The cost of capital of levered equity is equal to the cost of capital of

... with leverage, VL, by discounting its free cash flow using the weighted average cost of capital. The value of the interest tax shield can then be found by comparing the value of the levered firm, VL, to the unlevered value, VU, of the free cash flow discounted at the firm’s unlevered cost of capit ...

... with leverage, VL, by discounting its free cash flow using the weighted average cost of capital. The value of the interest tax shield can then be found by comparing the value of the levered firm, VL, to the unlevered value, VU, of the free cash flow discounted at the firm’s unlevered cost of capit ...

FOLLOWING MARKET CLOSE March 8, 2016 Red

... of actively buying back shares under an approved normal course issuer bid. The current bid will expire in April 2016 and will be renewed. ...

... of actively buying back shares under an approved normal course issuer bid. The current bid will expire in April 2016 and will be renewed. ...

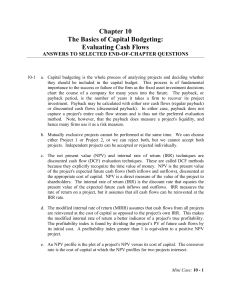

Chapter 10 The Basics of Capital Budgeting: Evaluating Cash Flows

... a. Capital budgeting is the whole process of analyzing projects and deciding whether they should be included in the capital budget. This process is of fundamental importance to the success or failure of the firm as the fixed asset investment decisions chart the course of a company for many years int ...

... a. Capital budgeting is the whole process of analyzing projects and deciding whether they should be included in the capital budget. This process is of fundamental importance to the success or failure of the firm as the fixed asset investment decisions chart the course of a company for many years int ...

Chapter 2

... Rate of Return Rule Accept investments that offer rates of return in excess of their opportunity cost of capital. Example In the project listed below, the foregone investment opportunity is 12%. Should we do the project? profit ...

... Rate of Return Rule Accept investments that offer rates of return in excess of their opportunity cost of capital. Example In the project listed below, the foregone investment opportunity is 12%. Should we do the project? profit ...

RTF 80kB - Commonwealth Grants Commission

... requirement to estimate future population related (compositional and total) and other needs for capital expenditure. Year of use needs are based on known populations, age composition etc. ...

... requirement to estimate future population related (compositional and total) and other needs for capital expenditure. Year of use needs are based on known populations, age composition etc. ...

幻灯片 1

... The Cash Flow Statement summarises the flow of CASH ONLY (not credit transactions) through the business for a given period of time ...

... The Cash Flow Statement summarises the flow of CASH ONLY (not credit transactions) through the business for a given period of time ...

Basic Stock Valuation

... A seasoned equity offering occurs when a company with public stock issues additional shares. After an IPO or SEO, the stock trades in the secondary market, such as the NYSE or Nasdaq. ...

... A seasoned equity offering occurs when a company with public stock issues additional shares. After an IPO or SEO, the stock trades in the secondary market, such as the NYSE or Nasdaq. ...

Cost of Capital for a Project

... earnings, selling debt or selling equity. Does it make any difference how the firm raises money in determining the cost of capital? – How can we determine the proper discount rate when the firm uses both debt and equity? – How do we do capital budgeting when the project has different risk and/or a d ...

... earnings, selling debt or selling equity. Does it make any difference how the firm raises money in determining the cost of capital? – How can we determine the proper discount rate when the firm uses both debt and equity? – How do we do capital budgeting when the project has different risk and/or a d ...

Working capital

... 10 % on both S-T and L-T debt. Three alternatives regarding projected current assets: 1) aggressive (current asstes = 45 % of sales), 2) average (50 % of sales), 3) conservative (60 % of sales). Expected EBIT is 12 % of sales, tax rate is 40 %. What is the expected ROE under each strategy? There is ...

... 10 % on both S-T and L-T debt. Three alternatives regarding projected current assets: 1) aggressive (current asstes = 45 % of sales), 2) average (50 % of sales), 3) conservative (60 % of sales). Expected EBIT is 12 % of sales, tax rate is 40 %. What is the expected ROE under each strategy? There is ...

Telkom - Duke University`s Fuqua School of Business

... – End of apartheid opened SA to foreign investment • new government friendly to foreign investment – A hybrid of the 1st and 3rd worlds • highly developed manufacturing sector, infrastructure – A “gateway” to Africa • “Sets the pace for the rest of Africa.” • the most diverse, advanced economy in Af ...

