The Structural Changes of the Hedge Fund Industry Over Time

... Aggrawal and Jorion (2008) took a unique approach to explaining discrepancies in hedge fund performance. The paper looked at emerging funds with new managers. The database used was TASS from 1977 to 2006. By using funds with the same inception and reporting date, backfill bias is eliminated. The stu ...

... Aggrawal and Jorion (2008) took a unique approach to explaining discrepancies in hedge fund performance. The paper looked at emerging funds with new managers. The database used was TASS from 1977 to 2006. By using funds with the same inception and reporting date, backfill bias is eliminated. The stu ...

Janus Research Fund - Proxy

... circumstances. However, under unusual circumstances, if the Research Team does not have high conviction in enough investment opportunities, the Fund’s uninvested assets may be held in cash or similar instruments. The Fund may lend portfolio securities on a short-term or long-term basis, in an amount ...

... circumstances. However, under unusual circumstances, if the Research Team does not have high conviction in enough investment opportunities, the Fund’s uninvested assets may be held in cash or similar instruments. The Fund may lend portfolio securities on a short-term or long-term basis, in an amount ...

Overview of Governmental Fund Accounting

... Appropriations—public safety salaries Appropriations—public safety other expenditures ...

... Appropriations—public safety salaries Appropriations—public safety other expenditures ...

PDP-Working Paper

... structure of liabilities usually separates long- and short-term investors. Many long-term investors, especially some SWFs, have relatively longer-term liabilities or sometimes no (explicit) expenditure requirements. The OECD (2013) argues that institutional investors generally benefit from a stable ...

... structure of liabilities usually separates long- and short-term investors. Many long-term investors, especially some SWFs, have relatively longer-term liabilities or sometimes no (explicit) expenditure requirements. The OECD (2013) argues that institutional investors generally benefit from a stable ...

MARKET SEGMENTATION AND THE COST OF CAPITAL IN

... investment. Both these results hold if we use changes in dividend yields which deliver a decline of 66 basis points. It is important to note that other potential interpretations of these findings exist. For example, managers of ADR firms may time the cross-listing, causing the pattern of returns to ...

... investment. Both these results hold if we use changes in dividend yields which deliver a decline of 66 basis points. It is important to note that other potential interpretations of these findings exist. For example, managers of ADR firms may time the cross-listing, causing the pattern of returns to ...

3040.03.04 fin statements

... Some of these assets are financed by increases in current liabilities such as accruals and payables The difference must be financed by other forms of financing ...

... Some of these assets are financed by increases in current liabilities such as accruals and payables The difference must be financed by other forms of financing ...

www.ibrademp.org.br

... Argentina default – Local factors: Devaluation (1999) Energy crisis (2001) Elections (2002) ...

... Argentina default – Local factors: Devaluation (1999) Energy crisis (2001) Elections (2002) ...

Q2 2016 - PwC India

... Indian private equity did reasonably well in the second quarter of 2016, with overall investments worth 4.3 billion USD across 147 deals. Despite ecommerce/consumer Internet investments slowing down considerably owing to valuation and profitability concerns, the IT & ITeS sector continued its domina ...

... Indian private equity did reasonably well in the second quarter of 2016, with overall investments worth 4.3 billion USD across 147 deals. Despite ecommerce/consumer Internet investments slowing down considerably owing to valuation and profitability concerns, the IT & ITeS sector continued its domina ...

Beginning Governmental Accounting

... accrual basis and is typically used for governmental funds. • Revenues must be both measurable and available to pay for the current periods liabilities. Revenues are considered available when collectible either during the current period or after the end of the current period but in time to pay year- ...

... accrual basis and is typically used for governmental funds. • Revenues must be both measurable and available to pay for the current periods liabilities. Revenues are considered available when collectible either during the current period or after the end of the current period but in time to pay year- ...

1 Quarterly Statistical Release March 2010, N° 40 This release and

... the important role played by investment fund managers in the European economy: they act as managers of long-term savings, investors in the European financial markets, shareholders in European companies, providers of short-term funding for many European corporations and important sources of employmen ...

