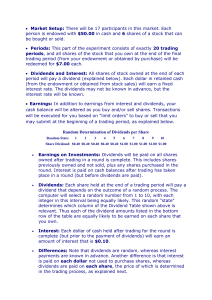

Experimental Instructions

... interest rate. The dividends may not be known in advance, but the interest rate will be known. Earnings: In addition to earnings from interest and dividends, your cash balance will be altered as you buy and/or sell shares. Transactions will be executed for you based on "limit orders" to buy or sel ...

... interest rate. The dividends may not be known in advance, but the interest rate will be known. Earnings: In addition to earnings from interest and dividends, your cash balance will be altered as you buy and/or sell shares. Transactions will be executed for you based on "limit orders" to buy or sel ...

Chapter 8 Errata

... 7. a. This portfolio is not well-diversified. The weight on the first security does not decline as n increases. Regardless of how much diversification there is in the rest of the portfolio, you will not shed the firm-specific risk of this security. b. This portfolio is well diversified. Even though ...

... 7. a. This portfolio is not well-diversified. The weight on the first security does not decline as n increases. Regardless of how much diversification there is in the rest of the portfolio, you will not shed the firm-specific risk of this security. b. This portfolio is well diversified. Even though ...

An Introduction to Hackney`s Markets

... We know that the East London line extension will be coming to Shoreditch and Dalston and wider plans are being drawn up to regenerate these areas. This is an exciting time for markets with investment opportunities and a revival of shopper’s interest. ...

... We know that the East London line extension will be coming to Shoreditch and Dalston and wider plans are being drawn up to regenerate these areas. This is an exciting time for markets with investment opportunities and a revival of shopper’s interest. ...

Dealer Markets (Cont.)

... set the price – Either a single trade between all parties at a single price or a series of trades at different prices Copyright © 2004 Pearson Addison-Wesley. All rights reserved. ...

... set the price – Either a single trade between all parties at a single price or a series of trades at different prices Copyright © 2004 Pearson Addison-Wesley. All rights reserved. ...

Lecture10(Ch10)

... airfares: “business” versus “vacation” travelers student version of software (e.g.mathematica) different prices in foreign markets volume discounts ...

... airfares: “business” versus “vacation” travelers student version of software (e.g.mathematica) different prices in foreign markets volume discounts ...

Elie Ayache - Writing Options on Futures

... If you follow this story, you will understand why there is no limit on the variety of derivatives that can be created, and how traders are continuously writing and finding new ways of writing them. When we wrote these options on futures for the first time at the Matif, we were introducing a layer of ...

... If you follow this story, you will understand why there is no limit on the variety of derivatives that can be created, and how traders are continuously writing and finding new ways of writing them. When we wrote these options on futures for the first time at the Matif, we were introducing a layer of ...

Weekly Commentary 01-25-16

... central bank seeks to normalize policy. Instead, traders put the odds on just one rate rise this year.” A late-week rally in oil prices also helped push stock markets higher. The Financial Times reported crude oil hit a 12-year low midweek and then bounced more than 18 percent. While improving oil p ...

... central bank seeks to normalize policy. Instead, traders put the odds on just one rate rise this year.” A late-week rally in oil prices also helped push stock markets higher. The Financial Times reported crude oil hit a 12-year low midweek and then bounced more than 18 percent. While improving oil p ...

This paper is not to be removed from the Examination Halls

... Suppose a competitive risk neutral market maker clears the market by offering bid and ask quotes at which she is willing to trade one share of a stock. Traders are either uninformed noise traders who are as willing to buy a share as sell a share of the stock, or informed traders who know exactly the ...

... Suppose a competitive risk neutral market maker clears the market by offering bid and ask quotes at which she is willing to trade one share of a stock. Traders are either uninformed noise traders who are as willing to buy a share as sell a share of the stock, or informed traders who know exactly the ...

A Survey of Behavioral Finance - Internet Surveys of American Opinion

... • Correct Prices => No Free Lunch • No Free Lunch ≠> Correct Prices • Why Care? ...

