Why Has Swedish Stock Market Volatility Increased?

... Events on financial markets have come to play an increasingly important role in media and public discussion. All big news media today have daily coverage of the latest developments at the stock markets. Sudden shifts in the value of the stock market and periods of higher than usual financial volatil ...

... Events on financial markets have come to play an increasingly important role in media and public discussion. All big news media today have daily coverage of the latest developments at the stock markets. Sudden shifts in the value of the stock market and periods of higher than usual financial volatil ...

The Process of Portfolio Management

... efficient markets hypothesis On a well-developed securities exchange, asset prices accurately reflect the tradeoff between relative risk and potential returns of a security – Efforts to identify undervalued securities will be essentially fruitless – Free lunches are difficult to find ...

... efficient markets hypothesis On a well-developed securities exchange, asset prices accurately reflect the tradeoff between relative risk and potential returns of a security – Efforts to identify undervalued securities will be essentially fruitless – Free lunches are difficult to find ...

The Causal Effects of Short-Selling Bans

... it is not clear whether the estimated treatment effects documented in the existing literature are due to the implementation of the regulation or to differences between stocks, countries, or time periods. In this paper, we identify causal effects by exploiting exogenous variation in short-selling ban ...

... it is not clear whether the estimated treatment effects documented in the existing literature are due to the implementation of the regulation or to differences between stocks, countries, or time periods. In this paper, we identify causal effects by exploiting exogenous variation in short-selling ban ...

MORGAN GROUP HOLDING CO (Form: 10-Q

... Note 1. Basis of Presentation Morgan Group Holding Co. (“Holding” or “the Company”) was incorporated in November 2001 as a wholly-owned subsidiary of LICT Corporation (“LICT, formerly Lynch Interactive Corporation”) to serve, among other business purposes, as a holding company for LICT’s controlling ...

... Note 1. Basis of Presentation Morgan Group Holding Co. (“Holding” or “the Company”) was incorporated in November 2001 as a wholly-owned subsidiary of LICT Corporation (“LICT, formerly Lynch Interactive Corporation”) to serve, among other business purposes, as a holding company for LICT’s controlling ...

The relationship between board independence and stock price

... independence and accounting-related variables such as ROA, ROE, Tobins Q and market-to-book ratios, the US literature has also iterated to examine the relationship between stock price returns and board composition.³ Given that the returns earned by investors in the shares of companies is actually in ...

... independence and accounting-related variables such as ROA, ROE, Tobins Q and market-to-book ratios, the US literature has also iterated to examine the relationship between stock price returns and board composition.³ Given that the returns earned by investors in the shares of companies is actually in ...

Is Bitcoin a Security?

... found to be, Bitcoin miners are either acquiring securities directly from the issuer, or those who purchase Bitcoins from them are acquiring securities directly from the issuer; transactions on the blockchain are publicly disclosed, even if the transacting parties are identified only anonymously; an ...

... found to be, Bitcoin miners are either acquiring securities directly from the issuer, or those who purchase Bitcoins from them are acquiring securities directly from the issuer; transactions on the blockchain are publicly disclosed, even if the transacting parties are identified only anonymously; an ...

Affinity Investment Advisors, LLC

... Past performance is no guarantee of future results. Actual individual account results may differ from the performance shown in this profile. There is no guarantee that this investment strategy will work under all market conditions. Do not use this profile as the sole basis for your investment decisi ...

... Past performance is no guarantee of future results. Actual individual account results may differ from the performance shown in this profile. There is no guarantee that this investment strategy will work under all market conditions. Do not use this profile as the sole basis for your investment decisi ...

CAPM in Market Overreaction Conditions: Evidence in Indonesia

... strategy is obtained from the return reversal of stocks. Also, this strategy does not require an initial investment (zero cost) where investors will sell stocks that demanded by markets (winners) and using the funds obtained from the sale to buy stocks less attractive for the market (losers). Method ...

... strategy is obtained from the return reversal of stocks. Also, this strategy does not require an initial investment (zero cost) where investors will sell stocks that demanded by markets (winners) and using the funds obtained from the sale to buy stocks less attractive for the market (losers). Method ...

F2015L01378 F2015L01378 - Federal Register of Legislation

... register of members means, in relation to an entity, the register of members (however described) of the entity required to be kept under the laws of its place of origin. relevant regulatory requirements means the laws or rules referred to in paragraph (b) of the definition of foreign scrip bid. secu ...

... register of members means, in relation to an entity, the register of members (however described) of the entity required to be kept under the laws of its place of origin. relevant regulatory requirements means the laws or rules referred to in paragraph (b) of the definition of foreign scrip bid. secu ...

Measuring the value of employee stock options

... and pays tax only at capital gains rates when he eventually sells that stock. To qualify for advantageous tax treatment, an option program must stay within several limits: (a) less than 12 million yen’s worth of stock can be purchased in a year by exercising options; (b) options can be exercised wit ...

... and pays tax only at capital gains rates when he eventually sells that stock. To qualify for advantageous tax treatment, an option program must stay within several limits: (a) less than 12 million yen’s worth of stock can be purchased in a year by exercising options; (b) options can be exercised wit ...

