New EDHEC-Risk Institute research examines dynamic hedging of

... other reasons. If the substitute asset were perfectly correlated with the actual underlying asset, no further risk would be introduced, since one could offset any gain or loss in the option position by dynamically trading the substitute asset. In general, however, correlation is not perfect, and the ...

... other reasons. If the substitute asset were perfectly correlated with the actual underlying asset, no further risk would be introduced, since one could offset any gain or loss in the option position by dynamically trading the substitute asset. In general, however, correlation is not perfect, and the ...

The course presents an introduction to financial intermediation and

... role financial intermediaries have in insuring borrowers. We will then move to the trading industry and firstly analyse liquidity provision as a trading motive within both dealer markets (inventory models) and the limit order book. Then, we’ll introduce asymm ...

... role financial intermediaries have in insuring borrowers. We will then move to the trading industry and firstly analyse liquidity provision as a trading motive within both dealer markets (inventory models) and the limit order book. Then, we’ll introduce asymm ...

Sarris Alexander

... Cost modest. Between 2006 and 2008 the total cereal import bill of LDCs increased by roughly 20 percent or about 4 billion US$. If 10 percent of that could have been considered as extraordinary cost of vulnerable poor countries that would be compensated by developed countries as extraordinary aid un ...

... Cost modest. Between 2006 and 2008 the total cereal import bill of LDCs increased by roughly 20 percent or about 4 billion US$. If 10 percent of that could have been considered as extraordinary cost of vulnerable poor countries that would be compensated by developed countries as extraordinary aid un ...

A look at trading volumes in the euro

... electronic brokers. Given that electronically brokered transactions cover only a part of FX markets, it would be misleading to use them as a proxy for total turnover.13 Subject to this important caveat, however, they support the conclusion reached by looking at traders’ informal estimates. Another s ...

... electronic brokers. Given that electronically brokered transactions cover only a part of FX markets, it would be misleading to use them as a proxy for total turnover.13 Subject to this important caveat, however, they support the conclusion reached by looking at traders’ informal estimates. Another s ...

Total Return Swap

... The same rules that apply to residents (including taxation) apply to non-residents trading through 2689. However, from time to time there may be exceptions regarding taxation (e.g. CPMF tax on equities). ...

... The same rules that apply to residents (including taxation) apply to non-residents trading through 2689. However, from time to time there may be exceptions regarding taxation (e.g. CPMF tax on equities). ...

Document

... Cyclically Bonds are Vulnerable to Interest Rate/Inflation Risks Small Rise in Interest Rates Leads to Substantial Losses in Bonds Commodities Continue Secular Uptrend Risky for Bonds Opportunities in Inflation Sensitive Securities ...

... Cyclically Bonds are Vulnerable to Interest Rate/Inflation Risks Small Rise in Interest Rates Leads to Substantial Losses in Bonds Commodities Continue Secular Uptrend Risky for Bonds Opportunities in Inflation Sensitive Securities ...

Investigators probe $500tn interest rate swaps market

... the market totalled $505tn, around 80 per cent of the global swaps market, according to figures from the Bank for International Settlements. Isdafix prices are also used to settle interest rate swaps futures contracts traded on the Chicago Mercantile Exchange, the world’s most liquid futures market. ...

... the market totalled $505tn, around 80 per cent of the global swaps market, according to figures from the Bank for International Settlements. Isdafix prices are also used to settle interest rate swaps futures contracts traded on the Chicago Mercantile Exchange, the world’s most liquid futures market. ...

using pls methodology for understanding commodity market

... specific price behaviour can be observed in commodities market. This new behaviour characterised by both increasing prices and volatilities (Alquist and Kilian, 2010; Dvir and Rogo, 2010), but also increasing co-movements (Steen and Gjolberg, 2013; West and Wong, 2014) in commodity market prices hav ...

... specific price behaviour can be observed in commodities market. This new behaviour characterised by both increasing prices and volatilities (Alquist and Kilian, 2010; Dvir and Rogo, 2010), but also increasing co-movements (Steen and Gjolberg, 2013; West and Wong, 2014) in commodity market prices hav ...

Financial markets in popular culture

... Much effort has gone into the study of financial markets and how prices vary with time. Charles Dow, one of the founders of Dow Jones & Company and The Wall Street Journal, enunciated a set of ideas on the subject which are now called Dow Theory. This is the basis of the so-called technical analysis ...

... Much effort has gone into the study of financial markets and how prices vary with time. Charles Dow, one of the founders of Dow Jones & Company and The Wall Street Journal, enunciated a set of ideas on the subject which are now called Dow Theory. This is the basis of the so-called technical analysis ...

Circuit Breaker Levels for the Fourth Quarter

... There may be occasions when marketplaces in Canada are open for trading and the NYSE is closed for a recognized holiday in the United States. On those days, IIROC would invoke “circuit breakers” using levels representing 10%, 20% and 30% of the average closing value of the S&P/TSX Composite Index in ...

