JPMorgan Large Cap Growth Fund

... monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 ...

... monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 ...

Investment products risk and fees disclosure

... The strong fluctuation of the market value of bond may also be caused by the circumstances that are not directly associated with the bond issuer, but rather with changes in general interest rates (interest risk). As a rule, the prices of longer-term bonds are more sensitive towards any changes in th ...

... The strong fluctuation of the market value of bond may also be caused by the circumstances that are not directly associated with the bond issuer, but rather with changes in general interest rates (interest risk). As a rule, the prices of longer-term bonds are more sensitive towards any changes in th ...

The Great Escape? A Quantitative Evaluation of the Fed’s Non-Standard Policies ∗

... where 0 < λ < 1 is one minus the depreciation rate, and it (e) represents investment. We assume that β > λ. Investment opportunities are i.i.d. across time and entrepreneurs. Entrepreneurs rent out capital to firms and earn the rental rate rtk . Equity represents claims on the future stream of such ...

... where 0 < λ < 1 is one minus the depreciation rate, and it (e) represents investment. We assume that β > λ. Investment opportunities are i.i.d. across time and entrepreneurs. Entrepreneurs rent out capital to firms and earn the rental rate rtk . Equity represents claims on the future stream of such ...

Personalised discretionary portfolio management: the tailor

... in respect of the information expressed. Actual results, performance or events may differ materially from those presented in this publication. This can be due to many reasons, among which (i) the general economic conditions in ING’s core markets; (ii) the overall performance of financial markets, in ...

... in respect of the information expressed. Actual results, performance or events may differ materially from those presented in this publication. This can be due to many reasons, among which (i) the general economic conditions in ING’s core markets; (ii) the overall performance of financial markets, in ...

BPI Philippine Infrastructure Equity Index Fund

... The BPI Philippine Infrastructure Equity Index Fund is an index tracker UITF that tracks the performance of the BPI Philippine Infrastructure Equity Index. It buys all the stocks that comprise the BPI Philippine Infrastructure Equity Index in the same weights as the index. 2. What is the difference ...

... The BPI Philippine Infrastructure Equity Index Fund is an index tracker UITF that tracks the performance of the BPI Philippine Infrastructure Equity Index. It buys all the stocks that comprise the BPI Philippine Infrastructure Equity Index in the same weights as the index. 2. What is the difference ...

The Risk of Adverse Selection in Co-‐investing Private

... checks. That means they can’t do it out of their fund, so they need to bring in co-‐investors. And LPs like that. But the reality is that the adverse selection point in is a market ...

... checks. That means they can’t do it out of their fund, so they need to bring in co-‐investors. And LPs like that. But the reality is that the adverse selection point in is a market ...

Slides 1

... → equity price effect of JGTRRA depends on the wealth of (taxable) US investors relative to global wealth, and applies to all T (not just US stocks) . . . but there is little we can say about this empirically . . . ...

... → equity price effect of JGTRRA depends on the wealth of (taxable) US investors relative to global wealth, and applies to all T (not just US stocks) . . . but there is little we can say about this empirically . . . ...

T. ROWE PRICE® ActivePlus Portfolios Methodology

... of sub-asset classes helps to reduce the impact of an investment style going out of favor for a sustained period. Having selected sub-asset classes and identified major market indices to represent each one, TRP Advisory Services reviewed the performance and correlation of these asset classes over ti ...

... of sub-asset classes helps to reduce the impact of an investment style going out of favor for a sustained period. Having selected sub-asset classes and identified major market indices to represent each one, TRP Advisory Services reviewed the performance and correlation of these asset classes over ti ...

Business Angels in Germany

... 1. 56% of exits failed to return capital, but 9% generate more than 10 times the capital invested. 2. Despite the fact that only 44% of investments generate positive exits, the overall return to business angel investing in the UK is 2.2 times invested capital. 3. Given a holding period of just under ...

... 1. 56% of exits failed to return capital, but 9% generate more than 10 times the capital invested. 2. Despite the fact that only 44% of investments generate positive exits, the overall return to business angel investing in the UK is 2.2 times invested capital. 3. Given a holding period of just under ...

Price Discount of Private Equity Placement and Interests

... equity firms, and they find that staging has a positive effect on investment returns in the beginning of the investment decisions, however staging appears to be negatively associated with returns when used prior to the exit decision [10]. Huang and Chan (2012) propose that outside blockholders arisi ...

... equity firms, and they find that staging has a positive effect on investment returns in the beginning of the investment decisions, however staging appears to be negatively associated with returns when used prior to the exit decision [10]. Huang and Chan (2012) propose that outside blockholders arisi ...

Document

... By 1993, the rural strategy with local management and minimal technology made Key a very profitable bank. However, it was getting tougher for Riley and CFO William Dougherty to maintain their 15 percent return on equity target and investors were cooling on Key stock after many high growth years. Acc ...

... By 1993, the rural strategy with local management and minimal technology made Key a very profitable bank. However, it was getting tougher for Riley and CFO William Dougherty to maintain their 15 percent return on equity target and investors were cooling on Key stock after many high growth years. Acc ...

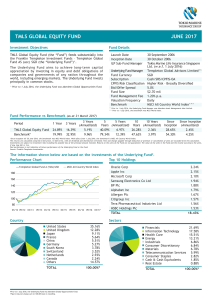

tmls global equity fund june 2017

... advanced and global value stocks posted strong absolute gains, value lagged growth during the quarter by the most in two years as heightened political uncertainty and rising equity risk premiums weighed on lowly valued stocks. • From a regional standpoint, stock-specific weakness in Europe (in whic ...