... – End of apartheid opened SA to foreign investment • new government friendly to foreign investment – A hybrid of the 1st and 3rd worlds • highly developed manufacturing sector, infrastructure – A “gateway” to Africa • “Sets the pace for the rest of Africa.” • the most diverse, advanced economy in Af ...

BUAD 611 – Managerial Finance

... division should invest in a new production process, but a college disagrees, pointing out that because the new investments first-year ROI is only 35 percent, it will hurt performance. How would you respond? First, in order to properly evaluate an investment decision several years of data is required ...

... division should invest in a new production process, but a college disagrees, pointing out that because the new investments first-year ROI is only 35 percent, it will hurt performance. How would you respond? First, in order to properly evaluate an investment decision several years of data is required ...

Governance, Transparency and Good Portfolio Management

... 1. Resource constrained: financial (budget) and staffing 2. “In public eye”: decisions are reviewed publicly 3. Need to demonstrate that decisions not political; need to show financial impact of political constraints 4. Good governance and transparency critical ...

... 1. Resource constrained: financial (budget) and staffing 2. “In public eye”: decisions are reviewed publicly 3. Need to demonstrate that decisions not political; need to show financial impact of political constraints 4. Good governance and transparency critical ...

Cash Available Segment

... Cash Flow Statement Cash available Minus Cash required Equals Cash available less cash required Plus Savings withdrawals Equals Cash position Plus Net borrowing Minus Other uses of cash Minus Additions to savings Equals Ending cash balance Implications for balance sheet ...

... Cash Flow Statement Cash available Minus Cash required Equals Cash available less cash required Plus Savings withdrawals Equals Cash position Plus Net borrowing Minus Other uses of cash Minus Additions to savings Equals Ending cash balance Implications for balance sheet ...

Are Dividends Really as Taxing as Firms Claim

... be very sensitive to changes in interest rates, since there are no coupon payments to reduce the impact of interest rates changes.) Cusser points to the 11 1/4 U.S. Treasuries, which have a face value of $100 but are currently trading at $165 since the market has placed such a high premium on Treasu ...

... be very sensitive to changes in interest rates, since there are no coupon payments to reduce the impact of interest rates changes.) Cusser points to the 11 1/4 U.S. Treasuries, which have a face value of $100 but are currently trading at $165 since the market has placed such a high premium on Treasu ...

Quantitative Techniques and Financial Mathematics

... PV=Discount Factor x C1=1/(1+r) x C1 =5LAC/1.09=Rs.4,58,715.59 Net Present Value=PV-Required Investment NPV=Rs.4,58,715.59-Rs.4,00,00=Rs.58,715.59 NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while compar ...

... PV=Discount Factor x C1=1/(1+r) x C1 =5LAC/1.09=Rs.4,58,715.59 Net Present Value=PV-Required Investment NPV=Rs.4,58,715.59-Rs.4,00,00=Rs.58,715.59 NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while compar ...

Quantitative Techniques and Financial Mathematics

... PV=Discount Factor x C1=1/(1+r) x C1 =5LAC/1.09=Rs.4,58,715.59 Net Present Value=PV-Required Investment NPV=Rs.4,58,715.59-Rs.4,00,00=Rs.58,715.59 NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while compar ...

... PV=Discount Factor x C1=1/(1+r) x C1 =5LAC/1.09=Rs.4,58,715.59 Net Present Value=PV-Required Investment NPV=Rs.4,58,715.59-Rs.4,00,00=Rs.58,715.59 NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while compar ...

Quantitative Techniques and Financial Mathematics

... PV=Discount Factor x C1=1/(1+r) x C1 =5LAC/1.09=Rs.4,58,715.59 Net Present Value=PV-Required Investment NPV=Rs.4,58,715.59-Rs.4,00,00=Rs.58,715.59 NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while compar ...

... PV=Discount Factor x C1=1/(1+r) x C1 =5LAC/1.09=Rs.4,58,715.59 Net Present Value=PV-Required Investment NPV=Rs.4,58,715.59-Rs.4,00,00=Rs.58,715.59 NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while compar ...

SKS Consulting - Company Rescue

... executives’ thoughts on “what immediate changes they would make if it were their company” • Private, individual interviews with leadership team and board members and other key executives • ABC analysis – best and worst performers; are individuals in the right positions? • Organizational structure an ...

... executives’ thoughts on “what immediate changes they would make if it were their company” • Private, individual interviews with leadership team and board members and other key executives • ABC analysis – best and worst performers; are individuals in the right positions? • Organizational structure an ...