QUICKLOGIC CORPORATION

... adequate working capital for the next twelve months. The Company’s liquidity is affected by many factors including, among others, the level of revenue and gross profit, market acceptance of existing and new products including ArcticLink™, PolarPro™ , Eclipse™ II and QuickPCI ® II devices, fluctuatio ...

... adequate working capital for the next twelve months. The Company’s liquidity is affected by many factors including, among others, the level of revenue and gross profit, market acceptance of existing and new products including ArcticLink™, PolarPro™ , Eclipse™ II and QuickPCI ® II devices, fluctuatio ...

Speculative Investors and Tobin`s Tax

... are sought later by homebuyers as well as by investors 4 (The Appendix provides additional details of the residential market background in Singapore). The presale market is more attractive to short-term speculators than the spot market for completed properties because a presale contract has a lower ...

... are sought later by homebuyers as well as by investors 4 (The Appendix provides additional details of the residential market background in Singapore). The presale market is more attractive to short-term speculators than the spot market for completed properties because a presale contract has a lower ...

Form 10-K, 7/24/01

... Corporation and Goldwyn Entertainment Company). In recent years, however, true "independent" motion picture production and distribution companies have played an important role in the production of motion pictures for the worldwide feature film market. INDEPENDENT FEATURE FILM PRODUCTION AND FINANCIN ...

... Corporation and Goldwyn Entertainment Company). In recent years, however, true "independent" motion picture production and distribution companies have played an important role in the production of motion pictures for the worldwide feature film market. INDEPENDENT FEATURE FILM PRODUCTION AND FINANCIN ...

SILVER WHEATON CORP. 17,869,840 Common Shares DIVIDEND

... We are a corporation incorporated under and governed by the Business Corporations Act (Ontario) (“OBCA”). Some of our officers and directors, and some of the experts named in this prospectus and the documents incorporated by reference herein, are Canadian residents, and many of our assets or the ass ...

... We are a corporation incorporated under and governed by the Business Corporations Act (Ontario) (“OBCA”). Some of our officers and directors, and some of the experts named in this prospectus and the documents incorporated by reference herein, are Canadian residents, and many of our assets or the ass ...

The Essays of Warren Buffett: Lessons for

... According to Buffett, one of the greatest problems among boards in corporate America is that members are selected for other reasons, such as adding diversity or prominence to a board. Most reforms are painted with a broad brush, without noting the major differences among types of board situations th ...

... According to Buffett, one of the greatest problems among boards in corporate America is that members are selected for other reasons, such as adding diversity or prominence to a board. Most reforms are painted with a broad brush, without noting the major differences among types of board situations th ...

STRATEGIC REPORT - Highlights Financial highlights

... We have an unrivalled view of the property marketplace. On one side of the network we are the only place with a whole of market view and national property database of 1 million current properties and 40 million historic property records. On the other side of our network we have consumer data from ou ...

... We have an unrivalled view of the property marketplace. On one side of the network we are the only place with a whole of market view and national property database of 1 million current properties and 40 million historic property records. On the other side of our network we have consumer data from ou ...

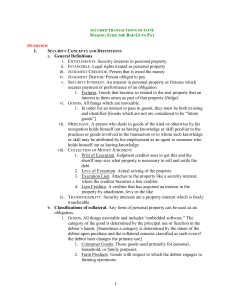

MAKING SURE THE BAD GUYS PAY

... a. A person buys in the ordinary course if the sale to the person comports with the usual customary practices in the kind of business in which the seller is engaged b. Buyer takes free of any security interest even if the buyer knows of its existence 3. ENTRUSTER. Any entrusting of possession of goo ...

... a. A person buys in the ordinary course if the sale to the person comports with the usual customary practices in the kind of business in which the seller is engaged b. Buyer takes free of any security interest even if the buyer knows of its existence 3. ENTRUSTER. Any entrusting of possession of goo ...

united states securities and exchange commission - corporate

... the risk that contracts are cancelled or not renewed or that we are not able to enter into additional contracts under terms that are acceptable to us; ...

