Saving

... • Savings often take the form of financial assets that pay a return: Interest-bearing checking, Bonds, savings, CDs, mutual funds, stocks • The real interest rate (r) is the nominal interest rate (i) minus the rate of inflation () ...

... • Savings often take the form of financial assets that pay a return: Interest-bearing checking, Bonds, savings, CDs, mutual funds, stocks • The real interest rate (r) is the nominal interest rate (i) minus the rate of inflation () ...

Equity Risk, Credit Risk, Default Correlation, and Corporate Sustainability

... Describe results in an empirical analysis of all US listed equities from 1992 to present Show that common conception of “sustainable” investing is confirmed in these results Illustrate an alternative use of this method as a way to define the level of systemic risk to developed economies ...

... Describe results in an empirical analysis of all US listed equities from 1992 to present Show that common conception of “sustainable” investing is confirmed in these results Illustrate an alternative use of this method as a way to define the level of systemic risk to developed economies ...

(DOC file) No 177/2006 amending Rules No 530/2004

... These Rules specify the criteria applied by the Financial Supervisory Authority (FME) for assessing levels of exposure and the need to request capital adequacy ratios above 8% for financial undertakings. Article 2 The weighted overall grade of a financial undertaking must on average be lower than 2. ...

... These Rules specify the criteria applied by the Financial Supervisory Authority (FME) for assessing levels of exposure and the need to request capital adequacy ratios above 8% for financial undertakings. Article 2 The weighted overall grade of a financial undertaking must on average be lower than 2. ...

TNS Kenya coffee - Rural Finance and Investment Learning Centre

... If we don’t provide a solution for start-ups and early-stage expansions, there won’t be any graduates looking for large expansion and mature financing; ...

... If we don’t provide a solution for start-ups and early-stage expansions, there won’t be any graduates looking for large expansion and mature financing; ...

ANNEXURE 2: FINANCIAL RATIOS It is important for business

... ROE can be calculated indirectly as: ROE = (Net Income/Total Assets) (Total Assets/Equity) ROE also can be calculated using the following method: ROE = (Net Income/Sales) (Sales/Total Assets) (Total Assets/Equity) This states that ROE is determined by multiplication of three levers: ...

... ROE can be calculated indirectly as: ROE = (Net Income/Total Assets) (Total Assets/Equity) ROE also can be calculated using the following method: ROE = (Net Income/Sales) (Sales/Total Assets) (Total Assets/Equity) This states that ROE is determined by multiplication of three levers: ...

Risk Architectural Principles

... – Focus on RoE and RoRWA to drive share price – this is good for the taxpayer! – Balance sheet optimisation Closer engagement with the customer to re-build trust – Here data and analytics are key Increased spend in the risk space – 50% of consulting spend is in this area – Stress testing and com ...

... – Focus on RoE and RoRWA to drive share price – this is good for the taxpayer! – Balance sheet optimisation Closer engagement with the customer to re-build trust – Here data and analytics are key Increased spend in the risk space – 50% of consulting spend is in this area – Stress testing and com ...

Extending Factor Models of Equity Risk to Credit Risk, Default Correlation, and Corporate Sustainability

... We propose “revenue weighted” expected average life as a measure of systemic stress on an economy By revenue weighting we capture the stress in the real economy Avoids bias of cap weighting since failing firm’s have small market capitalization and don’t count as much ...

... We propose “revenue weighted” expected average life as a measure of systemic stress on an economy By revenue weighting we capture the stress in the real economy Avoids bias of cap weighting since failing firm’s have small market capitalization and don’t count as much ...

presentation

... Note: Consensus on average years to convergence forecasted by different growth models (Barro model and Levine- Renelt model in Fisher et al (1998) and EU commission convergence model (2001). EU standards are based upon per capita GDP of the three low income EU members, Portugal, Spain and Greece, wi ...

... Note: Consensus on average years to convergence forecasted by different growth models (Barro model and Levine- Renelt model in Fisher et al (1998) and EU commission convergence model (2001). EU standards are based upon per capita GDP of the three low income EU members, Portugal, Spain and Greece, wi ...

Note 3 Finansiell risikostyring_EN

... loans. The fair value of all the company's borrowings taken out before 31 December 2009 will be affected by changes in interest rates, including changes in credit spreads. In the course of 2011 the change in credit spreads, viewed in isolation, resulted in a NOK 20 million reduction in the fair valu ...

