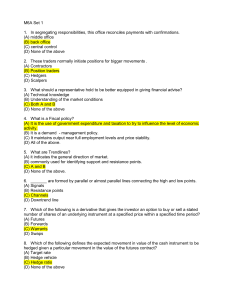

In segregating responsibilities, this office reconciles payments with

... (D) None of the above. 35. They usually trade for small gains. (A) Arbitrageurs (B) Scalpers (C) Speculators (D) Portfolio managers 36. Which of the following is financial instruments that combine an underlying asset with an option, where the payoff profile of the return component has an 'all or not ...

... (D) None of the above. 35. They usually trade for small gains. (A) Arbitrageurs (B) Scalpers (C) Speculators (D) Portfolio managers 36. Which of the following is financial instruments that combine an underlying asset with an option, where the payoff profile of the return component has an 'all or not ...

Document

... 6. Which sources of investment information are the most helpful to investors? 7. What can investors learn from stock, bond, and mutual fund quotations? 8. What are the current trends in the securities markets? ...

... 6. Which sources of investment information are the most helpful to investors? 7. What can investors learn from stock, bond, and mutual fund quotations? 8. What are the current trends in the securities markets? ...

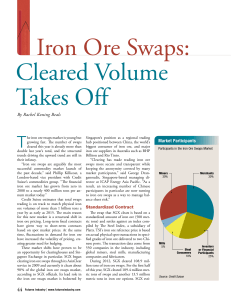

Iron Ore Swaps: Cleared Volume Takes Off

... Credit Suisse estimates that total swaps trading is on track to match physical iron ore volumes of more than 1 billion tons a year by as early as 2015. The main reason for this new market is a structural shift in iron ore pricing. Long-term fixed contracts have given way to short-term contracts base ...

... Credit Suisse estimates that total swaps trading is on track to match physical iron ore volumes of more than 1 billion tons a year by as early as 2015. The main reason for this new market is a structural shift in iron ore pricing. Long-term fixed contracts have given way to short-term contracts base ...

Demutualization of Stock Exchanges - SelectedWorks

... set the listing criterion to be too high, many firms may not be able to list their securities in the trading platform. This in turn implies that exchange will lose revenue from listing fees. On the other hand, if the eligibility criterion is set too low poor quality securities will get listed which ...

... set the listing criterion to be too high, many firms may not be able to list their securities in the trading platform. This in turn implies that exchange will lose revenue from listing fees. On the other hand, if the eligibility criterion is set too low poor quality securities will get listed which ...

ITEM

... Measures the rate of change of option value with respect to changes in the underlying asset's price The amount covered or exposed to the derivative. For 1000000 (€, futures and options corresponds to contract size etc.) multiplied by the number of contracts and for swaps and forwards corresponds to ...

... Measures the rate of change of option value with respect to changes in the underlying asset's price The amount covered or exposed to the derivative. For 1000000 (€, futures and options corresponds to contract size etc.) multiplied by the number of contracts and for swaps and forwards corresponds to ...

С П Е Ц И Ф И К А Ц И Я

... PLATT’S makes no warranties, express or implied, as to the results to be obtained by any person or entity from use of the index/assessment, trading based on the index/assessment, or any data included therein in connection with the trading of the contracts, or for any other use PLATT’S makes no warra ...

... PLATT’S makes no warranties, express or implied, as to the results to be obtained by any person or entity from use of the index/assessment, trading based on the index/assessment, or any data included therein in connection with the trading of the contracts, or for any other use PLATT’S makes no warra ...

OTC Derivatives Presentation

... – Like a futures contract, an agreement to buy or sell an asset at a specified future time and price – Customized between parties and not exchange traded • Can be for any underlier • Can be for any settlement date ...

... – Like a futures contract, an agreement to buy or sell an asset at a specified future time and price – Customized between parties and not exchange traded • Can be for any underlier • Can be for any settlement date ...

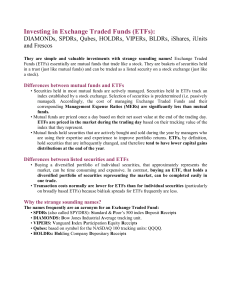

Investing in Exchange Traded Funds (ETFs):

... One of the more popular strategies! Investors place a large portion (i.e. the core) of their equity portfolio into Exchange Traded Funds. This portion acts as the anchor for the portfolio, ensuring that portfolio performance will approximate stock market returns. Size of the core depends upon the am ...

... One of the more popular strategies! Investors place a large portion (i.e. the core) of their equity portfolio into Exchange Traded Funds. This portion acts as the anchor for the portfolio, ensuring that portfolio performance will approximate stock market returns. Size of the core depends upon the am ...

Goldman Sachs Funds: Questions and Answers on Market Timing

... According to media reports, these are industry-wide inquiries, and in the case of the Securities and Exchange Commission informational requests have reportedly been made broadly across all of the major fund companies and broker/dealers. Goldman Sachs has received requests for information and we have ...

... According to media reports, these are industry-wide inquiries, and in the case of the Securities and Exchange Commission informational requests have reportedly been made broadly across all of the major fund companies and broker/dealers. Goldman Sachs has received requests for information and we have ...