... advanced and global value stocks posted strong absolute gains, value lagged growth during the quarter by the most in two years as heightened political uncertainty and rising equity risk premiums weighed on lowly valued stocks. • From a regional standpoint, stock-specific weakness in Europe (in whic ...

Rate of return = $2317.24 / $20000 = 11.59% per

... Purchasing on margin means borrowing some of the money used to buy securities. You do it because you desire a larger position than you can afford to pay for, recognizing that using margin is a form of financial leverage. As such, your gains and losses will be magnified. Of course, you hope you only ...

... Purchasing on margin means borrowing some of the money used to buy securities. You do it because you desire a larger position than you can afford to pay for, recognizing that using margin is a form of financial leverage. As such, your gains and losses will be magnified. Of course, you hope you only ...

Now - CT Corporation

... classifications, with real estate contained within the financials sector classification. The new sector recognizes the impressive growth of REITs, which have outperformed the S&P 500 each year since 2009, up 24 percent annually versus 18 percent for the stock market index. Over the past 15 years, mo ...

... classifications, with real estate contained within the financials sector classification. The new sector recognizes the impressive growth of REITs, which have outperformed the S&P 500 each year since 2009, up 24 percent annually versus 18 percent for the stock market index. Over the past 15 years, mo ...

Applicable analyst/Author disclosure, and any additional information

... slowdown in the UK economy, sterling depreciation, and monetary policy stimulus from the Bank of England. The UK is one of Canada’s top trading and investment partners, however the small relative size of these relationships points to a muted direct effect on Canada’s economy. Knock on effects could ...

... slowdown in the UK economy, sterling depreciation, and monetary policy stimulus from the Bank of England. The UK is one of Canada’s top trading and investment partners, however the small relative size of these relationships points to a muted direct effect on Canada’s economy. Knock on effects could ...

- SlideBoom

... • Class A: traditional load shares with high front-end load and low 12b-1 fee. • Class B: high 12b-1 fee and CDSC. No front-end load. No longer offered by many funds. • Class C: level load shares that combine a high 12b-1 fee with a ...

... • Class A: traditional load shares with high front-end load and low 12b-1 fee. • Class B: high 12b-1 fee and CDSC. No front-end load. No longer offered by many funds. • Class C: level load shares that combine a high 12b-1 fee with a ...

Why yield matters for investors – particularly now

... driver if bond investments are held to maturity – but if the bond is sold before then there may be a capital gain or loss if the bond’s price has changed. For shares and property, capital growth (or loss) is of course a key component of return, but dividends or rental income form the base. So for ex ...

... driver if bond investments are held to maturity – but if the bond is sold before then there may be a capital gain or loss if the bond’s price has changed. For shares and property, capital growth (or loss) is of course a key component of return, but dividends or rental income form the base. So for ex ...

NBER WORKING PAPER SERIES Jonathan Berk Johan Walden

... allocation even when the span of asset markets is restricted to just stocks and bonds. Capital markets facilitate this risk sharing because it is there that firms offload the labor market risk they assumed from workers. In effect, by investing in capital markets investors provide insurance to wage e ...

... allocation even when the span of asset markets is restricted to just stocks and bonds. Capital markets facilitate this risk sharing because it is there that firms offload the labor market risk they assumed from workers. In effect, by investing in capital markets investors provide insurance to wage e ...

Impact of New Capital Rule on Community Banks

... Claims on qualifying securities firms are now 100%. Certain high volatility commercial real estate (HVCRE) exposures are now 150% Past due exposures are now 150% for the portion that is not secured For mortgage backed securities, asset backed securities and structured securities, there are two gener ...

... Claims on qualifying securities firms are now 100%. Certain high volatility commercial real estate (HVCRE) exposures are now 150% Past due exposures are now 150% for the portion that is not secured For mortgage backed securities, asset backed securities and structured securities, there are two gener ...

The Equity Premium: Why Is It a Puzzle? Rajnish Mehra

... Furthermore, this pattern of excess returns to equity holdings is not unique to U.S. capital markets. Table 2 confirms that equity returns in other developed countries also exhibit this historical regularity when compared with the return to debt holdings. The annual return on the U.K. stock market, ...

... Furthermore, this pattern of excess returns to equity holdings is not unique to U.S. capital markets. Table 2 confirms that equity returns in other developed countries also exhibit this historical regularity when compared with the return to debt holdings. The annual return on the U.K. stock market, ...

Artisan Partners Targets Australian Market

... development for the company’s global equity and global fixed income assets across Australia and New Zealand. Dean Patenaude, Artisan Head of Global Distribution said, ‘‘Australia ranks as the fourth largest investment market in the world by funds under management. The size of that opportunity is att ...

... development for the company’s global equity and global fixed income assets across Australia and New Zealand. Dean Patenaude, Artisan Head of Global Distribution said, ‘‘Australia ranks as the fourth largest investment market in the world by funds under management. The size of that opportunity is att ...

Stimulating Investment in Emerging-Market SMEs

... given the shortage of buyers and the underdeveloped capital ...

... given the shortage of buyers and the underdeveloped capital ...

This Announcement is an advertisement and not a

... The project has been the brainchild of local businessman Karol McElhinney, who, as developer will be a shareholder in the Project and counterparty to the operations and feedstock supply contracts through holding company Connective Energy Holdings Limited. The EPC contractor responsible for construct ...

... The project has been the brainchild of local businessman Karol McElhinney, who, as developer will be a shareholder in the Project and counterparty to the operations and feedstock supply contracts through holding company Connective Energy Holdings Limited. The EPC contractor responsible for construct ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.