Armajaro presentation template - Globalserve International Network

... In both the primary and secondary markets, we support clients with a reliable and prompt service through a dedicated contact. In particular, our service extends across the entire life cycle of a product. In the primary market, our breadth of market knowledge and access can save investors time and mo ...

... In both the primary and secondary markets, we support clients with a reliable and prompt service through a dedicated contact. In particular, our service extends across the entire life cycle of a product. In the primary market, our breadth of market knowledge and access can save investors time and mo ...

Why the Mutual Fund Scandal Matters

... wondering what Tiemann Investment Advisors is, and how I work. I established Tiemann Investment Advisors (TIA) in June of 2002 as a vehicle to broaden and leverage my ability to offer investment expertise to high net worth investors. My aim is for TIA to become the most influential exemplar of ratio ...

... wondering what Tiemann Investment Advisors is, and how I work. I established Tiemann Investment Advisors (TIA) in June of 2002 as a vehicle to broaden and leverage my ability to offer investment expertise to high net worth investors. My aim is for TIA to become the most influential exemplar of ratio ...

Blockchange A look at the evolving nature of Canadian trading

... In summary, the continued trends of decreasing capital commitment and growing dependency on electronic trading have shifted the Canadian markets away from the nine-year-old Lego pit of yesteryear, to markets that are more heavily intermediated and reward tech savvy firms versed in the minutiae of ma ...

... In summary, the continued trends of decreasing capital commitment and growing dependency on electronic trading have shifted the Canadian markets away from the nine-year-old Lego pit of yesteryear, to markets that are more heavily intermediated and reward tech savvy firms versed in the minutiae of ma ...

B.A 5th Semester, Sub: Economics (M). Paper: 5.04 By : Surabi

... measure the performance of portfolios such as mutual funds .Alternatively, an index may also be considered as an instrument (after all it can be traded) which derives its value from other instruments or indices. The index maybe weighted to reflect the market capitalization of its components, or may ...

... measure the performance of portfolios such as mutual funds .Alternatively, an index may also be considered as an instrument (after all it can be traded) which derives its value from other instruments or indices. The index maybe weighted to reflect the market capitalization of its components, or may ...

PRINCIPLES OF INVESTMENT MAY 2012

... financial institutions and large corporations. These instruments are very liquid and considered extraordinarily safe. Because they are extremely conservative, money market securities offer significantly lower returns than most other securities. One of the main differences between the money market an ...

... financial institutions and large corporations. These instruments are very liquid and considered extraordinarily safe. Because they are extremely conservative, money market securities offer significantly lower returns than most other securities. One of the main differences between the money market an ...

ANSWER: True - We can offer most test bank and solution manual

... Full file at http://textbooktestbank.eu/Fundamentals-of-Financial-Management-Concise-8th-Edition-TestBank-Brigham 13. In a “Dutch auction” for new stock, individual investors place bids for shares directly. Each potential bidder indicates the price he or she is willing to pay and how many shares he ...

... Full file at http://textbooktestbank.eu/Fundamentals-of-Financial-Management-Concise-8th-Edition-TestBank-Brigham 13. In a “Dutch auction” for new stock, individual investors place bids for shares directly. Each potential bidder indicates the price he or she is willing to pay and how many shares he ...

ANSWER - We can offer most test bank and solution manual you need.

... Full file at http://testbankonline.eu/Test-bank-for-Fundamentals-of-Financial-Management,-ConciseEdition,-8th-Edition-by-Eugene-F.-Brigham 13. In a “Dutch auction” for new stock, individual investors place bids for shares directly. Each potential bidder indicates the price he or she is willing to p ...

... Full file at http://testbankonline.eu/Test-bank-for-Fundamentals-of-Financial-Management,-ConciseEdition,-8th-Edition-by-Eugene-F.-Brigham 13. In a “Dutch auction” for new stock, individual investors place bids for shares directly. Each potential bidder indicates the price he or she is willing to p ...

DISADVANTAGES of ISSUING BONDS LG4

... • Stock Exchange -- An organization whose members can buy and sell (exchange) securities on behalf of companies and individual investors. ...

... • Stock Exchange -- An organization whose members can buy and sell (exchange) securities on behalf of companies and individual investors. ...

Financing for Development: Capital markets as a source of finance

... the case of Korea, stock market recovery was very significant. However, since 1997, the volatility of the stock market has been high as Korean corporate environment undergoes a phase of consolidation and restructuring. 4. In addition, Table 2 shows that stock market trading activities declined in Ja ...

... the case of Korea, stock market recovery was very significant. However, since 1997, the volatility of the stock market has been high as Korean corporate environment undergoes a phase of consolidation and restructuring. 4. In addition, Table 2 shows that stock market trading activities declined in Ja ...

IKE`s Rationale for State Intervention in the Financial System

... solely composed of individuals trading with the view to the longer term, as long as fundamentals continue to trend in one direction, and revisions of forecasting strategies are moderate, stock prices will tend to move in one direction. ...

... solely composed of individuals trading with the view to the longer term, as long as fundamentals continue to trend in one direction, and revisions of forecasting strategies are moderate, stock prices will tend to move in one direction. ...

No #9

... mark. Each year the US party receives from\pays to the counterparty DM100,000($0.5-spot rate) ...

... mark. Each year the US party receives from\pays to the counterparty DM100,000($0.5-spot rate) ...

