on futures contracts

... • Long position: Agrees to purchase the underlying asset at the stated futures price at contract maturity • Short position: Agrees to deliver the underlying asset at the stated futures price at contract maturity • Profits on long and short positions at maturity – Long = Futures price at maturity min ...

... • Long position: Agrees to purchase the underlying asset at the stated futures price at contract maturity • Short position: Agrees to deliver the underlying asset at the stated futures price at contract maturity • Profits on long and short positions at maturity – Long = Futures price at maturity min ...

es220050945197.ps, page 1-3 @ Normalize_2 ( cs220050945197 )

... (a) the definitions of “advising on futures contracts” and “advising on securities” are amended so that the giving of advice by a person, who is licensed or registered for Type 9 regulated activity, solely for the purposes of carrying on securities or futures contracts management, as the case may be ...

... (a) the definitions of “advising on futures contracts” and “advising on securities” are amended so that the giving of advice by a person, who is licensed or registered for Type 9 regulated activity, solely for the purposes of carrying on securities or futures contracts management, as the case may be ...

Bloomberg 101

... 6) World Exchange Rates by Region or TKC

1) Major Currencies

9) World Currency Value or WCV

...

... 6) World Exchange Rates by Region or

Kevin Houstoun

... “New types of circuit breakers triggered by ex ante rather than ex post trading may be effective in dealing with periodic illiquidity.” “In times of overall market stress there is a need for coordination of circuit breakers across markets, and this could be a mandate for regulatory involvement.” Nee ...

... “New types of circuit breakers triggered by ex ante rather than ex post trading may be effective in dealing with periodic illiquidity.” “In times of overall market stress there is a need for coordination of circuit breakers across markets, and this could be a mandate for regulatory involvement.” Nee ...

November 2010 Economic Update - GLS Financial Consultants, Inc.

... index of the Bolsa de Madrid, Spain's principal stock exchange. The RTS Index (RTSI) is an index of 50 Russian stocks that trade on the RTS Stock Exchange in Moscow. The MSCI World Index is a free-float weighted equity index that includes developed world markets, and does not include emerging market ...

... index of the Bolsa de Madrid, Spain's principal stock exchange. The RTS Index (RTSI) is an index of 50 Russian stocks that trade on the RTS Stock Exchange in Moscow. The MSCI World Index is a free-float weighted equity index that includes developed world markets, and does not include emerging market ...

Tactical ETF Market Growth Strategy

... Commodity investments and derivatives may be more volatile and less liquid than direct investments in the underlying commodities themselves. Commodity-related equity returns can also be affected by the issuer's financial structure or the performance of unrelated businesses. The use of futures contra ...

... Commodity investments and derivatives may be more volatile and less liquid than direct investments in the underlying commodities themselves. Commodity-related equity returns can also be affected by the issuer's financial structure or the performance of unrelated businesses. The use of futures contra ...

CESR The Committee of European Securities Regulaters

... of business contracts and properties, but this is another matter that is not relevant to the motive for the forward contract as such, as the motive of the forward contract is still financial. The “hedger” takes on one financial market risk exposure against buying protection from the opposite market ...

... of business contracts and properties, but this is another matter that is not relevant to the motive for the forward contract as such, as the motive of the forward contract is still financial. The “hedger” takes on one financial market risk exposure against buying protection from the opposite market ...

Determinants of Agricultural and Mineral Commodity Prices

... The determination of prices for oil and other mineral and agricultural commodities has always fallen predominantly in the province of microeconomics. Nevertheless there are periods when so many commodity prices are moving so far in the same direction at the same time that it becomes difficult to ign ...

... The determination of prices for oil and other mineral and agricultural commodities has always fallen predominantly in the province of microeconomics. Nevertheless there are periods when so many commodity prices are moving so far in the same direction at the same time that it becomes difficult to ign ...

WTI-Brent spread and the value of refining firms

... The persistent supply imbalance and transportation frictions from mid-west crude producers have to a degree fractured the notion of a global oil price. These constraints on storage and transportation capacity have in turn created price differentials that are economically significant. Our focus on a ...

... The persistent supply imbalance and transportation frictions from mid-west crude producers have to a degree fractured the notion of a global oil price. These constraints on storage and transportation capacity have in turn created price differentials that are economically significant. Our focus on a ...

Mechanics of Futures Markets

... ※ A decline (rise) in futures price implies a loss (profit) for traders with a long position of futures ※ The decrement amount, e.g., $1,800 on Day 1, is transferred to the margin account of a trader with a short position ※ If the balance falls below the maintenance margin, the trader receives a mar ...

... ※ A decline (rise) in futures price implies a loss (profit) for traders with a long position of futures ※ The decrement amount, e.g., $1,800 on Day 1, is transferred to the margin account of a trader with a short position ※ If the balance falls below the maintenance margin, the trader receives a mar ...

Investments - GEOCITIES.ws

... Auction markets with centralized order flow Dealership function: can be competitive or assigned by the exchange (specialists or registered traders) Securities: stock, futures contracts, options, and to a lesser extent, bonds Examples: TSE, ME, NYSE, AMEX ...

