PRESCIENT GLOBAL POSITIVE RETURN (EURO) FUND

... of fees, charges and maximum commissions is available on request from the Manager. There is no guarantee in respect of capital or returns in a portfolio. A CIS may be closed to new investors in order for it to be managed more efficiently in accordance with its mandate. CIS prices are calculated on a ...

... of fees, charges and maximum commissions is available on request from the Manager. There is no guarantee in respect of capital or returns in a portfolio. A CIS may be closed to new investors in order for it to be managed more efficiently in accordance with its mandate. CIS prices are calculated on a ...

E(R i ) - Cengage

... Plots the relationship between expected return and betas In equilibrium, all assets lie on this line If stock lies above the line Expected return is too high Investors bid up price until expected return falls ...

... Plots the relationship between expected return and betas In equilibrium, all assets lie on this line If stock lies above the line Expected return is too high Investors bid up price until expected return falls ...

Finance 360 Problem Set #5 Solutions

... loans and an interest rate of 9%. Profits are equal to$4322. In part (d), things get interesting. The demand curve doesn’t change, but now, Total revenues become: ...

... loans and an interest rate of 9%. Profits are equal to$4322. In part (d), things get interesting. The demand curve doesn’t change, but now, Total revenues become: ...

ME - Ch. 8: Monopoly

... 2. There are high barriers that prevent other firms from entry. Barriers to entry are restrictions that make it difficult or impossible for new firms to enter a particular market. These barriers could be legal or natural. Examples of legal restrictions include government license, patent, copyright, ...

... 2. There are high barriers that prevent other firms from entry. Barriers to entry are restrictions that make it difficult or impossible for new firms to enter a particular market. These barriers could be legal or natural. Examples of legal restrictions include government license, patent, copyright, ...

Risk and Return

... Stand-alone (total) risk is the risk facing an investor (firm) who owns only one asset. Measures of stand-alone risk: ...

... Stand-alone (total) risk is the risk facing an investor (firm) who owns only one asset. Measures of stand-alone risk: ...

ECN 221 Practice Problems for Chapter 13 – Monopoly (this is not

... 17. _____ Because the marginal revenue curve for a monopolist lies below its demand curve, the profit maximizing price of the monopolist will be above marginal cost. 18. _____ Since the monopolist is the sole producer of a good, it can never incur a loss. ...

... 17. _____ Because the marginal revenue curve for a monopolist lies below its demand curve, the profit maximizing price of the monopolist will be above marginal cost. 18. _____ Since the monopolist is the sole producer of a good, it can never incur a loss. ...

PowerPoint - Columbia University

... Question: Would you play the game if the stakes were scaled up by a large factor? ...

... Question: Would you play the game if the stakes were scaled up by a large factor? ...

Explain what is meant by the term structure of interest rates. Critically

... investors used the Treasury market to construct yield curves by observing its prices and yields. Treasuries issued by the government are considered risk‐free; hence their yields are often used as the benchmarks for fixed‐income securities with the same maturities. The term structure of intere ...

... investors used the Treasury market to construct yield curves by observing its prices and yields. Treasuries issued by the government are considered risk‐free; hence their yields are often used as the benchmarks for fixed‐income securities with the same maturities. The term structure of intere ...

Chap 4 problem solutions

... If interest rates have fallen, the reinvestment of principal will be at a lower rate, with correspondingly lower interest payments and ending value. Note that long-term debt securities also have some reinvestment rate risk because their interest payments have to be reinvested at prevailing rates. p. ...

... If interest rates have fallen, the reinvestment of principal will be at a lower rate, with correspondingly lower interest payments and ending value. Note that long-term debt securities also have some reinvestment rate risk because their interest payments have to be reinvested at prevailing rates. p. ...

Issues in relation to discounted cash flow valuation - Sci-Hub

... interrelationships of DCF with other extant methods of valuations that include income multipliers, residual income, accrual accounting based methods etc. In today’s world of “fly by night” corporate operators, it is paramount to examine the susceptibility of a model to manipulations, and we also exa ...

... interrelationships of DCF with other extant methods of valuations that include income multipliers, residual income, accrual accounting based methods etc. In today’s world of “fly by night” corporate operators, it is paramount to examine the susceptibility of a model to manipulations, and we also exa ...

