Target Date Funds FRED REISH, ESQ.

... To consider the investor’s risk tolerance, personal circumstances, and complete financial situation. ...

... To consider the investor’s risk tolerance, personal circumstances, and complete financial situation. ...

Inefficient Markets, Efficient Investment?

... effectively transferring value from new shareholders to existing shareholders. To the extent that market inefficiency leads to a redistribution of wealth from one shareholder to another, market misvaluations will have no real economic impact. However, in the presence of financing constraints prevent ...

... effectively transferring value from new shareholders to existing shareholders. To the extent that market inefficiency leads to a redistribution of wealth from one shareholder to another, market misvaluations will have no real economic impact. However, in the presence of financing constraints prevent ...

INFORMATION ASYMMETRY AND ITS IMPACT ON COST OF

... make the proper decision (Kazemi & Rahmani, 2013). In cases when unknown or distorted information enters into a market, i.e. not accurate financial statements, it creates an uncertainty among shareholders which in turn will create a change in the stock prices due to the additional risk (Francis, LaF ...

... make the proper decision (Kazemi & Rahmani, 2013). In cases when unknown or distorted information enters into a market, i.e. not accurate financial statements, it creates an uncertainty among shareholders which in turn will create a change in the stock prices due to the additional risk (Francis, LaF ...

CF Prudential Managed Defensive Fund

... although the pace is likely to remain slow and short-term problems may well occur along the way. As European equities represent one of the larger components of the portfolio, he awaits greater clarity about the path of the eurozone economy. However, he recognises the trading bloc’s vulnerability, gi ...

... although the pace is likely to remain slow and short-term problems may well occur along the way. As European equities represent one of the larger components of the portfolio, he awaits greater clarity about the path of the eurozone economy. However, he recognises the trading bloc’s vulnerability, gi ...

Topic Note-11

... Of course, if the investor wants to hold on to the share for a longer period for other reasons, he can buy back the share after it has gone ex dividend. ...

... Of course, if the investor wants to hold on to the share for a longer period for other reasons, he can buy back the share after it has gone ex dividend. ...

Empirical Determinants and Patterns of Research and Development

... Especially since Krugman’s (1994) commentary on the nature of Asia’s high growth in the 1980s, much emphasis has been placed on the role of technological progress in sustaining economic growth in the region. Research and development (R&D) investment, the vital force behind innovation, was naturally ...

... Especially since Krugman’s (1994) commentary on the nature of Asia’s high growth in the 1980s, much emphasis has been placed on the role of technological progress in sustaining economic growth in the region. Research and development (R&D) investment, the vital force behind innovation, was naturally ...

what stock market returns to expect for the future?

... Therefore, its current assumption for the equity premium, defined as the difference between yields on equities and Treasuries, is 4.0 percent in the long run. Some critics contend that the projected return on stocks—and the resulting equity premium—used by the OACT are too high. It is important to r ...

... Therefore, its current assumption for the equity premium, defined as the difference between yields on equities and Treasuries, is 4.0 percent in the long run. Some critics contend that the projected return on stocks—and the resulting equity premium—used by the OACT are too high. It is important to r ...

What Stock Market Returns to Expect for the Future

... Therefore, its current assumption for the equity premium, defined as the difference between yields on equities and Treasuries, is 4.0 percent in the long run. Some critics contend that the projected return on stocks—and the resulting equity premium—used by the OACT are too high. It is important to r ...

... Therefore, its current assumption for the equity premium, defined as the difference between yields on equities and Treasuries, is 4.0 percent in the long run. Some critics contend that the projected return on stocks—and the resulting equity premium—used by the OACT are too high. It is important to r ...

NBER WORKING PAPER SERIES THE EQUITY PREMIUM IN RETROSPECT Rajnish Mehra

... averaged over certain time periods. We have divided the time period from 1929 to 2000 into subperiods, where the ratio market value of equity to national income was greater than 1 and where it was less than 1. Historically, as the figure illustrates, subsequent to periods when this ratio was ...

... averaged over certain time periods. We have divided the time period from 1929 to 2000 into subperiods, where the ratio market value of equity to national income was greater than 1 and where it was less than 1. Historically, as the figure illustrates, subsequent to periods when this ratio was ...

