Day-of-the-Week Effects in the Indian stock market

... The efficient market hypothesis (EMH) postulates that stock prices must efficiently reflect all available information about their intrinsic value. According to the EMH, stocks always trade at their fair value on stock exchanges, making it impossible for investors to either purchase undervalued stock ...

... The efficient market hypothesis (EMH) postulates that stock prices must efficiently reflect all available information about their intrinsic value. According to the EMH, stocks always trade at their fair value on stock exchanges, making it impossible for investors to either purchase undervalued stock ...

DOC - Investor Relations

... accruals and other liabilities. In addition, estimates are used in revenue recognition, income tax expense, performance-based compensation charges, depreciation and amortization, and the allowance for losses. Management believes its use of estimates in the interim condensed consolidated financial st ...

... accruals and other liabilities. In addition, estimates are used in revenue recognition, income tax expense, performance-based compensation charges, depreciation and amortization, and the allowance for losses. Management believes its use of estimates in the interim condensed consolidated financial st ...

Notes to Financial Statement

... Treasury stock is stated at cost and presented as a reduction from shareholders’ equity. Gains on disposal of treasury stock are determined by reference to its carrying amount and are taken to premium on treasury stock, losses on disposal of treasury stock are determined by reference to its carrying ...

... Treasury stock is stated at cost and presented as a reduction from shareholders’ equity. Gains on disposal of treasury stock are determined by reference to its carrying amount and are taken to premium on treasury stock, losses on disposal of treasury stock are determined by reference to its carrying ...

Twitter Volume Spikes: Analysis and Application in Stock Trading

... $AAPL represents the stock of Apple Inc. and $GOOG represents the stock of Google Inc. When collecting public tweets on S&P 500 stocks, we only search for tweets that follow the above convention (i.e., having a dollar sign before a stock symbol). This is because many stock symbols (e.g., A, CAT, GAS ...

... $AAPL represents the stock of Apple Inc. and $GOOG represents the stock of Google Inc. When collecting public tweets on S&P 500 stocks, we only search for tweets that follow the above convention (i.e., having a dollar sign before a stock symbol). This is because many stock symbols (e.g., A, CAT, GAS ...

One Half-Billion Shareholders and Counting

... retail investors hold shares. Partly this is because the data is extremely hard to collect and partly because almost universally there are no legal requirements to collect this data. There are two major difficulties in collecting and aggregating data on the numbers of shareholders within and across ...

... retail investors hold shares. Partly this is because the data is extremely hard to collect and partly because almost universally there are no legal requirements to collect this data. There are two major difficulties in collecting and aggregating data on the numbers of shareholders within and across ...

Trading Rules and Practices

... dividend received, the ex-day price drop will be rounded down to the nearest tick, so that the change in stock price on the ex-dividend day is always less than the amount of the dividend. Similarly, when a dividend received is between ticks, there will be positive abnormal returns. Frank and Jaganna ...

... dividend received, the ex-day price drop will be rounded down to the nearest tick, so that the change in stock price on the ex-dividend day is always less than the amount of the dividend. Similarly, when a dividend received is between ticks, there will be positive abnormal returns. Frank and Jaganna ...

the efficient market hypothesis in developing

... raised for the purposes of industry for both the local and central government (Armstrong, 1957).The market essentially provides a mechanism for garnering capital from savers and channelling it to the system‟s investors such that this becomes a way that the lion‟s share of the economy‟s savings flow ...

... raised for the purposes of industry for both the local and central government (Armstrong, 1957).The market essentially provides a mechanism for garnering capital from savers and channelling it to the system‟s investors such that this becomes a way that the lion‟s share of the economy‟s savings flow ...

Income Taxes Expense

... Stock Dividends Declared account is closed out to Retained Earnings at the end of the accounting period. The effect of the stock dividend is to: Permanently transfer the market value of the stock, $60,000, from retained earnings to contributed capital. Increase the number of shares outstanding b ...

... Stock Dividends Declared account is closed out to Retained Earnings at the end of the accounting period. The effect of the stock dividend is to: Permanently transfer the market value of the stock, $60,000, from retained earnings to contributed capital. Increase the number of shares outstanding b ...

Short Selling Risk - Rady School of Management

... from a variety of contributing customers including beneficial owners, hedge funds, investment banks, lending agents, and prime brokers; the market participants that contribute to this database are believed to account for the majority of all equity loans in the U.S. The initial database includes info ...

... from a variety of contributing customers including beneficial owners, hedge funds, investment banks, lending agents, and prime brokers; the market participants that contribute to this database are believed to account for the majority of all equity loans in the U.S. The initial database includes info ...

securities regulations

... - an income deposit security consists of two securities – common shares and subordinate notes of the issuer. C. Government Securities - fed., provincial and municipal gov’t raise funds though securities + taxes - Gov’t of Canada sells: bonds, treasury Bills, Canada Savings Bonds - Bonds can be short ...

