SEBI

... A market Index is a convenient and effective product because of the following reasons: - It acts as a barometer for market behavior; - It is used to benchmark portfolio performance; - It is used in derivative instruments like index futures and Index options ...

... A market Index is a convenient and effective product because of the following reasons: - It acts as a barometer for market behavior; - It is used to benchmark portfolio performance; - It is used in derivative instruments like index futures and Index options ...

A-View-from-the-Desk

... These securities, while never a favorite of ours, understandably became vehicles to bolster portfolio yields. Now that extension risk has manifested itself in degraded market values, portfolio managers have been looking to reduce exposure to longer duration callable agencies to mitigate extension ri ...

... These securities, while never a favorite of ours, understandably became vehicles to bolster portfolio yields. Now that extension risk has manifested itself in degraded market values, portfolio managers have been looking to reduce exposure to longer duration callable agencies to mitigate extension ri ...

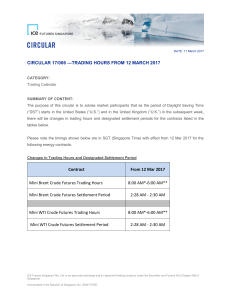

Stocks - Northwest ISD Moodle

... Price Earning (PE) Ratio – price of one share of stock divided by the corporation’s earnings per share of stock outstanding over the last 12 months. ...

... Price Earning (PE) Ratio – price of one share of stock divided by the corporation’s earnings per share of stock outstanding over the last 12 months. ...

Some Lessons from Capital Market History

... • Implies that technical analysis will not lead to abnormal returns • Empirical evidence indicates that markets are generally weak form efficient ...

... • Implies that technical analysis will not lead to abnormal returns • Empirical evidence indicates that markets are generally weak form efficient ...

Law for Business

... transactions Public Equity slices are sold in regulated stock markets Public Corporations must meet various government regulations on shareholder rights and dissemination of information about company activity ...

... transactions Public Equity slices are sold in regulated stock markets Public Corporations must meet various government regulations on shareholder rights and dissemination of information about company activity ...

a-team-dec-2016

... Mkt data for TCA, market surveillance & algo back testing must NOT impact T2T, order ack times, or trade execution times. Offload any analytics and above functions separately & asynchronously Proper software can replay market data with multiple algo’s at original rates, latencies, or alter (ex: spee ...

... Mkt data for TCA, market surveillance & algo back testing must NOT impact T2T, order ack times, or trade execution times. Offload any analytics and above functions separately & asynchronously Proper software can replay market data with multiple algo’s at original rates, latencies, or alter (ex: spee ...

Law for Business

... Pool of assets managed by an investment advisor Open end funds can be bought or sold at the close of business each day based on NAV (Net Asset Value) Closed end funds can be bought or sold during the trading day like a stock or ETF and can trade at premiums or discounts to NAV Common investment vehi ...

... Pool of assets managed by an investment advisor Open end funds can be bought or sold at the close of business each day based on NAV (Net Asset Value) Closed end funds can be bought or sold during the trading day like a stock or ETF and can trade at premiums or discounts to NAV Common investment vehi ...

Law for Business

... Pool of assets managed by an investment advisor Open end funds can be bought or sold at the close of business each day based on NAV (Net Asset Value) Closed end funds can be bought or sold during the trading day like a stock or ETF and can trade at premiums or discounts to NAV Common investment vehi ...

... Pool of assets managed by an investment advisor Open end funds can be bought or sold at the close of business each day based on NAV (Net Asset Value) Closed end funds can be bought or sold during the trading day like a stock or ETF and can trade at premiums or discounts to NAV Common investment vehi ...

Why YOU Should Trade CME Currency Futures Instead

... This apparently implies that the total volume traded in the cash currency markets works in your favor. But the truth is in the actual execution. What do I mean by that? Just this: Will YOU get better prices and have your limit orders and stop orders executed at better rates in the cash FX market or ...

... This apparently implies that the total volume traded in the cash currency markets works in your favor. But the truth is in the actual execution. What do I mean by that? Just this: Will YOU get better prices and have your limit orders and stop orders executed at better rates in the cash FX market or ...

Exploiting Market Anomalies in the Saudi Stock

... Strategy: A short-term gain is likely if one invests in the market before the Ramadan period and sells in the subsequent month, and increase positions during the end of March and October, where the TASI always showed the worst performance during these mentioned months and then recovered significantl ...

... Strategy: A short-term gain is likely if one invests in the market before the Ramadan period and sells in the subsequent month, and increase positions during the end of March and October, where the TASI always showed the worst performance during these mentioned months and then recovered significantl ...

Marketing plan Powerpoint

... • All marketing plans should be made to ensure a profit for your operation on each commodity. • Marketing plans need to be flexible to be successful. Be ready to change with the ...

