A review of Israel`s Capital market:

... different sectors of the economy, but with a heavy emphasis on the financial sector where half of the companies can be classified as affiliated to business groups. A recent report issued by the Bank of Israel found that companies affiliated to these business groups tended to be mature, exhibit lower ...

... different sectors of the economy, but with a heavy emphasis on the financial sector where half of the companies can be classified as affiliated to business groups. A recent report issued by the Bank of Israel found that companies affiliated to these business groups tended to be mature, exhibit lower ...

Form 10-K, 7/15/02

... Independent Feature Film Production and Financing. Generally, independent production companies do not have access to the extensive capital required to make big budget motion pictures, such as the "blockbuster" product produced by the major studios. They also do not have the capital necessary to main ...

... Independent Feature Film Production and Financing. Generally, independent production companies do not have access to the extensive capital required to make big budget motion pictures, such as the "blockbuster" product produced by the major studios. They also do not have the capital necessary to main ...

Do Retail Trades Move Markets? - Faculty Directory | Berkeley-Haas

... stocks one week (or month) as they did the previous week (or month). (3) Stocks heavily bought by individual investors one week (i.e., stocks for which most small trades that week are buyer initiated) earn strong returns contemporaneously and in the subsequent week, while stocks heavily sold one wee ...

... stocks one week (or month) as they did the previous week (or month). (3) Stocks heavily bought by individual investors one week (i.e., stocks for which most small trades that week are buyer initiated) earn strong returns contemporaneously and in the subsequent week, while stocks heavily sold one wee ...

Investor Sentiment and the Mean-Variance Relation

... studies find consistent evidence that sentiment-driven investors participate and trade more aggressively in high-sentiment periods (e.g. Karlsson, Loewenstein, and Seppi (2005), Yuan (2008)). Second, because sentiment traders tend to be inexperienced and naive investors, they are likely to have a po ...

... studies find consistent evidence that sentiment-driven investors participate and trade more aggressively in high-sentiment periods (e.g. Karlsson, Loewenstein, and Seppi (2005), Yuan (2008)). Second, because sentiment traders tend to be inexperienced and naive investors, they are likely to have a po ...

prospectus

... Any investment involves risk, and there is no assurance that the Fund’s objective will be achieved. The Fund is actively managed and the investment techniques and risk analyses used by the Fund’s manager(s) may not produce the desired results. Credit risk is expected to be low for the Fund because i ...

... Any investment involves risk, and there is no assurance that the Fund’s objective will be achieved. The Fund is actively managed and the investment techniques and risk analyses used by the Fund’s manager(s) may not produce the desired results. Credit risk is expected to be low for the Fund because i ...

Sharī`ah and SRI Portfolio Performance in the UK: Effect of Oil Price

... performance, specifically stock returns, which many previous empirical studies have conducted and they found different findings whether there is an effect or not and whether the effect is positive or negative. Studies conducted by Ajmi, et al. (2014) in MENA countries from 2007 until 2012, Narayan a ...

... performance, specifically stock returns, which many previous empirical studies have conducted and they found different findings whether there is an effect or not and whether the effect is positive or negative. Studies conducted by Ajmi, et al. (2014) in MENA countries from 2007 until 2012, Narayan a ...

Frequently Asked Questions about Exchange

... more of these reference assets. Who issues ETNs? ETNs are issued by companies registered with the Securities and Exchange Commission (the “SEC”) that are bank holding companies or banks. What is the difference between a listed debt security ...

... more of these reference assets. Who issues ETNs? ETNs are issued by companies registered with the Securities and Exchange Commission (the “SEC”) that are bank holding companies or banks. What is the difference between a listed debt security ...

THU VI?N PHÁP LU?T

... consultancy, securities depository, securities investment fund management or portfolio management. 20. Securities brokerage means an operation of a securities company acting as an intermediary to buy or sell securities for its customers. 21. Securities dealing means buying or selling securities by a ...

