Chapter Twelve The Role of Real Assets KEY POINTS

... shows, this material is intended as a primer on the basic principles of timberland investment. The notion of product class shift (Figure 12-3) is an often-overlooked aspect of a forest. While there is a continuing problem with a lack of a consistent timberland index, the evidence is clear regarding ...

... shows, this material is intended as a primer on the basic principles of timberland investment. The notion of product class shift (Figure 12-3) is an often-overlooked aspect of a forest. While there is a continuing problem with a lack of a consistent timberland index, the evidence is clear regarding ...

Storage costs in commodity option pricing

... hardly possible within common risk neutral commodity price models. At the present level of the theory, the practitioner is essentially left alone with the problem of how to adapt a given commodity price model to account for a perfect storability or for an absolute nonstorability of the underlying go ...

... hardly possible within common risk neutral commodity price models. At the present level of the theory, the practitioner is essentially left alone with the problem of how to adapt a given commodity price model to account for a perfect storability or for an absolute nonstorability of the underlying go ...

Historical Performance of Commodity and Stock Markets

... Ph.D. student, Department of Agricultural Economics and Agribusiness, Louisiana State University Agricultural Center, Baton Rouge, Louisiana. ...

... Ph.D. student, Department of Agricultural Economics and Agribusiness, Louisiana State University Agricultural Center, Baton Rouge, Louisiana. ...

When Selecting Stocks, He Knows No Boundaries

... breathing challenges are common, it's best to have a medical team along. “We feel that it's essential that we see these projects and get to know both the executives and the employees, including local people,” Mr. Gissen said of his trek up the South American mountain range. “You're not comfortable. ...

... breathing challenges are common, it's best to have a medical team along. “We feel that it's essential that we see these projects and get to know both the executives and the employees, including local people,” Mr. Gissen said of his trek up the South American mountain range. “You're not comfortable. ...

,-

... used on the futures markets as it is on the New York spot market. No prearranged trading is allowed on the Chicago futures market, neither is block trading permitted. ...

... used on the futures markets as it is on the New York spot market. No prearranged trading is allowed on the Chicago futures market, neither is block trading permitted. ...

Impending US Regulations and Their Effects on the

... • (Henry Jarecki): No limits needed – business is strictly pass through with no leverage. Individual Investors: • Position limits are definitely necessary but aggregated across all markets, not by individual market. This must also include the OTC market. • ETF’s on Platinum group metals are dange ...

... • (Henry Jarecki): No limits needed – business is strictly pass through with no leverage. Individual Investors: • Position limits are definitely necessary but aggregated across all markets, not by individual market. This must also include the OTC market. • ETF’s on Platinum group metals are dange ...

im09

... charge a premium to provide this insurance. Financial institutions can use options to hedge balance sheet risk, much as described above for futures contracts. Option prices rise when the price of the underlying security is more volatile or when the expiration date is further in the future, because t ...

... charge a premium to provide this insurance. Financial institutions can use options to hedge balance sheet risk, much as described above for futures contracts. Option prices rise when the price of the underlying security is more volatile or when the expiration date is further in the future, because t ...

united states international university - africa

... Examination of the implications of the globalization of financial markets, financial instruments in a global market, composition of world bond and equity markets, foreign exchange markets, interest rate and currency swaps, global interest rate links, and cross-currency and cross-border arbitrages. ...

... Examination of the implications of the globalization of financial markets, financial instruments in a global market, composition of world bond and equity markets, foreign exchange markets, interest rate and currency swaps, global interest rate links, and cross-currency and cross-border arbitrages. ...

Presentation

... all commodities is directly correlated with the price of crude oil. Since commodity prices became volatile, instruments for risk management became increasingly popular. Consequently commodity derivatives got a further impetus. ...

... all commodities is directly correlated with the price of crude oil. Since commodity prices became volatile, instruments for risk management became increasingly popular. Consequently commodity derivatives got a further impetus. ...

TO: NYSE Listed Company Executives FROM: NYSE Regulation, Inc

... The Exchange will have the authority to halt trading pending dissemination of a news announcement that is issued between 7.00 a.m. ET and the opening of trading on the NYSE at 9.30 a.m. ET, provided that the announcement is material in nature and the listed company itself requests a halt in trading. ...

... The Exchange will have the authority to halt trading pending dissemination of a news announcement that is issued between 7.00 a.m. ET and the opening of trading on the NYSE at 9.30 a.m. ET, provided that the announcement is material in nature and the listed company itself requests a halt in trading. ...

Determination of Forward and Futures Prices

... Conventional Yield(y), which is the additional benefit of holding the asset rather than holding a forward or futures contract on the asset, such as being able to take advantage of shortages, ability to keep production process smoothly. So F0 <= S0 e(r+u -y)T However, the convenience yield cannot be ...