The 2008 Cotton Price Spike and Extraordinary Hedging Costs

... number of U.S. acres planted in cotton in 2008/09 would be the lowest of any of the previous 25 years. However, very high levels of end-of-year inventories, both in the United States and else where, should have moderated prices. In addition, there was new specula tive activity in cotton futures. S ...

... number of U.S. acres planted in cotton in 2008/09 would be the lowest of any of the previous 25 years. However, very high levels of end-of-year inventories, both in the United States and else where, should have moderated prices. In addition, there was new specula tive activity in cotton futures. S ...

trading instructions

... (4) The Stock Exchange informs the Republic of Srpska Securities Commission on reported block trades. (5) The Stock Exchange keeps a special record of block trades. Interrupted auctions due to price fluctuations Article 5 (1) According to the Article 109, paragraph 1 of the Rules, trading interval i ...

... (4) The Stock Exchange informs the Republic of Srpska Securities Commission on reported block trades. (5) The Stock Exchange keeps a special record of block trades. Interrupted auctions due to price fluctuations Article 5 (1) According to the Article 109, paragraph 1 of the Rules, trading interval i ...

File: Ch04, Chapter 4 Securities Markets Type: Multiple Choice 1

... 2. Why do most companies use investment bankers to help with IPOs? a)The use of investment bankers is required by the Securities and Exchange Commission. b) The investment banks have huge amounts of money, and seek many investment opportunities. c) The investment banks have substantial expertise in ...

... 2. Why do most companies use investment bankers to help with IPOs? a)The use of investment bankers is required by the Securities and Exchange Commission. b) The investment banks have huge amounts of money, and seek many investment opportunities. c) The investment banks have substantial expertise in ...

Vanguard High Dividend Yield Index Fund ETF Shares

... Consequently, these ETFs may experience losses even in situations where the underlying index or benchmark has performed as hoped. Aggressive investment techniques such as futures, forward contracts, swap agreements, derivatives, options, can increase ETF volatility and decrease performance. Investor ...

... Consequently, these ETFs may experience losses even in situations where the underlying index or benchmark has performed as hoped. Aggressive investment techniques such as futures, forward contracts, swap agreements, derivatives, options, can increase ETF volatility and decrease performance. Investor ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... need to be in a market where they are able to actively manage and devise mechanisms that promote fund growth and managing the risks they are exposed to. Derivatives are financial instruments in the form of contracts, the value of which is derived from the value of an underlying asset, Apanardet al. ...

... need to be in a market where they are able to actively manage and devise mechanisms that promote fund growth and managing the risks they are exposed to. Derivatives are financial instruments in the form of contracts, the value of which is derived from the value of an underlying asset, Apanardet al. ...

Food Commodity Prices Volatility: The Role of Biofuels

... Global biofuels production has increased rapidly over the last 20 years. In the US, biofuels production started to rise rapidly in 2003 while in the EU it accelerated from 2005. The US expanded maize area by 23 percent in 2007 in response to high maize prices and rapid demand growth for maize for et ...

... Global biofuels production has increased rapidly over the last 20 years. In the US, biofuels production started to rise rapidly in 2003 while in the EU it accelerated from 2005. The US expanded maize area by 23 percent in 2007 in response to high maize prices and rapid demand growth for maize for et ...

OSC Staff Notice 33-744 – Availability of registration exemptions to

... In Ontario, if a customer meets the definition of a “hedger” for the purposes of a trade, the customer may trade in a contract without registration if the trade is made through a dealer,5 including an unregistered foreign dealer. The term “hedger” is defined in the CFA as follows: “hedger” means a p ...

... In Ontario, if a customer meets the definition of a “hedger” for the purposes of a trade, the customer may trade in a contract without registration if the trade is made through a dealer,5 including an unregistered foreign dealer. The term “hedger” is defined in the CFA as follows: “hedger” means a p ...

Precious Metals Bulletin

... information from sources which Andrew Fleming considers reliable, its accuracy and completeness cannot be guaranteed. Any opinions expressed reflect Andrew Fleming’s judgement at this date and are subject to change. Morgans does not accept any liability for the results of any actions taken or not ta ...

... information from sources which Andrew Fleming considers reliable, its accuracy and completeness cannot be guaranteed. Any opinions expressed reflect Andrew Fleming’s judgement at this date and are subject to change. Morgans does not accept any liability for the results of any actions taken or not ta ...

VanEck Starts ETF Distribution in Austria and Italy

... (GDXJ) provide access to the global gold mining sector. GDX covers a comprehensive portfolio of large, midsized, and small global gold mining companies. GDX is currently the third largest gold mining UCITS ETFs in Europe by assets under management. GDXJ invests in micro-, small-, and medium-capitali ...

... (GDXJ) provide access to the global gold mining sector. GDX covers a comprehensive portfolio of large, midsized, and small global gold mining companies. GDX is currently the third largest gold mining UCITS ETFs in Europe by assets under management. GDXJ invests in micro-, small-, and medium-capitali ...

Futures - HSBC Broking Services

... ‘geared’. The lower the initial margin amount is used to open a position, the higher will be the gearing. The high degree of leverage which is often obtained in connection with margin trades can work against you as well as for you. The use of leverage can lead to large losses as well as gains. 6. ...

... ‘geared’. The lower the initial margin amount is used to open a position, the higher will be the gearing. The high degree of leverage which is often obtained in connection with margin trades can work against you as well as for you. The use of leverage can lead to large losses as well as gains. 6. ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.