Implications of Dodd-Frank for UK and EU fund

... "Registration Act"). This was one part of the Dodd-Frank Wall Street Reform and Consumer Protection Act. The Registration Act includes amendments to the US Investment Advisers Act of 1940 (the "Advisers Act"), which is the principal US law concerning the regulation of investment managers and adviser ...

... "Registration Act"). This was one part of the Dodd-Frank Wall Street Reform and Consumer Protection Act. The Registration Act includes amendments to the US Investment Advisers Act of 1940 (the "Advisers Act"), which is the principal US law concerning the regulation of investment managers and adviser ...

Marginal leverage ratio as a monitoring tool of

... principle, this can be done by a ratio combining any two variable from debt, total assets and equity. However, not all such ratios are equaly valid. Effects like wrong framing and denominator neglect indicate that what we are trying to measure, i.e. debt, should appear in the numerator. Furthermore, ...

... principle, this can be done by a ratio combining any two variable from debt, total assets and equity. However, not all such ratios are equaly valid. Effects like wrong framing and denominator neglect indicate that what we are trying to measure, i.e. debt, should appear in the numerator. Furthermore, ...

Demand for SME finance - Greater London Authority

... The data on both debt and equity finance clearly shows the reduction in supply in London over the last two to three years. Overall, the amount of supply for both types of finance is still markedly higher in London than in other parts of the country, as would be expected with the size of the business ...

... The data on both debt and equity finance clearly shows the reduction in supply in London over the last two to three years. Overall, the amount of supply for both types of finance is still markedly higher in London than in other parts of the country, as would be expected with the size of the business ...

investor sentiment indicator

... As part of our ongoing commitment to developing a deeper understanding of the attitudes, behaviours, needs and perspectives of high net worth (HNW) Australians, Westpac Private Bank is delighted to release the latest version of the quarterly Investor Sentiment Indicator. The Indicator is an aggregat ...

... As part of our ongoing commitment to developing a deeper understanding of the attitudes, behaviours, needs and perspectives of high net worth (HNW) Australians, Westpac Private Bank is delighted to release the latest version of the quarterly Investor Sentiment Indicator. The Indicator is an aggregat ...

Large Cap Research Equity

... The table above shows the Portfolio’s past performance, which is no guarantee of future results. The value of an investment in the Portfolio will vary over time, and you could lose money by investing in the Portfolio. Returns are shown net of the Portfolio’s fees and expenses, and include the reinve ...

... The table above shows the Portfolio’s past performance, which is no guarantee of future results. The value of an investment in the Portfolio will vary over time, and you could lose money by investing in the Portfolio. Returns are shown net of the Portfolio’s fees and expenses, and include the reinve ...

APRA Prudential Standard APS 330 Capital and Credit Risk

... Applicable caps on the inclusion of provisions in Tier 2 Provisions eligible for inclusion in Tier 2 in respect of exposures subject to ...

... Applicable caps on the inclusion of provisions in Tier 2 Provisions eligible for inclusion in Tier 2 in respect of exposures subject to ...

In Millions

... 11-21 In consolidated statements, all the assets and liabilities of the parent and subsidiary are added together in the statements. But the shareholders of the parent do not own all of the combined assets and liabilities, so the interests of the minority owner’s must be subtracted. In contrast, wit ...

... 11-21 In consolidated statements, all the assets and liabilities of the parent and subsidiary are added together in the statements. But the shareholders of the parent do not own all of the combined assets and liabilities, so the interests of the minority owner’s must be subtracted. In contrast, wit ...

October 31 , 2016 This is what late cycle looks like… Weakness

... Performance, dividends and other figures have been obtained from sources believed reliable but have not been audited and cannot be guaranteed. Past performance does not ensure future results. Investing inherently contains risk including loss of principle. Corey Casilio is a founding partner of Casil ...

... Performance, dividends and other figures have been obtained from sources believed reliable but have not been audited and cannot be guaranteed. Past performance does not ensure future results. Investing inherently contains risk including loss of principle. Corey Casilio is a founding partner of Casil ...

