple terms which govern trading in all IB accounts. These rules recognize that from time to ...

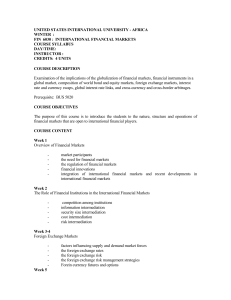

united states international university - africa

... global market, composition of world bond and equity markets, foreign exchange markets, interest rate and currency swaps, global interest rate links, and cross-currency and cross-border arbitrages. ...

... global market, composition of world bond and equity markets, foreign exchange markets, interest rate and currency swaps, global interest rate links, and cross-currency and cross-border arbitrages. ...

PAKISTAN STOCK EXCHANGE LIMITED Stock Exchange

... The customer transacting in the derivative and leveraged markets needs to carefully review the agreement provided by the brokers and also thoroughly read and understand the specifications, terms and conditions which may include markup rate, risk disclosures etc. There are a number of additional risk ...

... The customer transacting in the derivative and leveraged markets needs to carefully review the agreement provided by the brokers and also thoroughly read and understand the specifications, terms and conditions which may include markup rate, risk disclosures etc. There are a number of additional risk ...

Stock Market Liquidity: Behavior of Short-Term and Long-Term

... some of the inventory to other traders while processing information that arrives in the interim through hot potato trading and order modifications helps in managing inventory risk. We develop new methods for identifying and measuring hot potato trading and order modifications. Our findings are consi ...

... some of the inventory to other traders while processing information that arrives in the interim through hot potato trading and order modifications helps in managing inventory risk. We develop new methods for identifying and measuring hot potato trading and order modifications. Our findings are consi ...

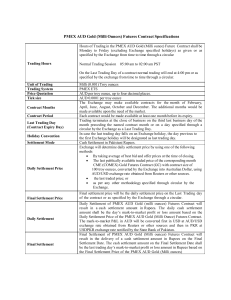

PMEX AUD Gold Futures Contract

... result in a cash settlement amount in Rupees. The daily cash settlement amount shall be the day’s mark-to-market profit or loss amount based on the Daily Settlement Price of the PMEX AUD Gold (Milli Ounce) Futures Contract. The mark-to-market P&L in AUD will be converted first in USD at AUD/USD exch ...

... result in a cash settlement amount in Rupees. The daily cash settlement amount shall be the day’s mark-to-market profit or loss amount based on the Daily Settlement Price of the PMEX AUD Gold (Milli Ounce) Futures Contract. The mark-to-market P&L in AUD will be converted first in USD at AUD/USD exch ...

Back to basics on Risk Management – Futures

... In order to trade Futures, buyers and sellers are required to post ‘margin deposits’ with the futures exchange or clearing house (intermediary between buyer and seller). These represent a financial guarantee that buyers and sellers will honour the contract. Margin deposits typically range between 5% ...

... In order to trade Futures, buyers and sellers are required to post ‘margin deposits’ with the futures exchange or clearing house (intermediary between buyer and seller). These represent a financial guarantee that buyers and sellers will honour the contract. Margin deposits typically range between 5% ...

Day Trading Disclosure Day traders rapidly buy and sell stocks

... rules of NYSE and the Financial Industry Regulatory Authority (FINRA), customers who are deemed "pattern day traders" must have at least $25,000 in their accounts and can only trade in margin accounts. Day trading is extremely risky and can result in substantial financial losses in a very short peri ...

... rules of NYSE and the Financial Industry Regulatory Authority (FINRA), customers who are deemed "pattern day traders" must have at least $25,000 in their accounts and can only trade in margin accounts. Day trading is extremely risky and can result in substantial financial losses in a very short peri ...

Heding Grain Production with Futures

... mentioned in this article without first consulting your own investment advisor in order to ascertain whether the securities or investment strategy mentioned are suitable for your circumstances. The information contained herein has been obtained from sources believed to be reliable at the time obtain ...

... mentioned in this article without first consulting your own investment advisor in order to ascertain whether the securities or investment strategy mentioned are suitable for your circumstances. The information contained herein has been obtained from sources believed to be reliable at the time obtain ...