Lesson 2-1 - Lawton Community Schools

... • Paid cash to owner for personal use, 600.00. • Withdrawals decrease Owner’s Equity--so a drawing account’s normal balance is the left side. ...

... • Paid cash to owner for personal use, 600.00. • Withdrawals decrease Owner’s Equity--so a drawing account’s normal balance is the left side. ...

Tilburg University The Life Cycle of the Firm with

... tax burden throughout the life cycle of the firm. In this way, we extend Sinn’s analysis by allowing for debt finance and debt redemption. The possibility of financing initial investment with debt allows the firm to more rapidly accumulate earnings that can be distributed or retained and reinvested. ...

... tax burden throughout the life cycle of the firm. In this way, we extend Sinn’s analysis by allowing for debt finance and debt redemption. The possibility of financing initial investment with debt allows the firm to more rapidly accumulate earnings that can be distributed or retained and reinvested. ...

equity method of accounting

... • Financial instrument (AASB 132) is: – any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity • Categories of financial instruments in which equity investments can be included (AASB 139): – Financial asset or financial liabil ...

... • Financial instrument (AASB 132) is: – any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity • Categories of financial instruments in which equity investments can be included (AASB 139): – Financial asset or financial liabil ...

Crisis Alpha and Risk in Alternative Investment

... This mispricing, in addition to a lack of liquidity, can also be due to differences in credit and counterparty risk between these two relative assets. By buying the higher yielding investment and selling the lower yielding investment, a non-directional strategy can also be described as providing cre ...

... This mispricing, in addition to a lack of liquidity, can also be due to differences in credit and counterparty risk between these two relative assets. By buying the higher yielding investment and selling the lower yielding investment, a non-directional strategy can also be described as providing cre ...

The International Diversification Fallacy of Exchange

... country funds in providing global risk diversification for U.S. investors. Barry, Peavy, and Rodriguez (1997) take a comprehensive look at emerging stock markets and country funds. They find that the country funds listed on the U.S. exchanges are more highly correlated with the S&P 500 than the retu ...

... country funds in providing global risk diversification for U.S. investors. Barry, Peavy, and Rodriguez (1997) take a comprehensive look at emerging stock markets and country funds. They find that the country funds listed on the U.S. exchanges are more highly correlated with the S&P 500 than the retu ...

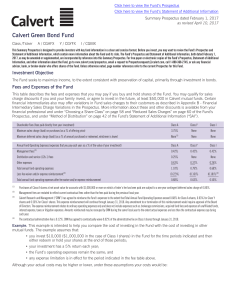

Calvert Green Bond Fund

... Fixed income markets have recently experienced a period of relatively high volatility due to rising U.S. treasury yields which, in part, reflect the market’s expectations for higher U.S. economic growth and inflation. As a result of the Federal Reserve’s recent decision to raise the target fed funds ...

... Fixed income markets have recently experienced a period of relatively high volatility due to rising U.S. treasury yields which, in part, reflect the market’s expectations for higher U.S. economic growth and inflation. As a result of the Federal Reserve’s recent decision to raise the target fed funds ...

F 385627 15 PaceUniversity FS

... Calculate Net Asset Value per Share (or Its Equivalent), to investments in alternative investments that do not have readily determinable fair values. This guidance allows, as a practical expedient, for the estimation of the fair value of investments in investment companies for which the investment d ...

... Calculate Net Asset Value per Share (or Its Equivalent), to investments in alternative investments that do not have readily determinable fair values. This guidance allows, as a practical expedient, for the estimation of the fair value of investments in investment companies for which the investment d ...

Lecture 5

... Free and clear holding: Unencumbered full ownership rights for an indefinite period Leveraged equity: Full ownership rights for an indefinite period encumbered by debt (a promissory note unrelated to the real asset under consideration) or a mortgage (a pledge that in case of inability to discharge t ...

... Free and clear holding: Unencumbered full ownership rights for an indefinite period Leveraged equity: Full ownership rights for an indefinite period encumbered by debt (a promissory note unrelated to the real asset under consideration) or a mortgage (a pledge that in case of inability to discharge t ...