... the risk that contracts are cancelled or not renewed or that we are not able to enter into additional contracts under terms that are acceptable to us; ...

0000950130-02-001093 - Lasalle Hotel Properties

... We intend to acquire additional hotel properties in targeted markets, consistent with the growth strategies outlined above and which may: . possess unique competitive advantages in the form of location, physical facilities or other attributes; . be available at significant discounts to replacement c ...

... We intend to acquire additional hotel properties in targeted markets, consistent with the growth strategies outlined above and which may: . possess unique competitive advantages in the form of location, physical facilities or other attributes; . be available at significant discounts to replacement c ...

Decimalization, trading costs, and information transmission between

... futures, and options markets are due to differences in trading costs, which they refer to as the trading-cost hypothesis. They show that markets with lower trading costs tend to lead those with higher trading costs in price discovery. Decimalization of ETFs offers another opportunity to test the tra ...

... futures, and options markets are due to differences in trading costs, which they refer to as the trading-cost hypothesis. They show that markets with lower trading costs tend to lead those with higher trading costs in price discovery. Decimalization of ETFs offers another opportunity to test the tra ...

2017 prospectus

... the extent that Authorized Participants exit the business or are unable to proceed with creation and/or redemption orders with respect to the Fund and no other Authorized Participant is able to step forward to create or redeem Creation Units (as defined in the Purchase and Sale of Fund Shares sectio ...

... the extent that Authorized Participants exit the business or are unable to proceed with creation and/or redemption orders with respect to the Fund and no other Authorized Participant is able to step forward to create or redeem Creation Units (as defined in the Purchase and Sale of Fund Shares sectio ...

Competition and Cooperation among Exchanges

... have listed their stocks on exchanges outside their country of origin. Many European companies have listed on the New York Stock Exchange (NYSE), and companies from emerging market countries such as Israel, India, and China have listed not only on the NYSE, but on various other American and European ...

... have listed their stocks on exchanges outside their country of origin. Many European companies have listed on the New York Stock Exchange (NYSE), and companies from emerging market countries such as Israel, India, and China have listed not only on the NYSE, but on various other American and European ...

Managed Futures: Portfolio Diversification Opportunities

... that businesses everywhere can substantially mitigate counterparty credit risk in both listed and over-the-counter derivatives markets. ...

... that businesses everywhere can substantially mitigate counterparty credit risk in both listed and over-the-counter derivatives markets. ...

5.45% Series J Cumulative Preferred Stock

... The Fund’s common shares are listed on the New York Stock Exchange (“NYSE”) under the symbol “GAB.” Currently, the Fund’s 5.875% Series D Cumulative Preferred Stock (“Series D Preferred”), Series G Cumulative Preferred Stock (“Series G Preferred”) and 5.00% Series H Cumulative Preferred Stock (“Seri ...

... The Fund’s common shares are listed on the New York Stock Exchange (“NYSE”) under the symbol “GAB.” Currently, the Fund’s 5.875% Series D Cumulative Preferred Stock (“Series D Preferred”), Series G Cumulative Preferred Stock (“Series G Preferred”) and 5.00% Series H Cumulative Preferred Stock (“Seri ...

The impact of dark trading and visible fragmentation on market quality

... Finally, our paper is related to the literature on algorithmic trading,6 i.e. the use of computer programs to manage and execute trades in electronic limit order books. Algorithmic trading has strongly increased over time, and has drastically affected the trading environment (Hendershott and Riordan ...

... Finally, our paper is related to the literature on algorithmic trading,6 i.e. the use of computer programs to manage and execute trades in electronic limit order books. Algorithmic trading has strongly increased over time, and has drastically affected the trading environment (Hendershott and Riordan ...

Risk and Long-Run IPO Returns - Berkeley-Haas

... due to the extremely low returns earned by companies that went public during the period 1970{ 1972. The equal-weighted BHAR for size-matched rms is 68.7%, resulting in a relative IPO underperformance of BHAAR = ;28:8%, which compares to the BHAAR of ;50:7% reported for the IPO sample in Loughran an ...