... Conventional Yield(y), which is the additional benefit of holding the asset rather than holding a forward or futures contract on the asset, such as being able to take advantage of shortages, ability to keep production process smoothly. So F0 <= S0 e(r+u -y)T However, the convenience yield cannot be ...

EN_Interview_traders

... Q16: Do you still give your customers credit now, after the shock? How many and with what conditions? (Note the percentage of customers who received credit, how long credit was given for, and the criteria they had to fulfil) ...

... Q16: Do you still give your customers credit now, after the shock? How many and with what conditions? (Note the percentage of customers who received credit, how long credit was given for, and the criteria they had to fulfil) ...

The synchronized and long-lasting structural change on

... The causes behind the recent sharp price movements of many primary commodities have fuelled an intense debate among academics, asset managers, investment banks, and policy makers. The debate reflects several developments over the last decade. First, large developing economies have experienced a rapi ...

... The causes behind the recent sharp price movements of many primary commodities have fuelled an intense debate among academics, asset managers, investment banks, and policy makers. The debate reflects several developments over the last decade. First, large developing economies have experienced a rapi ...

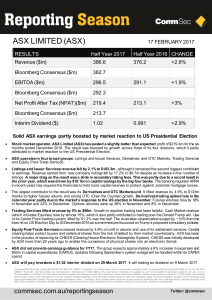

View PDF Report

... lows hit on US Election Day to 30 December 2016 as some investors focussed on Trump’s proposed stimulatory policies. ...

... lows hit on US Election Day to 30 December 2016 as some investors focussed on Trump’s proposed stimulatory policies. ...

TA Pai Management Institute - Xavier Institute of Management

... all commodities is directly correlated with the price of crude oil. Since commodity prices became volatile, instruments for risk management became increasingly popular. Consequently commodity derivatives got a further impetus. ...

... all commodities is directly correlated with the price of crude oil. Since commodity prices became volatile, instruments for risk management became increasingly popular. Consequently commodity derivatives got a further impetus. ...

Weekly Commentary 12-15-14 PAA

... It was no fun to be an investor last week. The week prior, a commentary in The Wall Street Journal’s blog, MoneyBeat, offered this insight: “Falling oil prices are thought to be good for stocks because they stimulate consumer spending and hold down inflation. The lower costs support economic growth, ...

... It was no fun to be an investor last week. The week prior, a commentary in The Wall Street Journal’s blog, MoneyBeat, offered this insight: “Falling oil prices are thought to be good for stocks because they stimulate consumer spending and hold down inflation. The lower costs support economic growth, ...

Federal Reserve energy transaction requirement The

... underwriting the risks. •• Because some banks have used physical commodity investments as hedges for speculation in their proprietary trading books, the market may become dominated by energy firms who are seeking only hedge positions, not speculative positions. This may reduce volatility and hold ba ...

... underwriting the risks. •• Because some banks have used physical commodity investments as hedges for speculation in their proprietary trading books, the market may become dominated by energy firms who are seeking only hedge positions, not speculative positions. This may reduce volatility and hold ba ...

Weekly Commentary 08-25-14 PAA

... * Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. *Corporate bonds ar ...

... * Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. *Corporate bonds ar ...

The COT reports consist of three different reports

... The index traders are classified only in the supplemental CIT report and are a combination of commercial and noncommercial traders who are generally long and passive. They account for a sizeable share of open interest (currently 24% of longs). Their trading position tends to be stable in the short t ...

... The index traders are classified only in the supplemental CIT report and are a combination of commercial and noncommercial traders who are generally long and passive. They account for a sizeable share of open interest (currently 24% of longs). Their trading position tends to be stable in the short t ...

Contd…

... Futures contracts which are traded for physical delivery includes agricultural commodities like wheat, oats, sugar etc, energy products like crude oil, heating oil, natural gas etc, or animals. Note that very commodity futures contracts actually end in delivery. Often these contracts are traded ju ...

... Futures contracts which are traded for physical delivery includes agricultural commodities like wheat, oats, sugar etc, energy products like crude oil, heating oil, natural gas etc, or animals. Note that very commodity futures contracts actually end in delivery. Often these contracts are traded ju ...

Great Computer Challenge

... problem will involve the calculation and manipulation of transactions associated with these investors. The Commodities Market (or Futures Market) is the buying and selling of contracts for the fixed quantity and quality of products. The types of commodities that are traded include (but are not limit ...

... problem will involve the calculation and manipulation of transactions associated with these investors. The Commodities Market (or Futures Market) is the buying and selling of contracts for the fixed quantity and quality of products. The types of commodities that are traded include (but are not limit ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.