How Wave-Wavelet Trading Wins and" Beats" the Market

... often be displayed in the same style of the SPY data set. For example, January 29th, 1993 is written as 1/29/93. The tables posted on the website are integral parts of the paper but they are too long to be included here. Each table will be explained as we go along. Interactive Brokers (IB) is used a ...

... often be displayed in the same style of the SPY data set. For example, January 29th, 1993 is written as 1/29/93. The tables posted on the website are integral parts of the paper but they are too long to be included here. Each table will be explained as we go along. Interactive Brokers (IB) is used a ...

Weekly Market Commentary - Quist Wealth Management

... Volume has picked up during the recent downturn. No, we are not talking about trading volumes; we are talking about the volume from your TVs with talking heads warning about an impending stock market downturn. If you turn off the TV and focus on what the market is telling you, rather than the talkin ...

... Volume has picked up during the recent downturn. No, we are not talking about trading volumes; we are talking about the volume from your TVs with talking heads warning about an impending stock market downturn. If you turn off the TV and focus on what the market is telling you, rather than the talkin ...

NYSE National, Inc. Schedule of Fees and Rebates As Of

... MDR credit (in such percent as is specified above) of the market data revenue attributable to such ETP Holder’s executions and displayed quotes in securities priced at $1.00 or greater. b) Adjustments. To the extent market data revenue from Tape “A”, "B" or “C” securities transactions is subject to ...

... MDR credit (in such percent as is specified above) of the market data revenue attributable to such ETP Holder’s executions and displayed quotes in securities priced at $1.00 or greater. b) Adjustments. To the extent market data revenue from Tape “A”, "B" or “C” securities transactions is subject to ...

Trade Alert - (SPY) - Mad Hedge Fund Trader

... Energy-sell oil rallies with (USO) put spreads *IEA report says US energy independence by 2030, US out produces Saudi Arabia by 2020 *Go short on every way rumor, *Futures structure says that prices are headed lower ...

... Energy-sell oil rallies with (USO) put spreads *IEA report says US energy independence by 2030, US out produces Saudi Arabia by 2020 *Go short on every way rumor, *Futures structure says that prices are headed lower ...

Financial markets in popular culture

... sector bodies. In the UK, the total borrowing requirement is often referred to as the Public sector net cash requirement (PSNCR). Governments borrow by issuing bonds. In the UK, the government also borrows from individuals by offering bank accounts and Premium Bonds. Government debt seems to be perm ...

... sector bodies. In the UK, the total borrowing requirement is often referred to as the Public sector net cash requirement (PSNCR). Governments borrow by issuing bonds. In the UK, the government also borrows from individuals by offering bank accounts and Premium Bonds. Government debt seems to be perm ...

Notice of a bondholder intention to sell a certain number of bonds to

... name of the bondholder) to Public Joint –Stock Company "Southern Telecommunications Company", according to terms and conditions of the Bond Prospectus and the Decision on the Bond Issue. Holder’s full name: _______________________________________________ Holder’s TIN. Quantity of bonds offered for s ...

... name of the bondholder) to Public Joint –Stock Company "Southern Telecommunications Company", according to terms and conditions of the Bond Prospectus and the Decision on the Bond Issue. Holder’s full name: _______________________________________________ Holder’s TIN. Quantity of bonds offered for s ...

Relationship Between Trading Volume And

... investors are classified as either "optimists" or "pessimists". Again, short positions are assumed to be more costly than long positions. In such a market, investors with short positions would be less responsive to price changes. Jennings, Starks, and Fellingham (1981) show that (generally) when the ...

... investors are classified as either "optimists" or "pessimists". Again, short positions are assumed to be more costly than long positions. In such a market, investors with short positions would be less responsive to price changes. Jennings, Starks, and Fellingham (1981) show that (generally) when the ...

C09 Personal Financial Management

... • Smartone used to adopt a high dividend policy by paying 100% of its earnings to shareholders in the form of cash dividends • On 12 Sept 2013, the management announced to cut its dividend payout ratio from 100% to 60% • Its share price dropped by about 13% on 12 Sept ...

