1 January 2016 Commentary Most major US stock market

... For the fourth quarter of 2015, D.F. Dent portfolios generally picked up after a weak third quarter. Your portfolio’s 4Q15 performance was hurt by stock-specific weakness in the Financials and Consumer Discretionary sectors, offset by strong stock selection within the Information Technology and Indu ...

... For the fourth quarter of 2015, D.F. Dent portfolios generally picked up after a weak third quarter. Your portfolio’s 4Q15 performance was hurt by stock-specific weakness in the Financials and Consumer Discretionary sectors, offset by strong stock selection within the Information Technology and Indu ...

CBOE SYSTEMS ACRONYM DICTIONARY

... maintain all types of orders from a Booth and Crowd in compliance with COATS systemization requirements. FBW also provides derived order functionality in support of order handling and trading in Hybrid classes. This system is currently provided by a vendor. FIX – Financial Information EXchange: A st ...

... maintain all types of orders from a Booth and Crowd in compliance with COATS systemization requirements. FBW also provides derived order functionality in support of order handling and trading in Hybrid classes. This system is currently provided by a vendor. FIX – Financial Information EXchange: A st ...

Education Memo - The Rainier Group

... Anecdotally, 90% of the cranes operating in the world right now are operating in China… and we’ve seen the largest migration of citizens from rural to urban areas in the history of the world there. These phenomena and others have produced a GDP growth rate in that country greater than 10% over each ...

... Anecdotally, 90% of the cranes operating in the world right now are operating in China… and we’ve seen the largest migration of citizens from rural to urban areas in the history of the world there. These phenomena and others have produced a GDP growth rate in that country greater than 10% over each ...

,-

... In this way "to arrive" contracts were created as the first form of futures, assuring farmers of the future purchase or delivery of their crops.4 ...

... In this way "to arrive" contracts were created as the first form of futures, assuring farmers of the future purchase or delivery of their crops.4 ...

DOC - Europa.eu

... Article 102 of the Treaty on the Functioning of the European Union (TFEU) prohibits the abuse of a dominant market position which may affect trade between Member States. The implementation of this provision is defined in the Antitrust Regulation (Council Regulation (EC) No 1/2003), which can be appl ...

... Article 102 of the Treaty on the Functioning of the European Union (TFEU) prohibits the abuse of a dominant market position which may affect trade between Member States. The implementation of this provision is defined in the Antitrust Regulation (Council Regulation (EC) No 1/2003), which can be appl ...

Trade Scheduling in Equity Markets: Theory and Practice

... our trades which lead to temporary price movement from equilibrium. Transient impact induced price will reverse after our trade and decay to 0 at the end. Permanent impact: Impact due to changes in the equilibrium price caused by our trading, which accumulates and remains for the life of the trade ...

... our trades which lead to temporary price movement from equilibrium. Transient impact induced price will reverse after our trade and decay to 0 at the end. Permanent impact: Impact due to changes in the equilibrium price caused by our trading, which accumulates and remains for the life of the trade ...

Tom Lawless

... Market Structure & Regulatory environment Recognise the contradiction in that the objectives of the market regulators may not always be the same as those of the participants ...

... Market Structure & Regulatory environment Recognise the contradiction in that the objectives of the market regulators may not always be the same as those of the participants ...

questions and answers on continuous all

... SGX-ST. Similarly, trading decisions carried out by investors or traders could also move prices. 7. Will the market be less liquid during 1230 to 1400 hours than at other times of the trading day? Market liquidity depends on various factors including the volume of orders coming into the market and n ...

... SGX-ST. Similarly, trading decisions carried out by investors or traders could also move prices. 7. Will the market be less liquid during 1230 to 1400 hours than at other times of the trading day? Market liquidity depends on various factors including the volume of orders coming into the market and n ...

Presentation of paper (in PowerPoint)

... Trillion US$, notional principal (as percent of U.S. GDP) ...

... Trillion US$, notional principal (as percent of U.S. GDP) ...

