Futures, Forwards, Options and Swaps FOCUS OF THE CHAPTER

... Hedge funds represent a pooling of funds from wealthy investors and large institutional investors that use spot and derivative market instruments to reduce investment risk (by combining leverage and short-selling). Margin is the amount of cash (deposit) put up by the investor as a security against ...

... Hedge funds represent a pooling of funds from wealthy investors and large institutional investors that use spot and derivative market instruments to reduce investment risk (by combining leverage and short-selling). Margin is the amount of cash (deposit) put up by the investor as a security against ...

Chapter 10 Forwards and Futures

... One problem with using forwards to hedge is that they are illiquid. Thus, if after 1 month you discover that there is no oil, then you no longer need the forward contract. In fact, holding just the forward contract you are now exposed to the risk of oil-price changes. In this case, you would want to ...

... One problem with using forwards to hedge is that they are illiquid. Thus, if after 1 month you discover that there is no oil, then you no longer need the forward contract. In fact, holding just the forward contract you are now exposed to the risk of oil-price changes. In this case, you would want to ...

Chapter 1: An Introduction to Corporate Finance

... Spot Versus Forward Contracts • A spot contract establishes a price today for immediate delivery of an asset, with the immediacy of the delivery depending on the nature of the underlying asset • A forward contract establishes a price today for future delivery on an asset, and can be specified for a ...

... Spot Versus Forward Contracts • A spot contract establishes a price today for immediate delivery of an asset, with the immediacy of the delivery depending on the nature of the underlying asset • A forward contract establishes a price today for future delivery on an asset, and can be specified for a ...

what the fed liftoff means for the us dollar and stocks

... Disclaimer: The information and opinions in this report are for general information use only and are not intended as an o er or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notic ...

... Disclaimer: The information and opinions in this report are for general information use only and are not intended as an o er or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notic ...

Course 5B Investment Management and

... Apply the appropriate principal methods (i.e. the standard Black-Scholes model and its variations), other models of a stochastic nature and numerical procedures in the valuation of equity, currency and commodity related derivatives. ...

... Apply the appropriate principal methods (i.e. the standard Black-Scholes model and its variations), other models of a stochastic nature and numerical procedures in the valuation of equity, currency and commodity related derivatives. ...

Trading Corner - Eurex Exchange

... markdowns or other added spreads. This direct market access also means that existing positions can be closed out without having to rely on one particular bank or broker – trades are executed on the market, at the best available price. • It is also important to note that Eurex Clearing remains the ce ...

... markdowns or other added spreads. This direct market access also means that existing positions can be closed out without having to rely on one particular bank or broker – trades are executed on the market, at the best available price. • It is also important to note that Eurex Clearing remains the ce ...

“Carry Trade” Model of Commodity Prices

... This paper presents and attempts to estimate a model of macroeconomic determinants of prices of oil and other commodities, with an emphasis on the intermediating role of inventories. It could be called the “carry trade” model in the light it shines on the trade-off between interest rates and specula ...

... This paper presents and attempts to estimate a model of macroeconomic determinants of prices of oil and other commodities, with an emphasis on the intermediating role of inventories. It could be called the “carry trade” model in the light it shines on the trade-off between interest rates and specula ...

Extended Hours Trading Disclosure

... securities. Generally, the more orders that are available in a market, the greater the liquidity. Liquidity is important because with greater liquidity it is easier for investors to buy or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securi ...

... securities. Generally, the more orders that are available in a market, the greater the liquidity. Liquidity is important because with greater liquidity it is easier for investors to buy or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securi ...

PAKISTAN STOCK EXCHANGE LIMITED Stock Exchange

... trading day prior to expiration, the customer shall be obligated to make or take delivery of the underlying securities, which could involve additional costs. The customer should carefully review the settlement and delivery conditions before entering into an equity futures contract. (h) Day trading s ...

... trading day prior to expiration, the customer shall be obligated to make or take delivery of the underlying securities, which could involve additional costs. The customer should carefully review the settlement and delivery conditions before entering into an equity futures contract. (h) Day trading s ...

Buyside Traders Want SEC to Press Exchanges and Dark Pools for

... Buyside traders want the Securities and Exchange Commission to wrest information about the inner workings of exchanges and alternative trading systems from their operators. That was the consensus of traders from 37 buyside desks that participated in a workshop put together by brokerdealer Bloomberg ...

... Buyside traders want the Securities and Exchange Commission to wrest information about the inner workings of exchanges and alternative trading systems from their operators. That was the consensus of traders from 37 buyside desks that participated in a workshop put together by brokerdealer Bloomberg ...

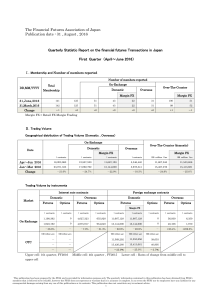

The Financial Futures Association of Japan Publication date : 31

... yen converted value of quarterly trading volume (in units) multiplied by the number of contracts. ・FFAJ converts the amounts of trading volume and open positions denominated in a foreign currency into JPY based on the value of each currency against the yen spot rate published by the Bank of Japan on ...

... yen converted value of quarterly trading volume (in units) multiplied by the number of contracts. ・FFAJ converts the amounts of trading volume and open positions denominated in a foreign currency into JPY based on the value of each currency against the yen spot rate published by the Bank of Japan on ...

Chapter 3: How Securities are Traded

... • Nasdaq and NYSE have evolved in response to new information technology • Both have increased their commitment to automated electronic trading ...

... • Nasdaq and NYSE have evolved in response to new information technology • Both have increased their commitment to automated electronic trading ...

New Evidence on the Financialization of Commodity Markets*

... underlying futures prices increase on the pricing dates when the hedge trades are executed, and decrease on the determination dates when the hedge trades are unwound. The OTC CLN issuances provide a convenient dataset to study the impact of investor flows for several reasons. First, it seems unlikel ...

... underlying futures prices increase on the pricing dates when the hedge trades are executed, and decrease on the determination dates when the hedge trades are unwound. The OTC CLN issuances provide a convenient dataset to study the impact of investor flows for several reasons. First, it seems unlikel ...

Fact Sheet - Toroso Investments

... management of the Sector Opportunities Portfolio. The market price for a share of an ETP may fluctuate from the value of its underlying securities. Consequently, ETPs can trade at a discount or premium to their net asset value. Certain equity and commodity ETPs are often more volatile and less liqui ...

... management of the Sector Opportunities Portfolio. The market price for a share of an ETP may fluctuate from the value of its underlying securities. Consequently, ETPs can trade at a discount or premium to their net asset value. Certain equity and commodity ETPs are often more volatile and less liqui ...

A Year to Remember The U.S. stock market punctuated an

... If anything, the five-year gains since the market downturn have been even more extraordinary. The Wilshire 5000 has posted an average 18.58% gains over the last 60 months, and the midcap (23.08%) and small cap (23.86%) indices have fared even better. Investors who got out of stocks during the marke ...

... If anything, the five-year gains since the market downturn have been even more extraordinary. The Wilshire 5000 has posted an average 18.58% gains over the last 60 months, and the midcap (23.08%) and small cap (23.86%) indices have fared even better. Investors who got out of stocks during the marke ...

Securities Markets Primary Versus Secondary Markets How

... Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...

... Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...

Weekly Economic Update - flight wealth management

... & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerl ...

... & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerl ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.