Asset Allocation - Columbia Basin Foundation

... Agencies and Corporate issues with a minimum rating of investment grade are required. If a security is downgraded below the minimum rating, the Investment Manager must promptly sell that investment. (Investment grade is defined by Standard & Poor’s as AAA, AA, A, BAA or any slight variation.) All ...

... Agencies and Corporate issues with a minimum rating of investment grade are required. If a security is downgraded below the minimum rating, the Investment Manager must promptly sell that investment. (Investment grade is defined by Standard & Poor’s as AAA, AA, A, BAA or any slight variation.) All ...

How the Affluent Manage Home Equity to Safely and Conservatively

... options other than the 30 year fixed mortgage. Wealthy Americans, those with the ability to pay off their mortgage but refuse to do so, understand how to make their mortgage work for them. They go against many of the beliefs of traditional thinking. They put very little money down, they keep their mo ...

... options other than the 30 year fixed mortgage. Wealthy Americans, those with the ability to pay off their mortgage but refuse to do so, understand how to make their mortgage work for them. They go against many of the beliefs of traditional thinking. They put very little money down, they keep their mo ...

Mandatory IFRS adoption and the cost of equity

... directives to improve financial market regulation (for instance, insider trading regulation). These institutional changes can modify firms’ reporting incentives leading to better quality disclosures and, thus, to a lower cost of capital. The investigation of mandatory IFRS adoption shows, however, s ...

... directives to improve financial market regulation (for instance, insider trading regulation). These institutional changes can modify firms’ reporting incentives leading to better quality disclosures and, thus, to a lower cost of capital. The investigation of mandatory IFRS adoption shows, however, s ...

Presentation

... These findings are all consistent with the presence of payoff complementarities among corporate bond-fund investors driven by the illiquidity of their assets. ...

... These findings are all consistent with the presence of payoff complementarities among corporate bond-fund investors driven by the illiquidity of their assets. ...

Capital requirements for MiFID investment firms

... all Member States would be clear and simple but could mean that some firms (while systemically significant domestically in their home states) are never caught in the highest category. An alternative approach would be to set quantitative thresholds in percentage rather than nominal terms (e.g. a firm ...

... all Member States would be clear and simple but could mean that some firms (while systemically significant domestically in their home states) are never caught in the highest category. An alternative approach would be to set quantitative thresholds in percentage rather than nominal terms (e.g. a firm ...

Ambiguous Growth and Asset Prices in Production Economies

... intertemporal substitution in consumption (henceforth, EIS), and stock holders with high EIS. Thus, separating the SDF (also known as the pricing kernel) for pricing bonds and stock returns. This method addresses the excess volatility of the risk free rate problem. In our research, we show that it i ...

... intertemporal substitution in consumption (henceforth, EIS), and stock holders with high EIS. Thus, separating the SDF (also known as the pricing kernel) for pricing bonds and stock returns. This method addresses the excess volatility of the risk free rate problem. In our research, we show that it i ...

Mutual Fund Assets and Flows in 1999

... Brian Reid is Assistant Vice President and Director of Industry and Financial Analysis, and Kimberlee Millar is Senior Research Associate at the Investment Company Institute. Travis Lee provided research support, and Janet Thompson-Conley prepared the charts and tables. ...

... Brian Reid is Assistant Vice President and Director of Industry and Financial Analysis, and Kimberlee Millar is Senior Research Associate at the Investment Company Institute. Travis Lee provided research support, and Janet Thompson-Conley prepared the charts and tables. ...

Working Capital Management

... • The days working capital (DWC), defined as the sum of receivables and inventories less payables divided by daily sales, averages 51.8 days • The inventory turnover rate (once every 32.0 days) • The number of days that payables are outstanding (32.4 days). • In all instances, the standard deviation ...

... • The days working capital (DWC), defined as the sum of receivables and inventories less payables divided by daily sales, averages 51.8 days • The inventory turnover rate (once every 32.0 days) • The number of days that payables are outstanding (32.4 days). • In all instances, the standard deviation ...

Chapter Fifteen

... combines the funds of investors who have purchased shares of ownership in the investment company and then invests that money in a diversified portfolio of stocks and bonds issued by other corporations or governments. • Portfolio – consists of a collection of securities and other investment alternati ...

