harnessing fixed-income returns through the cycle

... in exchange rates can be significant and can trend in one direction for months, if not years, at a time. Therefore, bond investors should be mindful of how currency risk can create opportunities and affect returns. One important signaling variable for the future performance of foreign currencies is ...

... in exchange rates can be significant and can trend in one direction for months, if not years, at a time. Therefore, bond investors should be mindful of how currency risk can create opportunities and affect returns. One important signaling variable for the future performance of foreign currencies is ...

Franklin Euro High Yield Fund - A (Ydis) EUR

... Copyright© 2017. Franklin Templeton Investments. All Rights Reserved. Issued by Templeton Asset Management Ltd. Registration No.(UEN) 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific object ...

... Copyright© 2017. Franklin Templeton Investments. All Rights Reserved. Issued by Templeton Asset Management Ltd. Registration No.(UEN) 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific object ...

While investments always carry a certain amount of risk, the iStar

... early paying a predefined return provided certain criteria are met. Counterparties: We only select structured products from banks that are rated as investment grade, meaning they are defined as relatively low risk by major ratings agencies and other market metrics. Capital protection: The securities ...

... early paying a predefined return provided certain criteria are met. Counterparties: We only select structured products from banks that are rated as investment grade, meaning they are defined as relatively low risk by major ratings agencies and other market metrics. Capital protection: The securities ...

ZI Barings Developed and Emerging Markets High Yield Bond

... liabilities to its policy owners, up to 90% of the liability to the protected policy owner will be met. ...

... liabilities to its policy owners, up to 90% of the liability to the protected policy owner will be met. ...

Compound Growth Rates and Yield - Jim Thomas

... The information in this presentation is for educational purposes only and is not intended to be a recommendation to purchase or sell any of the stocks, mutual funds, or other securities that may be referenced. The securities of companies referenced or featured in the seminar materials are for illust ...

... The information in this presentation is for educational purposes only and is not intended to be a recommendation to purchase or sell any of the stocks, mutual funds, or other securities that may be referenced. The securities of companies referenced or featured in the seminar materials are for illust ...

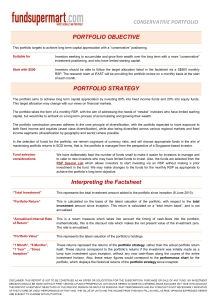

portfolio objective

... The portfolio takes the form of a monthly RSP, with the aim of addressing the needs of “newbie” investors who have limited starting capital, but would like to embark on a long term process of accumulating and growing their wealth. The portfolio construction process adheres to the core principle of d ...

... The portfolio takes the form of a monthly RSP, with the aim of addressing the needs of “newbie” investors who have limited starting capital, but would like to embark on a long term process of accumulating and growing their wealth. The portfolio construction process adheres to the core principle of d ...

Positioning Your Portfolio for Rising Interest Rates

... The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund’s short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate s ...

... The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund’s short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate s ...

“Risk-Free” Liabilities: Efficient Pension Management Requires The

... Sponsors may fully “defease” the financial risk of pensions by either transferring pension liabilities to a third party in exchange for a premium (e.g., group life annuities); or retaining pension liabilities, paying a third party to transfer demographic risks (hence, “locking in” required benefit p ...

... Sponsors may fully “defease” the financial risk of pensions by either transferring pension liabilities to a third party in exchange for a premium (e.g., group life annuities); or retaining pension liabilities, paying a third party to transfer demographic risks (hence, “locking in” required benefit p ...

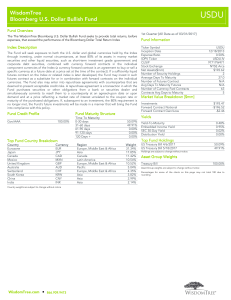

WisdomTree Bloomberg U.S. Dollar Bullish Fund

... through investing, under normal circumstances, at least 80% of its assets in money market securities and other liquid securities, such as short-term investment grade government and corporate debt securities, combined with currency forward contracts in the individual component currencies of the Index ...

