Illuminating Markets - a vision for cash and collateral

... Mandatory Swaps Margining and the effect of Mandatory Swaps clearing on collateral markets Initial Margin (IM) and Variation Margin (VM) for uncleared OTC derivatives will be phased in from September 2016 through to June 2021. The US will start IM from September 2016 for the largest of counterpartie ...

... Mandatory Swaps Margining and the effect of Mandatory Swaps clearing on collateral markets Initial Margin (IM) and Variation Margin (VM) for uncleared OTC derivatives will be phased in from September 2016 through to June 2021. The US will start IM from September 2016 for the largest of counterpartie ...

Macroeconomic Determination of Prices of Agricultural and Mineral

... 3. The spot-futures spread, s-f. A higher spot-futures spread (normal backwardation) signifies a low speculative return and should have a negative effect on inventory demand and on prices. ...

... 3. The spot-futures spread, s-f. A higher spot-futures spread (normal backwardation) signifies a low speculative return and should have a negative effect on inventory demand and on prices. ...

average daily value traded in cash equities up ten

... million (€467 million). Derivatives On the Group’s derivatives platforms, the average daily notional value traded was down 11 per cent at £2.6 billion (€3.1 billion), while the average daily number of contracts traded was down 41 per cent to 217,831 against July 2009. A large proportion of the reduc ...

... million (€467 million). Derivatives On the Group’s derivatives platforms, the average daily notional value traded was down 11 per cent at £2.6 billion (€3.1 billion), while the average daily number of contracts traded was down 41 per cent to 217,831 against July 2009. A large proportion of the reduc ...

Alchemist 63 v6_05.qxd

... became the first bank to accept gold bullion as collateral via its tri-party collateral management arm. Exchanges across the world, such as the Chicago Mercantile Exchange, are now accepting gold as collateral for certain trades and London-based clearing house LCH Clearnet has said that it also plan ...

... became the first bank to accept gold bullion as collateral via its tri-party collateral management arm. Exchanges across the world, such as the Chicago Mercantile Exchange, are now accepting gold as collateral for certain trades and London-based clearing house LCH Clearnet has said that it also plan ...

Hedging with Interest Rate Futures

... Rate Futures (11) Another alternative would be to do the basic hedge by selling 20 Dec futures As this is using earlier dated contracts, the short hedger will now have to do a number of long spread trades ...

... Rate Futures (11) Another alternative would be to do the basic hedge by selling 20 Dec futures As this is using earlier dated contracts, the short hedger will now have to do a number of long spread trades ...

Networking Solutions for the Financial Trading Industry

... can be “lit” (publishing information about their transactions) or “dark” (not disseminating information about their transactions in any way). Over The Counter (OTC) are venues outside formal exchanges, used generally for trading stocks or other instruments that have falled dramatically in value or h ...

... can be “lit” (publishing information about their transactions) or “dark” (not disseminating information about their transactions in any way). Over The Counter (OTC) are venues outside formal exchanges, used generally for trading stocks or other instruments that have falled dramatically in value or h ...

Document

... In the Indian context the securities contracts (Regulation)Act, 1956(SC(R)A) defines “Derivative” to include : A security derived from a debt instrument ,share, loan, whether secured or unsecured risk instrument or contract for differences or any other form of security. A contract which derives its ...

... In the Indian context the securities contracts (Regulation)Act, 1956(SC(R)A) defines “Derivative” to include : A security derived from a debt instrument ,share, loan, whether secured or unsecured risk instrument or contract for differences or any other form of security. A contract which derives its ...

Vanguard Developed All-Cap ex North America Equity Index Pooled

... Vanguard Index Pooled Funds, which sets out all of the features of the funds, including the fees and expenses associated with an investment in the funds, as well as the risks and conditions associated with an investment in the funds. This document does not provide disclosure of all information requi ...

... Vanguard Index Pooled Funds, which sets out all of the features of the funds, including the fees and expenses associated with an investment in the funds, as well as the risks and conditions associated with an investment in the funds. This document does not provide disclosure of all information requi ...

Document

... the value of another security or commodity, called the underlying asset • Forward and Futures contracts are agreements between two parties - the buyer agrees to purchase an asset from the seller at a specific date at a price agreed to now • Options offer the buyer the right without obligation to buy ...

... the value of another security or commodity, called the underlying asset • Forward and Futures contracts are agreements between two parties - the buyer agrees to purchase an asset from the seller at a specific date at a price agreed to now • Options offer the buyer the right without obligation to buy ...

Option Derivatives in Electricity Hedging

... “take or pay” contracts, which will motivate the end customer to consume in order with the contracted volume. Gains and losses from hedging activities that occur in the futures market when a hedge is undertaken must be viewed as part of the electricity price that the market participant provides to i ...

