Factsheet Eurex Exchange

... but only for the use ofgeneral information. Eurex offers services directly to members of the Eurex market. Those wishing to trade in any products available on the Eurex market or to offer and sell any such products to others should consider both their legal and regulatory position in the relevant ju ...

... but only for the use ofgeneral information. Eurex offers services directly to members of the Eurex market. Those wishing to trade in any products available on the Eurex market or to offer and sell any such products to others should consider both their legal and regulatory position in the relevant ju ...

More Consumer and Producer Surplus Practice

... More Consumer and Producer Surplus Practice Consumer Surplus I’m selling bags of candy in class. Below is the demand schedule for candy (assume I asked everyone for this information): Price ...

... More Consumer and Producer Surplus Practice Consumer Surplus I’m selling bags of candy in class. Below is the demand schedule for candy (assume I asked everyone for this information): Price ...

記錄 編號 6812 狀態 NC094FJU00457001 助教 查核 索書 號 學校

... Through a certain domestic reputed securities company, 53680 individual investors account transaction details were supplied for this research. Based on the research model of Barber and Odean (2001) as the basis, the behavioral framework of procurement decision by dispersed investors is established. ...

... Through a certain domestic reputed securities company, 53680 individual investors account transaction details were supplied for this research. Based on the research model of Barber and Odean (2001) as the basis, the behavioral framework of procurement decision by dispersed investors is established. ...

Chapter03 - U of L Class Index

... firms formed to spread the risk associated with the purchase and distribution of a new issuance of securities Lead or Managing Underwriter: The member of an underwriting syndicate who actually manages the distribution and sale of a new security offering Selling Group: A network of brokerage firm ...

... firms formed to spread the risk associated with the purchase and distribution of a new issuance of securities Lead or Managing Underwriter: The member of an underwriting syndicate who actually manages the distribution and sale of a new security offering Selling Group: A network of brokerage firm ...

Monte-Carlo simulation with Black-Scholes

... fixed. Formally, they are partial derivatives of the option price with respect to the independent variables. The Greeks give the investor a better idea of how a stock has been performing. They are very helpful in deciding on options strategies choosing. These statistics forecast the trends of stock ...

... fixed. Formally, they are partial derivatives of the option price with respect to the independent variables. The Greeks give the investor a better idea of how a stock has been performing. They are very helpful in deciding on options strategies choosing. These statistics forecast the trends of stock ...

Chapter 2

... • Threat of new entrants and more competition • Industry indicators Copyright © 2009 Pearson Education Canada ...

... • Threat of new entrants and more competition • Industry indicators Copyright © 2009 Pearson Education Canada ...

Stock Trading Using Analytics - American Institute of Science

... eliminating the human emotional impacts and errors which results in increased profit for the trader and market liquidity. Another major advantage is that can trade continuously on all opened markets in the same time, applying the same algorithms over and over again, without any pause. Technical anal ...

... eliminating the human emotional impacts and errors which results in increased profit for the trader and market liquidity. Another major advantage is that can trade continuously on all opened markets in the same time, applying the same algorithms over and over again, without any pause. Technical anal ...

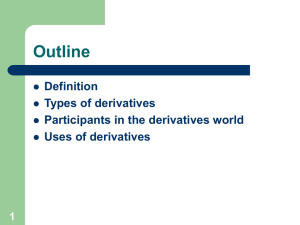

ch01 - Class Index

... “What many critics of equity derivatives fail to realize is that the markets for these instruments have become so large not because of slick sales campaigns, but because they are providing economic value to their users” ...

... “What many critics of equity derivatives fail to realize is that the markets for these instruments have become so large not because of slick sales campaigns, but because they are providing economic value to their users” ...

L ogo

... Calendar spread: to buy in or sell out futures contracts of the same commodity or in the same exchange but with different delivery months, and gain profit from the changing spread between the contracts. Holding cost strategy: the spread between contracts of the same commodity but different delivery ...

... Calendar spread: to buy in or sell out futures contracts of the same commodity or in the same exchange but with different delivery months, and gain profit from the changing spread between the contracts. Holding cost strategy: the spread between contracts of the same commodity but different delivery ...

Behavioral Finance

... Behavioral finance research focuses on how investors make decisions to buy and sell securities, and how they choose between alternatives. ...

... Behavioral finance research focuses on how investors make decisions to buy and sell securities, and how they choose between alternatives. ...

trading hours euronext amsterdam, brussels, lisbon and

... 24 December 2013 to 3 January 2014, inclusive, can be summarised as described in the table on page 2. Members are reminded of the importance of ensuring that all trades executed during the Christmas and New Year period are correctly and promptly processed, e.g. allocated and/or claimed. For further ...

... 24 December 2013 to 3 January 2014, inclusive, can be summarised as described in the table on page 2. Members are reminded of the importance of ensuring that all trades executed during the Christmas and New Year period are correctly and promptly processed, e.g. allocated and/or claimed. For further ...

nymex 1090 - CME Group

... The provisions of these rules shall apply to all contracts bought or sold on the Exchange for cash settlement based on the Floating Price. ...

... The provisions of these rules shall apply to all contracts bought or sold on the Exchange for cash settlement based on the Floating Price. ...

Snímek 1

... • If spot-futures parity is not observed, then arbitrage is possible • If the futures price is too high, short the futures and acquire the stock by borrowing the money at the riskfree rate • If the futures price is too low, go long futures, short the stock and invest the proceeds at the riskfree rat ...

... • If spot-futures parity is not observed, then arbitrage is possible • If the futures price is too high, short the futures and acquire the stock by borrowing the money at the riskfree rate • If the futures price is too low, go long futures, short the stock and invest the proceeds at the riskfree rat ...

