The Investment Association Guidelines for New Issue Transactions

... procedures relating to the pre-sounding, bookbuilding and allocation process. These are applied to individual transactions, but may be tailored where appropriate to accommodate any issuer requirements, other bookrunner procedures and any specificities of the market segment concerned. In this respect ...

... procedures relating to the pre-sounding, bookbuilding and allocation process. These are applied to individual transactions, but may be tailored where appropriate to accommodate any issuer requirements, other bookrunner procedures and any specificities of the market segment concerned. In this respect ...

Invest globally - Putnam Investments

... This data is historical, and past performance is not a guarantee of future results. The MSCI ACWI is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 44 country indices co ...

... This data is historical, and past performance is not a guarantee of future results. The MSCI ACWI is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 44 country indices co ...

Launch Alert: Moerus Worldwide Value Fund

... employed a similar approach. The portfolio is built from the bottom up and will generally hold 25-40 names, including firms in the U.S. and the emerging markets. The target is undervalued stocks of firms that have “solid balance sheets, high quality business models and shareholder-friendly managemen ...

... employed a similar approach. The portfolio is built from the bottom up and will generally hold 25-40 names, including firms in the U.S. and the emerging markets. The target is undervalued stocks of firms that have “solid balance sheets, high quality business models and shareholder-friendly managemen ...

Living Annuity 3.4MB

... the average return of large fund managers (BEFORE FEES) since inception (1 January 2008). 10X’s total fees are generally half the industry average** and so 10X saves most clients at least 1% pa (of the investment balance) in fees. We thus also show the average return of large fund managers reduced b ...

... the average return of large fund managers (BEFORE FEES) since inception (1 January 2008). 10X’s total fees are generally half the industry average** and so 10X saves most clients at least 1% pa (of the investment balance) in fees. We thus also show the average return of large fund managers reduced b ...

What is a Security?

... o Business stays private and makes enough profits to pay returns to investors o Management buy-out of the early stage investors, or o IPO. Crowdfunding recently adopted by the JOBS Act in 2012, though enabling Rules and Regulations not yet adopted by the SEC making Crowdfunding active. No such thi ...

... o Business stays private and makes enough profits to pay returns to investors o Management buy-out of the early stage investors, or o IPO. Crowdfunding recently adopted by the JOBS Act in 2012, though enabling Rules and Regulations not yet adopted by the SEC making Crowdfunding active. No such thi ...

Venture Capital and Private Equity in India:

... the Planning Commission to examine issues related to technology innovation and policies for growth in venture capital activity in India. This is a very important report as it differentiated between 'Venture Capital' & 'Private Equity' and also summarizes the factors under which risk capital would fl ...

... the Planning Commission to examine issues related to technology innovation and policies for growth in venture capital activity in India. This is a very important report as it differentiated between 'Venture Capital' & 'Private Equity' and also summarizes the factors under which risk capital would fl ...

Slides

... If you are managers of a firm with no debt, and you generate high income and cash flows each year, you tend to become complacent. The complacency can lead to inefficiency and investing in poor projects. There is little or no cost borne by the managers Forcing such a firm to borrow money can be a ...

... If you are managers of a firm with no debt, and you generate high income and cash flows each year, you tend to become complacent. The complacency can lead to inefficiency and investing in poor projects. There is little or no cost borne by the managers Forcing such a firm to borrow money can be a ...

Large Cap Growth Factsheet

... in the second half of the year, the Federal Reserve will end the zero interest rate policy (the ZIRP) that has been in effect since the end of 2007. The increase will be of a large magnitude (moving up from zero will look dramatic on a percentage basis) but will probably only go to .5%. At that poin ...

... in the second half of the year, the Federal Reserve will end the zero interest rate policy (the ZIRP) that has been in effect since the end of 2007. The increase will be of a large magnitude (moving up from zero will look dramatic on a percentage basis) but will probably only go to .5%. At that poin ...

Private Sector Finance and Climate Change Adaptation

... investors. They do yield economic benefits, but these accrue to the wider community and cannot be captured within the project itself. Some projects in the agriculture or water sectors might be suitable targets for equity, although supporting adaptation through equity may otherwise be difficult. Debt ...