... “take or pay” contracts, which will motivate the end customer to consume in order with the contracted volume. Gains and losses from hedging activities that occur in the futures market when a hedge is undertaken must be viewed as part of the electricity price that the market participant provides to i ...

Real Assets and Inflation Hedging Strategies

... investing in any of the strategies described in this presentation. The fees and expenses charged in connection with investment in any of the strategies may be higher than those charged in connection with other investments and, in some market conditions, may offset any profits achieved by the strateg ...

... investing in any of the strategies described in this presentation. The fees and expenses charged in connection with investment in any of the strategies may be higher than those charged in connection with other investments and, in some market conditions, may offset any profits achieved by the strateg ...

MGM-19 - International Journal of Advance Research and Innovation

... price risks by locking-in asset prices. As instruments of risk management, these generally do not influence the fluctuations in the underlying asset prices. However, by locking-in asset prices, derivative product minimizes the impact of fluctuations in asset prices on the profitability and cash flow ...

... price risks by locking-in asset prices. As instruments of risk management, these generally do not influence the fluctuations in the underlying asset prices. However, by locking-in asset prices, derivative product minimizes the impact of fluctuations in asset prices on the profitability and cash flow ...

SU54 - CMAPrepCourse

... – Buyer has taken a long position while the seller has taken a short position. – Both parties are contractually obligated to perform ...

... – Buyer has taken a long position while the seller has taken a short position. – Both parties are contractually obligated to perform ...

www.FirstRate.com | Evaluating Performance of Alternative

... There are a wide range of alternative strategies available for participation in the global markets. However, most of these can be included within six basic classifications. 1. Real Estate: Investors can have direct investments in property or indirect investments in funds or companies that derive ret ...

... There are a wide range of alternative strategies available for participation in the global markets. However, most of these can be included within six basic classifications. 1. Real Estate: Investors can have direct investments in property or indirect investments in funds or companies that derive ret ...

Derivatives and their feedback effects on the spot markets

... importance and information content, Monthly Report, ...

... importance and information content, Monthly Report, ...

FUTURE // noun [C, usually pl

... The increased volume of swaps has boosted futures trading on the Mexican derivatives exchange. 3 (Finance) an act of exchanging one investment or asset for another, instead of for money: The company is negotiating a swap deal with bondholders. The weakness of the stock market means that many deals a ...

... The increased volume of swaps has boosted futures trading on the Mexican derivatives exchange. 3 (Finance) an act of exchanging one investment or asset for another, instead of for money: The company is negotiating a swap deal with bondholders. The weakness of the stock market means that many deals a ...

Interim Report on Crude Oil

... Analysis of Crude Oil Futures Markets Activity in crude oil futures and options contracts has been increasing since 2004. During that period, the number of contracts outstanding (known as “open interest”) has more than tripled, and the number of traders has almost doubled. The fastest growth in open ...

... Analysis of Crude Oil Futures Markets Activity in crude oil futures and options contracts has been increasing since 2004. During that period, the number of contracts outstanding (known as “open interest”) has more than tripled, and the number of traders has almost doubled. The fastest growth in open ...

Demutualizing African Stock Exchanges

... Improved governance Investor participation Competition Globalization and consolidation Unlocking stock exchange value ...

... Improved governance Investor participation Competition Globalization and consolidation Unlocking stock exchange value ...

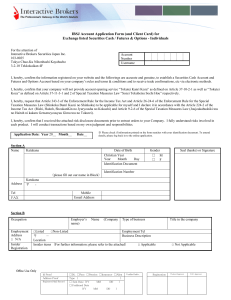

IBSJ Account Application Form (and Client Card) for Exchange listed

... I am obligated to accept all executions that are consistent with the instructions specified in my orders. Although we believe our failure rate is among the lowest in the industry, any system may fail at one time or another, often by reason of forces beyond human control. IB is not liable for system ...

... I am obligated to accept all executions that are consistent with the instructions specified in my orders. Although we believe our failure rate is among the lowest in the industry, any system may fail at one time or another, often by reason of forces beyond human control. IB is not liable for system ...

Primary Market Liquidity Vs. Secondary Market Liquidity

... This marketing information is intended for professional clients (as defined in the glossary of the FCA Handbook) only and has been derived from information generally available to the public from sources believed to be reliable. WisdomTree Europe Ltd. does not warrant the accuracy or completeness of ...

... This marketing information is intended for professional clients (as defined in the glossary of the FCA Handbook) only and has been derived from information generally available to the public from sources believed to be reliable. WisdomTree Europe Ltd. does not warrant the accuracy or completeness of ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.