Session 8 - MineAfrica

... Build Modestly in 2009 Copper prices are, nevertheless, expected to outperform other base metals. While ‘visible’ exchange stocks on the LME, COMEX and Shanghai Metal Exchange increased to 7.2 days of global consumption in late 2008 (the highest since April 2004), stocks remain well below previous p ...

... Build Modestly in 2009 Copper prices are, nevertheless, expected to outperform other base metals. While ‘visible’ exchange stocks on the LME, COMEX and Shanghai Metal Exchange increased to 7.2 days of global consumption in late 2008 (the highest since April 2004), stocks remain well below previous p ...

ASG Managed Futures Strategy Fund

... may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not inve ...

... may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not inve ...

Islamic Financial System

... exchange or transaction as well as a measurement of the value of goods or services. Legally, it’s defined as thing that’s formulated by law as a money. Based on its function, it’s defined as everything that performs the functions of money included as a medium of exchange, a mode of payment, a va ...

... exchange or transaction as well as a measurement of the value of goods or services. Legally, it’s defined as thing that’s formulated by law as a money. Based on its function, it’s defined as everything that performs the functions of money included as a medium of exchange, a mode of payment, a va ...

Understanding ETF Premiums and Discounts

... If the market price is higher than NAV, the ETF is said to be trading at a “premium”. If the price is lower, it is trading at a “discount”. An ETF may trade at a premium or discount when, for example; · its underlying assets trade at different hours than the stock exchange (e.g., commodities) · ...

... If the market price is higher than NAV, the ETF is said to be trading at a “premium”. If the price is lower, it is trading at a “discount”. An ETF may trade at a premium or discount when, for example; · its underlying assets trade at different hours than the stock exchange (e.g., commodities) · ...

Commodities Outlook - CIBC World Markets

... Commodities Still Have a Place in Portfolios A lower speed limit on global growth is already restraining prices for many commodities. But that doesn’t mean investors should shy away from that space. The decline in oil prices, for example, has been more a story of excess supply than flailing demand. ...

... Commodities Still Have a Place in Portfolios A lower speed limit on global growth is already restraining prices for many commodities. But that doesn’t mean investors should shy away from that space. The decline in oil prices, for example, has been more a story of excess supply than flailing demand. ...

PDF

... the shift from mass production to an end-user value focus. Consolidated Grain and Barge Company3 (CGB) is a corporate effort interested in building alliances. CGB, operating 60 plus grain elevators located on the Mississippi, Illinois and Ohio Rivers, purchases grain directly from thousands of produ ...

... the shift from mass production to an end-user value focus. Consolidated Grain and Barge Company3 (CGB) is a corporate effort interested in building alliances. CGB, operating 60 plus grain elevators located on the Mississippi, Illinois and Ohio Rivers, purchases grain directly from thousands of produ ...

cetin ciner - University of North Carolina Wilmington

... Maritime Economics and Shipping Finance ...

... Maritime Economics and Shipping Finance ...

Weekly roundup - Jesmond Mizzi Financial Advisors

... The result of the continuous positive outcome that the Malta Stock Exchange has been experiencing lately is mainly being achieved by HSBC Bank and FIMBank – the highest two gainers for the week. Both HSBC and FIMBank reached their all time high throughout the week. The best performer for the week w ...

... The result of the continuous positive outcome that the Malta Stock Exchange has been experiencing lately is mainly being achieved by HSBC Bank and FIMBank – the highest two gainers for the week. Both HSBC and FIMBank reached their all time high throughout the week. The best performer for the week w ...

A Beginners` Guide to Commodity Market

... A forward contract is a legally enforceable agreement for delivery of goods or the underlying asset on a specific date in future at a price agreed on the date of contract. Under Forward Contracts (Regulation) Act, 1952, all the contracts for delivery of goods, which are settled by payment of money d ...

... A forward contract is a legally enforceable agreement for delivery of goods or the underlying asset on a specific date in future at a price agreed on the date of contract. Under Forward Contracts (Regulation) Act, 1952, all the contracts for delivery of goods, which are settled by payment of money d ...

ethiopian commodity exchange - Making The Connection: Value

... ticker boards around the country. The ECX website is the second most visited website of Electronic price ticker board at ECX ...

... ticker boards around the country. The ECX website is the second most visited website of Electronic price ticker board at ECX ...

The Weekly Brief 03-13-17 - Paramount Wealth Management

... * The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index. * All indices referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index p ...

... * The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index. * All indices referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index p ...

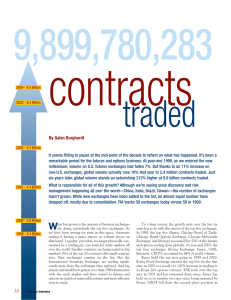

contracts 9,899,780,283 traded

... volatility, the market for individual equity options has continued to grow in the U.S. the way it has. Last year, contract volume at the Chicago Board Options Exchange (up 29.7%), the International Securities Exchange (up 24.3%), the Philadelphia Stock Exchange (up 21.9%) and the Pacific Exchange (u ...