... investors. They do yield economic benefits, but these accrue to the wider community and cannot be captured within the project itself. Some projects in the agriculture or water sectors might be suitable targets for equity, although supporting adaptation through equity may otherwise be difficult. Debt ...

Investment Style and Process - Qualified Financial Services

... • Consequently, the Fund exhibits significant benchmark risk • However, absolute return volatility is reduced due to our focus on businesses with more moderate revenue/cash flow/earnings volatility ...

... • Consequently, the Fund exhibits significant benchmark risk • However, absolute return volatility is reduced due to our focus on businesses with more moderate revenue/cash flow/earnings volatility ...

Century Bonds: Issuance Motivations and Debt versus Equity

... intention is to embark upon the corporate adventure, taking the risks of loss attendant upon it, so that he may enjoy the chances of profit. The creditor, on the other hand, does not intend to take such risks so far as they may be avoided, but merely to lend his capital to others who do intend to ta ...

... intention is to embark upon the corporate adventure, taking the risks of loss attendant upon it, so that he may enjoy the chances of profit. The creditor, on the other hand, does not intend to take such risks so far as they may be avoided, but merely to lend his capital to others who do intend to ta ...

1 - Blackwell Publishing

... having to raise funds externally in the capital markets. Changes in both profitability and capital expenditure needs necessitate that a firm seek external financing from time to time. When a firm raises external funds, it initially prefers issuing debt securities. If the firm cannot issue debt secur ...

... having to raise funds externally in the capital markets. Changes in both profitability and capital expenditure needs necessitate that a firm seek external financing from time to time. When a firm raises external funds, it initially prefers issuing debt securities. If the firm cannot issue debt secur ...

Active vs. Passive Management in 12 Points

... price volatility. Bond investments may be worth more or less than the original cost when redeemed. Derivatives may involve certain costs and risks, such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in deriv ...

... price volatility. Bond investments may be worth more or less than the original cost when redeemed. Derivatives may involve certain costs and risks, such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in deriv ...

Using Risk Analysis to Classify Junk Bonds as Equity for Federal

... 4. The flexibility and variety of a hybrid security offers advantages to both the corporation and the investor. For example, a convertible bond is more attractive to investors than a standard bond because investors value the ability to exchange their debt instrument for an equity instrument in the f ...

... 4. The flexibility and variety of a hybrid security offers advantages to both the corporation and the investor. For example, a convertible bond is more attractive to investors than a standard bond because investors value the ability to exchange their debt instrument for an equity instrument in the f ...

Investment Objective - Marmot Library Network Information Center

... The Marmot Library Network (Marmot) is a nonprofit 501(c)(3) corporation whose mission is to support information technology in educational institutions: public libraries, school districts, and colleges. Marmot investment goals are unlike those of most nonprofit organizations: Marmot is not intended ...

... The Marmot Library Network (Marmot) is a nonprofit 501(c)(3) corporation whose mission is to support information technology in educational institutions: public libraries, school districts, and colleges. Marmot investment goals are unlike those of most nonprofit organizations: Marmot is not intended ...

PIPEs Transaction and Regulation D

... Generally, large financial institutions that are WKSIs issue structured products, usually on an SEC-registered basis Foreign banks may issue structured products to US investors in reliance on the Section 3(a)(2) exemption or in a private placement Usually, the broker-dealer affiliate of the fi ...

... Generally, large financial institutions that are WKSIs issue structured products, usually on an SEC-registered basis Foreign banks may issue structured products to US investors in reliance on the Section 3(a)(2) exemption or in a private placement Usually, the broker-dealer affiliate of the fi ...

q. are you the same charles e. olson whose direct testimony

... her cost of capital determination on the sustainable growth approach as it is set forth by Mr. Hill. In my opinion that is simply unrealistic. ...

... her cost of capital determination on the sustainable growth approach as it is set forth by Mr. Hill. In my opinion that is simply unrealistic. ...

Investment Management Policy

... Month-wise receivable has to be prepared. FDR maturating on months along with other receivable has to be considered. Government grant or loan, IDA grant or loan or grant and loan of any other funder will influence the figure in any month. FDR maturity for the months can be obtained from the FDR ...