... consultancy, securities depository, securities investment fund management or portfolio management. 20. Securities brokerage means an operation of a securities company acting as an intermediary to buy or sell securities for its customers. 21. Securities dealing means buying or selling securities by a ...

Form 10-K - Investor Relations Solutions

... (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Inte ...

... (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Inte ...

the yale law journal - Queen`s Economics Department

... acquisition agreements, such as asset purchases, stock purchases, and mergers. We note the important role played by the set of embedded options held by the buyer and observe the mix of precise and vague language. In Part II, we set out various explanations for vague provisions and provide the intuit ...

... acquisition agreements, such as asset purchases, stock purchases, and mergers. We note the important role played by the set of embedded options held by the buyer and observe the mix of precise and vague language. In Part II, we set out various explanations for vague provisions and provide the intuit ...

Glove Manufacturers

... worker levy enforced by the Employer Mandatory Commitment (EMC), employers would be disallowed from deducting the levy from the wages of their workers. This could be negative for the glove players as the foreign worker levy is borne by the employees initially. A levy of RM1,850 would increase cost a ...

... worker levy enforced by the Employer Mandatory Commitment (EMC), employers would be disallowed from deducting the levy from the wages of their workers. This could be negative for the glove players as the foreign worker levy is borne by the employees initially. A levy of RM1,850 would increase cost a ...

"Sophisticated Trading and Market Efficiency: Evidence from Macroeconomic News Announcements"

... news reports above {below} a given threshold. For both assets, the Sharpe ratios are lower when the strategies are implemented in the days before announcements than the hours before announcements. The reason is that the return standard deviations are higher and not that the return means are lower. S ...

... news reports above {below} a given threshold. For both assets, the Sharpe ratios are lower when the strategies are implemented in the days before announcements than the hours before announcements. The reason is that the return standard deviations are higher and not that the return means are lower. S ...

Vanguard Ultra-Short-Term Bond Fund Prospectus Investor Shares

... another independent rating agency or, if unrated, are determined to be of comparable quality by the Fund’s advisor; medium-quality fixed income securities are those rated the equivalent of Baa1, Baa2, or Baa3 by Moody‘s or another independent rating agency or, if unrated, are determined to be of com ...

... another independent rating agency or, if unrated, are determined to be of comparable quality by the Fund’s advisor; medium-quality fixed income securities are those rated the equivalent of Baa1, Baa2, or Baa3 by Moody‘s or another independent rating agency or, if unrated, are determined to be of com ...

Did Stop Signs Stop Investor Trading?

... (2006) find that larger OTC firms that were required to increase their disclosure as a result of the 1964 Securities Acts Amendments experienced an increase in firm value. Our results suggest that a regulatory mandate for additional disclosures may not be required and that firm liquidity can still s ...

... (2006) find that larger OTC firms that were required to increase their disclosure as a result of the 1964 Securities Acts Amendments experienced an increase in firm value. Our results suggest that a regulatory mandate for additional disclosures may not be required and that firm liquidity can still s ...

#32842_30_Mutual Fund Regulation_P1 1..72

... references to rules under the ICA unless otherwise noted. Certain of Rule 2a-7’s provisions discussed in this chapter in connection with guarantees, demand features, and asset-backed securities do not apply to such instruments if they were issued on or before February 10, 1998. For a discussion of t ...

... references to rules under the ICA unless otherwise noted. Certain of Rule 2a-7’s provisions discussed in this chapter in connection with guarantees, demand features, and asset-backed securities do not apply to such instruments if they were issued on or before February 10, 1998. For a discussion of t ...

BFC FINANCIAL CORP (Form: 10-K, Received: 04

... originating commercial real estate and business loans, and consumer and small business loans, (iii) purchasing wholesale residential loans from third parties, and (iv) making other investments in mortgage-backed securities, tax certificates and other securities. BankAtlantic is regulated and examine ...