... combines the funds of investors who have purchased shares of ownership in the investment company and then invests that money in a diversified portfolio of stocks and bonds issued by other corporations or governments. • Portfolio – consists of a collection of securities and other investment alternati ...

Working capital lecture 08122009 students

... • The days working capital (DWC), defined as the sum of receivables and inventories less payables divided by daily sales, averages 51.8 days • The inventory turnover rate (once every 32.0 days) • The number of days that payables are outstanding (32.4 days). • In all instances, the standard deviation ...

... • The days working capital (DWC), defined as the sum of receivables and inventories less payables divided by daily sales, averages 51.8 days • The inventory turnover rate (once every 32.0 days) • The number of days that payables are outstanding (32.4 days). • In all instances, the standard deviation ...

negative interest rates create rush for real estate

... want to increase by more than €50m, 29% between €10–50m and 10% by less than €10m. Furthermore, there are some investors (10%) planning to decrease their holdings over the next 12 months, according to the survey. In total, the Nordic institutions are planning to acquire real estate for approximatel ...

... want to increase by more than €50m, 29% between €10–50m and 10% by less than €10m. Furthermore, there are some investors (10%) planning to decrease their holdings over the next 12 months, according to the survey. In total, the Nordic institutions are planning to acquire real estate for approximatel ...

Forecasting the equity premium in the Australian market

... The most common approach to estimating equity risk premiums remains the use of historical returns, with the difference in annual returns on stocks and bonds over a long time period comprising the expected risk premium, in the future. There are limitations to this approach given that the attitude to ...

... The most common approach to estimating equity risk premiums remains the use of historical returns, with the difference in annual returns on stocks and bonds over a long time period comprising the expected risk premium, in the future. There are limitations to this approach given that the attitude to ...

Target Outcome Funds

... trusts providing investors a broad complement of outcome style investments to build more robust and resilient portfolios. “Outcome investments” involve passive strategies targeting a specific risk/reward trade‐off achieved through a combination of fixed income securities and options contracts. Each ...

... trusts providing investors a broad complement of outcome style investments to build more robust and resilient portfolios. “Outcome investments” involve passive strategies targeting a specific risk/reward trade‐off achieved through a combination of fixed income securities and options contracts. Each ...

Identifying Speculative Bubbles: A Two-Pillar Surveillance

... right to resell a stock makes them willing to pay more for it than they would pay if obliged to hold it forever. On this basis, an asset bubble exists where investors make a purchase only if they have the ability to subsequently sell the asset at some future date.11 Kindleberger (1987) defines a spe ...

... right to resell a stock makes them willing to pay more for it than they would pay if obliged to hold it forever. On this basis, an asset bubble exists where investors make a purchase only if they have the ability to subsequently sell the asset at some future date.11 Kindleberger (1987) defines a spe ...

A Modern, Behavior-Aware Approach to Asset Allocation and

... behavior in long-term investment results. Despite his foundational research in MPT, even Dr. Markowitz has admitted to forgoing its application within his own personal investments for behavioral reasons. “Instead, I visualized my grief if the stock market went up and I wasn’t in it – or if it went w ...

... behavior in long-term investment results. Despite his foundational research in MPT, even Dr. Markowitz has admitted to forgoing its application within his own personal investments for behavioral reasons. “Instead, I visualized my grief if the stock market went up and I wasn’t in it – or if it went w ...

ACCESS TO FINANCE OF CROATIAN SMEs

... enterprises in their start-up or the earliest development phases, because such enterprises usually do not posses assets worth at least as required amount of finance. Proof of further business opportunities is also a must. In order to finance a business, bank or other financial institutions require ...

... enterprises in their start-up or the earliest development phases, because such enterprises usually do not posses assets worth at least as required amount of finance. Proof of further business opportunities is also a must. In order to finance a business, bank or other financial institutions require ...

NBER WORKING PAPER SERIES RATIONAL ASSET PRICES George M. Constantinides 8826

... inflation. Over the period 1872 to 2000, the sample mean of the real equity return is 8.9 percent and of the premium is 6.9 percent. Over the period 1926 to 2000, the sample mean of the equity return is 9.7 percent and of the premium is 9.3 percent. Over the postwar period 1951 to 2000, the sample ...