... Month-wise receivable has to be prepared. FDR maturating on months along with other receivable has to be considered. Government grant or loan, IDA grant or loan or grant and loan of any other funder will influence the figure in any month. FDR maturity for the months can be obtained from the FDR ...

forsight labs, llc announces formation of its third company, forsight

... the Upper Midwest. Split Rock Partners was formed in June, 2004 by the healthcare and software investment teams of St. Paul Venture Capital. In April, 2005, Split Rock announced the closing of a new $275 million venture fund. Split Rock Partners' portfolio of healthcare investments has included such ...

... the Upper Midwest. Split Rock Partners was formed in June, 2004 by the healthcare and software investment teams of St. Paul Venture Capital. In April, 2005, Split Rock announced the closing of a new $275 million venture fund. Split Rock Partners' portfolio of healthcare investments has included such ...

A Portfolio Built on Divident Growth - Presentation by Scott Malatesta

... represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performanc ...

... represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performanc ...

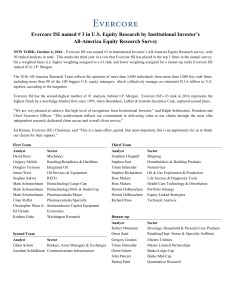

Evercore ISI named # 3 in US Equity Research by

... The 2016 All-America Research Team reflects the opinions of more than 3,800 individuals from more than 1,000 buy-side firms, including more than 90 of the 100 biggest U.S. equity managers, which collectively manage an estimated $11.6 trillion in U.S. equities, according to the magazine. Evercore ISI ...

... The 2016 All-America Research Team reflects the opinions of more than 3,800 individuals from more than 1,000 buy-side firms, including more than 90 of the 100 biggest U.S. equity managers, which collectively manage an estimated $11.6 trillion in U.S. equities, according to the magazine. Evercore ISI ...

The SEI Strategic Portfolios We have prepared the following

... About The SEI Strategic Portfolios SEI’s Strategic Portfolios are a range of seven funds designed to meet a wide range of financial goals and appetites for risk. The SEI Strategic Portfolios may invest in a combination of SEI and Third-Party Funds as well as in additional manager pools depending on ...

... About The SEI Strategic Portfolios SEI’s Strategic Portfolios are a range of seven funds designed to meet a wide range of financial goals and appetites for risk. The SEI Strategic Portfolios may invest in a combination of SEI and Third-Party Funds as well as in additional manager pools depending on ...

Implications of Proposed Bank Capital Regulations for Investors in

... On June 7, 2012, the Federal Reserve released its long-awaited Notice of Proposed Rulemaking (NPR) on bank capital requirements, along with two related NPRs on rules for calculating risk weighted assets (RWA). Although these rules are not yet final – that will happen after a public comment period an ...

... On June 7, 2012, the Federal Reserve released its long-awaited Notice of Proposed Rulemaking (NPR) on bank capital requirements, along with two related NPRs on rules for calculating risk weighted assets (RWA). Although these rules are not yet final – that will happen after a public comment period an ...

portfolio commentary - Cary Street Partners

... US equity markets pushed higher in the quarter, generally posting consistent gains in each month. Markets faced some turbulence right at quarter’s end as investors attempted to surmise the consequences of “Brexit” on global markets. The S&P 500 Index had managed to return to near record levels at 21 ...

... US equity markets pushed higher in the quarter, generally posting consistent gains in each month. Markets faced some turbulence right at quarter’s end as investors attempted to surmise the consequences of “Brexit” on global markets. The S&P 500 Index had managed to return to near record levels at 21 ...

Regulation af Debt and Equity

... no equity other than that of their related enterprises. Insurance companies and the rapidly growing pension funds together have obtained their equity on secondary markets from households, which have been liquidating their positions since the 1950s (table 1). Accordingly, the acquisition of equity by ...

... no equity other than that of their related enterprises. Insurance companies and the rapidly growing pension funds together have obtained their equity on secondary markets from households, which have been liquidating their positions since the 1950s (table 1). Accordingly, the acquisition of equity by ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.