... the important role played by investment fund managers in the European economy: they act as managers of long-term savings, investors in the European financial markets, shareholders in European companies, providers of short-term funding for many European corporations and important sources of employmen ...

Inflation Risk Management in Project Finance

... The taxonomy of costs is even more co mplicated: “hot” costs are typically related to “hot” revenues and “cold” costs to the contractual – fixed – remuneration of the investment; but costs concern even depreciation (fully irrespective of inflat ion, if they are calculated on fixed assets with a not ...

... The taxonomy of costs is even more co mplicated: “hot” costs are typically related to “hot” revenues and “cold” costs to the contractual – fixed – remuneration of the investment; but costs concern even depreciation (fully irrespective of inflat ion, if they are calculated on fixed assets with a not ...

Capital efficiency and optimization Measured steps to achieve return

... most Indian banks. Measurement effect can cause increase in capital requirement on many counts. These may include use of sub-optimal statistical methods under the advanced approaches, incorrect assumptions and computations, improper stratification of portfolios and the inability to migrate to more s ...

... most Indian banks. Measurement effect can cause increase in capital requirement on many counts. These may include use of sub-optimal statistical methods under the advanced approaches, incorrect assumptions and computations, improper stratification of portfolios and the inability to migrate to more s ...

Capital Entity Procedures

... operating activity. Unrestricted funds are funds from various sources that can be used in any manner by the parish in accordance with its tax exempt purpose. Designated funds are unrestricted funds that the Pastor has agreed to set aside for a specific purpose, for example a capital building project ...

... operating activity. Unrestricted funds are funds from various sources that can be used in any manner by the parish in accordance with its tax exempt purpose. Designated funds are unrestricted funds that the Pastor has agreed to set aside for a specific purpose, for example a capital building project ...

The Great Escape? A Quantitative Evaluation of the Fed’s Liquidity Facilities

... Reserve started to expand its balance sheet. By January 2009, the overall size of the Fed’s balance sheet exceeded $2 trillion, an increase of more than $1 trillion compared to a few months earlier (Figure 1). This expansion mostly involved the Federal Reserve exchanging government liquidity (money ...

... Reserve started to expand its balance sheet. By January 2009, the overall size of the Fed’s balance sheet exceeded $2 trillion, an increase of more than $1 trillion compared to a few months earlier (Figure 1). This expansion mostly involved the Federal Reserve exchanging government liquidity (money ...

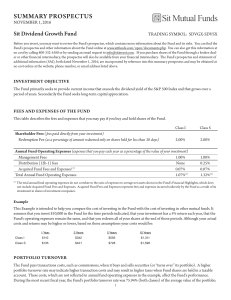

summary prospectus

... intermediary may impose account charges. The Fund and its related companies may also pay that intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary to recommend the Fund over another inve ...

... intermediary may impose account charges. The Fund and its related companies may also pay that intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary to recommend the Fund over another inve ...

Batelco`s Cost of Capital

... The gearing level of a firm shows the relative share of debt in the financing of the firm, i.e., gearing = debt/(debt + equity). The key conclusion on gearing from the consultation process was that, since there is no corporate tax in Bahrain, the TRA would not expect the WACC to be affected signific ...

... The gearing level of a firm shows the relative share of debt in the financing of the firm, i.e., gearing = debt/(debt + equity). The key conclusion on gearing from the consultation process was that, since there is no corporate tax in Bahrain, the TRA would not expect the WACC to be affected signific ...

Structure and nature of sa#7305 (Page 1)

... has generated a substantial amount of savings from pension and life insurance funds that resulted in a high domestic saving, although investment and economic growth have performed sluggishly. This makes the country to present a paradoxical scenario with a high saving rate that does not seem to trans ...

... has generated a substantial amount of savings from pension and life insurance funds that resulted in a high domestic saving, although investment and economic growth have performed sluggishly. This makes the country to present a paradoxical scenario with a high saving rate that does not seem to trans ...

