Statement of Financial Condition

... Cash and cash equivalents are defined as highly liquid investments, with an original maturity of three months or less when purchased. At June 30, 2016, the Company had cash equivalents of $9,656 in demand deposit accounts at cost, which approximates fair value. Financial Instruments Financial instru ...

... Cash and cash equivalents are defined as highly liquid investments, with an original maturity of three months or less when purchased. At June 30, 2016, the Company had cash equivalents of $9,656 in demand deposit accounts at cost, which approximates fair value. Financial Instruments Financial instru ...

IFM7 Chapter 3

... short time horizon and buy stocks thinking about returns over a few days or weeks, while another might buy for the “long haul” and not even check his or her results except annually, and the investor’s time horizons might change over time. Adjusted betas are generally calculated as some sort of avera ...

... short time horizon and buy stocks thinking about returns over a few days or weeks, while another might buy for the “long haul” and not even check his or her results except annually, and the investor’s time horizons might change over time. Adjusted betas are generally calculated as some sort of avera ...

TIAA BROKERAGE SERVICES ACCOUNT APPLICATION

... I am opening a brokerage account (“Account”) with TIAA Brokerage Services (“TBS”). TBS is a division of TIAA-CREF Individual & Institutional Services, LLC (“Services LLC”). Brokerage accounts and related brokerage services are provided by TBS as a registered broker/dealer. I certify that the informa ...

... I am opening a brokerage account (“Account”) with TIAA Brokerage Services (“TBS”). TBS is a division of TIAA-CREF Individual & Institutional Services, LLC (“Services LLC”). Brokerage accounts and related brokerage services are provided by TBS as a registered broker/dealer. I certify that the informa ...

The Fallacy behind Investor versus Fund Returns

... No recognition is made of this fact. Thus, a complete leap has been made from a too-facile interpretation of the mathematical measure, investor return, and its difference from time-weighted investment return, to a conventional wisdom about the meaning of this difference. Without a better analysis of ...

... No recognition is made of this fact. Thus, a complete leap has been made from a too-facile interpretation of the mathematical measure, investor return, and its difference from time-weighted investment return, to a conventional wisdom about the meaning of this difference. Without a better analysis of ...

Abstract Edward Chamberlin, who initiated classroom

... A natural candidate for an alternative to competitive equilibrium theory is the following “profit-splitting hypothesis.” At the beginning of trade, suppliers and demanders are paired at random. For any pair, if the demander’s buyer value exceeds the supplier’s seller cost, then the two of them will ...

... A natural candidate for an alternative to competitive equilibrium theory is the following “profit-splitting hypothesis.” At the beginning of trade, suppliers and demanders are paired at random. For any pair, if the demander’s buyer value exceeds the supplier’s seller cost, then the two of them will ...

The Impact of Serial Correlation on Option Prices in a Non

... to consider the vega risk and jump risk in replicating options, but transaction costs as well. While by no means minimizing vega and jump risk, we focus on the transaction costs involved in performing dynamic replication. For comparison purposes, we will apply bounds established by Boyle and Vorst ( ...

... to consider the vega risk and jump risk in replicating options, but transaction costs as well. While by no means minimizing vega and jump risk, we focus on the transaction costs involved in performing dynamic replication. For comparison purposes, we will apply bounds established by Boyle and Vorst ( ...

Kellogg Direct - Morningstar Document Research

... Kellogg Direct is a direct stock purchase and dividend reinvestment plan that provides a convenient and economical method for new investors to make an initial investment in shares of Kellogg Company common stock and for existing investors to increase their holdings of our common stock. As a particip ...

... Kellogg Direct is a direct stock purchase and dividend reinvestment plan that provides a convenient and economical method for new investors to make an initial investment in shares of Kellogg Company common stock and for existing investors to increase their holdings of our common stock. As a particip ...

Model Uncertainty, Limited Market Participation, and Asset Prices

... model. Section 2 describes investors’ portfolio choices and their participation decisions. Section 3 analyzes how the limited market participation relates to equity premium, while Section 4 extends the model to allow for two stocks and investigates the relation between limited participation and the ...

... model. Section 2 describes investors’ portfolio choices and their participation decisions. Section 3 analyzes how the limited market participation relates to equity premium, while Section 4 extends the model to allow for two stocks and investigates the relation between limited participation and the ...

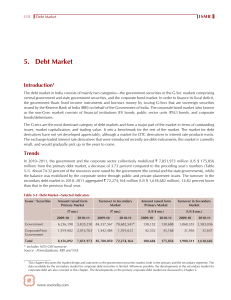

5. Debt Market

... of the CMBs depend on the temporary cash requirement of the government. The announcement of their auction is made by the RBI through a Press Release that would be issued one day prior to the date of auction. The settlement of the auction is on a T+1 basis. Dated Government Securities: Dated governme ...

... of the CMBs depend on the temporary cash requirement of the government. The announcement of their auction is made by the RBI through a Press Release that would be issued one day prior to the date of auction. The settlement of the auction is on a T+1 basis. Dated Government Securities: Dated governme ...

