Prospectus View the prospectus

... The offer, sale and/or issue of the Ordinary Shares has not been, and will not be, qualified for sale under any applicable securities laws of Australia, Canada, Japan or South Africa. Subject to certain exceptions, the Ordinary Shares may not be offered, sold or delivered within Australia, Canada, J ...

... The offer, sale and/or issue of the Ordinary Shares has not been, and will not be, qualified for sale under any applicable securities laws of Australia, Canada, Japan or South Africa. Subject to certain exceptions, the Ordinary Shares may not be offered, sold or delivered within Australia, Canada, J ...

The conceptual and empirical relationship between gambling

... with the following, capturing the sentiments of most: “purchasing or allocating money into an asset with the expectation of long term capital appreciation or profits deriving from that asset” (e.g., Bogle, 2012). Similarly, although there have been dozens of definitions of gambling proposed over the y ...

... with the following, capturing the sentiments of most: “purchasing or allocating money into an asset with the expectation of long term capital appreciation or profits deriving from that asset” (e.g., Bogle, 2012). Similarly, although there have been dozens of definitions of gambling proposed over the y ...

PRIMERO MINING CORP

... The following information is of significant importance to shareholders of the Company who do not hold Common Shares in their own name. Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by registered shareholders or as s ...

... The following information is of significant importance to shareholders of the Company who do not hold Common Shares in their own name. Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by registered shareholders or as s ...

Misvaluation and Return Anomalies in Distressed Stocks

... clearly irrational manner, suggesting that it is hard for certain types of investors to understand and value options correctly (Poteshman and Serbin find that this is particularly true for retail investors; traders at large investment houses do not exhibit irrational behavior.) Furthermore, Benartzi ...

... clearly irrational manner, suggesting that it is hard for certain types of investors to understand and value options correctly (Poteshman and Serbin find that this is particularly true for retail investors; traders at large investment houses do not exhibit irrational behavior.) Furthermore, Benartzi ...

WellsTrade Customer Account Transfer

... employer or retirement plan provider for rollover instructions. They may require you to complete paperwork they provide. If an asset cannot be held in your WellsTrade account, you will be notified and provided other available options, including selling the asset and transferring the cash proceeds to ...

... employer or retirement plan provider for rollover instructions. They may require you to complete paperwork they provide. If an asset cannot be held in your WellsTrade account, you will be notified and provided other available options, including selling the asset and transferring the cash proceeds to ...

Tender Offers: Safeguards and Restraints-An

... An earlier application for a Hartford Fire merger in IT&T had been turned down by the Insurance Commissioner, who suggested, among other things, that an exchange offer would be fairer to minority shareholders. Hartford Fire Ins. Co.-International Tel. & Tel. Corp., Conn. Ins. Comm'r., Finding and Fi ...

... An earlier application for a Hartford Fire merger in IT&T had been turned down by the Insurance Commissioner, who suggested, among other things, that an exchange offer would be fairer to minority shareholders. Hartford Fire Ins. Co.-International Tel. & Tel. Corp., Conn. Ins. Comm'r., Finding and Fi ...

Boundless Study Slides

... • clientele The body or class of people who frequent an establishment or purchase a service, especially when considered as forming a more-or-less homogeneous group of clients in terms of values or habits. • clientele effect The theory that changes in a firm's dividend policy will cause loss of some ...

... • clientele The body or class of people who frequent an establishment or purchase a service, especially when considered as forming a more-or-less homogeneous group of clients in terms of values or habits. • clientele effect The theory that changes in a firm's dividend policy will cause loss of some ...

OCC Rule Filing No. SR-OCC-2017-803

... Member’s margin deposit. The Summary of Terms and Conditions contemplates that the New Facility would also modify the ratings standards for securities that are issued or guaranteed by the Government of Canada. Such securities would be acceptable as permitted collateral provided that they have minim ...

... Member’s margin deposit. The Summary of Terms and Conditions contemplates that the New Facility would also modify the ratings standards for securities that are issued or guaranteed by the Government of Canada. Such securities would be acceptable as permitted collateral provided that they have minim ...

Rare Element Resources Ltd.

... The term “Measured Mineral Resource” refers to that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and econo ...

... The term “Measured Mineral Resource” refers to that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and econo ...

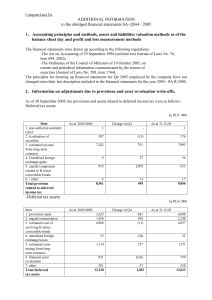

notes to - Sygnity

... The banking and financial sector accounted for over one-third of the entire Group’s sales in 2005. It brought PLN 285 million in revenues. However, this level of sales was achieved at a considerably higher level of profitability. In 2005, the Group consolidated cooperation with its biggest clients, ...

... The banking and financial sector accounted for over one-third of the entire Group’s sales in 2005. It brought PLN 285 million in revenues. However, this level of sales was achieved at a considerably higher level of profitability. In 2005, the Group consolidated cooperation with its biggest clients, ...

Vanguard Windsor Funds Statement of Additional Information

... Fund receive one vote for each dollar of net asset value owned on the record date and a fractional vote for each fractional dollar of net asset value owned on the record date. However, only the shares of the Fund or class affected by a particular matter are entitled to vote on that matter. In additi ...

... Fund receive one vote for each dollar of net asset value owned on the record date and a fractional vote for each fractional dollar of net asset value owned on the record date. However, only the shares of the Fund or class affected by a particular matter are entitled to vote on that matter. In additi ...

SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... was to provide mobile medical examinations. This business was discontinued in June 1989. Since February 1987, the Company's primary business has been the operation of a clinical laboratory located in northern New Jersey servicing the greater New York metropolitan area. The Company expanded its labor ...