Tab 1.1 - University of Maine System

... government/corporate desk as well as the Pegasus Bond Fund, the Pegasus Intermediate Bond Fund, the Mortgage-Backed Securities Fund, the Market Plus Fund and large institutional portfolios. Prior to that position, Doug was a fixed income quantitative research analyst. He holds a B.S. in chemistry fr ...

... government/corporate desk as well as the Pegasus Bond Fund, the Pegasus Intermediate Bond Fund, the Mortgage-Backed Securities Fund, the Market Plus Fund and large institutional portfolios. Prior to that position, Doug was a fixed income quantitative research analyst. He holds a B.S. in chemistry fr ...

1 CORPORATE GOVERNANCE PATTERNS IN OECD

... Neo-classical economics suggests that a firm which operates in a competitive product market and meets its capital needs in an efficient capital market should maximise the welfare of its owners (as they would otherwise not supply it with capital) and that of its customers (by pricing its products at ...

... Neo-classical economics suggests that a firm which operates in a competitive product market and meets its capital needs in an efficient capital market should maximise the welfare of its owners (as they would otherwise not supply it with capital) and that of its customers (by pricing its products at ...

REIT Stocks: An Underutilized Portfolio Diversifier

... [Please note that diversification and asset allocation do not ensure a profit or guarantee against loss.] The following article will outline why many investors should consider maintaining a higher exposure to commercial property through REIT stocks, particularly in multi-asset-class portfolios with ...

... [Please note that diversification and asset allocation do not ensure a profit or guarantee against loss.] The following article will outline why many investors should consider maintaining a higher exposure to commercial property through REIT stocks, particularly in multi-asset-class portfolios with ...

Download attachment

... sheet of an IIFS suggests that its business activities resemble a “one-stop shopping” model. • The nature of risks to which an IIFS is exposed is not necessarily the same as those of a conventional bank. • IIFS do not have the option to sell at a discount or to repackage and sell off their financial ...

... sheet of an IIFS suggests that its business activities resemble a “one-stop shopping” model. • The nature of risks to which an IIFS is exposed is not necessarily the same as those of a conventional bank. • IIFS do not have the option to sell at a discount or to repackage and sell off their financial ...

New rules for money market funds

... NAV that fluctuates from day to day. They must also round the NAV to the fourth decimal place (e.g., $1.0000). In addition, the amendments state that institutional MMFs must be invested using the same risk-limiting conditions included in the current regulations, which restrict investments to short-t ...

... NAV that fluctuates from day to day. They must also round the NAV to the fourth decimal place (e.g., $1.0000). In addition, the amendments state that institutional MMFs must be invested using the same risk-limiting conditions included in the current regulations, which restrict investments to short-t ...

Draft Policy Statement to Regulation 81

... at any time, and the securities returned must be the same or substantially the same as the original securities. These conditions reduce the risk of the investment fund not being able to transact the original securities. The original securities remain on the books of the investment fund. ...

... at any time, and the securities returned must be the same or substantially the same as the original securities. These conditions reduce the risk of the investment fund not being able to transact the original securities. The original securities remain on the books of the investment fund. ...

The CFO`s Dilemma

... Housekeeping Items • This Webinar is Being Recorded ̶ A recording of today’s webinar will be emailed to attendees after the webinar ...

... Housekeeping Items • This Webinar is Being Recorded ̶ A recording of today’s webinar will be emailed to attendees after the webinar ...

Multinational Firms, FDI Flows and Imperfect Capital Markets

... con…rmed to be a function of the quality of investor protections and the depth of capital markets. The model also suggests that these e¤ects should be most pronounced for technologically advanced …rms because these …rms are most likely to be able to provide valuable monitoring services. The empiric ...

... con…rmed to be a function of the quality of investor protections and the depth of capital markets. The model also suggests that these e¤ects should be most pronounced for technologically advanced …rms because these …rms are most likely to be able to provide valuable monitoring services. The empiric ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.