Intel In Talks To Buy Altera Economic Growth

... Corporate profits after tax—without accounting for the value of inventory and depreciation of buildings and equipment— fell at a 3% pace from the third quarter. That was the largest quarterly drop in profits since the first quarter of 2011. ...

... Corporate profits after tax—without accounting for the value of inventory and depreciation of buildings and equipment— fell at a 3% pace from the third quarter. That was the largest quarterly drop in profits since the first quarter of 2011. ...

Competitive Analysis of On-line Securities Investment

... compare the Mixed Strategy and the popular Dollar Average Strategy, and an investing example is stimulated using the two strategies based on the actual market data of CBM in 2003. Conclusions and work-in-progress are reported in section 4. ...

... compare the Mixed Strategy and the popular Dollar Average Strategy, and an investing example is stimulated using the two strategies based on the actual market data of CBM in 2003. Conclusions and work-in-progress are reported in section 4. ...

Electricity Markets Market Power Definition Monopoly Power

... Waiting for a better price is not possible in RT, contrary to what occurs in forward markets Withholding in forward markets means only arbitrage But in the long-run, RT price levels are reflected in forward price Expected forward prices play a role when assessing the profitability of RT price distor ...

... Waiting for a better price is not possible in RT, contrary to what occurs in forward markets Withholding in forward markets means only arbitrage But in the long-run, RT price levels are reflected in forward price Expected forward prices play a role when assessing the profitability of RT price distor ...

Flexible “Trend Following” Strategies

... An alternative investment strategy that takes advantage of price decay in certain exchange traded funds and exchange traded notes due to their structural design. This strategy is not available for IRAs or Roth IRAs. ...

... An alternative investment strategy that takes advantage of price decay in certain exchange traded funds and exchange traded notes due to their structural design. This strategy is not available for IRAs or Roth IRAs. ...

Automated Market Makers - A Survey

... a University run market that lets traders bet on a variety of outcomes ranging from presidential elections to weather events. The information gathered from the market is available for students to use in research. Another example is the New York Stock Exchange, which helps aggregate company valuation ...

... a University run market that lets traders bet on a variety of outcomes ranging from presidential elections to weather events. The information gathered from the market is available for students to use in research. Another example is the New York Stock Exchange, which helps aggregate company valuation ...

Stocks: An Introduction

... for growth. When resources flow to their most valued uses, the economy operates more efficiently Most people see stock market as a place where fortunes are easily made or lost, and they recoil at its unfathomable booms and busts. Great American Depression (1929) Post-September 11, 2001 scenari ...

... for growth. When resources flow to their most valued uses, the economy operates more efficiently Most people see stock market as a place where fortunes are easily made or lost, and they recoil at its unfathomable booms and busts. Great American Depression (1929) Post-September 11, 2001 scenari ...

smgclassroompresentation[1]

... 6. Bears, Bulls, and Pigs are found in the stock market. 7. Stock prices are set by the Securities and Exchange Commission, a regulatory agency of the U.S. government. 8. Stock markets are open on business days around the clock, around the world. ...

... 6. Bears, Bulls, and Pigs are found in the stock market. 7. Stock prices are set by the Securities and Exchange Commission, a regulatory agency of the U.S. government. 8. Stock markets are open on business days around the clock, around the world. ...

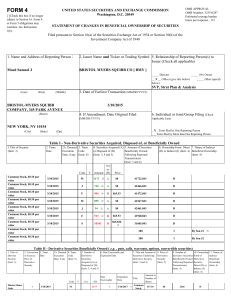

BRISTOL MYERS SQUIBB CO (Form: 4, Received

... ( 1) Represents vesting of one-quarter of market share units granted on March 10, 2013. ( 2) Adjustment reflects additional shares acquired upon the vesting of market share units due to the performance factor. ( 3) Shares withheld for payment of taxes upon vesting of awards. ( 4) Represents vesting ...

... ( 1) Represents vesting of one-quarter of market share units granted on March 10, 2013. ( 2) Adjustment reflects additional shares acquired upon the vesting of market share units due to the performance factor. ( 3) Shares withheld for payment of taxes upon vesting of awards. ( 4) Represents vesting ...

ANTS TRADE MANAGEMENT

... signal. In a long side trade, the ATR value is added to the low of the bar. A close below the ATR line is an exit signal. This is a very robust stop loss method. However, in the ANTS system the ATR is applied to a range bar chart. This significant improves the reliability of the ATR signal. Most of ...

... signal. In a long side trade, the ATR value is added to the low of the bar. A close below the ATR line is an exit signal. This is a very robust stop loss method. However, in the ANTS system the ATR is applied to a range bar chart. This significant improves the reliability of the ATR signal. Most of ...

Robust measurement of implied correlations

... evaporating. In the extreme case there is no diversification possible in an asset portfolio and stock picking doesn't make sense anymore as the portfolio return is not determined by the particular stocks composing the portfolio, but whether one is exposed to the stock market or not. Asset correlatio ...

... evaporating. In the extreme case there is no diversification possible in an asset portfolio and stock picking doesn't make sense anymore as the portfolio return is not determined by the particular stocks composing the portfolio, but whether one is exposed to the stock market or not. Asset correlatio ...

- Miller Capital Management

... surprise. Analysts have been factoring slower growth into their calculations for some time. U.S. rate hikes are highly anticipated and, even though some fear they could tip the American economy into recession (and argue recent stock price movement supports the claim), relatively strong economic data ...

... surprise. Analysts have been factoring slower growth into their calculations for some time. U.S. rate hikes are highly anticipated and, even though some fear they could tip the American economy into recession (and argue recent stock price movement supports the claim), relatively strong economic data ...