... through investing, under normal circumstances, at least 80% of its assets in money market securities and other liquid securities, such as short-term investment grade government and corporate debt securities, combined with currency forward contracts in the individual component currencies of the Index ...

An Assessment on Graham`s Approach for Stock Selection: The

... • Results of this research indicate that an investor who made use of the combinations of Graham’s criteria investigated to create a portfolio, would have achieved results better than that of the BIST-100 during the period 2005 and 2014, excluded crisis period. • When considered in conjunction with m ...

... • Results of this research indicate that an investor who made use of the combinations of Graham’s criteria investigated to create a portfolio, would have achieved results better than that of the BIST-100 during the period 2005 and 2014, excluded crisis period. • When considered in conjunction with m ...

Quantitative Investment Analysis by Richard A. DeFusco/ CFA

... 1. All investors are risk averse; they prefer less risk to more for the same level of expected return. 2. Expected returns for all assets are known. 3.The variances and covariances of all asset returns are known. 4. Investors need only know the expected returns, variances, and covariances of returns ...

... 1. All investors are risk averse; they prefer less risk to more for the same level of expected return. 2. Expected returns for all assets are known. 3.The variances and covariances of all asset returns are known. 4. Investors need only know the expected returns, variances, and covariances of returns ...

Quantitative Investment Analysis by Richard A. DeFusco/ CFA

... 1. All investors are risk averse; they prefer less risk to more for the same level of expected return. 2. Expected returns for all assets are known. 3.The variances and covariances of all asset returns are known. 4. Investors need only know the expected returns, variances, and covariances of returns ...

... 1. All investors are risk averse; they prefer less risk to more for the same level of expected return. 2. Expected returns for all assets are known. 3.The variances and covariances of all asset returns are known. 4. Investors need only know the expected returns, variances, and covariances of returns ...

Financial Markets

... 1.225%. A bill with par value of $10000 could be purchased for $10000 x (1-.01225) = $9877.50 Ask yld: 5.03 - an investor who buys the bill for asked price and holds it until maturity will see her investment grow over 90 days by a multiple of $10000/$9877.50 = 1.01240 or 1.24%. Annualizing this re ...

... 1.225%. A bill with par value of $10000 could be purchased for $10000 x (1-.01225) = $9877.50 Ask yld: 5.03 - an investor who buys the bill for asked price and holds it until maturity will see her investment grow over 90 days by a multiple of $10000/$9877.50 = 1.01240 or 1.24%. Annualizing this re ...

Investment Strategy

... Overall investment (21% of GDP) has been low. Although private investment rose for the first time in December 2014 after staying flat for nine month, B2-3tr government investment budget has not been disbursed as much as planned. As of 5M15 (October 2014 - February 2015), only 17.92% or B449bn of gov ...

... Overall investment (21% of GDP) has been low. Although private investment rose for the first time in December 2014 after staying flat for nine month, B2-3tr government investment budget has not been disbursed as much as planned. As of 5M15 (October 2014 - February 2015), only 17.92% or B449bn of gov ...

Introduction to Financial Management

... Unsystematic Risk • = Diversifiable risk • Risk factors that affect a limited number of assets • Risk that can be eliminated by combining assets into portfolios • “Unique risk” • “Asset-specific risk” • Examples: labor strikes, part shortages, etc. Return to Quick Quiz ...

... Unsystematic Risk • = Diversifiable risk • Risk factors that affect a limited number of assets • Risk that can be eliminated by combining assets into portfolios • “Unique risk” • “Asset-specific risk” • Examples: labor strikes, part shortages, etc. Return to Quick Quiz ...

An affine factor model of the Greek term structure

... that ensures no arbitrage across the entire term structure. Despite their complexities, because yields are a¢ ne functions of the underlying state vector, the models remain tractable and have closed form solutions. A key characteristic of a¢ ne term structure models is that all missing bond yields c ...

... that ensures no arbitrage across the entire term structure. Despite their complexities, because yields are a¢ ne functions of the underlying state vector, the models remain tractable and have closed form solutions. A key characteristic of a¢ ne term structure models is that all missing bond yields c ...

