Holding the middle ground with convertible securities

... Topics presented in this paper are not necessarily applicable to funds managed by the authors, which may employ strategies not covered here. See the fund’s prospectus for details. The opinions expressed here are those of Eric Harthun and Robert Salvin and are not intended as investment advice. They ...

... Topics presented in this paper are not necessarily applicable to funds managed by the authors, which may employ strategies not covered here. See the fund’s prospectus for details. The opinions expressed here are those of Eric Harthun and Robert Salvin and are not intended as investment advice. They ...

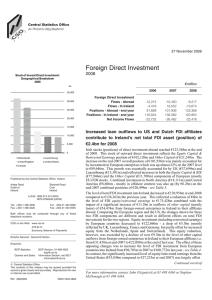

Foreign Direct Investment Annual (PDF 239KB)

... investment according to the location of the non-resident counterpart and the principal economic activity of the resident direct investment enterprise (using the NACE Rev. 1.1 classification). It provides end-2008 FDI positions (balance sheet) as well as transactions during the year along with compar ...

... investment according to the location of the non-resident counterpart and the principal economic activity of the resident direct investment enterprise (using the NACE Rev. 1.1 classification). It provides end-2008 FDI positions (balance sheet) as well as transactions during the year along with compar ...

Bank CEO Incentives and the Credit Crisis

... wealth which can change his willingness to take risks (see Ross (2004)). Whether greater sensitivity of CEO wealth to volatility makes the CEO’s interests better aligned with the interests of shareholders would seem to depend on many considerations. For example, if the CEO’s holdings of stock make h ...

... wealth which can change his willingness to take risks (see Ross (2004)). Whether greater sensitivity of CEO wealth to volatility makes the CEO’s interests better aligned with the interests of shareholders would seem to depend on many considerations. For example, if the CEO’s holdings of stock make h ...

Eurasia Drilling Co. 4Q12 preview – results and outlook known – but

... This report has been prepared by the analysts of Gazprombank (Open Joint Stock Company) (hereinafter – Gazprombank) and is based on information obtained from public sources believed to be reliable, but is not guaranteed as necessarily being accurate. With the exception of information directly pertai ...

... This report has been prepared by the analysts of Gazprombank (Open Joint Stock Company) (hereinafter – Gazprombank) and is based on information obtained from public sources believed to be reliable, but is not guaranteed as necessarily being accurate. With the exception of information directly pertai ...

Structural Models of Credit Risk are Useful: Evidence

... underlying asset and that the pattern of sensitivities is broadly consistent with the level of credit exposure. In other words, this paper focusses attention on the second-moment predictions of the model. In structural models, any change in the value of a credit risky bond credit is a result of a ch ...

... underlying asset and that the pattern of sensitivities is broadly consistent with the level of credit exposure. In other words, this paper focusses attention on the second-moment predictions of the model. In structural models, any change in the value of a credit risky bond credit is a result of a ch ...

F Stock Prices and the Equity Premium during the Recent Bull and

... true to previous experience, the companies with the greatest market capitalization and the highest priceearnings ratios accounted for most of the value of the index and most of its variation. The particularly high stock prices that emerged in the 1990s, especially for the few companies that accounte ...

... true to previous experience, the companies with the greatest market capitalization and the highest priceearnings ratios accounted for most of the value of the index and most of its variation. The particularly high stock prices that emerged in the 1990s, especially for the few companies that accounte ...

- Columbia Business School

... of sophisticated mutual fund investors in the market. Mutual fund flows, on average, have been considered to proxy for investor sentiments. Teo and Woo (2004) and Frazzini and Lamont (2008) show the “dumb money” effect where investors’ reallocation of wealth across different mutual funds reduce the ...

... of sophisticated mutual fund investors in the market. Mutual fund flows, on average, have been considered to proxy for investor sentiments. Teo and Woo (2004) and Frazzini and Lamont (2008) show the “dumb money” effect where investors’ reallocation of wealth across different mutual funds reduce the ...

MPF Scheme Series S800

... 7. The Principal MPF Conservative Fund under this Scheme is not a guaranteed fund and does not guarantee the repayment of capital. Fees and charges of a MPF conservative fund can be deducted from either (i) the assets of the fund or (ii) members’ account by way of unit deduction. This Fund uses met ...

... 7. The Principal MPF Conservative Fund under this Scheme is not a guaranteed fund and does not guarantee the repayment of capital. Fees and charges of a MPF conservative fund can be deducted from either (i) the assets of the fund or (ii) members’ account by way of unit deduction. This Fund uses met ...