... - an income deposit security consists of two securities – common shares and subordinate notes of the issuer. C. Government Securities - fed., provincial and municipal gov’t raise funds though securities + taxes - Gov’t of Canada sells: bonds, treasury Bills, Canada Savings Bonds - Bonds can be short ...

0000950123-08-005299 - Investor Relations

... (2) The results for the three months ended March 31, 2008 and 2007 include $0.07 and $(0.01) per share, respectively, from discontinued operations. Note 5 — Stock-Based Compensation The Company grants stock-based compensation awards as an incentive for employees and directors to contribute to the Co ...

... (2) The results for the three months ended March 31, 2008 and 2007 include $0.07 and $(0.01) per share, respectively, from discontinued operations. Note 5 — Stock-Based Compensation The Company grants stock-based compensation awards as an incentive for employees and directors to contribute to the Co ...

Paying for Market Quality

... the NYSE use the profits from trading in liquid stocks to subsidize losses incurred in trading illiquid ones (Cao, Choe and Hatheway (1997.) While this system works well on the NYSE’s floor based system (not without its share of critics), electronic markets have struggled to find an alternative mech ...

... the NYSE use the profits from trading in liquid stocks to subsidize losses incurred in trading illiquid ones (Cao, Choe and Hatheway (1997.) While this system works well on the NYSE’s floor based system (not without its share of critics), electronic markets have struggled to find an alternative mech ...

Factors Determining the Price of Butter

... is actually sold on these exchanges, the bulk price is based in large part on what happens there. The two mercantile exchanges provide facilities for cash trading of butter each business day of the year. Trading is conducted by voice on the exchange floor. Offers to sell or bids to buy are posted al ...

... is actually sold on these exchanges, the bulk price is based in large part on what happens there. The two mercantile exchanges provide facilities for cash trading of butter each business day of the year. Trading is conducted by voice on the exchange floor. Offers to sell or bids to buy are posted al ...

Financial Markets

... economic value. Assets are divided into two categories: tangible assets with physical properties and intangible assets. An intangible asset represents a legal claim to some future economic benefits. The value of an intangible asset bears no relation to the form, physical or otherwise, in which the c ...

... economic value. Assets are divided into two categories: tangible assets with physical properties and intangible assets. An intangible asset represents a legal claim to some future economic benefits. The value of an intangible asset bears no relation to the form, physical or otherwise, in which the c ...

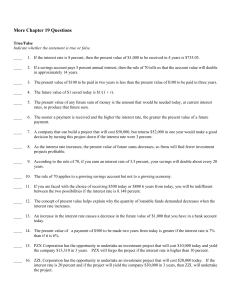

More Finance Questions

... ____ 24. Risk-averse persons will take no risks. ____ 25. The market for insurance is one example of reducing risk by using diversification. ____ 26. A person with diminishing marginal utility of wealth is risk averse. ____ 27. Adverse selection is illustrated by people who take greater risks after ...

... ____ 24. Risk-averse persons will take no risks. ____ 25. The market for insurance is one example of reducing risk by using diversification. ____ 26. A person with diminishing marginal utility of wealth is risk averse. ____ 27. Adverse selection is illustrated by people who take greater risks after ...

139 CHAPTER – 4. PROTECTION OF INVESTORS IN PRIMARY

... of stock broker, sub brokers or other intermediaries, so that investor’s money can not be lost by malpractices or in other way. The investment through primary market by investors deemed to the first step in this most technical securities market. Therefore, it is primary duty of the SEBI to protect t ...

... of stock broker, sub brokers or other intermediaries, so that investor’s money can not be lost by malpractices or in other way. The investment through primary market by investors deemed to the first step in this most technical securities market. Therefore, it is primary duty of the SEBI to protect t ...

an empirical analysis - Indian Commerce Association (ICA)

... Foreign Institutional Investors (FIIs) were permitted to invest in all the listed securities traded in Indian capital market for the first time in September, 1992. As per the RBI, Report on Currency & Finance (2003-04), since 1991 there has been continuous move towards the integration of the Indian ...

... Foreign Institutional Investors (FIIs) were permitted to invest in all the listed securities traded in Indian capital market for the first time in September, 1992. As per the RBI, Report on Currency & Finance (2003-04), since 1991 there has been continuous move towards the integration of the Indian ...

CE91 - MexDer

... Each 91-Day Cetes Futures Contract covers an amount of ten thousand (10,000) Cetes, equivalent to a face value of MX $100,000.00 (One Hundred Thousand Mexican Pesos 00/100). 3. Series. Under the terms of their respective Internal Regulations, MexDer and Asigna are entitled to quote and make availabl ...

... Each 91-Day Cetes Futures Contract covers an amount of ten thousand (10,000) Cetes, equivalent to a face value of MX $100,000.00 (One Hundred Thousand Mexican Pesos 00/100). 3. Series. Under the terms of their respective Internal Regulations, MexDer and Asigna are entitled to quote and make availabl ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.