short selling regulations

... The Chief Executive may restrict or prohibit an Exchange Participant from short selling Designated Securities provided he has first obtained the approval of the Chairman of the Board, which may be given either orally or in writing. Notice of such restriction or prohibition to the Exchange Participan ...

... The Chief Executive may restrict or prohibit an Exchange Participant from short selling Designated Securities provided he has first obtained the approval of the Chairman of the Board, which may be given either orally or in writing. Notice of such restriction or prohibition to the Exchange Participan ...

No #9

... mark. Each year the US party receives from\pays to the counterparty DM100,000($0.5-spot rate) ...

... mark. Each year the US party receives from\pays to the counterparty DM100,000($0.5-spot rate) ...

Pricing and Fees

... A stop order is an order to buy or sell once a pre-defined price is reached. When the price is reached, the stop order becomes a market order. Stop orders are available without charge for SALT Trading customers, and are often used as a risk management tool to close your position once a specific leve ...

... A stop order is an order to buy or sell once a pre-defined price is reached. When the price is reached, the stop order becomes a market order. Stop orders are available without charge for SALT Trading customers, and are often used as a risk management tool to close your position once a specific leve ...

Financial Markets in Electricity: Introduction to Derivative Instruments

... not yet sold this on to another trader faces the risk that prices may decline during that period. . Position limit: A control placed on traders, by management of a firm, to prevent its traders from taking price and credit risks which may result in losses which could damage the financial strength of ...

... not yet sold this on to another trader faces the risk that prices may decline during that period. . Position limit: A control placed on traders, by management of a firm, to prevent its traders from taking price and credit risks which may result in losses which could damage the financial strength of ...

IB Comment Letter to SEC Opposing New Margin Requirements for

... and close out a position in the same day for a variety of reasons, for example because of a change in market conditions, an unexpectedly large gain or loss in the position, or because the trade was done to take advantage of an available arbitrage opportunity. By artificially constraining investors’ ...

... and close out a position in the same day for a variety of reasons, for example because of a change in market conditions, an unexpectedly large gain or loss in the position, or because the trade was done to take advantage of an available arbitrage opportunity. By artificially constraining investors’ ...

Emerging Derivative Markets

... Enabling regulation: Futures Modernization Act (2000) deletion of real demand principle. ...

... Enabling regulation: Futures Modernization Act (2000) deletion of real demand principle. ...

Futures and Options

... Recommended book: John Hull (H) Options, Futures and Other Derivatives, Prentice Hall, 2005. The book comes with a futures/options software CD. The book is not a substitute for the lecture notes. Some topics and details are not covered by the book. Other recommended books; Cox and Rubinstein (CR) Op ...

... Recommended book: John Hull (H) Options, Futures and Other Derivatives, Prentice Hall, 2005. The book comes with a futures/options software CD. The book is not a substitute for the lecture notes. Some topics and details are not covered by the book. Other recommended books; Cox and Rubinstein (CR) Op ...

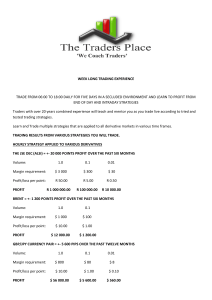

week long trading experience trade from 06:00 to 18:00 daily for five

... to anyone serious in improving their trading skills. There is also great support available via a skype group chat where any questions can be asked and trading tips provided. Warren, keep up the great service! Regards Gavin ...

... to anyone serious in improving their trading skills. There is also great support available via a skype group chat where any questions can be asked and trading tips provided. Warren, keep up the great service! Regards Gavin ...

Presentation - NCDEX Institute of Commodity Markets and Research

... Both indices are not stationary in level form. First Difference of log form, i.e., rates of growth series of these indices are stationary. It implies that while it may not be possible to predict future values, the rate of growth of either of the two series is predictable. ...

... Both indices are not stationary in level form. First Difference of log form, i.e., rates of growth series of these indices are stationary. It implies that while it may not be possible to predict future values, the rate of growth of either of the two series is predictable. ...

13 characteristics of a successful trader

... government notes), oil, gold, and major global stock indexes. On an intraday basis, they look to these other markets for confirmation of short-term U.S. dollar directional bias. For example, if the dollar is moving higher, U.S. ten-year yields are rising, and gold is falling, it’s confirmation from ...

... government notes), oil, gold, and major global stock indexes. On an intraday basis, they look to these other markets for confirmation of short-term U.S. dollar directional bias. For example, if the dollar is moving higher, U.S. ten-year yields are rising, and gold is falling, it’s confirmation from ...

Chapter 3: How Securities are Traded

... • Commission: fee paid to broker for making the transaction • Spread: cost of trading with dealer – Bid: price dealer will buy from you – Ask: price dealer will sell to you – Spread: ask - bid • Combination: on some trades both are paid ...

... • Commission: fee paid to broker for making the transaction • Spread: cost of trading with dealer – Bid: price dealer will buy from you – Ask: price dealer will sell to you – Spread: ask - bid • Combination: on some trades both are paid ...

Securities Markets Primary Versus Secondary Markets How

... Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...

... Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...