Market Funds and Trust-Investment Law

... are known as "index" or "market" funds. These are mutual or other investment funds that have abandoned the traditional attempt to "beat the market" by picking and choosing among securities-buying stocks or bonds that they believe to be undervalued' and selling those they believe to be overvalued. In ...

... are known as "index" or "market" funds. These are mutual or other investment funds that have abandoned the traditional attempt to "beat the market" by picking and choosing among securities-buying stocks or bonds that they believe to be undervalued' and selling those they believe to be overvalued. In ...

SCHEDULE 14A INFORMATION Proxy Statement Pursuant to

... Bruce C. Gottwald, Floyd D. Gottwald, Jr., John D. Gottwald and William M. Gottwald may be considered a "group" under Section 13(d) of the Securities Exchange Act of 1934, and the shares owned or attributed to them and their children are reported in the table "Security Ownership of Certain Beneficia ...

... Bruce C. Gottwald, Floyd D. Gottwald, Jr., John D. Gottwald and William M. Gottwald may be considered a "group" under Section 13(d) of the Securities Exchange Act of 1934, and the shares owned or attributed to them and their children are reported in the table "Security Ownership of Certain Beneficia ...

ROYAL BANK OF CANADA

... Return is positive, Royal Bank of Canada will repay the principal amount at maturity plus pay a return equal to 1.5 (the “Multiplier”) times the Index Return, up to the Maximum Gain. If the Index Return is zero or negative, and the Index Ending Level is greater than or equal to the Trigger Level, Ro ...

... Return is positive, Royal Bank of Canada will repay the principal amount at maturity plus pay a return equal to 1.5 (the “Multiplier”) times the Index Return, up to the Maximum Gain. If the Index Return is zero or negative, and the Index Ending Level is greater than or equal to the Trigger Level, Ro ...

Stock characteristics and market myopia

... difference between market price and fair value. Robustness tests show this finding to be robust to the choice of proxies for these characteristics. This revelation suggests that well a organized and liquid market is a necessary, but not sufficient, condition to make market price the best proxy for t ...

... difference between market price and fair value. Robustness tests show this finding to be robust to the choice of proxies for these characteristics. This revelation suggests that well a organized and liquid market is a necessary, but not sufficient, condition to make market price the best proxy for t ...

Earnings Release

... Stock Exchange have to publish a press release about their earnings. According to studies realised by the Banking and Finance Commission (1998; 1999), such a publication was already made on a voluntary basis by around two third of the listed companies before 1999. The introduction of this legal obli ...

... Stock Exchange have to publish a press release about their earnings. According to studies realised by the Banking and Finance Commission (1998; 1999), such a publication was already made on a voluntary basis by around two third of the listed companies before 1999. The introduction of this legal obli ...

CFA Institute

... For property shares, none of the available international data bases make a clear difference between property investors and property developers. Especially in the Far East, property companies are involved in development activities. This involvement is reflected in most available indexes, so using th ...

... For property shares, none of the available international data bases make a clear difference between property investors and property developers. Especially in the Far East, property companies are involved in development activities. This involvement is reflected in most available indexes, so using th ...

What are commercial mortgage-backed securities?

... was resolved. The value of US CMBS outstanding grew from USD42 billion in 1990 to approximately USD900 billion by 2007.2 Since then, the size of the market has declined to USD565 billon, as loans have been paid down and issuance slowed following the global financial crisis.3 However, origination act ...

... was resolved. The value of US CMBS outstanding grew from USD42 billion in 1990 to approximately USD900 billion by 2007.2 Since then, the size of the market has declined to USD565 billon, as loans have been paid down and issuance slowed following the global financial crisis.3 However, origination act ...

Borrowing to invest

... investment. No allowance has been made for inflation, taxation, fees or expenses. ...

... investment. No allowance has been made for inflation, taxation, fees or expenses. ...

Pay for Short-Term Performance: Executive Compensation in

... the reality of executive pay negotiations is far from the idealized arm’s-length bargaining situation of the principal-agent paradigm, they do not provide a compelling explanation for how and why both the level of pay and the sensitivity to stock price performance have risen so much over the 1990s. ...

... the reality of executive pay negotiations is far from the idealized arm’s-length bargaining situation of the principal-agent paradigm, they do not provide a compelling explanation for how and why both the level of pay and the sensitivity to stock price performance have risen so much over the 1990s. ...

International diversification of investment portfolios

... both the dollar and the yen; in fact, the highest return bond market, i.e., Japan, has a lower return than the lowest return stock market, Switzerland. Of course, risk tends to be higher for the stock markets than for bonds markets. It is also noted that in both numeraire currencies, Japan (Switzerl ...

... both the dollar and the yen; in fact, the highest return bond market, i.e., Japan, has a lower return than the lowest return stock market, Switzerland. Of course, risk tends to be higher for the stock markets than for bonds markets. It is also noted that in both numeraire currencies, Japan (Switzerl ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.