... loans. The fair value of all the company's borrowings taken out before 31 December 2009 will be affected by changes in interest rates, including changes in credit spreads. In the course of 2011 the change in credit spreads, viewed in isolation, resulted in a NOK 20 million reduction in the fair valu ...

Financial Targets / Capital Efficiency

... Please refer to the 2011 Annual Report and Accounts for the definition of terms used in this presentation. Set out below, are the definitions of terms not defined in the 2011 Annual Report and Accounts. RoRWA ...

... Please refer to the 2011 Annual Report and Accounts for the definition of terms used in this presentation. Set out below, are the definitions of terms not defined in the 2011 Annual Report and Accounts. RoRWA ...

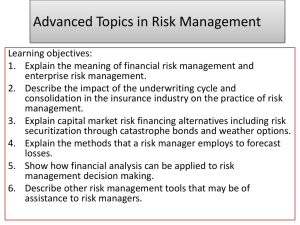

Advanced Topics in Risk Management

... budgeting perspective by employing time value of money analysis. Capital budgeting : a method of determining which capital investment projects a company should undertake. Only those projects that benefit the organization financially should be accepted. If not enough capital is available to undertake ...

... budgeting perspective by employing time value of money analysis. Capital budgeting : a method of determining which capital investment projects a company should undertake. Only those projects that benefit the organization financially should be accepted. If not enough capital is available to undertake ...

FDI Glossary - Office for National Statistics

... Coefficient of variation- standard error expressed as percentage of total value. Creditor/Debtor principle- A debtor is a person or an entity which has a financial obligation to another person or entity. Conversely, a creditor is a person or entity which has a financial claim on another person or e ...

... Coefficient of variation- standard error expressed as percentage of total value. Creditor/Debtor principle- A debtor is a person or an entity which has a financial obligation to another person or entity. Conversely, a creditor is a person or entity which has a financial claim on another person or e ...

chapter 2 2

... they used no DCF approach at all, and 9% used no formal analysis of any form. Little use was ever made of any market value rules afforded by present-value analysis.xii In an examination in 1986 of surveys and the finance literature Bhandari said that ‘… in small firms, payback is not simply the majo ...

... they used no DCF approach at all, and 9% used no formal analysis of any form. Little use was ever made of any market value rules afforded by present-value analysis.xii In an examination in 1986 of surveys and the finance literature Bhandari said that ‘… in small firms, payback is not simply the majo ...

Two Agency-Cost Explanations of Dividends

... o prosperous firms often withhold dividends because internal financing is cheaper than issuing dividends and floating new securities o however, dividends do not distinguish well-managed firms from others they are not irrational for poorly-managed or failing firms such firms should disinvest or l ...

... o prosperous firms often withhold dividends because internal financing is cheaper than issuing dividends and floating new securities o however, dividends do not distinguish well-managed firms from others they are not irrational for poorly-managed or failing firms such firms should disinvest or l ...

Processing`s Domino Effect

... even better premium, 30%, based on the stock’s price the day before the deal’s May 17 announcement. In addition to rewarding the shareholders, “our clients will now have the added benefit of working with an organization that is completely focused on their success,” said J. Michael Parks, chief execu ...

... even better premium, 30%, based on the stock’s price the day before the deal’s May 17 announcement. In addition to rewarding the shareholders, “our clients will now have the added benefit of working with an organization that is completely focused on their success,” said J. Michael Parks, chief execu ...

Capital Flows to Emerging Market Economies

... The level of complexity of capital controls has to be weighed against the administrative capacity of regulators. If capital flow regulation taxes risky forms of flows more than safe forms, then it will achieve a shift in the liability structure of emerging economies towards safer forms of finance. ...

... The level of complexity of capital controls has to be weighed against the administrative capacity of regulators. If capital flow regulation taxes risky forms of flows more than safe forms, then it will achieve a shift in the liability structure of emerging economies towards safer forms of finance. ...

C 0 - chass.utoronto

... • Since borrowing and lending take place at the same rate of interest, then the individual’s production optimum is independent of his resources and tastes • If asked to vote on their preferred production decisions at a shareholder’s meeting, different shareholders will be unanimous in their decision ...

... • Since borrowing and lending take place at the same rate of interest, then the individual’s production optimum is independent of his resources and tastes • If asked to vote on their preferred production decisions at a shareholder’s meeting, different shareholders will be unanimous in their decision ...