IRRI-6 Weekly

... stitched. No tare allowance will be applicable. Karachi or Port Qasim at Exchange approved and designated warehouses. The Exchange will notify in advance the contract weeks available for IRRI-6 Rice futures. Trading in any contract will open at least one week before the last trading day. Contracts w ...

... stitched. No tare allowance will be applicable. Karachi or Port Qasim at Exchange approved and designated warehouses. The Exchange will notify in advance the contract weeks available for IRRI-6 Rice futures. Trading in any contract will open at least one week before the last trading day. Contracts w ...

Buyside Traders Want SEC to Press Exchanges and Dark Pools for

... know if the venue offers certain players special advantages in the venue. This concern echoes recent criticism from the buyside that some exchange order types may give professional traders unfair advantages. At the workshop, the traders "expressed a real need for more transparency around how their e ...

... know if the venue offers certain players special advantages in the venue. This concern echoes recent criticism from the buyside that some exchange order types may give professional traders unfair advantages. At the workshop, the traders "expressed a real need for more transparency around how their e ...

Chapter 371 NY Harbor ULSD vs. Low Sulphur Gasoil (1,000bbl

... The settlement prices for the first nearby contract month will be used except on the last day of trading for the expiring Low Sulphur Gasoil Futures contract when the settlement prices of the second nearby Low Sulphur Gasoil contract will be used. The Floating Price is calculated using the non-commo ...

... The settlement prices for the first nearby contract month will be used except on the last day of trading for the expiring Low Sulphur Gasoil Futures contract when the settlement prices of the second nearby Low Sulphur Gasoil contract will be used. The Floating Price is calculated using the non-commo ...

BAML Partners with Thesys on New High-Speed Trading

... Morgan and Morgan Stanley—on an initiative to centrally monitor and manage FX trading activity on multilateral trading venues. Traiana said that by connecting prime brokers and trading venues in real-time, the service will provide prime brokers with the ability to monitor and manage risks from algor ...

... Morgan and Morgan Stanley—on an initiative to centrally monitor and manage FX trading activity on multilateral trading venues. Traiana said that by connecting prime brokers and trading venues in real-time, the service will provide prime brokers with the ability to monitor and manage risks from algor ...

Complex Financial Instrument Information Sheet

... This Information Sheet is intended to provide you with an overview of the risks associated with Derivatives and similar instruments (a description which may include Options, Contracts for Differences, Warrants, Securitised Derivatives/Covered Warrants, and certain Exchange Traded Funds). These inves ...

... This Information Sheet is intended to provide you with an overview of the risks associated with Derivatives and similar instruments (a description which may include Options, Contracts for Differences, Warrants, Securitised Derivatives/Covered Warrants, and certain Exchange Traded Funds). These inves ...

Derivatives-chapter1

... An option is the right to either buy or sell something at a set price, within a set period of time ...

... An option is the right to either buy or sell something at a set price, within a set period of time ...

Investments - GEOCITIES.ws

... Auction markets with centralized order flow Dealership function: can be competitive or assigned by the exchange (specialists or registered traders) Securities: stock, futures contracts, options, and to a lesser extent, bonds Examples: TSE, ME, NYSE, AMEX ...

... Auction markets with centralized order flow Dealership function: can be competitive or assigned by the exchange (specialists or registered traders) Securities: stock, futures contracts, options, and to a lesser extent, bonds Examples: TSE, ME, NYSE, AMEX ...

Lecture 1

... • Last 35 years: extraordinary growth worldwide. • Today: derivatives are used to manage risk exposures in interest rates, currencies, commodities, equity markets, the weather. ...

... • Last 35 years: extraordinary growth worldwide. • Today: derivatives are used to manage risk exposures in interest rates, currencies, commodities, equity markets, the weather. ...

risk management strategies

... are considered with an appropriate haircut, haircut is minimum 25%) We have withdrawn all the NEAT trading terminals and installed CTCL terminals for better control & Risk management at all places. This CTCL set up gives us client level control. Limits to all clients are set based on SPAN methodolog ...

... are considered with an appropriate haircut, haircut is minimum 25%) We have withdrawn all the NEAT trading terminals and installed CTCL terminals for better control & Risk management at all places. This CTCL set up gives us client level control. Limits to all clients are set based on SPAN methodolog ...

By Robert C Merton, John and Natty McArthur

... into the archaic trading pits just under a decade later, trading costs have plummeted and derivatives trading volumes have escalated dramatically. The major advantages of using derivatives are that they are efficient in transferring huge amounts of risk; they can be customised, they are reversible a ...

... into the archaic trading pits just under a decade later, trading costs have plummeted and derivatives trading volumes have escalated dramatically. The major advantages of using derivatives are that they are efficient in transferring huge amounts of risk; they can be customised, they are reversible a ...

RMS Policy - Adinath Capital Services Limited

... We have margin based automated RMS system. Total deposits of the clients are uploaded in the system and client may take exposure on the basis of margin applicable for respective security as per VAR based margining system of the stock exchange. Client may take benefit of “credit for sale” i.e. benefi ...

... We have margin based automated RMS system. Total deposits of the clients are uploaded in the system and client may take exposure on the basis of margin applicable for respective security as per VAR based margining system of the stock exchange. Client may take benefit of “credit for sale” i.e. benefi ...