Introducing a Better Gauge of Market Volatility

... The SPYIX calculation incorporates a proprietary “price-dragging” technique to capture live options prices, reducing erratic intraday movement in the index that can result from using only midpoint values. Price dragging only updates the price of the option in the index when a trade occurs or the quo ...

... The SPYIX calculation incorporates a proprietary “price-dragging” technique to capture live options prices, reducing erratic intraday movement in the index that can result from using only midpoint values. Price dragging only updates the price of the option in the index when a trade occurs or the quo ...

Regulation 10(5)

... f. Rationale, if any, for the proposed transfer Relevant sub-clause of regulation 10(1)(a) under which the acquirer is exempted from making open offer ...

... f. Rationale, if any, for the proposed transfer Relevant sub-clause of regulation 10(1)(a) under which the acquirer is exempted from making open offer ...

The Stock Market Boom

... Not sure how to stem the panic, the decision was made to close the stock market on Friday, November 1 for few days. When it reopened on Monday, November 4 for limited hours, stocks dropped again. The slump continued until November 23, 1929, when prices seemed to stabilize. However, this was not the ...

... Not sure how to stem the panic, the decision was made to close the stock market on Friday, November 1 for few days. When it reopened on Monday, November 4 for limited hours, stocks dropped again. The slump continued until November 23, 1929, when prices seemed to stabilize. However, this was not the ...

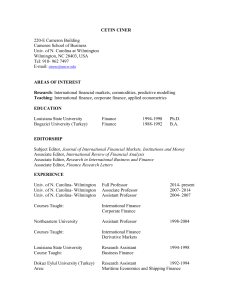

cetin ciner - University of North Carolina Wilmington

... Maritime Economics and Shipping Finance ...

... Maritime Economics and Shipping Finance ...

C. Mon. Sept. 30--STOCK MARKET GAME PACKET FALL 2013

... An exchange-traded fund (or ETF) is an investment vehicle traded on stock exchanges, much like stocks. An ETF holds assets such as stocks or bonds and trades at approximately the same price as the net asset value of its underlying assets over the course of the trading day. ETFs may be attractive as ...

... An exchange-traded fund (or ETF) is an investment vehicle traded on stock exchanges, much like stocks. An ETF holds assets such as stocks or bonds and trades at approximately the same price as the net asset value of its underlying assets over the course of the trading day. ETFs may be attractive as ...

File: Ch04, Chapter 4 Securities Markets Type: Multiple Choice 1

... Response: NYSE (and AMEX) uses a single specialist for each company, but NASDAQ uses several, maybe many “market makers” to buy and sell stocks from the general public. Section: The Secondary Markets. ...

... Response: NYSE (and AMEX) uses a single specialist for each company, but NASDAQ uses several, maybe many “market makers” to buy and sell stocks from the general public. Section: The Secondary Markets. ...

Profitability of Pairs Trading Strategy

... stocks whose prices move together over an indicated historical time period. If the pair prices deviate wide enough, the strategy calls for shorting the increasing-price security, while simultaneously buying the declining-price security. The idea behind the pair trade is to profit from convergence fo ...

... stocks whose prices move together over an indicated historical time period. If the pair prices deviate wide enough, the strategy calls for shorting the increasing-price security, while simultaneously buying the declining-price security. The idea behind the pair trade is to profit from convergence fo ...

Market Trading in India - Customer Perception

... Futures: A futures contract is just what it's called a contract. It is not equity in a stock or commodity. It is a contract to make or take delivery of a product in the future, at a price set in the present. In formalized trading of futures contracts on exchanges, agreements specify price, quantity ...

... Futures: A futures contract is just what it's called a contract. It is not equity in a stock or commodity. It is a contract to make or take delivery of a product in the future, at a price set in the present. In formalized trading of futures contracts on exchanges, agreements specify price, quantity ...

Fabozzi_CM4_Chapter13(equitymarkets)

... • A NYSE specialist is a market maker for each stock and is required to buy and sell those shares from other members and maintain an orderly market for that stock • Specialists maintain the limit order book which contains the prearranged quantities and prices which the specialist receives from broke ...

... • A NYSE specialist is a market maker for each stock and is required to buy and sell those shares from other members and maintain an orderly market for that stock • Specialists maintain the limit order book which contains the prearranged quantities and prices which the specialist receives from broke ...

File

... Common Stock – is a share of ownership in a corporation, and it gives shareholders voting rights. Preferred stock – gives shareholders a share of profit (paid before common stockholders) but no voting rights. Most people own common stock ...

... Common Stock – is a share of ownership in a corporation, and it gives shareholders voting rights. Preferred stock – gives shareholders a share of profit (paid before common stockholders) but no voting rights. Most people own common stock ...

Stock market

... The New York Stock Exchange is a physical exchange, also referred to as a listed exchange — only stocks listed with the exchange may be traded. Orders enter by way of exchange members and flow down to a floor broker, who goes to the floor trading post specialist for that stock to trade the order. T ...

... The New York Stock Exchange is a physical exchange, also referred to as a listed exchange — only stocks listed with the exchange may be traded. Orders enter by way of exchange members and flow down to a floor broker, who goes to the floor trading post specialist for that stock to trade the order. T ...

Lewisham Trading Standards consumer rights toolkit

... repair / replace within a reasonable period of time ...

... repair / replace within a reasonable period of time ...