... originating commercial real estate and business loans, and consumer and small business loans, (iii) purchasing wholesale residential loans from third parties, and (iv) making other investments in mortgage-backed securities, tax certificates and other securities. BankAtlantic is regulated and examine ...

株券等の大量保有の状況の開示に関する内閣府令

... (v) Share Certificates, etc. for which a sales agreement has been concluded, but whose transfer has yet to be completed (limited to Share Certificates, etc. which are to be transferred within five days from the date of the agreement, and excluding share certificates for which a sales agreement was c ...

... (v) Share Certificates, etc. for which a sales agreement has been concluded, but whose transfer has yet to be completed (limited to Share Certificates, etc. which are to be transferred within five days from the date of the agreement, and excluding share certificates for which a sales agreement was c ...

0001193125-13-078669 - Lasalle Hotel Properties

... Generally, we may not redeem the Series I Preferred Shares until March , 2018. On or after March , 2018, we may, at our option, redeem the Series I Preferred Shares, in whole or from time to time in part, by paying $25.00 per share, plus any accrued and unpaid distributions to and including the date ...

... Generally, we may not redeem the Series I Preferred Shares until March , 2018. On or after March , 2018, we may, at our option, redeem the Series I Preferred Shares, in whole or from time to time in part, by paying $25.00 per share, plus any accrued and unpaid distributions to and including the date ...

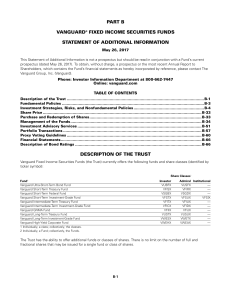

Vanguard Fixed Income Securities Funds Statement of Additional

... Internal Revenue Code of 1986, as amended (the IRC). This special tax status means that the Fund will not be liable for federal tax on income and capital gains distributed to shareholders. In order to preserve its tax status, each Fund must comply with certain requirements. If a Fund fails to meet t ...

... Internal Revenue Code of 1986, as amended (the IRC). This special tax status means that the Fund will not be liable for federal tax on income and capital gains distributed to shareholders. In order to preserve its tax status, each Fund must comply with certain requirements. If a Fund fails to meet t ...

Private Placement Memorandum

... described in this Memorandum. Royal Oak Realty Trust Inc. was formed under the name Buckingham Net Leased Properties Group Inc. but changed its name as of the end of December 2015. We are managed by Cambridge Street Asset Management LLC, an asset manager majority-owned and controlled by our sponsor ...

... described in this Memorandum. Royal Oak Realty Trust Inc. was formed under the name Buckingham Net Leased Properties Group Inc. but changed its name as of the end of December 2015. We are managed by Cambridge Street Asset Management LLC, an asset manager majority-owned and controlled by our sponsor ...

0001193125-13-083748 - Lasalle Hotel Properties

... Generally, we may not redeem the Series I Preferred Shares until March 4, 2018. On or after March 4, 2018, we may, at our option, redeem the Series I Preferred Shares, in whole or from time to time in part, by paying $25.00 per share, plus any accrued and unpaid distributions to and including the da ...

... Generally, we may not redeem the Series I Preferred Shares until March 4, 2018. On or after March 4, 2018, we may, at our option, redeem the Series I Preferred Shares, in whole or from time to time in part, by paying $25.00 per share, plus any accrued and unpaid distributions to and including the da ...

printmgr file - AnnualReports.com

... At our Investor Day in November of 2013, we discussed our potential opportunity to deliver significant growth in adjusted funds from operations (AFFO) per share by pushing on several levers: leasing existing assets and new investments, contractual rent bumps, lower leasing costs and interest savings ...

... At our Investor Day in November of 2013, we discussed our potential opportunity to deliver significant growth in adjusted funds from operations (AFFO) per share by pushing on several levers: leasing existing assets and new investments, contractual rent bumps, lower leasing costs and interest savings ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.