Fin 3710 Investment Analysis

... If gold had a perfectly positive correlation with stocks, gold would not be a part of efficient portfolios. The set of risk/return combinations of stocks and gold would plot as a straight line with a negative slope. (See the following graph.) The graph shows that the stock-only portfolio dominates a ...

... If gold had a perfectly positive correlation with stocks, gold would not be a part of efficient portfolios. The set of risk/return combinations of stocks and gold would plot as a straight line with a negative slope. (See the following graph.) The graph shows that the stock-only portfolio dominates a ...

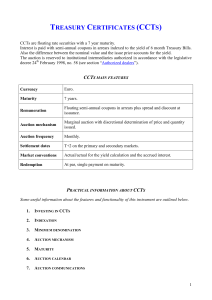

TREASURY CERTIFICATES (CCTS)

... Treasury Certificates are a kind of security very appreciated by families because of their feature to adjust coupons to market rates and therefore guarantee, in case of a negotiation before maturity, a capital amount very similar to that initially invested. CCTs have been issued, since March 1991, w ...

... Treasury Certificates are a kind of security very appreciated by families because of their feature to adjust coupons to market rates and therefore guarantee, in case of a negotiation before maturity, a capital amount very similar to that initially invested. CCTs have been issued, since March 1991, w ...

How important is dividend yield?

... payouts and the yield on your investment will drop. If you spot a stock with a large dividend yield, first check its market price over the previous six months. If the price has dropped precipitously, proceed cautiously. Summary The dividend yield indicates the ability to generate dividend income as ...

... payouts and the yield on your investment will drop. If you spot a stock with a large dividend yield, first check its market price over the previous six months. If the price has dropped precipitously, proceed cautiously. Summary The dividend yield indicates the ability to generate dividend income as ...

Risk and Return: The Portfolio Theory The crux of portfolio theory

... • Does the CAPM work? • Is beta a good proxy for risk? (it should be correlated with expected returns if it is!). • Roll (1977) showed that the CAPM cannot be tested as the market portfolio is unobservable (the market portfolio must consist of all possible investment alternatives that the investor h ...

... • Does the CAPM work? • Is beta a good proxy for risk? (it should be correlated with expected returns if it is!). • Roll (1977) showed that the CAPM cannot be tested as the market portfolio is unobservable (the market portfolio must consist of all possible investment alternatives that the investor h ...

FSM260 Portfolio Analysis

... vulnerabilities and understand drivers of risk at the asset and portfolio levels. ...

... vulnerabilities and understand drivers of risk at the asset and portfolio levels. ...

CAS 2002 CANE Meeting

... Shortcomings of Policyholder oriented risk metrics Narrow focus on loss typically does not reflect variability in loss payment, premium amount and collection, expense amount and payment and the impact of taxes and investment income on float and surplus Reliability of results is questionable due ...

... Shortcomings of Policyholder oriented risk metrics Narrow focus on loss typically does not reflect variability in loss payment, premium amount and collection, expense amount and payment and the impact of taxes and investment income on float and surplus Reliability of results is questionable due ...

Personalised discretionary portfolio management: the tailor

... To benefit from a direct and personalised contact with a dedicated portfolio manager ...

... To benefit from a direct and personalised contact with a dedicated portfolio manager ...

Market Effeciency

... mean-variance analysis adequately explains the inherent risks of non-traditional investments It is the aim of the research study to show that H0 is indeed true. ...

... mean-variance analysis adequately explains the inherent risks of non-traditional investments It is the aim of the research study to show that H0 is indeed true. ...

Grant Samuel Epoch Global Equity Shareholder Yield

... Presentation of the Firm—Epoch Investment Partners, Inc. became a registered investment adviser under the Investment Advisers Act of 1940 in June, 2004. Performance from 4/01 through 5/04 is for Epoch’s investment team and accounts while at Steinberg Priest & Sloane Capital Management, LLC. For the ...

... Presentation of the Firm—Epoch Investment Partners, Inc. became a registered investment adviser under the Investment Advisers Act of 1940 in June, 2004. Performance from 4/01 through 5/04 is for Epoch’s investment team and accounts while at Steinberg Priest & Sloane Capital Management, LLC. For the ...

C16_Reilly1ce

... • Immunize a portfolio from interest rate risk by keeping the portfolio duration equal to the ...

... • Immunize a portfolio from interest rate risk by keeping the portfolio duration equal to the ...

Chapter 07 - Introduction to Risk and Return

... The covariance of BP with the market portfolio (σBP, Market) is the mean of the eight respective covariances between BP and each of the eight stocks in the portfolio. (The covariance of BP with itself is the variance of BP.) Therefore, σBP, Market is equal to the average of the eight covariances in ...

... The covariance of BP with the market portfolio (σBP, Market) is the mean of the eight respective covariances between BP and each of the eight stocks in the portfolio. (The covariance of BP with itself is the variance of BP.) Therefore, σBP, Market is equal to the average of the eight covariances in ...

1Q17 FT Preferred Securities and Income Fact

... You should consider the Fund’s investment objectives, risks, and charges and expenses carefully before investing. Contact First Trust Portfolios L.P. at 1-800-621-1675 or visit www.ftportfolios.com to obtain a prospectus or summary prospectus which contains this and other information about the Fund. ...