NBER WORKING PAPER SERIES LEVERAGE CONSTRAINTS AND THE INTERNATIONAL TRANSMISSION OF SHOCKS

... The paper’s main contribution is to compare how macro shocks are transmitted under different financial market structures. We do not attempt to provide an integrated explanation of the recent crisis, or a full quantitative calibration, but instead highlight how the joint process of balance sheet con ...

... The paper’s main contribution is to compare how macro shocks are transmitted under different financial market structures. We do not attempt to provide an integrated explanation of the recent crisis, or a full quantitative calibration, but instead highlight how the joint process of balance sheet con ...

The Best of Times and the Worst of Times for Institutional Investors

... developed and developing economies. The past decade also started with a series of corporate scandals and bankruptcies such as Enron and Worldcom and ended similarly with the Madoff case, the Lehman bankruptcy and unprecedented state interventions to limit the downward spiral resulting from the credi ...

... developed and developing economies. The past decade also started with a series of corporate scandals and bankruptcies such as Enron and Worldcom and ended similarly with the Madoff case, the Lehman bankruptcy and unprecedented state interventions to limit the downward spiral resulting from the credi ...

Think active can`t outperform? Think again

... management did underperform the passive benchmark. The study focuses on the stated time periods, as we believe they represent five distinct full market cycles over the past 20 years. ...

... management did underperform the passive benchmark. The study focuses on the stated time periods, as we believe they represent five distinct full market cycles over the past 20 years. ...

HSBC World Selection Personal Pension

... lifestyles for example if you smoke. Impaired life annuities may be available for people who suffer from certain health problems that require to be individually assessed, for example blood pressure. If you qualify for an enhanced or impaired life annuity you could benefit from a higher than normal a ...

... lifestyles for example if you smoke. Impaired life annuities may be available for people who suffer from certain health problems that require to be individually assessed, for example blood pressure. If you qualify for an enhanced or impaired life annuity you could benefit from a higher than normal a ...

Investment Options and Risk

... Government bonds Investing in government bonds basically means your money is lent to governments wishing to raise capital. Generally in return, you receive a fixed rate of interest, until the bond matures and the amount invested is repayable. CSC invests in both Australian and international governme ...

... Government bonds Investing in government bonds basically means your money is lent to governments wishing to raise capital. Generally in return, you receive a fixed rate of interest, until the bond matures and the amount invested is repayable. CSC invests in both Australian and international governme ...

Sample Glossary of Investment-Related Terms for

... annual percentage of the principal. For example, someone investing in bonds will receive interest payments from the bond’s issuer. Interest Rate Risk: The possibility that a bond’s or bond fund’s market value will decrease due to rising interest rates. When interest rates (and bond yields) go up, bo ...

... annual percentage of the principal. For example, someone investing in bonds will receive interest payments from the bond’s issuer. Interest Rate Risk: The possibility that a bond’s or bond fund’s market value will decrease due to rising interest rates. When interest rates (and bond yields) go up, bo ...

Materials

... responded to state revenue shortfalls totaling $7.1 billion from August 2007 through August 2009. Public higher education institutions have been among the state agencies hardest hit. The University has experienced a cumulative general fund budget reduction of $51.5 million over this period. If not f ...

... responded to state revenue shortfalls totaling $7.1 billion from August 2007 through August 2009. Public higher education institutions have been among the state agencies hardest hit. The University has experienced a cumulative general fund budget reduction of $51.5 million over this period. If not f ...

View PDF - Dolphin Capital Investors

... Dolphin Capital Investors (www.dolphinci.com) Dolphin is the leading investor in the residential resort sector in south-east Europe and the largest real estate investment company quoted on AIM in terms of net asset value. Dolphin seeks to generate strong capital growth for its shareholders by acquir ...