... inflation. Over the period 1872 to 2000, the sample mean of the real equity return is 8.9 percent and of the premium is 6.9 percent. Over the period 1926 to 2000, the sample mean of the equity return is 9.7 percent and of the premium is 9.3 percent. Over the postwar period 1951 to 2000, the sample ...

1 A $1000 bond has a coupon of 6% and matures after

... (Be certain to point out that a firm may operate at an accounting loss but still generate positive cash flow.) ...

... (Be certain to point out that a firm may operate at an accounting loss but still generate positive cash flow.) ...

पीडीएफ फाइल जो नई विंडों में खुलती है।

... water bills, etc. The short-term finance is required for a period of one year or less. This financial requirement for short period is also known as working capital requirement or circulating capital requirement. It may be noted that a part of the working capital requirement is of a long-term nature, ...

... water bills, etc. The short-term finance is required for a period of one year or less. This financial requirement for short period is also known as working capital requirement or circulating capital requirement. It may be noted that a part of the working capital requirement is of a long-term nature, ...

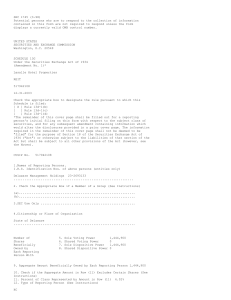

0000921739-04-000026 - Lasalle Hotel Properties

... Ownership of More than Five Percent on Behalf of Another Person. If any other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, such securities, a statement to that effect should be included in response to this item a ...

... Ownership of More than Five Percent on Behalf of Another Person. If any other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, such securities, a statement to that effect should be included in response to this item a ...

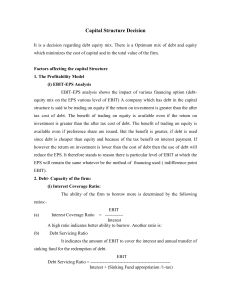

Capital Structure Decision

... Maneuverability refers to the firm ability to either increasing or decreasing its sources of funds in response to changes in the need of funds on while designing the capital structure it should not loose site of the future impact of its present financial plan. For example if the firm has exhausted i ...

... Maneuverability refers to the firm ability to either increasing or decreasing its sources of funds in response to changes in the need of funds on while designing the capital structure it should not loose site of the future impact of its present financial plan. For example if the firm has exhausted i ...

Managerial Economics - e

... business is "leveraged," it means that the business has borrowed money to finance the purchase of assets. The other way to purchase assets is through use of owner funds, or equity. One way to determine leverage is to calculate the Debt-toEquity ratio, showing how much of the assets of the business a ...

... business is "leveraged," it means that the business has borrowed money to finance the purchase of assets. The other way to purchase assets is through use of owner funds, or equity. One way to determine leverage is to calculate the Debt-toEquity ratio, showing how much of the assets of the business a ...

Information Asymmetry within Financial Markets and Corporate

... promoting the internal funding sources rather than the external ones. Most often, firms with large profits being made usually tend to have recourse and access to the preserved wealth rather than engaging in to debt practices to finance their investment projects and strategies. In fact, such a financ ...

... promoting the internal funding sources rather than the external ones. Most often, firms with large profits being made usually tend to have recourse and access to the preserved wealth rather than engaging in to debt practices to finance their investment projects and strategies. In fact, such a financ ...

Session 25- Dividends II (The trade off)

... If a firm's investment policies (and hence cash flows) don't change, the value of the firm cannot change as it changes dividends. If a firm pays more in dividends, it will have to issue new equity to fund the same projects. By doing so, it will reduce expected price appreciation on the stock but it ...

... If a firm's investment policies (and hence cash flows) don't change, the value of the firm cannot change as it changes dividends. If a firm pays more in dividends, it will have to issue new equity to fund the same projects. By doing so, it will reduce expected price appreciation on the stock but it ...

Venture Capital Fund

... These materials provided by WithumSmith+Brown, PC (“Withum”) are intended to provide general information on a particular subject or subjects and are not to be considered an authoritative or necessarily an exhaustive treatment of such subject(s) and are not intended to be a substitute for reading the ...

... These materials provided by WithumSmith+Brown, PC (“Withum”) are intended to provide general information on a particular subject or subjects and are not to be considered an authoritative or necessarily an exhaustive treatment of such subject(s) and are not intended to be a substitute for reading the ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.