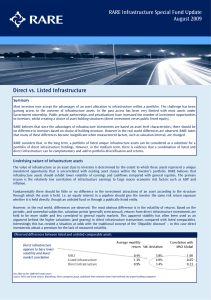

Listed vs Unlisted rgc - RARE Infrastructure Limited

... Potential investors should seek independent advice as to the suitability of the Fund to their investment needs. Treasury Group Investment Services Limited is the responsible entity for the RARE Infrastructure Value Fund (“RIVAF”), the RARE Series Value Fund and the RARE Series Emerging Markets Fund ...

... Potential investors should seek independent advice as to the suitability of the Fund to their investment needs. Treasury Group Investment Services Limited is the responsible entity for the RARE Infrastructure Value Fund (“RIVAF”), the RARE Series Value Fund and the RARE Series Emerging Markets Fund ...

chapter 3

... stockholders can maintain control of a firm while limiting their investment. (2) Creditors look to the equity, or owner-supplied funds, to provide a margin of safety, so if the stockholders have provided only a small proportion of the total financing, the firm’s risks are borne mainly by its credito ...

... stockholders can maintain control of a firm while limiting their investment. (2) Creditors look to the equity, or owner-supplied funds, to provide a margin of safety, so if the stockholders have provided only a small proportion of the total financing, the firm’s risks are borne mainly by its credito ...

Chapter 2 Assignment Grid

... chapters. Spend adequate time in the beginning with accounting terminology. Accounting is a “foreign” language to many students, and, as true with a real foreign language, you must start with the basics. Students seemingly understand assets and liabilities more easily than equity. An asset can be to ...

... chapters. Spend adequate time in the beginning with accounting terminology. Accounting is a “foreign” language to many students, and, as true with a real foreign language, you must start with the basics. Students seemingly understand assets and liabilities more easily than equity. An asset can be to ...

Portfolio1 - people.bath.ac.uk

... • Trading stocks naturally generates significant transaction costs, which reduce the overall return. • Moreover, when a fund is large enough, it faces investment capacity restrictions. When a fund wishes to take a strong position in one stock, it might not be able to get the shares at the existing p ...

... • Trading stocks naturally generates significant transaction costs, which reduce the overall return. • Moreover, when a fund is large enough, it faces investment capacity restrictions. When a fund wishes to take a strong position in one stock, it might not be able to get the shares at the existing p ...

Long-term Capital Market Return Assumptions

... Our assumptions are informed by a process that carefully balances quantitative and qualitative inputs, both of which have been rigorously researched and continuously refined over the past two decades. The Assumptions Committee driving this process includes some of the most senior investors from our ...

... Our assumptions are informed by a process that carefully balances quantitative and qualitative inputs, both of which have been rigorously researched and continuously refined over the past two decades. The Assumptions Committee driving this process includes some of the most senior investors from our ...

OMB APPROVAL ------------------------------ OMB NUMBER: 3235

... ------------------------------------------------The securities with respect to which this Amended Schedule 13D is filed were purchased by the Funds using working capital contributed by their respective partners and shareholders. ITEM 4: PURPOSE OF TRANSACTION: ---------------------The securities wer ...

... ------------------------------------------------The securities with respect to which this Amended Schedule 13D is filed were purchased by the Funds using working capital contributed by their respective partners and shareholders. ITEM 4: PURPOSE OF TRANSACTION: ---------------------The securities wer ...

Will my portfolio give me an inflation plus return?

... case focused on technology stocks and the emergence of the internet. The tech bubble and bust foreshadowed more than just another boom-bust event. It marked the end of the era of disinflation and heralded more difficult economic and investment times ahead. As this realisation has progressively dawne ...

... case focused on technology stocks and the emergence of the internet. The tech bubble and bust foreshadowed more than just another boom-bust event. It marked the end of the era of disinflation and heralded more difficult economic and investment times ahead. As this realisation has progressively dawne ...

Thanigaimani Ph.D. 2 - Welcome to Bharathidasan University

... of the business are carried on. Poor operational performance may indicate poor sales and hence poor profits. A lower profitability may arise due to the lack of control over the expenses. Banks, financial institutions and other creditors look at the profitability ratio as an indicator whether or not ...

... of the business are carried on. Poor operational performance may indicate poor sales and hence poor profits. A lower profitability may arise due to the lack of control over the expenses. Banks, financial institutions and other creditors look at the profitability ratio as an indicator whether or not ...