... was to provide mobile medical examinations. This business was discontinued in June 1989. Since February 1987, the Company's primary business has been the operation of a clinical laboratory located in northern New Jersey servicing the greater New York metropolitan area. The Company expanded its labor ...

The Market Reaction to Stock Split Announcements

... Although a manager may cite multiple reasons for a stock split, we hypothesize that these reasons are often coupled with the manager’s belief that the firm is doing well. For example, if managers employ splits to maintain a desired share price range, then they are more likely to split the firm’s st ...

... Although a manager may cite multiple reasons for a stock split, we hypothesize that these reasons are often coupled with the manager’s belief that the firm is doing well. For example, if managers employ splits to maintain a desired share price range, then they are more likely to split the firm’s st ...

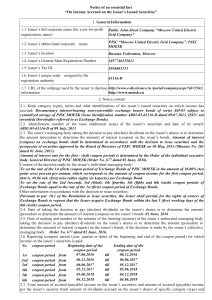

On Income Accrued on the Issuer`s Issued Securitiespdf

... 1.7. URL of the webpage used by the issuer to disclose http://www.e-disclosure.ru /portal/company.aspx?id=5563; information http://www.moesk.ru 2. Notice content 2.1. Kind, category (type), series and other identifications of the issuer’s issued securities on which income has accrued: Documentary in ...

... 1.7. URL of the webpage used by the issuer to disclose http://www.e-disclosure.ru /portal/company.aspx?id=5563; information http://www.moesk.ru 2. Notice content 2.1. Kind, category (type), series and other identifications of the issuer’s issued securities on which income has accrued: Documentary in ...

for an offer of 50000000 shares at an issue price

... The Company is based in Singapore and has its origins in the boutique design and construction service company that I personally founded in 1978. During the last 37 years the “Kingsland Singapore Group” has evolved into a sophisticated and innovative integrated specialist property developer offering ...

... The Company is based in Singapore and has its origins in the boutique design and construction service company that I personally founded in 1978. During the last 37 years the “Kingsland Singapore Group” has evolved into a sophisticated and innovative integrated specialist property developer offering ...

Employer Stock Ownership in 401(k)

... the desire for an employee to invest the stock of his employer (since it should be both geographically proximate and familiar). This local bias has also been noted by Goetzman and Kumar (2008) and Ivkovic and Weisbenner (2005). Coval and Moskowitz (1999) find that U.S. investment managers exhibit a ...

... the desire for an employee to invest the stock of his employer (since it should be both geographically proximate and familiar). This local bias has also been noted by Goetzman and Kumar (2008) and Ivkovic and Weisbenner (2005). Coval and Moskowitz (1999) find that U.S. investment managers exhibit a ...

Securities Settlement Systems in Poland and the European Union

... A word to the Reader I would like to invite you to read this study, which has been prepared with the cooperation of three institutions, i.e. the National Bank of Poland, the National Depository for Securities (KDPW), and the Warsaw Stock Exchange. Each of those institutions plays a different but ex ...

... A word to the Reader I would like to invite you to read this study, which has been prepared with the cooperation of three institutions, i.e. the National Bank of Poland, the National Depository for Securities (KDPW), and the Warsaw Stock Exchange. Each of those institutions plays a different but ex ...

A Theory of Repurchase Agreements, Collateral Re-use

... and Pedersen (2009) illustrate. Dealer banks also play a major role as repo intermediaries between cash providers and cash borrowers. Finally, most major central banks implement monetary policy using repos, thus contributing to the size and liquidity of these markets. Repos may be popular because th ...

... and Pedersen (2009) illustrate. Dealer banks also play a major role as repo intermediaries between cash providers and cash borrowers. Finally, most major central banks implement monetary policy using repos, thus contributing to the size and liquidity of these markets. Repos may be popular because th ...

Do retail traders suffer from high frequency traders?

... It is, however, challenging to assess the impact and possible externalities caused by HFTs. First, to establish an externality from HFTs to other traders, researchers need to be able to differentiate between different types of traders. A second issue is that electronic trading has increased over tim ...

... It is, however, challenging to assess the impact and possible externalities caused by HFTs. First, to establish an externality from HFTs to other traders, researchers need to be able to differentiate between different types of traders. A second issue is that electronic trading has increased over tim ...

HSBC Global Liquidity Funds Prospectus

... Managers) for client and proprietary accounts may need to be aggregated with positions held by each Fund. In this case, where BHCA imposes a cap on the amount of a position that may be held, HSBC may utilize available capacity to make investments for its proprietary accounts or for the accounts of o ...

... Managers) for client and proprietary accounts may need to be aggregated with positions held by each Fund. In this case, where BHCA imposes a cap on the amount of a position that may be held, HSBC may utilize available capacity to make investments for its proprietary accounts or for the accounts of o ...

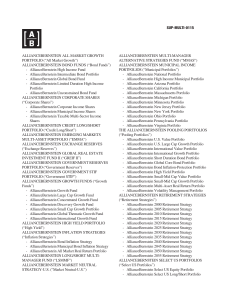

SUP-MULTI-0115 ALLIANCEBERNSTEIN ALL MARKET GROWTH

... are financial contracts whose value depend on, or is derived from, the value of an underlying asset, reference rate or index. These assets, rates, and indices may include bonds, stocks, mortgages, commodities, interest rates, currency exchange rates, bond indices, and stock indices. There are four ...

... are financial contracts whose value depend on, or is derived from, the value of an underlying asset, reference rate or index. These assets, rates, and indices may include bonds, stocks, mortgages, commodities, interest rates, currency exchange rates, bond indices, and stock indices. There are four ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.