... • Smartone used to adopt a high dividend policy by paying 100% of its earnings to shareholders in the form of cash dividends • On 12 Sept 2013, the management announced to cut its dividend payout ratio from 100% to 60% • Its share price dropped by about 13% on 12 Sept ...

Securities Trading Policy

... This Policy has important implications for all Staff. If you do not understand the implications of this Policy or how it applies to you, you should raise the matter with the Managing Director or the Company Secretary before trading in any securities which may be affected by this Policy or the law. ...

... This Policy has important implications for all Staff. If you do not understand the implications of this Policy or how it applies to you, you should raise the matter with the Managing Director or the Company Secretary before trading in any securities which may be affected by this Policy or the law. ...

The Stock Market Game

... The minimum market capitalization for stocks in the Stock Market Game is $25 million. This rule supports the trading of highly liquid and stable stocks with low volatility. ...

... The minimum market capitalization for stocks in the Stock Market Game is $25 million. This rule supports the trading of highly liquid and stable stocks with low volatility. ...

Financial Markets in Electricity: Introduction to Derivative Instruments

... Position: A description of the amount of price risk a trader is taking. For example, a trader who has bought 1000 platinum futures on NYMEX, for delivery in two months time, but has not yet sold this on to another trader faces the risk that prices may decline during that period. . Position limit: A ...

... Position: A description of the amount of price risk a trader is taking. For example, a trader who has bought 1000 platinum futures on NYMEX, for delivery in two months time, but has not yet sold this on to another trader faces the risk that prices may decline during that period. . Position limit: A ...

The Hunger-Makers: How Deutsche Bank, Goldman

... capital investment, and due to the limited volume of physical goods involved they are not suitable for this purpose. Because investors use them for capital investments, their powerful presence on the market creates an apparent additional demand for commodities over longer periods of time, which ulti ...

... capital investment, and due to the limited volume of physical goods involved they are not suitable for this purpose. Because investors use them for capital investments, their powerful presence on the market creates an apparent additional demand for commodities over longer periods of time, which ulti ...

National Potato Committee - Irish Farmers` Association

... IFA Potato Section Report Achievements and Work Done 2011 has been an extremely difficult season for potato producers. While the planting season was good, the early growing season supply increased ahead of demand very quickly, once more placing undue pressure on farm gate price. Despite a 13% reduct ...

... IFA Potato Section Report Achievements and Work Done 2011 has been an extremely difficult season for potato producers. While the planting season was good, the early growing season supply increased ahead of demand very quickly, once more placing undue pressure on farm gate price. Despite a 13% reduct ...

Latency Arbitrage, Market Fragmentation, and Efficiency: A Two

... orders for approximately 150 stocks in the New York Stock Exchange. The repeated buying and selling of millions of shares caused dramatic price changes in these stocks, and as a result, all trades executed at 30% higher or lower than the opening price were later canceled [Popper 2012]. Another incid ...

... orders for approximately 150 stocks in the New York Stock Exchange. The repeated buying and selling of millions of shares caused dramatic price changes in these stocks, and as a result, all trades executed at 30% higher or lower than the opening price were later canceled [Popper 2012]. Another incid ...

semester v cm05bba05 – investment management

... d. None of the above 76. …………….. is an organized market for trading securities a. Stock exchange b. Primary market c. New issue market d. None of the above 77. Carry over the transactions /settlement of share purchase to the next day is called ………………. a. Badla b. Call c. Spot delivery d. Hand delive ...

... d. None of the above 76. …………….. is an organized market for trading securities a. Stock exchange b. Primary market c. New issue market d. None of the above 77. Carry over the transactions /settlement of share purchase to the next day is called ………………. a. Badla b. Call c. Spot delivery d. Hand delive ...

Stochastic Calculus, Week 9 Applications of risk

... where the right-hand side is the conditionally expected con- ...

... where the right-hand side is the conditionally expected con- ...

chapter 4: buying and selling equities

... It will not prevent a loss if it is discontinued when the value of an account is less than its cost The “success” of dollar-cost averaging depends on the investor making regular purchases irrespective of market conditions There is no guarantee that dollar-cost averaging will always be the most ...