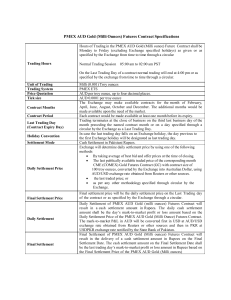

PMEX AUD Gold Futures Contract

... Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will result in a cash settlement amount in Rupees. The daily cash settlement amount ...

... Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will result in a cash settlement amount in Rupees. The daily cash settlement amount ...

memorandum - Africa Newsroom

... In accordance with the legal provisions governing the CEMAC Financial Market, the Central African Financial Market Supervisory Commission (COSUMAF), in its capacity as the authority responsible for supervising, regulating and monitoring the market, has three primary tasks. It ensures: ...

... In accordance with the legal provisions governing the CEMAC Financial Market, the Central African Financial Market Supervisory Commission (COSUMAF), in its capacity as the authority responsible for supervising, regulating and monitoring the market, has three primary tasks. It ensures: ...

IB Comment Letter to SEC Opposing New Margin Requirements for

... fewer of all trades during that period). The Exchange has not specified why it considers as few as four day trades in five days (less than one “day trade” per day) to pose a risk to the customer, the member or the Exchange. Even customers who are not pursuing a day trading strategy may decide to ope ...

... fewer of all trades during that period). The Exchange has not specified why it considers as few as four day trades in five days (less than one “day trade” per day) to pose a risk to the customer, the member or the Exchange. Even customers who are not pursuing a day trading strategy may decide to ope ...

3.1. Trading Volume Activity and Price Earning Ratio

... Capitalization of common stock / Earning available to the owner of capital stock ?) if other fixed so Price Earning Ratio expectation relative will higher compare to current repot profit. The Price Earning Ratio (P/E) is the ratio of stock market price with profit per-share, part of its show how muc ...

... Capitalization of common stock / Earning available to the owner of capital stock ?) if other fixed so Price Earning Ratio expectation relative will higher compare to current repot profit. The Price Earning Ratio (P/E) is the ratio of stock market price with profit per-share, part of its show how muc ...

Goldman Sachs Funds: Questions and Answers on Market Timing

... disruptive trading practices, including market-timing activity in the Goldman Sachs Funds, which we have had in place for a number of years. In light of these measures, we have been able to detect, warn, and in certain instances, remove from the Goldman Sachs Funds, shareholders who we believe engag ...

... disruptive trading practices, including market-timing activity in the Goldman Sachs Funds, which we have had in place for a number of years. In light of these measures, we have been able to detect, warn, and in certain instances, remove from the Goldman Sachs Funds, shareholders who we believe engag ...

hw1-adam

... digital age, the execution of the trades is almost always done electronically (except for ...

... digital age, the execution of the trades is almost always done electronically (except for ...

1 The temptation to sell is always when the market drops the furthest.

... Beca use of t he possibility of human or m echanical error by DST Systems, In c. or its sources, n either DST Sy stems, In c. nor its sources g u arantees the accuracy, adequacy, com pleteness or availability of any information and is not responsible for any errors or om issions or for t h e results ...

... Beca use of t he possibility of human or m echanical error by DST Systems, In c. or its sources, n either DST Sy stems, In c. nor its sources g u arantees the accuracy, adequacy, com pleteness or availability of any information and is not responsible for any errors or om issions or for t h e results ...

Investments, Mon. Feb. 4, `08

... Well, that is what we going to fix. The more dull version is that we study portfolio choice, asset prices and equilibrium in statepreference models. One period, finite #outcomes makes the math (although not necessarily the algebra) simple. Our approach: Experimental; or ”simulation” as Sharpe says.( ...

... Well, that is what we going to fix. The more dull version is that we study portfolio choice, asset prices and equilibrium in statepreference models. One period, finite #outcomes makes the math (although not necessarily the algebra) simple. Our approach: Experimental; or ”simulation” as Sharpe says.( ...

• Always deal with the market intermediaries registered with SEBI

... Before placing an order with the market intermediaries, please check about the credentials of the companies, its management, fundamentals and recent announcements made by them and various other disclosures made under various regulations. The sources of information are the websites of Exchanges and c ...