... There may be occasions when marketplaces in Canada are open for trading and the NYSE is closed for a recognized holiday in the United States. On those days, IIROC would invoke “circuit breakers” using levels representing 10%, 20% and 30% of the average closing value of the S&P/TSX Composite Index in ...

Introduction

... Futures Contracts - standardized forward contracts that are traded on some organized exchange A futures contract is a legally binding agreement between a seller and buyer, that calls for the seller to deliver to the buyer a standardized commodity (with specified quantity and quality) at a set price ...

... Futures Contracts - standardized forward contracts that are traded on some organized exchange A futures contract is a legally binding agreement between a seller and buyer, that calls for the seller to deliver to the buyer a standardized commodity (with specified quantity and quality) at a set price ...

Crisis Regulation: Reacting to High Energy Prices

... underlies prices are typically not of concern. We know exactly what is being traded at exactly what price, and how many contracts change hands. Moreover, although there are requirements that exchanges publish daily information on prices, trading volume and open interest, the level of ...

... underlies prices are typically not of concern. We know exactly what is being traded at exactly what price, and how many contracts change hands. Moreover, although there are requirements that exchanges publish daily information on prices, trading volume and open interest, the level of ...

50 The LC Gupta Committee Report: Some Observations

... when the product concerned is stock index futures contracts. As discussed in Bhaumik (1998), effective enforcement of margin requirements is an important precondition for avoidance of a derivatives-market-initiated systemic crisis. This, in turn, requires daily settlement of margin calls by traders ...

... when the product concerned is stock index futures contracts. As discussed in Bhaumik (1998), effective enforcement of margin requirements is an important precondition for avoidance of a derivatives-market-initiated systemic crisis. This, in turn, requires daily settlement of margin calls by traders ...

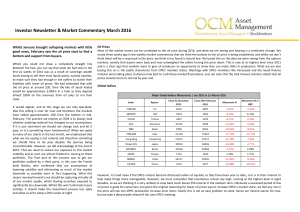

Market Commentary March 2016

... expected, namely that we are seeing deflation on the back of the lower oil prices. If we strip this out we are seeing inflation now running at 0.3% from 0.7%, which again raises the question, what will the European Central Bank (ECB) do next? The obvious call is an enlarged asset buying programme to ...

... expected, namely that we are seeing deflation on the back of the lower oil prices. If we strip this out we are seeing inflation now running at 0.3% from 0.7%, which again raises the question, what will the European Central Bank (ECB) do next? The obvious call is an enlarged asset buying programme to ...

WisdomTree Launches Emerging Markets High

... respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages ...

... respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages ...

Five Over Five - Research and Perspectives

... group which includes Australia, New Zealand and Canada, then the U.S. and the UK, thirdly Europe, and with Japan bringing up the rear. China, now the world’s No. 2 economy, is, although slowing, in a league of its own, with official GDP near 7% today and unofficial estimates ranging around 5%. Apart ...

... group which includes Australia, New Zealand and Canada, then the U.S. and the UK, thirdly Europe, and with Japan bringing up the rear. China, now the world’s No. 2 economy, is, although slowing, in a league of its own, with official GDP near 7% today and unofficial estimates ranging around 5%. Apart ...

Emerging Market Overview_March 2016

... We remain well positioned in financials and consumer-related stocks. Banks are showing signs that the worst of the provisions for bad loans have been completed, and we could see banking portfolios with improved asset quality in 2017. In the consumer space, we continue to favour companies with low-ti ...

... We remain well positioned in financials and consumer-related stocks. Banks are showing signs that the worst of the provisions for bad loans have been completed, and we could see banking portfolios with improved asset quality in 2017. In the consumer space, we continue to favour companies with low-ti ...

Chap31

... $0.8229 on October 27, 2000. Potential participants include the U.K. and Sweden; Denmark voted against joining the EMU on September 28, 2000. ...

... $0.8229 on October 27, 2000. Potential participants include the U.K. and Sweden; Denmark voted against joining the EMU on September 28, 2000. ...

News Release Template:

... investment objectives. Gold may not provide long-term investment returns. Gold is a commodity, and, like other commodities, its price can fluctuate dramatically.” Historically speaking, the value of gold-related investments fluctuates even more than the stock market. Gold often moves in reverse of s ...

... investment objectives. Gold may not provide long-term investment returns. Gold is a commodity, and, like other commodities, its price can fluctuate dramatically.” Historically speaking, the value of gold-related investments fluctuates even more than the stock market. Gold often moves in reverse of s ...

Derivatives in India

... Definition and Uses of Derivatives A derivative security is a financial contract whose value is derived from the value of something else, such as a stock price, a commodity price, an exchange rate, an interest rate, or even an index of prices. In the Appendix, I describe some simple types of derivat ...

... Definition and Uses of Derivatives A derivative security is a financial contract whose value is derived from the value of something else, such as a stock price, a commodity price, an exchange rate, an interest rate, or even an index of prices. In the Appendix, I describe some simple types of derivat ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.