Fund Account System (GASB Statement 54) 7215

... 1. Deficiency resulting in a minimum fund balance between 12.5% and 15% shall be replenished over a period not to exceed one (1) year; 2. Deficiency resulting in a minimum fund balance between 0% and 12.5% shall be replenished over a period not to exceed three (3) years. Surplus fund balance: Should ...

... 1. Deficiency resulting in a minimum fund balance between 12.5% and 15% shall be replenished over a period not to exceed one (1) year; 2. Deficiency resulting in a minimum fund balance between 0% and 12.5% shall be replenished over a period not to exceed three (3) years. Surplus fund balance: Should ...

The Importance of Asset Management

... Thanks to the asset management industry, individual savers are able to access financial markets they were previously unable, or unwilling, to access directly. In some countries, asset management plays an increasingly important role in corporate governance of investee companies, thus monitoring firms ...

... Thanks to the asset management industry, individual savers are able to access financial markets they were previously unable, or unwilling, to access directly. In some countries, asset management plays an increasingly important role in corporate governance of investee companies, thus monitoring firms ...

key investor information

... simulated historical series as appropriate. This profile is determined using historical data, as such may not be a reliable indication for the future risk profile. It is not guaranteed and may shift over time. ...

... simulated historical series as appropriate. This profile is determined using historical data, as such may not be a reliable indication for the future risk profile. It is not guaranteed and may shift over time. ...

Important Information about Hedge Funds

... not subject to regulation under the Investment Company Act and offerings of interests in hedge funds are not registered with the SEC under the Securities Act of 1933. Hedge fund advisers are not required to be registered investment advisers until the fund(s) they manager have $150 million or more in ...

... not subject to regulation under the Investment Company Act and offerings of interests in hedge funds are not registered with the SEC under the Securities Act of 1933. Hedge fund advisers are not required to be registered investment advisers until the fund(s) they manager have $150 million or more in ...

Annual Financial Report as at December 31, 2010

... The Company closed fiscal 2010 with net income of $18.7 million (net income of $17.1 million in 2009), representing a return of 2.0% (2.0% in 2009). Based on the number of shares outstanding, this brings net assets per share to $9.91 at year-end from $9.73 compared with the end of fiscal 2009. For i ...

... The Company closed fiscal 2010 with net income of $18.7 million (net income of $17.1 million in 2009), representing a return of 2.0% (2.0% in 2009). Based on the number of shares outstanding, this brings net assets per share to $9.91 at year-end from $9.73 compared with the end of fiscal 2009. For i ...

Venture capital

... BDC Venture Capital Mandate Objectives stated by the shareholder: > Focus on – Knowledge Based Industries (KBI) – Pre-seed/seed, innovative early-stage and start-up investments (direct and indirect) – Commercialization of research – Leading-edge technologies – Attracting foreign investors in VC – R ...

... BDC Venture Capital Mandate Objectives stated by the shareholder: > Focus on – Knowledge Based Industries (KBI) – Pre-seed/seed, innovative early-stage and start-up investments (direct and indirect) – Commercialization of research – Leading-edge technologies – Attracting foreign investors in VC – R ...

mutual fund strategy

... the fund manager at the close of each business day. Open-end funds Most mutual funds, and all mutual funds in 401(k) retirement accounts in the United States, are open-end funds. Open-end mutual funds must be willing to buy back their shares from their investors at the end of every business day at t ...

... the fund manager at the close of each business day. Open-end funds Most mutual funds, and all mutual funds in 401(k) retirement accounts in the United States, are open-end funds. Open-end mutual funds must be willing to buy back their shares from their investors at the end of every business day at t ...

Short-term Expectations in Listed Firms: The Effects of Different

... both transient and more long-term owners.8 Many institutional investors such as mutual fund managers face short-term compensation schemes tied to recent fund performance, and are involved in active trading, elements which can make their focus rather short-term, such as on returns from daily up to a ...

... both transient and more long-term owners.8 Many institutional investors such as mutual fund managers face short-term compensation schemes tied to recent fund performance, and are involved in active trading, elements which can make their focus rather short-term, such as on returns from daily up to a ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.