... due to the extremely low returns earned by companies that went public during the period 1970{ 1972. The equal-weighted BHAR for size-matched rms is 68.7%, resulting in a relative IPO underperformance of BHAAR = ;28:8%, which compares to the BHAAR of ;50:7% reported for the IPO sample in Loughran an ...

words - Nasdaq`s INTEL Solutions

... In March 2017, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2017-07, "Compensation Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost" ("ASU 2017-07"). ASU 2017-07 requi ...

... In March 2017, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2017-07, "Compensation Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost" ("ASU 2017-07"). ASU 2017-07 requi ...

RTF - Vornado Realty Trust

... FFO is computed in accordance with the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts (“NAREIT”). NAREIT defines FFO as net income or loss determined in accordance with Generally Accepted Accounting Principles (“GAAP”), excluding extraordina ...

... FFO is computed in accordance with the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts (“NAREIT”). NAREIT defines FFO as net income or loss determined in accordance with Generally Accepted Accounting Principles (“GAAP”), excluding extraordina ...

WILSON GREATBATCH TECHNOLOGIES INC

... -----------------------On May 28, 2003, we issued and sold $170,000,000 aggregate principal amount of our 2 ¼% Convertible Subordinated Debentures due 2013 in a private offering. Selling securityholders will use this prospectus to resell the debentures and the shares of our common stock issuable upo ...

... -----------------------On May 28, 2003, we issued and sold $170,000,000 aggregate principal amount of our 2 ¼% Convertible Subordinated Debentures due 2013 in a private offering. Selling securityholders will use this prospectus to resell the debentures and the shares of our common stock issuable upo ...

CUMULUS MEDIA INC (Form: 10-K, Received: 03/17

... Our strategy has evolved as we recognize that large radio markets can provide an attractive combination of scale, stability and opportunity for future growth, particularly for emerging digital advertising initiatives. According to BIA, these markets typically have per capita and household income, an ...

... Our strategy has evolved as we recognize that large radio markets can provide an attractive combination of scale, stability and opportunity for future growth, particularly for emerging digital advertising initiatives. According to BIA, these markets typically have per capita and household income, an ...

The Development of Secondary Market Liquidity for NYSE

... stabilization and may discontinue support at any time. Since the underwriter trades through a floor broker, we expect underwriter stabilization to result in a high floor contribution to bid depth when other buying interest at the offer price is low. Stabilization may also have indirect effects on li ...

... stabilization and may discontinue support at any time. Since the underwriter trades through a floor broker, we expect underwriter stabilization to result in a high floor contribution to bid depth when other buying interest at the offer price is low. Stabilization may also have indirect effects on li ...

1 Plaintiff`s First Amended Consolidated Class Action Complaint 01

... stock was, and is, registered with the SEC pursuant to the Exchange Act, traded on the New York Stock Exchange (the "NYSE"), and governed by the provisions of the federal securities laws, the Individual Defendants each had a duty to disseminate promptly, accurate and truthful information with respec ...

... stock was, and is, registered with the SEC pursuant to the Exchange Act, traded on the New York Stock Exchange (the "NYSE"), and governed by the provisions of the federal securities laws, the Individual Defendants each had a duty to disseminate promptly, accurate and truthful information with respec ...

Do Noise Traders Move Markets?

... be net buyers or net sellers of the same stocks; if, instead, noise traders buy and sell randomly, their trades tend to cancel, rather than reinforce, each other. Third, there must be limits to the ability of rational, well-informed investors to correct mispricing through arbitrage. If these conditi ...

... be net buyers or net sellers of the same stocks; if, instead, noise traders buy and sell randomly, their trades tend to cancel, rather than reinforce, each other. Third, there must be limits to the ability of rational, well-informed investors to correct mispricing through arbitrage. If these conditi ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.