... • Correct Prices => No Free Lunch • No Free Lunch ≠> Correct Prices • Why Care? ...

FOR IMMEDIATE RELEASE What do stock markets tell us about

... investors allocating money across global stock markets when returns are measured in an investor’s home currency. The result also means that predictable movements in stock markets are of no use in predicting exchange rate movements. The work, published as a Bank of England working paper and forthcomi ...

... investors allocating money across global stock markets when returns are measured in an investor’s home currency. The result also means that predictable movements in stock markets are of no use in predicting exchange rate movements. The work, published as a Bank of England working paper and forthcomi ...

HISTORY OF MARKET RECOVERIES Don`t let the headlines get

... Don’t let the headlines get you down. Look at how the markets have rebounded. Provided by DARRELL J. DRUMMOND The stock market has been amazingly resilient. The sky is not falling, despite what the pessimists would have you believe. Yes, the Dow Jones Industrial Average entered bear market territory ...

... Don’t let the headlines get you down. Look at how the markets have rebounded. Provided by DARRELL J. DRUMMOND The stock market has been amazingly resilient. The sky is not falling, despite what the pessimists would have you believe. Yes, the Dow Jones Industrial Average entered bear market territory ...

Quantity Controls: Quotas

... to buy a given quantity ($5.00) • Supply Price: the price at which producers will supply a given quantity ($5.00) ...

... to buy a given quantity ($5.00) • Supply Price: the price at which producers will supply a given quantity ($5.00) ...

Making ads responsible: How we enforce the advertising rules

... be appropriate to apply. Ultimately, however, it is down to you as the marketer to become compliant or the above-mentioned sanctions could be imposed. Marketers are encouraged to engage with our Compliance team. You can also seek free, confidential advice on how to stick to the rules at www.cap.org. ...

... be appropriate to apply. Ultimately, however, it is down to you as the marketer to become compliant or the above-mentioned sanctions could be imposed. Marketers are encouraged to engage with our Compliance team. You can also seek free, confidential advice on how to stick to the rules at www.cap.org. ...

No news is bad news - CIS @ UPenn

... starts with the numerical side, looking at trends, phases and turning points, and then pushes back into the text to identify signals that we could use to predict them.” Middleton at Citi is in no doubt about the challenge. “Because of the richness of the semantic content of news feeds,” he says, “ou ...

... starts with the numerical side, looking at trends, phases and turning points, and then pushes back into the text to identify signals that we could use to predict them.” Middleton at Citi is in no doubt about the challenge. “Because of the richness of the semantic content of news feeds,” he says, “ou ...

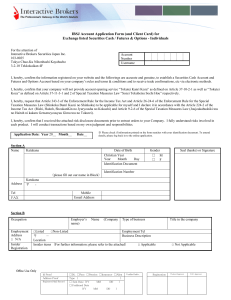

IBSJ Account Application Form (and Client Card) for Exchange listed

... Interactive Brokers (“IB”) can maintain its low commission structure because we have built automated trade processes to minimize human intervention and discretion. In this respect, we have established some simple terms which govern trading in all IB accounts. These rules recognize that from time to ...

... Interactive Brokers (“IB”) can maintain its low commission structure because we have built automated trade processes to minimize human intervention and discretion. In this respect, we have established some simple terms which govern trading in all IB accounts. These rules recognize that from time to ...

Macro Trading and Investment Strategies. Macroeconomic Arbitrage in Brochure

... Macro Trading and Investment Strategies is the first thorough examination of one of the most proficient and enigmatic trading strategies in use today - global macro. More importantly, it introduces an innovative strategy to this popular hedge fund investment style - global macroeconomic arbitrage. I ...

... Macro Trading and Investment Strategies is the first thorough examination of one of the most proficient and enigmatic trading strategies in use today - global macro. More importantly, it introduces an innovative strategy to this popular hedge fund investment style - global macroeconomic arbitrage. I ...

short selling regulations

... with a public float capitalisation of not less than HK$20 billion for a period of 20 consecutive trading days commencing from the second day of their listing on the Exchange and an aggregate turnover of not less than HK$500 million during such period; and ...