... • All marketing plans should be made to ensure a profit for your operation on each commodity. • Marketing plans need to be flexible to be successful. Be ready to change with the ...

Financial Heat Machine - Business Perspectives

... point of view. In steam engine we have boiler, cooler, and the cylinder where the Carnot cycle (in the idealized case) takes place. The cylinder in our language is the analogue of financial market. What are the analogues of the boiler and the cooler (without which steam engine will not work)? Boiler ...

... point of view. In steam engine we have boiler, cooler, and the cylinder where the Carnot cycle (in the idealized case) takes place. The cylinder in our language is the analogue of financial market. What are the analogues of the boiler and the cooler (without which steam engine will not work)? Boiler ...

Get the flexibility to determine a futures price without

... price without committing to a basis. What is it? A fixed futures contract allows you to fix the futures price on a quantity of grain and leave the basis open. ...

... price without committing to a basis. What is it? A fixed futures contract allows you to fix the futures price on a quantity of grain and leave the basis open. ...

12-1

... • Prices reflect all publicly available information including trading information, annual reports, press releases, etc. • If the market is semistrong form efficient, then investors cannot earn abnormal returns by trading on public information • Implies that fundamental analysis will not lead to abno ...

... • Prices reflect all publicly available information including trading information, annual reports, press releases, etc. • If the market is semistrong form efficient, then investors cannot earn abnormal returns by trading on public information • Implies that fundamental analysis will not lead to abno ...

Lecture Three - the School of Economics and Finance

... z HHI within 75 miles z Change in HHI within 75 miles with a suspected conspiracy { An average of 6.5% price elevation over 10 years excluding years the cartel indictment { With market power, average price increase can be 24.6% z John Nash, the Nobel Prize winner analyzing selfish rivalries in marke ...

... z HHI within 75 miles z Change in HHI within 75 miles with a suspected conspiracy { An average of 6.5% price elevation over 10 years excluding years the cartel indictment { With market power, average price increase can be 24.6% z John Nash, the Nobel Prize winner analyzing selfish rivalries in marke ...

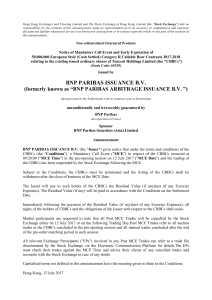

bnp paribas issuance bv

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

bnp paribas issuance bv

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

Limit Orders and the Intraday Behavior of Market Liquidity

... expected gains from trading with liquidity traders exceeded the expected loss from trading with informed traders. However, his model does not endogenize the traders' choice between market and limit orders. Handa and Schwartz (1996) extend Glosten's analysis by examining the investors' rational choic ...

... expected gains from trading with liquidity traders exceeded the expected loss from trading with informed traders. However, his model does not endogenize the traders' choice between market and limit orders. Handa and Schwartz (1996) extend Glosten's analysis by examining the investors' rational choic ...

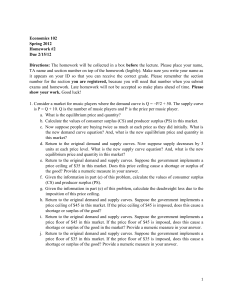

Economics 102 Spring 2012 Homework #2 Due 2/15/12 Directions

... number for the section you are registered, because you will need that number when you submit exams and homework. Late homework will not be accepted so make plans ahead of time. Please show your work. Good luck! 1. Consider a market for music players where the demand curve is Q = P/2 + 50. The suppl ...

... number for the section you are registered, because you will need that number when you submit exams and homework. Late homework will not be accepted so make plans ahead of time. Please show your work. Good luck! 1. Consider a market for music players where the demand curve is Q = P/2 + 50. The suppl ...

EquityCompass Share Buyback Strategy

... presented herein are as of the date indicated and are subject to change. EquityCompass Strategies is a research and investment advisory unit of Choice Financial Partners, Inc., a wholly owned subsidiary and affiliated SEC registered investment adviser of Stifel Financial Corp. Portfolios based on Eq ...

... presented herein are as of the date indicated and are subject to change. EquityCompass Strategies is a research and investment advisory unit of Choice Financial Partners, Inc., a wholly owned subsidiary and affiliated SEC registered investment adviser of Stifel Financial Corp. Portfolios based on Eq ...

February 2017 - SIX Swiss Exchange

... platforms reported trading turnover totaling CHF 228.5 billion, a moderate 2.8% decline year-on-year. Trading turnover was generated by a smaller number of transactions than in the previous year. The number of trades fell 16% to 8,178,660. The average daily trading turnover was CHF 5.6 billion. In F ...

... platforms reported trading turnover totaling CHF 228.5 billion, a moderate 2.8% decline year-on-year. Trading turnover was generated by a smaller number of transactions than in the previous year. The number of trades fell 16% to 8,178,660. The average daily trading turnover was CHF 5.6 billion. In F ...