... volatility, the market for individual equity options has continued to grow in the U.S. the way it has. Last year, contract volume at the Chicago Board Options Exchange (up 29.7%), the International Securities Exchange (up 24.3%), the Philadelphia Stock Exchange (up 21.9%) and the Pacific Exchange (u ...

By Robert C Merton, John and Natty McArthur

... The revolutionising effect of technology is clearly evidenced in the emergence of new financial marketplaces, such as the then Deutsche Terminbörse (the DTB, now Eurex) and ISE, whose histories are outlined in detail in this book. The impact of those two pioneering electronic marketplaces cannot be ...

... The revolutionising effect of technology is clearly evidenced in the emergence of new financial marketplaces, such as the then Deutsche Terminbörse (the DTB, now Eurex) and ISE, whose histories are outlined in detail in this book. The impact of those two pioneering electronic marketplaces cannot be ...

CHAPTER 1: INTRODUCTION

... Use of options in 17th Century! Later, however, options were increasingly used by speculators who found that call options were an effective vehicle for obtaining maximum possible gains on investment. As long as tulip prices continued to skyrocket, a call buyer would realize returns far in excess ...

... Use of options in 17th Century! Later, however, options were increasingly used by speculators who found that call options were an effective vehicle for obtaining maximum possible gains on investment. As long as tulip prices continued to skyrocket, a call buyer would realize returns far in excess ...

UNCTAD Nairobi,

... markets, with few immediate prospects for a rally. In most cases, confronted by painful real-economy contractions in their commodities sectors and falling revenues, CDDC governments must redouble their diversification policies, at the same time as they tighten their macroeconomic belts to prevent cu ...

... markets, with few immediate prospects for a rally. In most cases, confronted by painful real-economy contractions in their commodities sectors and falling revenues, CDDC governments must redouble their diversification policies, at the same time as they tighten their macroeconomic belts to prevent cu ...

Commodity-Derivatives

... were traded. Now hundreds of different contracts are traded on raw and processed grains and oils, live and slaughtered animals, sugar, orange juice, coffee and inedible agricultural products such as lumber, rubber and cotton. Until recently global volume in agricultural futures trading was dominated ...

... were traded. Now hundreds of different contracts are traded on raw and processed grains and oils, live and slaughtered animals, sugar, orange juice, coffee and inedible agricultural products such as lumber, rubber and cotton. Until recently global volume in agricultural futures trading was dominated ...

Insurance, Weather, and Energy Derivatives

... Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull ...

... Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull ...

iShares US Treasury Bond 7-10 Year JPY Hedged ETF

... - Because ETFs invest in securities whose prices fluctuate, the market price or base value may decrease due to shifts in the underling index or foreign exchange market, fluctuations in the price of constituent securities, bankruptcy or deterioration in the financial conditions of constituent securit ...

... - Because ETFs invest in securities whose prices fluctuate, the market price or base value may decrease due to shifts in the underling index or foreign exchange market, fluctuations in the price of constituent securities, bankruptcy or deterioration in the financial conditions of constituent securit ...

Document

... firm size, industry affiliation, ownership concentration, ownership type, and financial performance), and stock market’s specific factors (tick size)), were significantly affected the relative bid-ask spread in ASE except the industry affiliation variable. Also, the cross-sectional variation in spre ...

... firm size, industry affiliation, ownership concentration, ownership type, and financial performance), and stock market’s specific factors (tick size)), were significantly affected the relative bid-ask spread in ASE except the industry affiliation variable. Also, the cross-sectional variation in spre ...

CEE Trader - Wiener Börse

... ■ Consolidated order book for double listed instruments (for example Erste Group in Vienna and Prague can be merged in one order book) ■ Drop copy support with Xetra® native interfaces Technical Key Figures ■ Connection via Internet or private network ■ RSA securID trading login (one login for ...

... ■ Consolidated order book for double listed instruments (for example Erste Group in Vienna and Prague can be merged in one order book) ■ Drop copy support with Xetra® native interfaces Technical Key Figures ■ Connection via Internet or private network ■ RSA securID trading login (one login for ...

managed futures strategy fund

... Mutual Funds involve risk including possible loss of principal. The Fund will invest a percentage of its assets in derivatives, such as commodities, futures and options contracts. The use of such derivatives and the resulting high portfolio turn-over, may expose the Fund to additional risks that it ...

... Mutual Funds involve risk including possible loss of principal. The Fund will invest a percentage of its assets in derivatives, such as commodities, futures and options contracts. The use of such derivatives and the resulting high portfolio turn-over, may expose the Fund to additional risks that it ...

Regulatory Focus on Market Structure and Trading Issues

... FINRA alleged that traders at Trillium engaged in a “repeated pattern of layering conduct to take advantage of trading, including algorithmic trading by other firms” After entering a buy (sell) limit order into Nasdaq, a Trillium trader would repeatedly enter numerous layered, non-bona fide, mar ...

... FINRA alleged that traders at Trillium engaged in a “repeated pattern of layering conduct to take advantage of trading, including algorithmic trading by other firms” After entering a buy (sell) limit order into Nasdaq, a Trillium trader would repeatedly enter numerous layered, non-bona fide, mar ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.