... It will not prevent a loss if it is discontinued when the value of an account is less than its cost The “success” of dollar-cost averaging depends on the investor making regular purchases irrespective of market conditions There is no guarantee that dollar-cost averaging will always be the most ...

Derivatives and their feedback effects on the spot markets

... rivatives markets. Their choice of market usually depends on a number of factors. If transaction costs and financing restrictions exist, ...

... rivatives markets. Their choice of market usually depends on a number of factors. If transaction costs and financing restrictions exist, ...

Q3 2014 Presentation PDF

... This announcement may contain forward-looking statements, including ‘forward-looking statements’ within the meaning of the United States Private Securities Litigation Reform Act of 1995. Words such as ‘will’, ‘aim’, ‘expects’, ‘anticipates’, ‘intends’, ‘looks’, ‘believes’, ‘vision’, or the negative ...

... This announcement may contain forward-looking statements, including ‘forward-looking statements’ within the meaning of the United States Private Securities Litigation Reform Act of 1995. Words such as ‘will’, ‘aim’, ‘expects’, ‘anticipates’, ‘intends’, ‘looks’, ‘believes’, ‘vision’, or the negative ...

NYU_class7

... How much capital should I have on hand for a rainy day (VaR is an input) What extreme moves should I test for (that may not have already happened)? – Stress testing vs. “expected” moves ...

... How much capital should I have on hand for a rainy day (VaR is an input) What extreme moves should I test for (that may not have already happened)? – Stress testing vs. “expected” moves ...

Equity Trading by Institutional Investors: To Cross or Not

... Several trading cost components are low for traders in crossing networks compared with trading on regular exchanges. First, crossing commissions are substantially lower than commissions charged by brokers on exchanges. Second, there are no spread costs because the participants in the network are pro ...

... Several trading cost components are low for traders in crossing networks compared with trading on regular exchanges. First, crossing commissions are substantially lower than commissions charged by brokers on exchanges. Second, there are no spread costs because the participants in the network are pro ...

chapter two - Sigma Capital

... a) The nominal shares offered to the public shall not be less than 30% of the total company shares. b) The subscribers to the offered shares should not be less than l50 subscribers, even if they are non-Egyptians. In case the trading of company shares results in the reduction of the number of shareh ...

... a) The nominal shares offered to the public shall not be less than 30% of the total company shares. b) The subscribers to the offered shares should not be less than l50 subscribers, even if they are non-Egyptians. In case the trading of company shares results in the reduction of the number of shareh ...

Crashing Hopes: The Great Depression

... For five years prior to 1929, rising prices typified the stock market. During this period, American investors enjoyed an enormous "bull market." (The opposite, a market characterized by falling prices, is called a "bear market."). Americans invested in the stock market for six reasons during the 192 ...

... For five years prior to 1929, rising prices typified the stock market. During this period, American investors enjoyed an enormous "bull market." (The opposite, a market characterized by falling prices, is called a "bear market."). Americans invested in the stock market for six reasons during the 192 ...

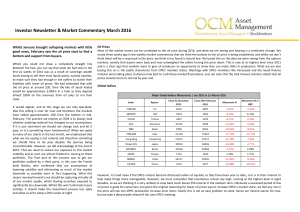

Market Commentary March 2016

... 2016 has been annus horribilis for Europe so far, be it regarding Brexit, the refugee/migration question and the breakdown of the Schengen agreement, or economic data; most news has been negative. European data out on Monday saw what we expected, namely that we are seeing deflation on the back of th ...

... 2016 has been annus horribilis for Europe so far, be it regarding Brexit, the refugee/migration question and the breakdown of the Schengen agreement, or economic data; most news has been negative. European data out on Monday saw what we expected, namely that we are seeing deflation on the back of th ...

Contemporary Securities Market in Cambodia

... • And subsequently, other Prakas as shown at www.secc.gov.kh ...

... • And subsequently, other Prakas as shown at www.secc.gov.kh ...