High Quality High Yield Select UMA Seix Advisors

... manager's results in managing Morgan Stanley program accounts, or the investment manager's results in managing accounts and investment products, in the same or a substantially similar investment discipline. (For periods through June 2012, the Fiduciary Services program operated through two channels ...

... manager's results in managing Morgan Stanley program accounts, or the investment manager's results in managing accounts and investment products, in the same or a substantially similar investment discipline. (For periods through June 2012, the Fiduciary Services program operated through two channels ...

Quantity demanded

... In many economies, except for those that are ruled by central planning at all levels, markets play a very important (or, at least some) role in the determination of quantities and prices. Markets are where buyers and sellers meet and interact and it is through this interaction that prices and quant ...

... In many economies, except for those that are ruled by central planning at all levels, markets play a very important (or, at least some) role in the determination of quantities and prices. Markets are where buyers and sellers meet and interact and it is through this interaction that prices and quant ...

Fixed Income in a Rising Rate Enviornment

... levels have more room to tighten. This may help reduce the overall yield increase if spreads tighten. The result is less of a decline in the prices of non-government bonds. However, if credit spreads are tight at the start of the rising rate period, there is little potential offset to falling bond p ...

... levels have more room to tighten. This may help reduce the overall yield increase if spreads tighten. The result is less of a decline in the prices of non-government bonds. However, if credit spreads are tight at the start of the rising rate period, there is little potential offset to falling bond p ...

Franklin Quotential Balanced Income Portfolio Series A

... historical risk. The overall Star Rating for a fund is a weighted combination of its 3-, 5-, and 10-year ratings. Overall ratings are adjusted where a fund has less than five or 10 years’ history. Within each Morningstar category, the top 10% of funds receive five stars, the next 22.5% four stars, t ...

... historical risk. The overall Star Rating for a fund is a weighted combination of its 3-, 5-, and 10-year ratings. Overall ratings are adjusted where a fund has less than five or 10 years’ history. Within each Morningstar category, the top 10% of funds receive five stars, the next 22.5% four stars, t ...

Navigating Interest Rate Cycles with the Laddered Bond Portfolio

... interest rate risk and long-term bonds to produce income with their higher yields. But short-term bonds yield little, while long-term bonds are more subject to market price risk and so are much more volatile. The “bullet” strategy concentrates in bonds of a specific duration or maturity, which in re ...

... interest rate risk and long-term bonds to produce income with their higher yields. But short-term bonds yield little, while long-term bonds are more subject to market price risk and so are much more volatile. The “bullet” strategy concentrates in bonds of a specific duration or maturity, which in re ...

Bond Calculator

... maturity. It is usually shown as percentage per annum. Yield to maturity can be calculated either including reinvestment of coupon payments over the course of the year (effective yield), or excluding reinvestment of coupon payments over the course of the year (nominal yield). It should be noted that ...

... maturity. It is usually shown as percentage per annum. Yield to maturity can be calculated either including reinvestment of coupon payments over the course of the year (effective yield), or excluding reinvestment of coupon payments over the course of the year (nominal yield). It should be noted that ...

Chapter 10 Some Lessons from Capital Market History Chapter

... • Prices reflect all past market information such as price and volume • If the market is weak form efficient, then investors cannot earn abnormal returns by trading on market information • Implies that technical analysis will not lead to abnormal returns • Empirical evidence indicates that markets a ...

... • Prices reflect all past market information such as price and volume • If the market is weak form efficient, then investors cannot earn abnormal returns by trading on market information • Implies that technical analysis will not lead to abnormal returns • Empirical evidence indicates that markets a ...

Chapter 6 - Moodle UMK

... Define and measure the expected rate of return of an individual investment Define and measure the riskiness of an individual investment Compare the historical relationship between risk and rates of return in the capital markets Explain how diversifying investments affect the riskiness and expected r ...

... Define and measure the expected rate of return of an individual investment Define and measure the riskiness of an individual investment Compare the historical relationship between risk and rates of return in the capital markets Explain how diversifying investments affect the riskiness and expected r ...