Chapter 9

... Each firm has an optimal capital structure, defined as that mix of debt, preferred, and common equity that causes its stock price to be maximized. A value-maximizing firm will determine its optimal capital structure, use it as a target, and then raise new capital in a manner designed to keep the act ...

... Each firm has an optimal capital structure, defined as that mix of debt, preferred, and common equity that causes its stock price to be maximized. A value-maximizing firm will determine its optimal capital structure, use it as a target, and then raise new capital in a manner designed to keep the act ...

Institutional Ownership and Credit Spreads: An Information

... Recent literature has examined whether firms attracting more institutional investors on the equity side also tend to have lower cost of debt capital. For example, Ashbaugh, Collins, and LaFond (2006) and Bhojraj and Sengupta (BS, 2003) find the higher the total institutional equity ownership (IO), t ...

... Recent literature has examined whether firms attracting more institutional investors on the equity side also tend to have lower cost of debt capital. For example, Ashbaugh, Collins, and LaFond (2006) and Bhojraj and Sengupta (BS, 2003) find the higher the total institutional equity ownership (IO), t ...

Asset Enhancement CPF INVESTMENT GUIDELINES (CPFIG

... A FMC/Insurer is required to inform the CPF Board of a breach of the CPF Investment Guidelines by Funds that it manages within 14 calendar days of the occurrence of the breach. For Funds which invest in other funds that are not managed by the FMC/Insurer itself, the FMC/Insurer is required to inform ...

... A FMC/Insurer is required to inform the CPF Board of a breach of the CPF Investment Guidelines by Funds that it manages within 14 calendar days of the occurrence of the breach. For Funds which invest in other funds that are not managed by the FMC/Insurer itself, the FMC/Insurer is required to inform ...

Establishing China`s Green Financial System Detailed

... Bank lending served as an early means of attracting private capital into the environmental protection sector. Therefore, within the green finance policy system, green credit was launched the ...

... Bank lending served as an early means of attracting private capital into the environmental protection sector. Therefore, within the green finance policy system, green credit was launched the ...

View

... Solving for rd gives us the YTM for this bond. Remember that you can solve for the YTM by using: (1) trial-and-error—that is, plug in different values for rd until the right side of the equation equals $942.65; (2) the TVM keys on your calculator—input N = 20 (20 interest payments), PV = –942.65 (ma ...

... Solving for rd gives us the YTM for this bond. Remember that you can solve for the YTM by using: (1) trial-and-error—that is, plug in different values for rd until the right side of the equation equals $942.65; (2) the TVM keys on your calculator—input N = 20 (20 interest payments), PV = –942.65 (ma ...

Vanguard`s framework for constructing globally diversified portfolios

... variability. (See Figure A-1 on page 20 in Appendix II for individual regions.) Although the average annual returns represent averages over 116 years and should not be expected in any given year or time period, they provide an idea of the long-term historical returns and downside market risk that h ...

... variability. (See Figure A-1 on page 20 in Appendix II for individual regions.) Although the average annual returns represent averages over 116 years and should not be expected in any given year or time period, they provide an idea of the long-term historical returns and downside market risk that h ...

2015 Year-End Dermatology Update

... equity groups have typically gone below their typical investment size, aggregated several practices into one unified platform, or approached other private equity-backed practices for an acquisition. This strong demand has generated premium valuations for practices. Looking into 2016, Provident expec ...

... equity groups have typically gone below their typical investment size, aggregated several practices into one unified platform, or approached other private equity-backed practices for an acquisition. This strong demand has generated premium valuations for practices. Looking into 2016, Provident expec ...

Active management can add big value in small

... A strong case for active management The case for active management of equities and long-term investment portfolios remains strong, despite the recent growth in passive investment strategies. The small-cap universe is particularly compelling given its size and the limited availability of research. Th ...

... A strong case for active management The case for active management of equities and long-term investment portfolios remains strong, despite the recent growth in passive investment strategies. The small-cap universe is particularly compelling given its size and the limited availability of research. Th ...

TrustSM Target Date Collective Investment Funds

... Trust”) is a member of the Principal Financial Group®. Principal Trust maintains various Collective Investment Funds, as trustee, under certain plan and declaration of trust documents, which may be amended from time to time (“Trusts”). Principal Trust has discretion over the investment of the Collec ...

... Trust”) is a member of the Principal Financial Group®. Principal Trust maintains various Collective Investment Funds, as trustee, under certain plan and declaration of trust documents, which may be amended from time to time (“Trusts”). Principal Trust has discretion over the investment of the Collec ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.