Equity Income and Dividend Growth Strategies

... bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the U.S. government. Diversification does not guarantee a profit nor protect against loss. Dividends ...

... bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the U.S. government. Diversification does not guarantee a profit nor protect against loss. Dividends ...

FM11 Ch 07 Show

... which must be paid before dividends can be paid on common stock. However, unlike bonds, preferred stock dividends can be omitted without fear of pushing the firm into bankruptcy. ...

... which must be paid before dividends can be paid on common stock. However, unlike bonds, preferred stock dividends can be omitted without fear of pushing the firm into bankruptcy. ...

FM11 Ch 09 Instructors Manual

... component costs of capital—-debt, preferred stock, and common equity. Each weighting factor is the proportion of that type of capital in the optimal, or target, capital structure. The after-tax cost of debt, rd(1 - T), is the relevant cost to the firm of new debt financing. Since interest is deducti ...

... component costs of capital—-debt, preferred stock, and common equity. Each weighting factor is the proportion of that type of capital in the optimal, or target, capital structure. The after-tax cost of debt, rd(1 - T), is the relevant cost to the firm of new debt financing. Since interest is deducti ...

CAPITAL STRUCTURE ANALYSIS

... common stock, and retained earnings. Sufficient equity must exist to provide financial stability Debt can be used as leverage to increase returns to shareholders, but it can also reduce returns on shareholders’ investments ...

... common stock, and retained earnings. Sufficient equity must exist to provide financial stability Debt can be used as leverage to increase returns to shareholders, but it can also reduce returns on shareholders’ investments ...

PRACTICE ONLY

... (e) Insufficient information provided to answer the question. 12. Suppose you analyze a particular deal and it appears that for an investment of $1,000,000 your client can obtain a positive NPV of over $500,000. Your client is typical of the type of high tax bracket individual investors who commonly ...

... (e) Insufficient information provided to answer the question. 12. Suppose you analyze a particular deal and it appears that for an investment of $1,000,000 your client can obtain a positive NPV of over $500,000. Your client is typical of the type of high tax bracket individual investors who commonly ...

Financial Reporting and Analysis Chapter 11 Web Solutions

... Management might prefer “collateralized” debt if it lowers the cost of debt. Collateralized loans are found in industries where there are valuable “fixed assets” in place—trucking, construction, heavy manufacturing, etc. These kinds of loans are not common in other industries because there are no va ...

... Management might prefer “collateralized” debt if it lowers the cost of debt. Collateralized loans are found in industries where there are valuable “fixed assets” in place—trucking, construction, heavy manufacturing, etc. These kinds of loans are not common in other industries because there are no va ...

Chapter 3

... Regardless of our preferences for cash today versus cash in the future, we should always maximize NPV first. We can then borrow or lend to shift cash flows through time and find our most preferred pattern of cash flows. ...

... Regardless of our preferences for cash today versus cash in the future, we should always maximize NPV first. We can then borrow or lend to shift cash flows through time and find our most preferred pattern of cash flows. ...

a more volatile world The - Around The World in 80 Minutes

... The Prospectus and/or Simplified Prospectus should be read before an investment is made. This document can be obtained from www.bnymellonam.co.uk or by calling 0500 66 00 00. To help us continually improve our service and in the interest of security, we may monitor and/or record your telephone calls ...

... The Prospectus and/or Simplified Prospectus should be read before an investment is made. This document can be obtained from www.bnymellonam.co.uk or by calling 0500 66 00 00. To help us continually improve our service and in the interest of security, we may monitor and/or record your telephone calls ...

Reserve Policy - The District Council of Cleve

... Council has significant cash backed reserves. Council currently does not account for reserves separately but instead invests cash funds for future expenditure as per Council’s Cash Summary presented to Council as an addendum to its Annual Financial Statements. A cash backed reserve is when Council d ...

... Council has significant cash backed reserves. Council currently does not account for reserves separately but instead invests cash funds for future expenditure as per Council’s Cash Summary presented to Council as an addendum to its Annual Financial Statements. A cash backed reserve is when Council d ...