... with a public float capitalisation of not less than HK$20 billion for a period of 20 consecutive trading days commencing from the second day of their listing on the Exchange and an aggregate turnover of not less than HK$500 million during such period; and ...

Fin 331, Exam 2, Spring 2009

... *The expected returns are based on the market prices of the stocks and your assessment of each firm’s future potential. They could also be called “predicted returns.” The correlation between returns on X and Y is 0.4. A portfolio has 40 percent invested in X and 60 percent invested in Y. a. Calculat ...

... *The expected returns are based on the market prices of the stocks and your assessment of each firm’s future potential. They could also be called “predicted returns.” The correlation between returns on X and Y is 0.4. A portfolio has 40 percent invested in X and 60 percent invested in Y. a. Calculat ...

Derivatives Market

... Now, for the sake of understanding, suppose you were to buy a ‘futures’ of stock A for Rs 120. In this context, it is important for you to understand that in a derivative product what you actually do is take a view on future price movements and at the end of the settlement period, you reconcile ...

... Now, for the sake of understanding, suppose you were to buy a ‘futures’ of stock A for Rs 120. In this context, it is important for you to understand that in a derivative product what you actually do is take a view on future price movements and at the end of the settlement period, you reconcile ...

U.S. Equity Market Structure

... unintentionally increase costs for investors, both retail and institutional alike.10 The current minimum tick size of one cent does not mean that all stocks trade at the minimum possible spread. Many stocks trade at spreads wider than a penny due to the higher volatility and lower liquidity in those ...

... unintentionally increase costs for investors, both retail and institutional alike.10 The current minimum tick size of one cent does not mean that all stocks trade at the minimum possible spread. Many stocks trade at spreads wider than a penny due to the higher volatility and lower liquidity in those ...

Allan Thomson, CEO, Dreadnought Capital, South Africa

... In August of 2001 the JSE Securities Exchange purchased the South African Futures Exchange (SAFEX). Allan joined the JSE primarily to manage the smooth integration of the equities and Equity Derivatives market. He has a passion for new and exciting products, and has been instrumental in developing t ...

... In August of 2001 the JSE Securities Exchange purchased the South African Futures Exchange (SAFEX). Allan joined the JSE primarily to manage the smooth integration of the equities and Equity Derivatives market. He has a passion for new and exciting products, and has been instrumental in developing t ...

Contemporary-Financial-Management-11th-Edition

... 7. The New York Stock Exchange is a physical location where buyers and sellers of securities meet to exchange assets. The New York Stock Exchange works through a specialist system and complex computer linkages that match buyers and sellers and maintain an orderly market. In contrast, the over-the-co ...

... 7. The New York Stock Exchange is a physical location where buyers and sellers of securities meet to exchange assets. The New York Stock Exchange works through a specialist system and complex computer linkages that match buyers and sellers and maintain an orderly market. In contrast, the over-the-co ...

Media Prima Berhad

... distribution only under such circumstances as may be permitted by applicable law. Readers should be fully aware that this report is for information purposes only. The opinions contained in this report are based on information obtained or derived from sources that we believe are reliable. MIDF AMANAH ...

... distribution only under such circumstances as may be permitted by applicable law. Readers should be fully aware that this report is for information purposes only. The opinions contained in this report are based on information obtained or derived from sources that we believe are reliable. MIDF AMANAH ...

Would a free-market be a perfect market?

... gas, you can often see a difference of 5% between two stations in the same vicinity. If perfect market does not exist even in an extremely liquid commodity, how can it exist in other things? Indeed, I recently picked up a currency bill from a sidewalk in Denver while attending the gold show here. I ...

... gas, you can often see a difference of 5% between two stations in the same vicinity. If perfect market does not exist even in an extremely liquid commodity, how can it exist in other things? Indeed, I recently picked up a currency bill from a sidewalk in Denver while attending the gold show here. I ...