... Dolphin Capital Investors (www.dolphinci.com) Dolphin is the leading investor in the residential resort sector in south-east Europe and the largest real estate investment company quoted on AIM in terms of net asset value. Dolphin seeks to generate strong capital growth for its shareholders by acquir ...

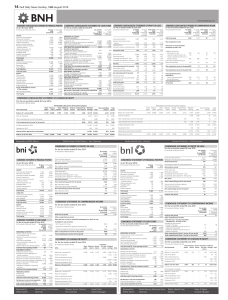

14 Gulf Daily News Sunday, 14th August 2016

... Payments to insurance and reinsurance companies Claims paid to policyholders Claims recovered from reinsurers and salvage recoveries Payment made for other operating expenses ...

... Payments to insurance and reinsurance companies Claims paid to policyholders Claims recovered from reinsurers and salvage recoveries Payment made for other operating expenses ...

Understanding the New Tennessee Small Business Investment

... the venture capitalists with their money, which the venture capitalists will then use to make equity investments in privately held companies. 13 Obtaining investments is a difficult task, requiring venture capitalists to prove that they have the experience and track record of making equity investmen ...

... the venture capitalists with their money, which the venture capitalists will then use to make equity investments in privately held companies. 13 Obtaining investments is a difficult task, requiring venture capitalists to prove that they have the experience and track record of making equity investmen ...

Here

... Colgate-Palmolive has strong statements with low levels of debt and will continue this way. Debt currently makes up only about 75% of the firm’s capital structure, with nearly 30 notes outstanding. The firm only issues small notes, with none that have a principal of $1.0B or more and currently have ...

... Colgate-Palmolive has strong statements with low levels of debt and will continue this way. Debt currently makes up only about 75% of the firm’s capital structure, with nearly 30 notes outstanding. The firm only issues small notes, with none that have a principal of $1.0B or more and currently have ...

Investment Management Regulatory Update

... SEC Grants No Action Relief from Sections 12(d)(1)(A) and (B) and 17(a) of the Investment Company Act to Franklin Templeton Investments On April 3, 2015, the Division of Investment Management (the “Division”) of the SEC issued a letter (the “Letter”) to Franklin Templeton Investments (“FTI”) provid ...

... SEC Grants No Action Relief from Sections 12(d)(1)(A) and (B) and 17(a) of the Investment Company Act to Franklin Templeton Investments On April 3, 2015, the Division of Investment Management (the “Division”) of the SEC issued a letter (the “Letter”) to Franklin Templeton Investments (“FTI”) provid ...

140225_Presentation_Intro_Update

... Sit alongside: Other vehicles accessing the same underlying asset ...

... Sit alongside: Other vehicles accessing the same underlying asset ...

GASB Statement No. 54 and Iowa School Districts

... authorized to make assignments and the policy that delegated entity is to follow • Flows: In what order will the resources be used? • Start now with the prior year audit report and determine ...

... authorized to make assignments and the policy that delegated entity is to follow • Flows: In what order will the resources be used? • Start now with the prior year audit report and determine ...

Euro Blue Chip Fund

... Annualised volatility: a measure of how variable returns for a fund or comparative market index have been around their historical average (also known as “standard deviation”). Two funds may produce the same return over a period. The fund whose monthly returns have varied less will have a lower annua ...

... Annualised volatility: a measure of how variable returns for a fund or comparative market index have been around their historical average (also known as “standard deviation”). Two funds may produce the same return over a period. The fund whose monthly returns have varied less will have a lower annua ...

International Capital Flows, Economic Growth and

... agents to overcome large informational barriers. The next in the ranking, referred to as a ’pecking-order’, are debt flows, while equity will be issued as a last resort when information asymmetries are the least.5 However, building up a framework which would allow us to obtain financial market equilib ...

... agents to overcome large informational barriers. The next in the ranking, referred to as a ’pecking-order’, are debt flows, while equity will be issued as a last resort when information asymmetries are the least.5 However, building up a framework which would allow us to obtain financial market equilib ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.