The Case for shorT-MaTuriTy, higher QualiTy, high yield

... Paul Appleby, CFA Managing Director and Head of Leveraged Finance Group Prudential Fixed Income ...

... Paul Appleby, CFA Managing Director and Head of Leveraged Finance Group Prudential Fixed Income ...

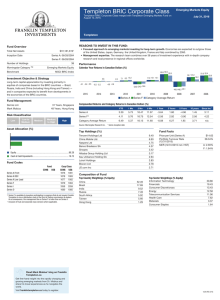

Templeton BRIC Corporate Class Series A

... historical risk. The overall Star Rating for a fund is a weighted combination of its 3-, 5-, and 10-year ratings. Overall ratings are adjusted where a fund has less than five or 10 years’ history. Within each Morningstar category, the top 10% of funds receive five stars, the next 22.5% four stars, t ...

... historical risk. The overall Star Rating for a fund is a weighted combination of its 3-, 5-, and 10-year ratings. Overall ratings are adjusted where a fund has less than five or 10 years’ history. Within each Morningstar category, the top 10% of funds receive five stars, the next 22.5% four stars, t ...

Diversification and Portfolio Management (Ch. 8)

... reduce risk by spreading the funds invested across many securities. ...

... reduce risk by spreading the funds invested across many securities. ...

Connecting the dots: a yield ... Zealand’s interest rates ARTICLES

... market will seek to pay a lower price for the security (thereby ...

... market will seek to pay a lower price for the security (thereby ...

ch05_final - U of L Class Index

... • Result: if term structure slopes up, future short interest rates are expected to rise. If term structure slopes down, future short interest rates are expected to fall • Predicting future short interest rates - the implied forward rate. Copyright © 2004 Pearson Education Canada Inc. ...

... • Result: if term structure slopes up, future short interest rates are expected to rise. If term structure slopes down, future short interest rates are expected to fall • Predicting future short interest rates - the implied forward rate. Copyright © 2004 Pearson Education Canada Inc. ...

A Look Forward— Understanding Forward Curves in Energy

... something other than exchange-based curves. This is especially helpful in cases where the operating characteristics of a particular asset are more granular than available market quotes. For instance, a company may have rights to a natural gas storage facility between November and March. If the compa ...

... something other than exchange-based curves. This is especially helpful in cases where the operating characteristics of a particular asset are more granular than available market quotes. For instance, a company may have rights to a natural gas storage facility between November and March. If the compa ...

Pioneer Funds – US Dollar Short-Term I USD

... United States under the Securities Act of 1933. The Sub-Fund is not registered or otherwise notified for public offering with the relevant authorities of any Central American, South American, Latin American or Caribbean country. Past performance does not guarantee and is not indicative of future res ...

... United States under the Securities Act of 1933. The Sub-Fund is not registered or otherwise notified for public offering with the relevant authorities of any Central American, South American, Latin American or Caribbean country. Past performance does not guarantee and is not indicative of future res ...

Columbia Limited Duration Credit Fund

... investment’s movements is explained by movements in its benchmark index. Sharpe ratio divides an investment’s return in excess of the 90-day Treasury bill by the investment’s standard deviation to measure risk-adjusted performance. Standard deviation is a statistical measure of the degree to which a ...

... investment’s movements is explained by movements in its benchmark index. Sharpe ratio divides an investment’s return in excess of the 90-day Treasury bill by the investment’s standard deviation to measure risk-adjusted performance. Standard deviation is a statistical measure of the degree to which a ...

Fact Sheet - Toroso Investments

... management of the Sector Opportunities Portfolio. The market price for a share of an ETP may fluctuate from the value of its underlying securities. Consequently, ETPs can trade at a discount or premium to their net asset value. Certain equity and commodity ETPs are often more volatile and less liqui ...

... management of the Sector Opportunities Portfolio. The market price for a share of an ETP may fluctuate from the value of its underlying securities. Consequently, ETPs can trade at a discount or premium to their net asset value. Certain equity and commodity ETPs are often more volatile and less liqui ...

ECONOMICS – I – [1.2]

... DEMAND = the amount of a good or service that is bought at a particular price over a particular time period ...

... DEMAND = the amount of a good or service that is bought at a particular price over a particular time period ...

![ECONOMICS – I – [1.2]](http://s1.studyres.com/store/data/008346471_1-f2a3a71e5a31e7d1d392b3a8eac2c132-300x300.png)