... Auction markets with centralized order flow Dealership function: can be competitive or assigned by the exchange (specialists or registered traders) Securities: stock, futures contracts, options, and to a lesser extent, bonds Examples: TSE, ME, NYSE, AMEX ...

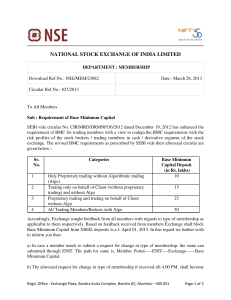

Ref No

... 3.00 PM, the revised BMC requirement shall become effective on next working day i.e. April 02, 2013. However, in case the request is received on April 01, 2013 at 5.30 PM, the revised BMC requirement shall become effective on April 03, 2013. c) The Base Minimum Capital primarily shall be blocked fro ...

... 3.00 PM, the revised BMC requirement shall become effective on next working day i.e. April 02, 2013. However, in case the request is received on April 01, 2013 at 5.30 PM, the revised BMC requirement shall become effective on April 03, 2013. c) The Base Minimum Capital primarily shall be blocked fro ...

Chapter Ten

... Futures contracts are exchange traded. The CME and the New York Futures Exchange are examples of futures markets. Membership seat prices on the CME as of July 28, 2005 were valued at $370,000, although leases were appreciably less (www.cme.com ). A buyer of a futures contract (long position) incurs ...

... Futures contracts are exchange traded. The CME and the New York Futures Exchange are examples of futures markets. Membership seat prices on the CME as of July 28, 2005 were valued at $370,000, although leases were appreciably less (www.cme.com ). A buyer of a futures contract (long position) incurs ...

Lecture Notes

... monetary exposure of the parties under the terms of the derivative instrument. As money usually is not due until the specified date of performance of the parties' obligations, lack of up-front commitment of cash may obscure the eventual monetary significance of the parties' obligations. An often ove ...

... monetary exposure of the parties under the terms of the derivative instrument. As money usually is not due until the specified date of performance of the parties' obligations, lack of up-front commitment of cash may obscure the eventual monetary significance of the parties' obligations. An often ove ...

Job Title: Trading Compliance Officer Location: Downtown

... solutions to both the retail public as well as the customers of over 200 financial institutions including credit unions, banks, trust companies and financial planning companies across Canada. Qtrade currently administers over $9 billion of investment assets through our subsidiaries and is ranked as ...

... solutions to both the retail public as well as the customers of over 200 financial institutions including credit unions, banks, trust companies and financial planning companies across Canada. Qtrade currently administers over $9 billion of investment assets through our subsidiaries and is ranked as ...

Expected Commodity Futures Returns

... The hedging pressure variables are constructed using weekly trader’s commitment data from the Commodity Futures Trading Commission (CFTC).2 The CFTC requires large traders to report whether their trading activity is for speculative or hedging purposes. Bessembinder (1992) discusses these data in det ...

... The hedging pressure variables are constructed using weekly trader’s commitment data from the Commodity Futures Trading Commission (CFTC).2 The CFTC requires large traders to report whether their trading activity is for speculative or hedging purposes. Bessembinder (1992) discusses these data in det ...

Short-Dated New Crop Options White Paper

... York Mercantile Exchange and NYMEX are registered trademarks of New York Mercantile Exchange, Inc. Futures trading is not suitable for all investors, and involves the risk of loss. Futures are a leveraged investment, and because only a percentage of a contract’s value is required to trade, it is pos ...

... York Mercantile Exchange and NYMEX are registered trademarks of New York Mercantile Exchange, Inc. Futures trading is not suitable for all investors, and involves the risk of loss. Futures are a leveraged investment, and because only a percentage of a contract’s value is required to trade, it is pos ...

Capital Markets

... Market Supervisory Authority (FINMA). Since it was founded in 2007, the Swiss Structured Products Exchange has helped shape the market and set new standards. Together with the Swiss Structured Products Association (SSPA), it has sought to make structured products more transparent, serve as a source ...

... Market Supervisory Authority (FINMA). Since it was founded in 2007, the Swiss Structured Products Exchange has helped shape the market and set new standards. Together with the Swiss Structured Products Association (SSPA), it has sought to make structured products more transparent, serve as a source ...

PART 5: RISK MANAGEMENT CHAPTER 15: Hedging Instruments

... Hedge funds represent a pooling of funds from wealthy investors and large institutional investors that use spot and derivative market instruments to reduce investment risk (by combining leverage and short-selling). Page 1 of 8 Copyright © 2004 McGraw-Hill Ryerson Limited ...

... Hedge funds represent a pooling of funds from wealthy investors and large institutional investors that use spot and derivative market instruments to reduce investment risk (by combining leverage and short-selling). Page 1 of 8 Copyright © 2004 McGraw-Hill Ryerson Limited ...

Chapter 4: Using Futures Markets

... fall. Therefore, the trader sells a futures contract on U.S. Treasury bonds. If long-term interest rates rise as the trader expected, the trader will earn a profit. The risk is that the long-term interest rate will decline rather than increase. In which case the position trader will lose money. ...

... fall. Therefore, the trader sells a futures contract on U.S. Treasury bonds. If long-term interest rates rise as the trader expected, the trader will earn a profit. The risk is that the long-term interest rate will decline rather than increase. In which case the position trader will lose money. ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.