... Before placing an order with the market intermediaries, please check about the credentials of the companies, its management, fundamentals and recent announcements made by them and various other disclosures made under various regulations. The sources of information are the websites of Exchanges and c ...

insider trading policy

... Such black out periods shall continue until two (2) trading days after the time such information has been released to the public. At the beginning of each year, the CEO, or the CFO, or the Director of Communications will inform all employees, by way of e-mail, of the expected starting date and end ...

... Such black out periods shall continue until two (2) trading days after the time such information has been released to the public. At the beginning of each year, the CEO, or the CFO, or the Director of Communications will inform all employees, by way of e-mail, of the expected starting date and end ...

Oligopoly

... • Cartel: firms make formal agreements to fix price and/or output (eg. OPEC) – illegal in the UK • Secret collusion: firms agree secretly to fix price and/or output to gain mutual benefit – illegal in the UK • Tacit collusion: firms act as if they have made an agreement but have not discusses this f ...

... • Cartel: firms make formal agreements to fix price and/or output (eg. OPEC) – illegal in the UK • Secret collusion: firms agree secretly to fix price and/or output to gain mutual benefit – illegal in the UK • Tacit collusion: firms act as if they have made an agreement but have not discusses this f ...

pdf

... 1. You suspect that Delta airlines will merge with Northwest Airlines in the coming month. Delta stock is trading at $0.85. We assume that the forward price equals the stock price. There is a 60% chance that the merger will occur, in which case the stock will be worth $1.20. There is a 40% chance th ...

... 1. You suspect that Delta airlines will merge with Northwest Airlines in the coming month. Delta stock is trading at $0.85. We assume that the forward price equals the stock price. There is a 60% chance that the merger will occur, in which case the stock will be worth $1.20. There is a 40% chance th ...

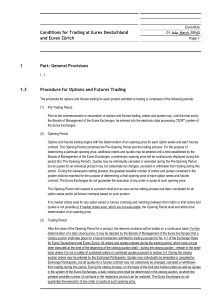

Ethan Frome - Eurex Exchange

... period (the ”Pre-Opening Period”). Quotes may be individually canceled or amended during the Pre-Opening Period, but all quotes for an individual product may not collectively be changed, canceled or withdrawn from trading during this period. During the subsequent netting process, the greatest possib ...

... period (the ”Pre-Opening Period”). Quotes may be individually canceled or amended during the Pre-Opening Period, but all quotes for an individual product may not collectively be changed, canceled or withdrawn from trading during this period. During the subsequent netting process, the greatest possib ...

Chapter 2.3

... company issuing the stock buys some of its own shares back. These shares then become __________________________ stock and are no longer considered to be outstanding. 3. When a company decides to offer securities they can choose between a private placement and a public offering. With a ______________ ...

... company issuing the stock buys some of its own shares back. These shares then become __________________________ stock and are no longer considered to be outstanding. 3. When a company decides to offer securities they can choose between a private placement and a public offering. With a ______________ ...

CBML Expert Group 4th Meeting Summary Minutes

... It was stressed that the report should discuss how liquid a naturally illiquid market, such as that of corporate bonds, could reasonably be, and how pricing could be made more efficient. The way placement actually happens and what infrastructures are used should be investigated. ...

... It was stressed that the report should discuss how liquid a naturally illiquid market, such as that of corporate bonds, could reasonably be, and how pricing could be made more efficient. The way placement actually happens and what infrastructures are used should be investigated. ...

Downlaod File

... line). During May to September, Sears’s stocks are either a little below or above the market index. The 100-day moving average is indicated by the light blue line, Sear’s stocks are trading above the 100-day moving average during the periods March to April and October to November, it means that Sear ...

... line). During May to September, Sears’s stocks are either a little below or above the market index. The 100-day moving average is indicated by the light blue line, Sear’s stocks are trading above the 100-day moving average during the periods March to April and October to November, it means that Sear ...