... You should consider the Fund’s investment objectives, risks, and charges and expenses carefully before investing. Contact First Trust Portfolios L.P. at 1-800-621-1675 or visit www.ftportfolios.com to obtain a prospectus or summary prospectus which contains this and other information about the Fund. ...

Chapter 2

... Based on his work, we will see how diversification works, and we can be sure that we have “efficiently diversified portfolios.” An efficiently diversified portfolio is one that has the highest expected return, given its risk. You must be aware of the difference between historic return and expect ...

... Based on his work, we will see how diversification works, and we can be sure that we have “efficiently diversified portfolios.” An efficiently diversified portfolio is one that has the highest expected return, given its risk. You must be aware of the difference between historic return and expect ...

Tab 1.1 - University of Maine System

... government/corporate desk as well as the Pegasus Bond Fund, the Pegasus Intermediate Bond Fund, the Mortgage-Backed Securities Fund, the Market Plus Fund and large institutional portfolios. Prior to that position, Doug was a fixed income quantitative research analyst. He holds a B.S. in chemistry fr ...

... government/corporate desk as well as the Pegasus Bond Fund, the Pegasus Intermediate Bond Fund, the Mortgage-Backed Securities Fund, the Market Plus Fund and large institutional portfolios. Prior to that position, Doug was a fixed income quantitative research analyst. He holds a B.S. in chemistry fr ...

robust regression in s-plus - R/Finance 2016

... Average Average Absolute Difference Standard Error ...

... Average Average Absolute Difference Standard Error ...

A Model-Based Approach to Constructing Corporate Bond Portfolios

... 2 The Quantitative Models for Risk Measurement and Valuation The quantitative tools supporting our model-based approach are Moody’s Analytics’ EDF (Expected Default Frequency) credit measures and Fair-value Spread (FVS) valuation framework. The EDF credit measure is calculated using a structural fra ...

... 2 The Quantitative Models for Risk Measurement and Valuation The quantitative tools supporting our model-based approach are Moody’s Analytics’ EDF (Expected Default Frequency) credit measures and Fair-value Spread (FVS) valuation framework. The EDF credit measure is calculated using a structural fra ...

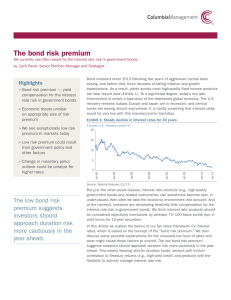

The bond risk premium

... Although longer term government bonds are default-risk-free (or at least we will work under that assumption here), they are also riskier than bills. In particular, they are much more sensitive to changes in interest rates. Nominal returns for default-risk-free bonds come from only two sources: the b ...

... Although longer term government bonds are default-risk-free (or at least we will work under that assumption here), they are also riskier than bills. In particular, they are much more sensitive to changes in interest rates. Nominal returns for default-risk-free bonds come from only two sources: the b ...

clearbridge dividend strategy portfolios

... Alpha is a measure of performance vs. a benchmark on a risk-adjusted basis. A positive alpha of 1.0 means the portfolio has outperformed its benchmark index by 1%. Correspondingly, a similar negative alpha would indicate an underperformance of 1%. Alpha is a measure of the difference between actual ...

... Alpha is a measure of performance vs. a benchmark on a risk-adjusted basis. A positive alpha of 1.0 means the portfolio has outperformed its benchmark index by 1%. Correspondingly, a similar negative alpha would indicate an underperformance of 1%. Alpha is a measure of the difference between actual ...

Empirical Evidence : CAPM and APT

... Predicted 'mean' excess return The two lines connect portfolios of different size categories, within a given book-to-market category. We only connect the points within the highest and lowest BMV categories. If we had joined up point for the other BMV quintiles, the lines would show a positive relati ...

... Predicted 'mean' excess return The two lines connect portfolios of different size categories, within a given book-to-market category. We only connect the points within the highest and lowest BMV categories. If we had joined up point for the other BMV quintiles, the lines would show a positive relati ...

Practice four

... (i.e., has an alpha of –6%), and hence is an overpriced portfolio. This is inconsistent with the CAPM. 18 Not possible. The SML is the same as in Problem 12. Here, the required expected return for Portfolio A is: 10% + (0.9 8%) = 17.2% This is still higher than 16%. Portfolio A is overpriced, with ...

... (i.e., has an alpha of –6%), and hence is an overpriced portfolio. This is inconsistent with the CAPM. 18 Not possible. The SML is the same as in Problem 12. Here, the required expected return for Portfolio A is: 10% + (0.9 8%) = 17.2% This is still higher than 16%. Portfolio A is overpriced, with ...

ENDOWMENT TRUSTEES

... and component changes. Changes are made based on prevailing market conditions and future expectations. Institutional Discretionary Portfolio (IDP) – Large Cap Value manager – reported a gain of 6.4% compared to its benchmark of 8.1%. This portfolio includes four individual large cap value style mana ...

... and component changes. Changes are made based on prevailing market conditions and future expectations. Institutional Discretionary Portfolio (IDP) – Large Cap Value manager – reported a gain of 6.4% compared to its benchmark of 8.1%. This portfolio includes four individual large cap value style mana ...