Financial Management in the International Business

... A. Royalties may be levied as a fixed monetary amount per unit of the product the subsidiary sells or as a percentage of a subsidiary's gross revenues B. A fee is compensation for professional services or expertise the parent company or another subsidiary supplies to a foreign subsidiary C. Royaltie ...

... A. Royalties may be levied as a fixed monetary amount per unit of the product the subsidiary sells or as a percentage of a subsidiary's gross revenues B. A fee is compensation for professional services or expertise the parent company or another subsidiary supplies to a foreign subsidiary C. Royaltie ...

BVR8ppt

... Use the industry average market debt ratio, obtained by looking at publicly traded companies in the sector, to estimate the cost of equity and capital. Use an estimated market value of equity, based upon applying a multiple (say a PE ratio) to your private company’s earnings to arrive at a debt to e ...

... Use the industry average market debt ratio, obtained by looking at publicly traded companies in the sector, to estimate the cost of equity and capital. Use an estimated market value of equity, based upon applying a multiple (say a PE ratio) to your private company’s earnings to arrive at a debt to e ...

WORKING CAPITAL MANAGEMENT What is Working Capital

... Pre received Income Other Current Liabilities ...

... Pre received Income Other Current Liabilities ...

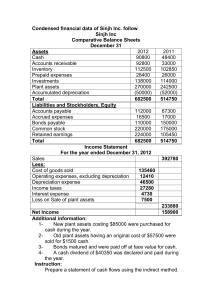

Condensed financial data of Sinjh Inc. follow Sinjh Inc Comparative

... 1New plant assets costing $85000 were purchased for cash during the year. 2Old plant assets having an original cost of $57500 were sold for $1500 cash. 3Bonds matured and were paid off at face value for cash. 4A cash dividend of $40350 was declared and paid during the year. Instruction: Prepare a st ...

... 1New plant assets costing $85000 were purchased for cash during the year. 2Old plant assets having an original cost of $57500 were sold for $1500 cash. 3Bonds matured and were paid off at face value for cash. 4A cash dividend of $40350 was declared and paid during the year. Instruction: Prepare a st ...

Capital Budgeting in Projects

... • Depends on assumptions that cannot be managed or controlled. • Will overall results be close to predicted value? • Sensitivity and risk analysis produce information about uncertainties. • Sensitivity analysis - which assumptions are most important in controlling overall results? • If predicted res ...

... • Depends on assumptions that cannot be managed or controlled. • Will overall results be close to predicted value? • Sensitivity and risk analysis produce information about uncertainties. • Sensitivity analysis - which assumptions are most important in controlling overall results? • If predicted res ...

Slides - World KLEMS

... • Neglects the fact that government has financing costs or opportunity costs • But SNA 2008 maintains that value of capital services for government asset = depreciation • Ironically, net return is needed to identify nonmarket producers ...

... • Neglects the fact that government has financing costs or opportunity costs • But SNA 2008 maintains that value of capital services for government asset = depreciation • Ironically, net return is needed to identify nonmarket producers ...

T14.1 Chapter Outline

... We assume that dividends will grow at a constant growth rate, g. 3. In calculating the firm’s WACC, we use the market value weights of debt and equity, if possible. Why? Because market values reflect the market’s expectations about the size, timing, and risk of future cash flows. ...

... We assume that dividends will grow at a constant growth rate, g. 3. In calculating the firm’s WACC, we use the market value weights of debt and equity, if possible. Why? Because market values reflect the market’s expectations about the size, timing, and risk of future cash flows. ...

Cash Flow IN Sources of Cash Flow in

... minus what a company owes OR What your business is worth at book value (not market value) ...

... minus what a company owes OR What your business is worth at book value (not market value) ...

CIS September 2011 Exam Diet Examination Paper 2.1:

... enterprise under conditions which are potentially unfavourable. B. Cash. C. A contractual right to exchange financial instruments with another company under conditions that are potentially favourable. D. A contractual right to receive cash or another financial instrument from another enterprise. ...

... enterprise under conditions which are potentially unfavourable. B. Cash. C. A contractual right to exchange financial instruments with another company under conditions that are potentially favourable. D. A contractual right to receive cash or another financial instrument from another enterprise. ...