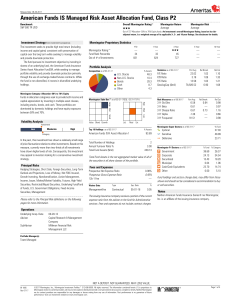

American Funds IS Managed Risk Asset Allocation Fund

... volatility as the value of these securities can change more rapidly and extremely than can the value of U.S. securities. Foreign securities are subject to increased issuer risk because foreign issuers may not experience the same degree of regulation as U.S. issuers do and are held to different repor ...

... volatility as the value of these securities can change more rapidly and extremely than can the value of U.S. securities. Foreign securities are subject to increased issuer risk because foreign issuers may not experience the same degree of regulation as U.S. issuers do and are held to different repor ...

Equity Trading by Institutional Investors: To Cross or Not

... have resulted in a proliferation of market places and trading methods in the US equity market. The consequences of this development for the main functions of the market are complex and not yet well understood. A stated goal of all new trading arrangements is to reduce transactions costs. Current ac ...

... have resulted in a proliferation of market places and trading methods in the US equity market. The consequences of this development for the main functions of the market are complex and not yet well understood. A stated goal of all new trading arrangements is to reduce transactions costs. Current ac ...

Secondary Issues

... The purpose of this briefing is to provide a background to the key points relevant to secondary issues by companies that are listed or quoted in the UK. The expression “secondary issue” refers to the process by which an existing listed or quoted company, often referred to as the “issuer”, raises new ...

... The purpose of this briefing is to provide a background to the key points relevant to secondary issues by companies that are listed or quoted in the UK. The expression “secondary issue” refers to the process by which an existing listed or quoted company, often referred to as the “issuer”, raises new ...

Corporate Governance in Russia

... intermediaries (banks and collective investments) after the widespread scandals involving pyramid schemes in 1994–1995 (more than 1,000 pyramid schemes were created during those years and some 30 million people fell victim to them) and people’s losses at banks stemming from the crisis of August 1998 ...

... intermediaries (banks and collective investments) after the widespread scandals involving pyramid schemes in 1994–1995 (more than 1,000 pyramid schemes were created during those years and some 30 million people fell victim to them) and people’s losses at banks stemming from the crisis of August 1998 ...

Expected Return

... large number of explanatory factors. If a theory of asset pricing is to have value, it must explain returns using a reasonably limited number of explanatory variables (i.e., systematic factors). 28. The APT factors must correlate with major sources of uncertainty, i.e., sources of uncertainty that a ...

... large number of explanatory factors. If a theory of asset pricing is to have value, it must explain returns using a reasonably limited number of explanatory variables (i.e., systematic factors). 28. The APT factors must correlate with major sources of uncertainty, i.e., sources of uncertainty that a ...

proyecto de escisión - Precio de Cementos Pacasmayo

... their respective Chief Executive Officers to jointly make the adjustments and amendments to the Spin-off Project that they may deem necessary and to reschedule the date of entry into force of the Spin-off. Furthermore, the shareholders’ Meetings of the Participating Companies shall confer the necess ...

... their respective Chief Executive Officers to jointly make the adjustments and amendments to the Spin-off Project that they may deem necessary and to reschedule the date of entry into force of the Spin-off. Furthermore, the shareholders’ Meetings of the Participating Companies shall confer the necess ...

Managing the Man Overboard Moment

... paralysis. A psychologist studying emergency checklists in aviation said the goal is to “minimize the need for a lot of effortful analysis when time may be limited and workload is high.”3 The goal of this report is to provide you with analytical guidance if one of your stocks declines 10 percent or ...

... paralysis. A psychologist studying emergency checklists in aviation said the goal is to “minimize the need for a lot of effortful analysis when time may be limited and workload is high.”3 The goal of this report is to provide you with analytical guidance if one of your stocks declines 10 percent or ...

What Makes the Bonding Stick?

... hypothesis and, more broadly, to assess the value of U.S. legal enforcement institutions for crosslisted firms, we find evidence that calls the legal bonding hypothesis into question. Successful bonding depends crucially on enforcement. Conventional wisdom from Bentham (1789) to Becker (1968) and b ...

... hypothesis and, more broadly, to assess the value of U.S. legal enforcement institutions for crosslisted firms, we find evidence that calls the legal bonding hypothesis into question. Successful bonding depends crucially on enforcement. Conventional wisdom from Bentham (1789) to Becker (1968) and b ...

How does investor sentiment affect stock market crises

... October 1987, for instance, remains enigmatic for researchers. During the crash, stock prices dropped an average of 22.6%, a decrease much larger than what can be explained by changes in economic variables (Black, 1988; Fama, 1989; Siegel, 1992). The view about the market "personality", the market b ...

... October 1987, for instance, remains enigmatic for researchers. During the crash, stock prices dropped an average of 22.6%, a decrease much larger than what can be explained by changes in economic variables (Black, 1988; Fama, 1989; Siegel, 1992). The view about the market "personality", the market b ...

returns on small cap growth stocks, or the lack

... The Fama-French domestic indexes are created using the CRSP (Center for Research in Security Prices) database. ...

... The Fama-French domestic indexes are created using the CRSP (Center for Research in Security Prices) database. ...

Dividend Yield vs. Dividend Growth

... The hypothetical backtested performance does not represent the results of actual trading using client assets nor decision-making during the period and does not and is not intended to indicate the past performance or future performance of any account or investment strategy managed by OSAM. If actual ...

... The hypothetical backtested performance does not represent the results of actual trading using client assets nor decision-making during the period and does not and is not intended to indicate the past performance or future performance of any account or investment strategy managed by OSAM. If actual ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.