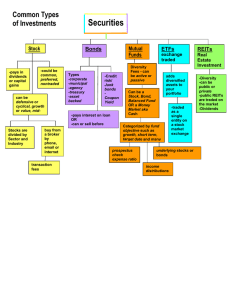

Securities

... Types of stock include Market Capitalization (indicates the size of a company, small-cap is less than one billion, mid-cap is one to 5 billion, large-cap-over is over 5 billion), Defensive (stocks with a stable demand such as groceries, health care or electricity), Cyclical (less stable, often fluct ...

... Types of stock include Market Capitalization (indicates the size of a company, small-cap is less than one billion, mid-cap is one to 5 billion, large-cap-over is over 5 billion), Defensive (stocks with a stable demand such as groceries, health care or electricity), Cyclical (less stable, often fluct ...

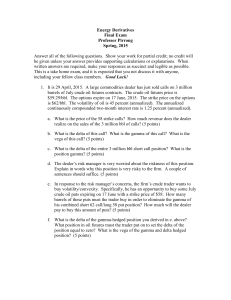

Risk Management

... barrels of July crude oil futures contracts. The crude oil futures price is $59.29/bbl. The options expire on 17 June, 2015. The strike price on the options is $62/bbl. The volatility of oil is 45 percent (annualized). The annualized continuously compounded two-month interest rate is 1.25 percent (a ...

... barrels of July crude oil futures contracts. The crude oil futures price is $59.29/bbl. The options expire on 17 June, 2015. The strike price on the options is $62/bbl. The volatility of oil is 45 percent (annualized). The annualized continuously compounded two-month interest rate is 1.25 percent (a ...

V - My LIUC

... portfolio is equally weighted, i.e all the positions have the same size, even though they may have opposite sign due to the long/short strategy. All stocks are then in your portfolio with either with a positive or a negative weight. a) Derive the expected profit and the standard deviation of your po ...

... portfolio is equally weighted, i.e all the positions have the same size, even though they may have opposite sign due to the long/short strategy. All stocks are then in your portfolio with either with a positive or a negative weight. a) Derive the expected profit and the standard deviation of your po ...

How did the stock market work?

... President Herbert Hoover in 1928 said ……. The poor man is vanishing from among us. With hard work and good fortune anyone can make money – look at what’s happening in the stock market ...

... President Herbert Hoover in 1928 said ……. The poor man is vanishing from among us. With hard work and good fortune anyone can make money – look at what’s happening in the stock market ...

strong trading and a successful transition

... 2.7 percent (H1 2015: 3.1 percent). It is important to note that H1 2015 was impacted by an exceptional volatility and a deep contango price structure which created significant trading opportunities in crude and product markets leading to record profit figures. In comparison the H1 2016 gross profit ...

... 2.7 percent (H1 2015: 3.1 percent). It is important to note that H1 2015 was impacted by an exceptional volatility and a deep contango price structure which created significant trading opportunities in crude and product markets leading to record profit figures. In comparison the H1 2016 gross profit ...

Quiz 5

... cost MC 100 . Find the long-run perfectly competitive industry price and quantity. (1.5 points) ...

... cost MC 100 . Find the long-run perfectly competitive industry price and quantity. (1.5 points) ...

$doc.title

... With residential real estate, the commission that you have to pay a real estate broker or salesperson can be 5-6% of the value of the asset. With commercial real estate, it may be smaller for larger transactions. ...

... With residential real estate, the commission that you have to pay a real estate broker or salesperson can be 5-6% of the value of the asset. With commercial real estate, it may be smaller for larger transactions. ...

Canadian Securities Regulators to Lower Trading Fee Cap for Non

... The amendments cap active trading fees for non-inter-listed securities at $0.0017 per security traded for an equity or per unit traded for an exchange-traded fund, if the execution price of the security or unit traded is greater than or equal to $1.00. Active trading fees for securities that trade o ...

... The amendments cap active trading fees for non-inter-listed securities at $0.0017 per security traded for an equity or per unit traded for an exchange-traded fund, if the execution price of the security or unit traded is greater than or equal to $1.00. Active trading fees for securities that trade o ...

Controlling Institutional Trading Costs

... rading costs are the bane of institutions. Despite tireless efforts to reduce them, institutions face inefficient market structures manned by inefficient intermediaries that conspire to keep costs high. This is the story line one would infer from the academic literature on institutional trading cost ...

... rading costs are the bane of institutions. Despite tireless efforts to reduce them, institutions face inefficient market structures manned by inefficient intermediaries that conspire to keep costs high. This is the story line one would infer from the academic literature on institutional trading cost ...

Netainment valuations 090103

... and related companies. Some On-Line Casino’s were also listed in these exchanges. The stock market indexes also reflect the market’s assessment of future economic prospects of its participants, and the economy in general. The NASDAQ and AIM indexes reflected a somewhat cautious and relatively negati ...

... and related companies. Some On-Line Casino’s were also listed in these exchanges. The stock market indexes also reflect the market’s assessment of future economic prospects of its participants, and the economy in general. The NASDAQ and AIM indexes reflected a somewhat cautious and relatively negati ...

Stock Market Game Workshop

... 6. Bears, Bulls, and Pigs are found in the stock market. 7. Stock prices are set by the Securities and Exchange Commission, a regulatory agency of the U.S. government. 8. Stock markets are open on business days around the clock, around the world. ...

... 6. Bears, Bulls, and Pigs are found in the stock market. 7. Stock prices are set by the Securities and Exchange Commission, a regulatory agency of the U.S. government. 8. Stock markets are open on business days around the clock, around the world. ...