Daily Equity Report - Highlight Investment Research

... information and we are not responsible for any loss incurred based upon it & takes no responsibility whatsoever for any financial profit s or loss which may arise from the recommendations above. The stock price projections shown are not necessarily indicative of future price performance. The informa ...

... information and we are not responsible for any loss incurred based upon it & takes no responsibility whatsoever for any financial profit s or loss which may arise from the recommendations above. The stock price projections shown are not necessarily indicative of future price performance. The informa ...

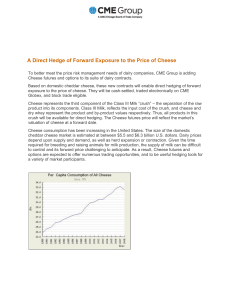

A Direct Hedge of Forward Exposure to the Price of Cheese

... Based on domestic cheddar cheese, these new contracts will enable direct hedging of forward exposure to the price of cheese. They will be cash-settled, traded electronically on CME Globex, and block trade eligible. Cheese represents the third component of the Class III Milk “crush” – the separation ...

... Based on domestic cheddar cheese, these new contracts will enable direct hedging of forward exposure to the price of cheese. They will be cash-settled, traded electronically on CME Globex, and block trade eligible. Cheese represents the third component of the Class III Milk “crush” – the separation ...

50 The LC Gupta Committee Report: Some Observations

... India has seen significant improvements during the nineties with the introduction of screen-based trading, creation of depositories, and dematerialisation of some of the shares; the participants in equity trading have had long exposures to this activity and hence have a fairly good understanding of ...

... India has seen significant improvements during the nineties with the introduction of screen-based trading, creation of depositories, and dematerialisation of some of the shares; the participants in equity trading have had long exposures to this activity and hence have a fairly good understanding of ...

FOREX 1

... Short position: A position that benefits from a decline in market prices. Long position: A position that increases its value if market prices increase. Pips: A pip is the smallest unit by which a FOREX cross price quote changes. So if EURUSD bid is now quoted at 0.9767 and it moves up 2 pips, ...

... Short position: A position that benefits from a decline in market prices. Long position: A position that increases its value if market prices increase. Pips: A pip is the smallest unit by which a FOREX cross price quote changes. So if EURUSD bid is now quoted at 0.9767 and it moves up 2 pips, ...

Key Concepts and Skills

... period over multiple periods • The geometric average will be less than the arithmetic average unless all the returns are equal • Which is better? – The arithmetic average is overly optimistic for long horizons – The geometric average is overly pessimistic for short horizons – So the answer depends o ...

... period over multiple periods • The geometric average will be less than the arithmetic average unless all the returns are equal • Which is better? – The arithmetic average is overly optimistic for long horizons – The geometric average is overly pessimistic for short horizons – So the answer depends o ...

4028-10-Syllabus

... – Market orders are executed immediately when a matching order(s) arrives irrespective of the stock price – The price may change during the waiting time ...

... – Market orders are executed immediately when a matching order(s) arrives irrespective of the stock price – The price may change during the waiting time ...

PPTX - DocDroid

... Binary Options may be simple to understand, but that does not mean that they do not come with a steep learning curve, in fact like most other forms of financial trading, they require the trader to have at least a passing knowledge of how the market works and making most of your trades successful is ...

... Binary Options may be simple to understand, but that does not mean that they do not come with a steep learning curve, in fact like most other forms of financial trading, they require the trader to have at least a passing knowledge of how the market works and making most of your trades successful is ...

W D&O Reinsurance Pricing A Financial Market Approach

... Credit ratings are adjusted to reflect outlook of each security, and minimum of adjusted ratings is selected. ...

... Credit ratings are adjusted to reflect outlook of each security, and minimum of adjusted ratings is selected. ...

Instructions Double-Oral Auction Market Experiment, Fall 2004

... exchanged in a competitive market structure are determined. The market structure used in this experiment is known as a "double-oral auction." This means that both buyers and sellers orally communicate their desires to the market and this information is known to all market participants. Because every ...

... exchanged in a competitive market structure are determined. The market structure used in this experiment is known as a "double-oral auction." This means that both buyers and sellers orally communicate their desires to the market and this information is known to all market participants. Because every ...

ETF Trading: Understanding ETF Liquidity

... Now let’s examine how to determine the appropriate trading strategy for a specific ETF, given market conditions. For example, assume that, based on a client’s investment objectives, you purchase 30,000 shares of FlexShares Quality Dividend Index Fund (QDF). Employing the First Level of Liquidity (Se ...

... Now let’s examine how to determine the appropriate trading strategy for a specific ETF, given market conditions. For example, assume that, based on a client’s investment objectives, you purchase 30,000 shares of FlexShares Quality Dividend Index Fund (QDF). Employing the First Level of Liquidity (Se ...

foreign exchange market (forex)

... Central Banks and Treasuries • Central banks and treasuries use the market to acquire or spend their country’s currency reserves as well as to influence the price at which their own currency trades. • They may act to support the value of their currency because of their government’s policies or obli ...

... Central Banks and Treasuries • Central banks and treasuries use the market to acquire or spend their country’s currency reserves as well as to influence the price at which their own currency trades. • They may act to support the value of their currency because of their government’s policies or obli ...

02_riskreturn_ch12

... Prices reflect all past market information such as price and volume If the market is weak form efficient, then investors cannot earn abnormal returns by trading on market information Implies that technical analysis will not lead to abnormal returns Empirical evidence indicates that markets are gener ...

... Prices reflect all past market information such as price and volume If the market is weak form efficient, then investors cannot earn abnormal returns by trading on market information Implies that technical analysis will not lead to abnormal returns Empirical evidence indicates that markets are gener ...

![smgclassroompresentation[1]](http://s1.studyres.com/store/data/021802581_1-1933bb9c9a7cfb38987e81a50d5e9b34-300x300.png)